VistaForex 2025 Review: Everything You Need to Know

Summary

VistaForex is an unregulated offshore broker with a poor reputation. Traders should approach this broker with extreme caution because of serious credibility and transparency issues. This vistaforex review reveals significant concerns about the broker's operations and trustworthiness that potential clients must consider carefully.

The broker offers MetaTrader5 trading platform and access to multiple asset classes. These include forex, indices, stocks, precious metals, cryptocurrencies, energy, and commodities, which provides variety for traders seeking diverse investment options. However, VistaForex lacks proper regulatory oversight which poses substantial risks to all traders who choose to work with them.

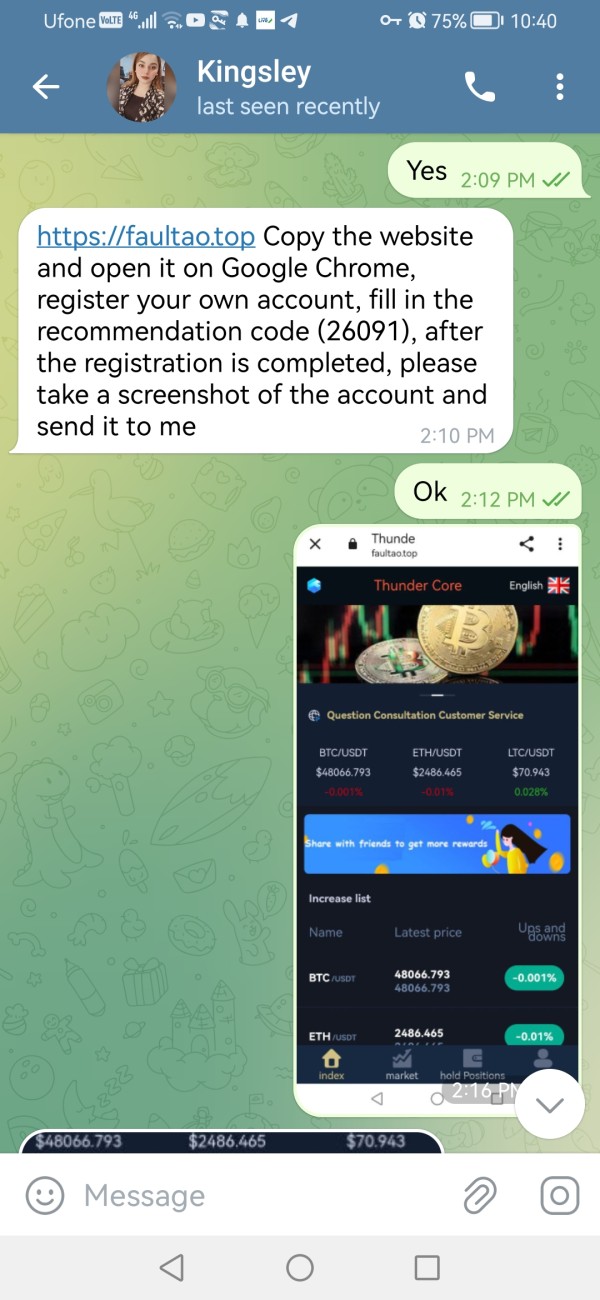

The primary user base consists of investors seeking diversified trading products. These traders must bear considerable risks due to the broker's unregulated status and questionable business practices. Multiple fraud allegations have been reported against VistaForex throughout its operation period.

Users provide consistently negative feedback about their trading experience with this broker. While VistaForex does offer welcome bonuses and promotional activities to attract new clients, potential traders should exercise extreme caution before engaging with their services. Based on available information and user feedback, VistaForex presents more risks than benefits for traders looking for a reliable trading partner in the competitive forex market.

Important Notice

VistaForex operates as an unregulated offshore broker. This status may present cross-regional trading risks that investors should carefully consider before opening accounts or depositing funds. The lack of regulatory supervision means that traders have limited recourse in case of disputes or issues with fund withdrawals.

This review is based on available information and user feedback. The analysis aims to help potential investors make informed decisions about whether to engage with this broker or seek alternatives. Given the multiple fraud allegations and consistently poor user reviews, we strongly recommend that traders consider regulated alternatives that offer better protection and transparency.

