Regarding the legitimacy of Global Markets Group forex brokers, it provides FCA and WikiBit, (also has a graphic survey regarding security).

Is Global Markets Group safe?

Pros

Cons

Is Global Markets Group markets regulated?

The regulatory license is the strongest proof.

FCA Market Making License (MM)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

Global Markets Group Limited

Effective Date: Change Record

2016-09-12Email Address of Licensed Institution:

info@gmgmarkets.co.uk, compliance_team@gmgmarkets.co.ukSharing Status:

No SharingWebsite of Licensed Institution:

www.gmgmarkets.co.ukExpiration Time:

--Address of Licensed Institution:

The Jellicoe 5, Beaconsfield Street Kings Cross London N1C 4EW UNITED KINGDOMPhone Number of Licensed Institution:

+442038653306Licensed Institution Certified Documents:

Is Global Markets Group A Scam?

Introduction

Global Markets Group (GMG) is a forex brokerage that positions itself as a bridge between retail traders and the vast financial markets. Established in the UK, GMG claims to offer a range of trading services, including forex and CFDs, leveraging advanced technology and market access. However, as the forex industry continues to grow, so do the number of brokers, making it crucial for traders to evaluate the legitimacy and trustworthiness of these platforms. With numerous reports of scams and fraudulent activities in the trading space, understanding whether "Is Global Markets Group safe?" is essential for potential investors.

This article aims to provide a comprehensive evaluation of Global Markets Group by analyzing its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and overall risk assessment. The information is gathered from various credible sources, including regulatory filings, user reviews, and expert analyses.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety and reliability. Global Markets Group claims to be regulated by the Financial Conduct Authority (FCA) in the UK, which is known for its stringent regulatory environment. However, the credibility of this claim has been questioned by several users and analysts.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | 744501 | United Kingdom | Verified |

The FCA is recognized as a top-tier regulator, ensuring that brokers adhere to strict financial standards, including client fund segregation and annual audits. However, some reports suggest that Global Markets Group may be operating as a clone firm, which means it could be falsely using the FCA's name to gain credibility. This raises concerns about the quality of its regulation and compliance history.

While GMG claims to provide a regulated environment, the presence of multiple complaints regarding withdrawal issues and unresponsive customer service suggests that traders should approach this broker with caution. Therefore, it is imperative to ask: Is Global Markets Group safe? The answer may depend on the individual trader's risk tolerance and expectations.

Company Background Investigation

Global Markets Group was founded in 2016, and its headquarters are located in London, UK. The company has positioned itself as an ECN broker, claiming to offer direct market access to various trading instruments. However, a closer examination of its ownership structure and management team reveals a lack of transparency.

The management team comprises individuals with varying degrees of experience in the financial industry, but detailed biographies are often absent from public disclosures. This lack of information can be a red flag for potential investors. Additionally, the company has faced scrutiny over its operational practices, with some users reporting that the platform has not been forthcoming with information regarding fees and trading conditions.

Transparency is a critical component of trust in the financial industry, and the absence of clear communication from Global Markets Group raises questions about its commitment to ethical practices. Hence, when considering whether Is Global Markets Group safe, traders should weigh the company's history and management practices carefully.

Trading Conditions Analysis

The trading conditions offered by a brokerage can significantly impact a trader's overall experience. Global Markets Group provides two types of accounts: a standard account with a minimum deposit of $200 and a raw spread account that also requires a $200 minimum deposit. The spreads start from 0.0 pips, which is competitive in the industry, but traders should be aware of the potential for hidden fees.

| Fee Type | Global Markets Group | Industry Average |

|---|---|---|

| Major Currency Pair Spread | From 0.0 pips | 1.0 pips |

| Commission Model | $3.5 per lot | $5.0 per lot |

| Overnight Interest Range | Varies | Varies |

Although the spreads appear attractive, the commission structure may deter some traders. Moreover, the company has been criticized for its opaque fee policies, which can lead to unexpected costs. Such practices can be detrimental to traders, especially those who rely on tight margins.

In assessing whether Is Global Markets Group safe, it is essential to scrutinize these trading conditions. While they may seem favorable on the surface, the potential for hidden fees and the lack of clarity surrounding costs could indicate underlying issues that traders should be wary of.

Customer Fund Safety

The safety of customer funds is paramount when evaluating a broker's reliability. Global Markets Group claims to segregate client funds and adhere to FCA regulations, which mandate that client money is held in separate accounts. This practice is designed to protect traders in the event of the broker's insolvency.

