Is VistaForex safe?

Business

License

Is VistaForex A Scam?

Introduction

VistaForex is an online trading platform that positions itself within the foreign exchange (forex) market, providing traders with access to various financial instruments, including forex currency pairs, commodities, and indices. As the forex market continues to grow, the need for traders to evaluate the credibility and safety of their chosen brokers becomes increasingly critical. This is especially true given the prevalence of scams and fraudulent activities in the online trading space. Therefore, it is essential for potential investors to conduct thorough research before committing their funds.

In this article, we will investigate whether VistaForex is a safe trading option or if it raises red flags that suggest it may be a scam. Our analysis will rely on a combination of qualitative assessments and quantitative data derived from various sources, including regulatory information, customer reviews, and trading conditions. By examining these factors, we aim to provide a comprehensive overview of VistaForex's legitimacy and safety.

Regulation and Legitimacy

One of the key indicators of a broker's reliability is its regulatory status. A regulated broker is subject to oversight by a recognized financial authority, which helps ensure that it adheres to strict operational standards and protects clients' interests. Unfortunately, VistaForex operates without any regulatory oversight, as it is registered in Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory environment.

Regulatory Information Table

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Saint Vincent and the Grenadines | Unregulated |

The absence of regulatory supervision raises significant concerns about the safety of traders' funds and the overall integrity of the broker. Without a regulatory framework, there is no guarantee that VistaForex will adhere to industry standards or provide adequate investor protection. Additionally, the lack of transparency regarding the company's operations and financial practices further complicates the assessment of its legitimacy. Historical compliance issues have been noted in similar offshore brokers, which adds to the skepticism surrounding VistaForex's operations.

Company Background Investigation

VistaForex appears to have a relatively short history, having been established in 2020. The broker's ownership structure is unclear, as there is limited information available about the individuals behind the company. This lack of transparency is a significant red flag, as it prevents potential traders from assessing the qualifications and experiences of the management team.

Moreover, the company's website and customer support do not provide detailed information about its operational history or any previous achievements. This obscurity can be troubling for investors who seek to understand the credibility of the broker they are considering. The absence of a clear and transparent company profile can lead to doubts about the broker's intentions and operational integrity.

Trading Conditions Analysis

When evaluating a broker, it's crucial to consider the trading conditions it offers, including fees, spreads, and commissions. VistaForex claims to provide competitive trading conditions; however, the lack of regulation raises questions about the legitimacy of these claims.

Core Trading Costs Comparison Table

| Fee Type | VistaForex | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.0 pips |

| Commission Model | Varies | $7 per 100k |

| Overnight Interest Range | High | Moderate |

The spreads offered by VistaForex are reported to be higher than the industry average, which could significantly impact trading profitability. Additionally, the commission structure lacks clarity, and there are indications that traders may incur unexpected fees. This uncertainty regarding the cost of trading can be detrimental to investors, particularly those who rely on precise calculations for their trading strategies.

Client Fund Safety

Client fund safety is paramount when considering a broker. VistaForex's lack of regulatory oversight means that there are no mandated requirements for segregating client funds from the company's operating capital. This poses a substantial risk, as traders' funds could be at risk in the event of the broker's financial difficulties.

The absence of investor protection measures, such as negative balance protection, further exacerbates concerns regarding fund safety. In the past, unregulated brokers have been known to engage in practices that jeopardize client funds, leading to significant financial losses for traders. Consequently, potential investors must weigh these risks carefully when considering whether to trade with VistaForex.

Customer Experience and Complaints

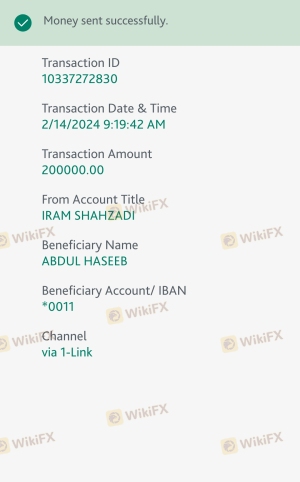

Customer feedback is a vital aspect of evaluating a broker's reputation. Reviews of VistaForex reveal a number of complaints from users regarding withdrawal difficulties, poor customer service, and unfulfilled promises.

Complaint Types and Severity Assessment Table

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Customer Service Quality | Medium | Unresolved |

| Misleading Promotions | High | No Acknowledgment |

Common complaints suggest that clients often face challenges when attempting to withdraw their funds, with many reporting delays or outright denials. This pattern of behavior raises significant concerns about the broker's reliability and ethical practices. In some cases, users have expressed frustration over the lack of responsiveness from customer support, which can further exacerbate the issues faced by traders.

Platform and Trade Execution

The trading platform offered by VistaForex is based on MetaTrader 5 (MT5), a widely recognized and respected trading platform. However, the quality of execution and overall user experience is critical to successful trading.

Users have reported mixed experiences with order execution, including instances of slippage and rejected orders. These issues can significantly impact trading outcomes, particularly for those engaged in high-frequency trading or scalping strategies. Furthermore, any signs of potential platform manipulation should be taken seriously, as they can indicate deeper issues within the broker's operational integrity.

Risk Assessment

Trading with an unregulated broker like VistaForex carries inherent risks that traders must consider.

Risk Scorecard

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight or protection. |

| Fund Safety Risks | High | No segregation of client funds. |

| Customer Service Risks | Medium | Poor responsiveness and unresolved issues. |

| Trading Conditions Risks | Medium | Higher spreads and unclear fee structures. |

To mitigate these risks, potential traders should conduct thorough research and consider using regulated brokers with established reputations. Additionally, maintaining a cautious approach to trading, including setting strict risk management parameters, can help safeguard investments.

Conclusion and Recommendations

In conclusion, the investigation into VistaForex raises significant concerns about its legitimacy and safety for traders. The lack of regulation, combined with numerous customer complaints and ambiguous trading conditions, suggests that potential investors should exercise extreme caution.

While VistaForex may offer access to various trading instruments, the associated risks and red flags indicate that it may not be a reliable choice for traders seeking a secure and trustworthy environment. For those considering forex trading, it is advisable to explore regulated alternatives that provide robust investor protections and transparent operations.

In summary, is VistaForex safe? The evidence suggests that it is not, and traders are encouraged to look for more reputable brokers to ensure their investments are secure.

Is VistaForex a scam, or is it legit?

The latest exposure and evaluation content of VistaForex brokers.

VistaForex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

VistaForex latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.