The information presented in this review should not be considered as investment advice. Potential clients should conduct their own thorough research before making any trading decisions or financial commitments with any broker.

Rating Framework

Broker Overview

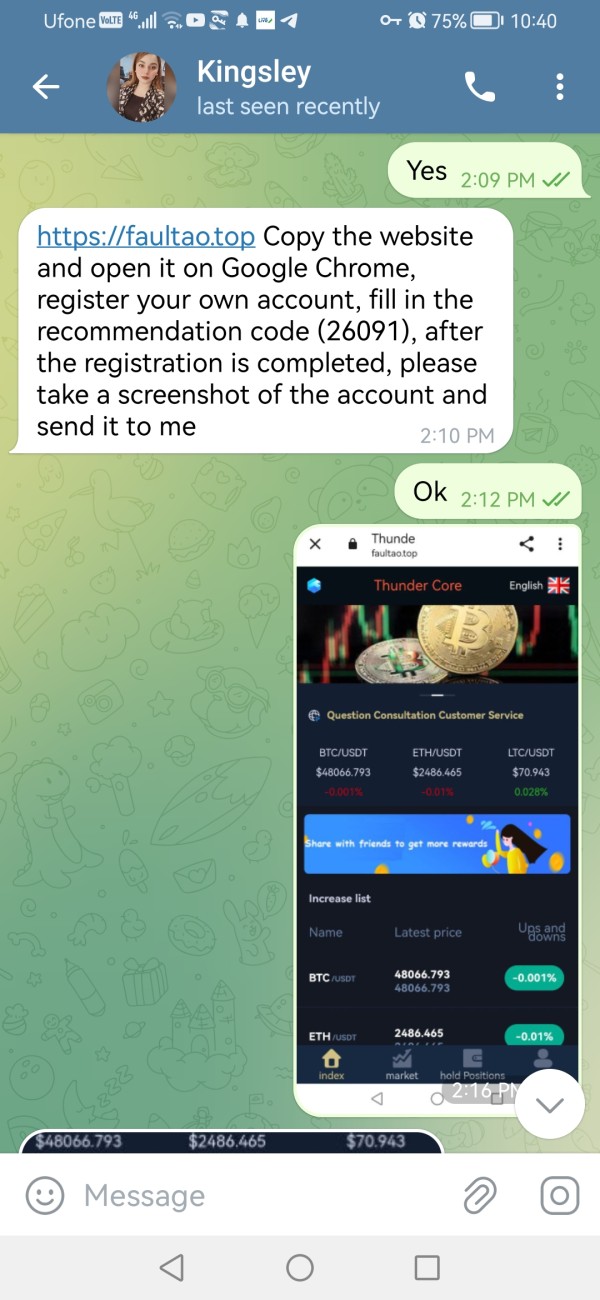

VistaForex operates as an unregulated offshore broker in the foreign exchange market. Specific information about its establishment date remains undisclosed in available materials, which raises immediate transparency concerns. The company's background raises significant concerns due to its lack of regulatory oversight and poor reputation within the trading community.

Multiple sources indicate that VistaForex has been subject to fraud allegations. These allegations severely undermine its credibility as a trading partner and should concern any potential client. The broker's primary business model revolves around providing forex and multi-asset trading services to retail clients worldwide.

However, the absence of proper regulatory supervision means that clients have limited protection and recourse in case of disputes. The company's operational transparency is questionable with limited information available about its corporate structure, management team, or physical office locations. VistaForex provides access to the MetaTrader5 trading platform, which is considered industry-standard software for forex and CFD trading.

The platform supports trading across multiple asset classes including forex pairs, stock indices, individual stocks, precious metals, cryptocurrencies, energy commodities, and other trading instruments. Despite offering this comprehensive range of tradeable assets, the vistaforex review data suggests that the broker's execution quality and overall service delivery fall short of industry standards. The broker's unregulated status means it operates without oversight from major financial regulatory bodies, which poses significant risks to client funds and trading operations.

Regulatory Status: VistaForex operates as an unregulated offshore broker. The broker lacks oversight from recognized financial regulatory authorities, which significantly increases risks for traders and reduces transparency in operations.