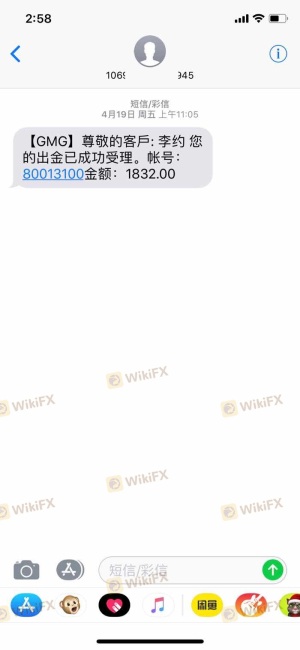

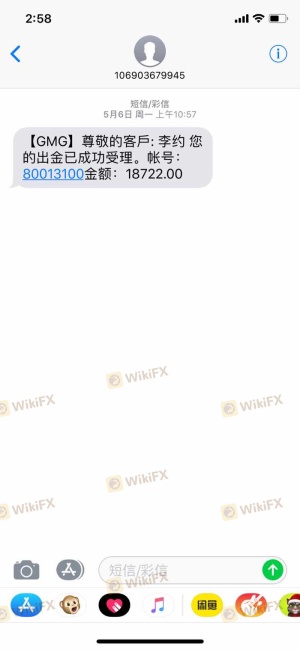

However, reports of delayed withdrawals and unresponsive customer service have raised concerns about the actual implementation of these safety measures. Traders have reported instances where their withdrawal requests were ignored or delayed for extended periods, leading to suspicions about the company's financial health.

Moreover, the absence of a clear investor compensation scheme further complicates the safety of funds held with Global Markets Group. In the event of a broker failure, traders may find it challenging to recover their investments. Therefore, when considering whether Is Global Markets Group safe, traders must carefully evaluate the broker's fund protection measures and any historical issues related to fund security.

Customer Experience and Complaints

Customer feedback is a valuable resource for assessing a broker's reputation and reliability. Global Markets Group has received mixed reviews from users, with some praising its trading platform and customer service, while others express frustration over withdrawal issues and lack of communication.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Transparency | Medium | Fair |

| Customer Service Issues | High | Poor |

Common complaints include difficulties in processing withdrawals, lack of timely responses from customer support, and unclear fee structures. Case studies reveal that several traders have experienced significant delays in accessing their funds, which raises red flags about the broker's operational integrity.

When examining whether Is Global Markets Group safe, it is crucial to consider the overall customer experience. The prevalence of complaints and the company's inadequate responses suggest a need for caution among potential traders.

Platform and Trade Execution

The trading platform's performance is a critical aspect of the trading experience. Global Markets Group offers the MetaTrader 4 and 5 platforms, which are well-regarded in the industry for their functionality and user-friendliness. However, some users have reported issues with order execution, including slippage and rejected orders.

Quality execution is vital for traders, particularly in fast-moving markets. Instances of slippage during volatile periods can significantly impact trading outcomes. Moreover, reports of potential platform manipulation have emerged, further complicating the assessment of GMG's reliability.

In light of these considerations, it is essential to question: Is Global Markets Group safe? The platform's performance and execution quality must be scrutinized, as they play a pivotal role in a trader's success.

Risk Assessment

Evaluating the risks associated with trading through Global Markets Group is crucial for informed decision-making. The following risk assessment summarizes key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | Medium | Questions about clone status |

| Fund Security | High | Reports of withdrawal issues |

| Customer Support | High | Poor response to complaints |

| Trading Conditions | Medium | Hidden fees and unclear policies |

To mitigate these risks, traders should conduct thorough due diligence, maintain realistic expectations, and consider diversifying their investments across multiple platforms.

Conclusion and Recommendations

In conclusion, the question of whether Is Global Markets Group safe is complex and multifaceted. While the broker claims to be regulated by the FCA and offers competitive trading conditions, numerous complaints and reports of withdrawal issues raise significant concerns about its reliability and operational integrity.

Traders are advised to exercise caution when considering this broker. It may be prudent to seek alternatives with a stronger track record and more transparent practices. Some reputable options include brokers with robust regulatory oversight, clear fee structures, and positive user experiences.

Ultimately, thorough research and careful evaluation are essential for any trader looking to navigate the forex market safely and effectively.

Is Global Markets Group a scam, or is it legit?

The latest exposure and evaluation content of Global Markets Group brokers.

Global Markets Group Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Global Markets Group latest industry rating score is 2.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 2.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.