Deposit and Withdrawal Methods: Specific information about deposit and withdrawal methods is not detailed in available materials. This lack of transparency raises concerns about the broker's operational clarity and client communication standards.

Minimum Deposit Requirements: The minimum deposit amount required to open an account with VistaForex is not specified in available sources. This indicates a lack of clear communication about account requirements and basic trading conditions.

Bonus and Promotions: VistaForex offers welcome bonuses and various promotional activities to attract new clients. However, given the broker's poor reputation and unregulated status, traders should exercise extreme caution when considering these offers and their associated terms.

Tradeable Assets: The broker provides access to multiple asset classes including foreign exchange pairs, stock indices, individual stocks, precious metals, cryptocurrencies, energy commodities, and other financial instruments through the MT5 platform. This variety gives traders options for portfolio diversification across different markets and instruments.

Cost Structure: Specific information about spreads, commissions, and other trading costs is not provided in available materials. User feedback suggests that the cost structure may not be competitive compared to regulated alternatives in the market.

Leverage Options: While VistaForex offers leveraged trading, specific leverage ratios are not detailed in available sources. This limits traders' ability to assess risk management parameters and plan their trading strategies effectively.

Platform Selection: The broker provides access to MetaTrader5, which is a widely recognized and feature-rich trading platform. MT5 supports advanced charting, automated trading, and multiple order types for comprehensive trading functionality.

Geographic Restrictions: Information about specific geographic restrictions or availability is not detailed in available materials. This lack of clarity makes it difficult for international traders to understand their eligibility for services.

Customer Support Languages: The range of languages supported by VistaForex customer service is not specified in available sources. This vistaforex review highlights the significant information gaps that potential clients should consider when evaluating the broker.

Detailed Rating Analysis

Account Conditions Analysis (Score: 3/10)

VistaForex's account conditions receive a low rating due to the lack of transparency regarding essential trading parameters. The broker does not provide clear information about account types, their specific features, or the requirements for each tier, which makes evaluation difficult. This opacity makes it difficult for potential clients to understand what they can expect from their trading accounts and plan their investment approach.

The absence of detailed information about minimum deposit requirements is particularly concerning. This is fundamental information that regulated brokers typically provide upfront to help clients make informed decisions. Without clear deposit thresholds, traders cannot properly plan their initial investment or understand the broker's target client base and service level.

User feedback consistently indicates poor experiences with account conditions. This suggests that the actual terms may not be competitive or favorable compared to industry standards. The account opening process is not well-documented in available materials, which raises questions about the broker's operational efficiency and customer onboarding procedures.

Regulated brokers typically provide clear, step-by-step guidance for account opening. This includes required documentation and verification processes that ensure compliance and client protection. Special account features such as Islamic accounts for Muslim traders are not mentioned in available sources, limiting the broker's appeal to diverse religious and cultural backgrounds.

The lack of detailed account information, combined with consistently negative user reviews, justifies the low rating for this vistaforex review category. Potential clients should expect better transparency and clearer terms from legitimate brokers.

VistaForex receives a moderate rating for tools and resources primarily due to its provision of the MetaTrader5 platform. MT5 is considered industry-standard software that offers comprehensive functionality for serious traders. The platform offers comprehensive charting capabilities, technical analysis tools, automated trading support through Expert Advisors, and access to multiple asset classes from a single interface.

The platform supports various order types and execution modes. This provides traders with flexibility in implementing their trading strategies and managing risk effectively. MT5's built-in economic calendar, market news feed, and technical indicators offer basic research and analysis capabilities that can support trading decisions.

However, the broker appears to lack additional proprietary tools or enhanced research resources. These could differentiate it from competitors and provide added value to clients seeking comprehensive market analysis. Educational resources are notably absent from available information about VistaForex, which is a significant drawback for novice traders who need guidance and learning materials.

Modern brokers typically provide webinars, tutorials, market analysis, and educational content. These resources support client development and trading success over time. The support for automated trading through MT5 is a positive feature, allowing experienced traders to implement algorithmic strategies and systematic approaches.

However, without additional tools, research resources, or educational support, VistaForex's offering remains basic compared to well-established regulated brokers. This limits its appeal to traders seeking comprehensive support and advanced functionality.

Customer Service and Support Analysis (Score: 2/10)

VistaForex receives an extremely low rating for customer service based on consistently negative user feedback and reported service quality issues. Multiple sources indicate that users have experienced poor customer support, which is critical for addressing trading issues, account problems, and technical difficulties that arise. The specific customer service channels available are not clearly detailed in available materials, which suggests poor communication about support options and accessibility.

Professional brokers typically provide multiple contact methods including live chat, email, phone support, and comprehensive FAQ sections. The absence of clear support channel information raises concerns about accessibility when clients need assistance with urgent trading matters. Response times for customer inquiries are not specified, and user feedback suggests that when support is available, the quality and effectiveness are substandard.

This is particularly problematic in the fast-paced trading environment where quick resolution of issues can be crucial. Problems with platform access, order execution, or account management require immediate attention to protect trading positions and account integrity. The broker's customer service appears to lack the multilingual support that international traders typically require for effective communication.

Without proper language support, non-English speaking clients may face additional barriers when seeking assistance. This limits the broker's ability to serve a global client base effectively. The combination of poor user feedback, limited information about support channels, and apparent service quality issues justifies the very low rating in this vistaforex review analysis.

Trading Experience Analysis (Score: 4/10)

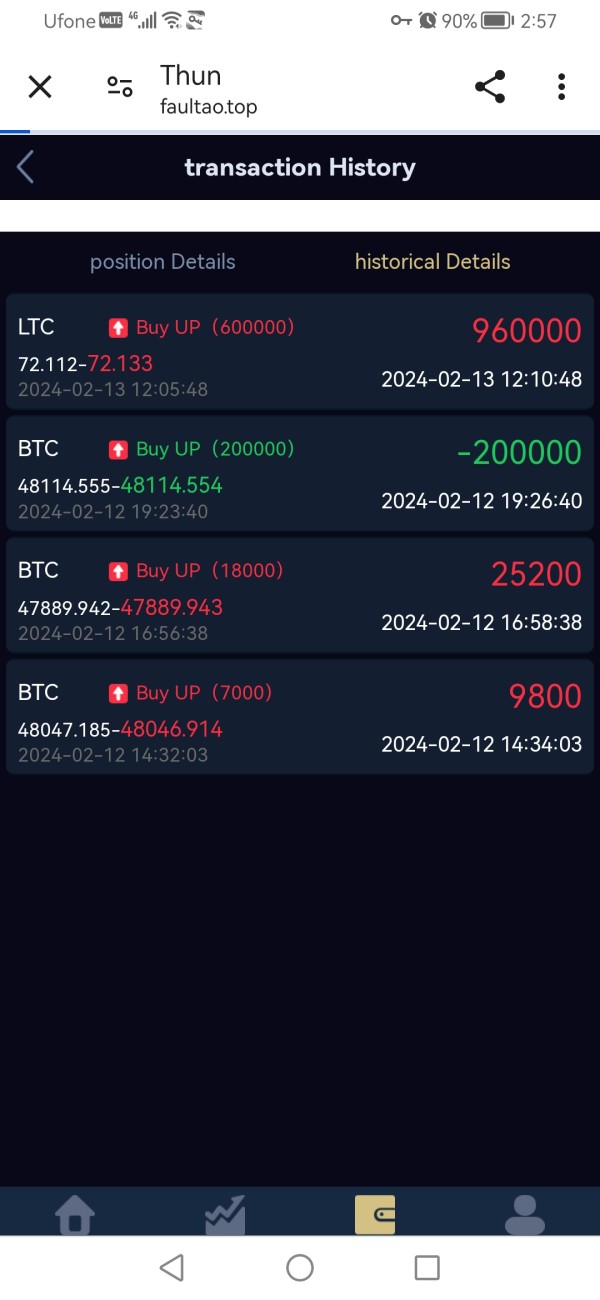

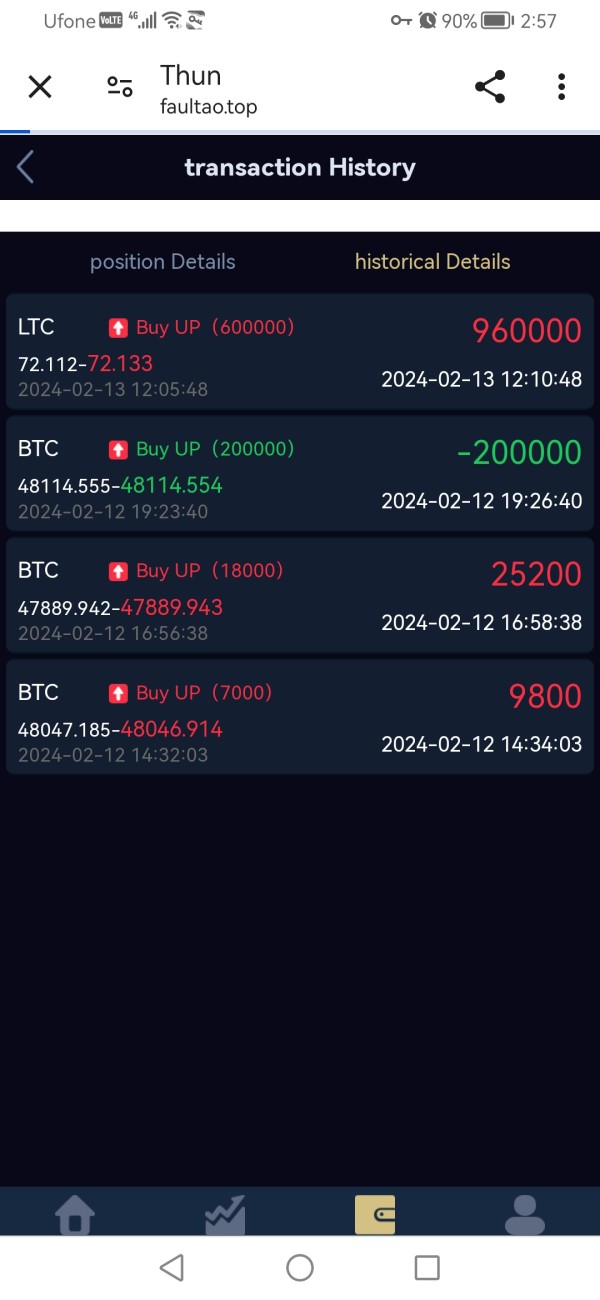

The trading experience with VistaForex receives a below-average rating based on user feedback indicating subpar performance across key trading metrics. While the broker provides access to the MT5 platform, which is technically capable and widely respected, user reports suggest that the overall trading environment does not meet industry standards. Platform stability and execution speed appear to be problematic based on negative user feedback from actual clients.

Reliable order execution is crucial for successful trading results. Any issues with platform performance can significantly impact trading outcomes and profitability. The lack of specific information about execution statistics, average spreads, or slippage data makes it difficult to assess the true quality of the trading environment objectively.

Order execution quality concerns include potential issues with slippage and requotes. However, specific performance data is not available in the provided materials to verify these concerns. Professional brokers typically provide transparency about their execution statistics and trading conditions to build client confidence and demonstrate their commitment to fair trading.

The mobile trading experience through MT5 should theoretically be adequate. The platform offers mobile applications that provide basic trading functionality on smartphones and tablets. However, without specific user feedback about mobile functionality and performance, it's difficult to assess this aspect thoroughly and provide accurate guidance.

User reviews suggest that overall trading conditions, including spread stability and execution reliability, do not meet expectations. This is particularly concerning for serious trading activities that require consistent performance and reliable market access.

Trust and Safety Analysis (Score: 1/10)

VistaForex receives the lowest possible rating for trust and safety due to its unregulated status and multiple fraud allegations. Operating without regulatory oversight from recognized financial authorities means that client funds lack the protection typically provided by regulated brokers through segregated accounts, compensation schemes, and regulatory supervision. The broker's unregulated status is particularly concerning because it means there is no external authority monitoring its business practices.

This absence of oversight extends to financial stability monitoring and compliance with industry standards. Regulated brokers must adhere to strict capital requirements, operational guidelines, and client protection measures that are absent in VistaForex's case. Multiple fraud allegations have been reported against VistaForex, which severely undermines its credibility and trustworthiness in the financial services industry.

These allegations, combined with consistently poor user reviews, suggest serious operational problems. The broker may not operate with the integrity and professionalism expected in the financial services industry. The lack of transparency about the company's corporate structure, management team, physical locations, and financial backing further reduces confidence in its legitimacy.

Professional brokers typically provide comprehensive information about their corporate governance and regulatory compliance. They also maintain operational transparency that allows clients to verify their legitimacy and track record. The absence of such information, combined with fraud allegations and poor reputation, makes VistaForex a high-risk choice for traders seeking a trustworthy partner.

User Experience Analysis (Score: 3/10)

VistaForex receives a low rating for user experience based on consistently negative feedback from clients who have engaged with the broker's services. Overall user satisfaction appears to be very poor with multiple reports indicating problems across various aspects of the trading experience and client relationship. The user interface and platform design, while based on the standard MT5 platform, may suffer from implementation issues or additional modifications that negatively impact usability.

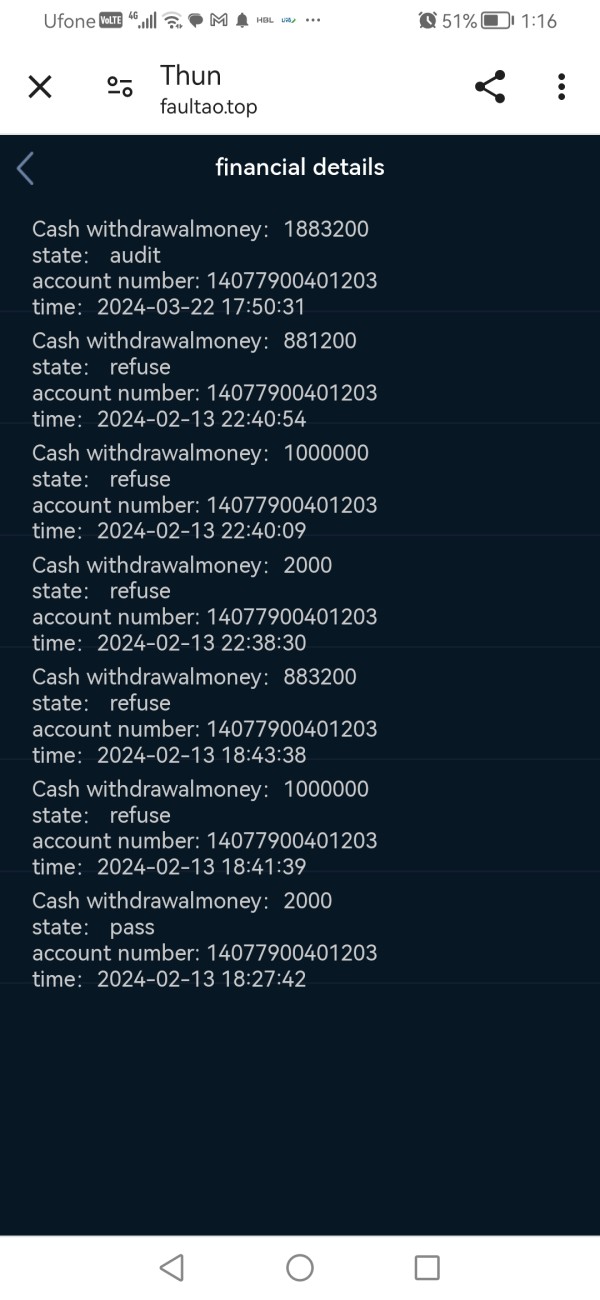

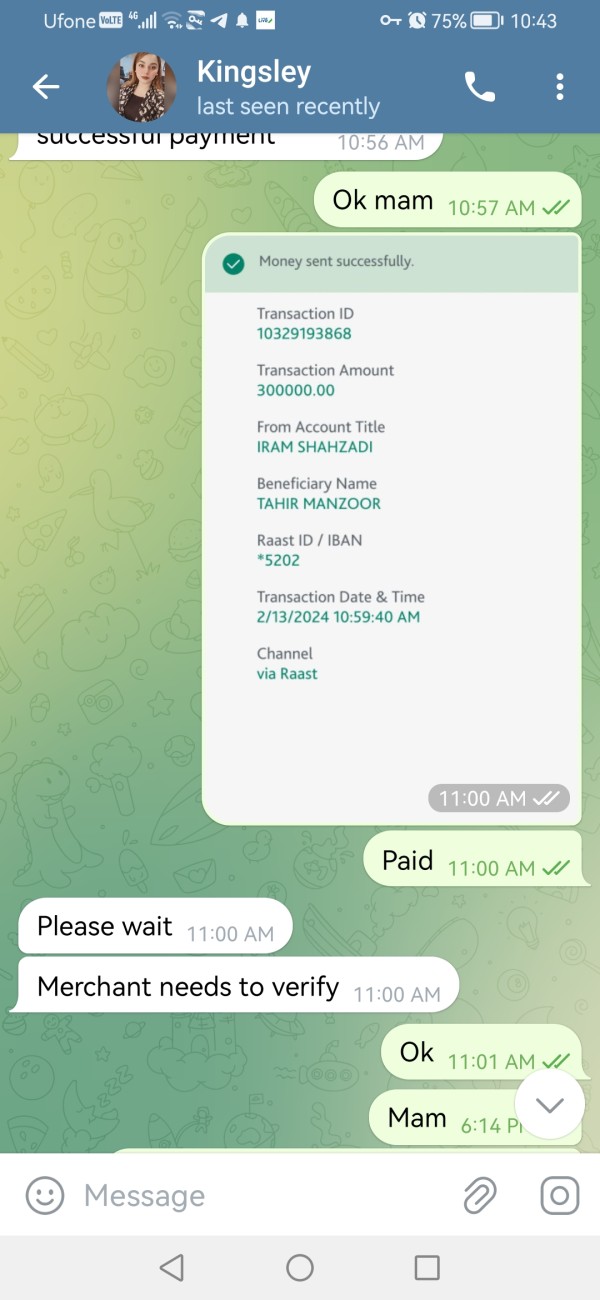

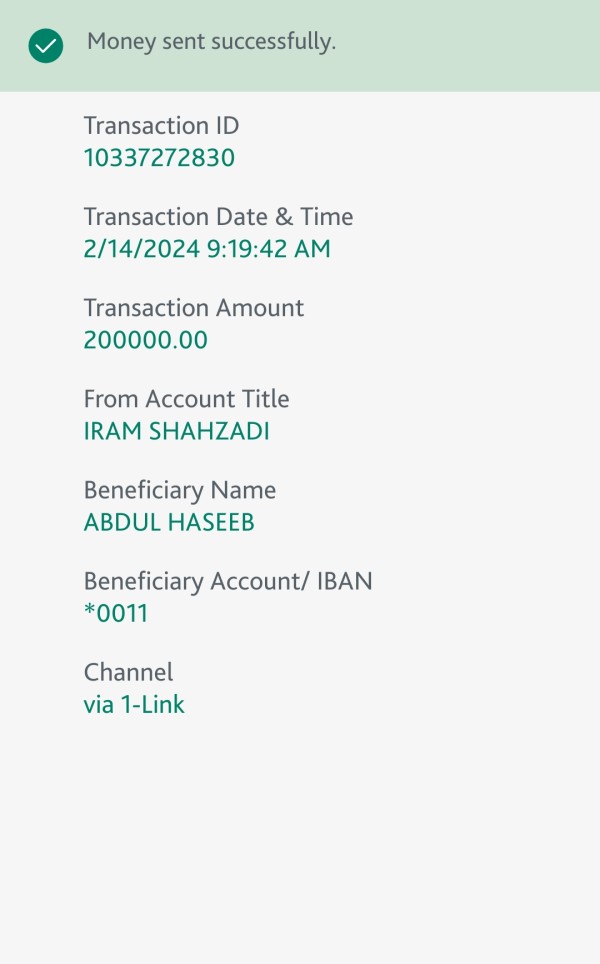

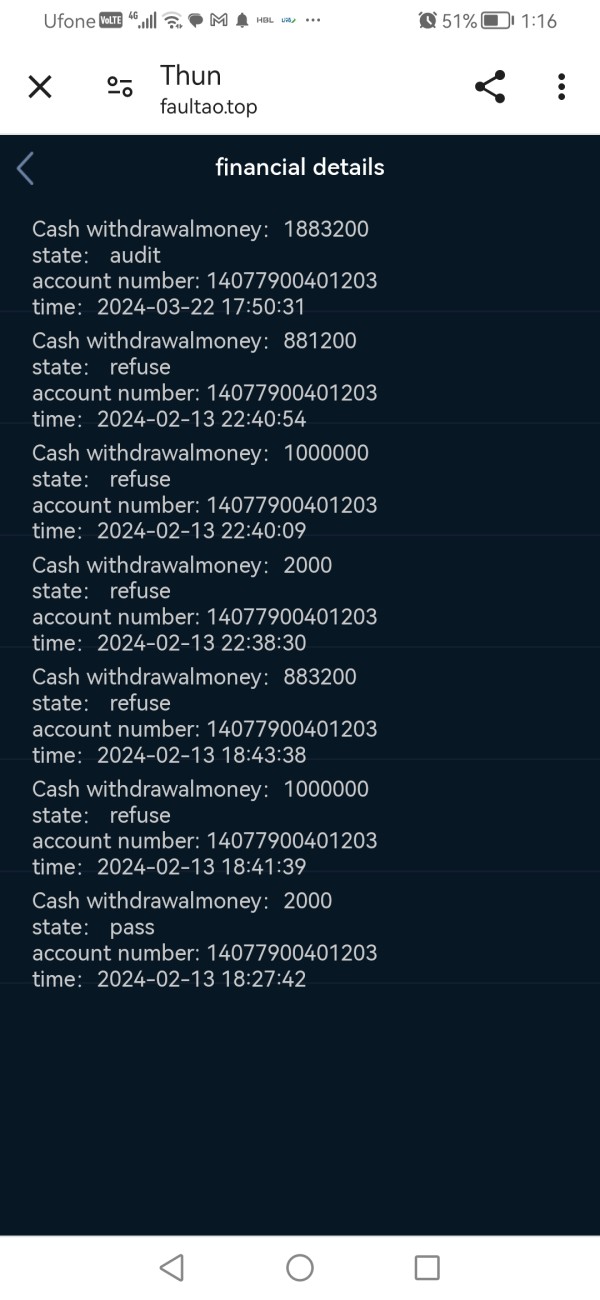

Without specific information about the registration and verification process, it's difficult to assess the ease of account opening. However, user feedback suggests that the overall client journey is problematic and frustrating for new users. Fund operation experiences appear to be particularly problematic with concerns about deposit and withdrawal processes based on the broker's poor reputation and fraud allegations.

Reliable and efficient fund transfers are essential for any trading relationship. Problems in this area significantly impact user satisfaction and create stress for clients managing their investments. Common user complaints include issues related to the broker's reliability, service quality, and overall trustworthiness in handling client accounts.

The vistaforex review feedback consistently points to negative experiences that suggest the broker fails to meet basic industry standards. These standards include client service excellence and operational reliability that traders expect from professional brokers. The broker appears to attract traders seeking diverse trading products and potentially higher leverage options.

However, the risks associated with its unregulated status and poor reputation far outweigh any potential benefits. Improvements in regulatory compliance, transparency, and service quality would be necessary to enhance user experience significantly and build client confidence.

Conclusion

Based on this comprehensive vistaforex review, VistaForex presents significant risks that outweigh its limited benefits for forex traders. As an unregulated offshore broker with multiple fraud allegations and consistently poor user feedback, the broker fails to meet basic industry standards that traders should expect. These standards include safety, reliability, and service quality that are essential for successful trading relationships.

While VistaForex offers access to the MetaTrader5 platform and multiple asset classes, these features cannot compensate for the fundamental issues. The problems with trust, regulation, and operational integrity create unacceptable risks for serious traders. The broker may appeal to traders seeking diverse trading products and potentially flexible trading conditions that are not available elsewhere.

However, the associated risks are substantial and should concern any potential client. The lack of regulatory oversight means client funds are not protected by industry-standard safeguards, and the multiple negative reports raise serious concerns about the broker's business practices and long-term viability.

Key advantages include MT5 platform access and multi-asset trading capabilities that provide variety. Major disadvantages encompass unregulated status, poor reputation, fraud allegations, inadequate customer service, lack of transparency, and consistently negative user experiences that create significant risks. For traders prioritizing safety and reliability, regulated alternatives would provide better protection and peace of mind in their trading activities and investment management.