Regarding the legitimacy of Vistabrokers forex brokers, it provides CYSEC and WikiBit, .

Is Vistabrokers safe?

Business

License

Is Vistabrokers markets regulated?

The regulatory license is the strongest proof.

CYSEC Forex Execution License (STP)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Global Trade CIF Ltd

Effective Date:

2013-01-24Email Address of Licensed Institution:

info@globaltradecif.comSharing Status:

No SharingWebsite of Licensed Institution:

www.finansero.com, www.globaltradecif.comExpiration Time:

--Address of Licensed Institution:

Tseriou Ave. 124, 2043 Strovolos, Nicosia, CyprusPhone Number of Licensed Institution:

+357 22 278 367Licensed Institution Certified Documents:

Is Vistabrokers Safe or a Scam?

Introduction

Vistabrokers is a forex and CFD broker that positions itself within the competitive landscape of the online trading market. Based in Cyprus, it claims to offer a range of trading instruments, including forex pairs, commodities, and indices. However, the increasing prevalence of scams in the financial industry necessitates that traders exercise caution when selecting a broker. The importance of due diligence cannot be overstated, as the wrong choice can lead to significant financial losses. This article aims to provide a comprehensive evaluation of Vistabrokers, focusing on its regulatory status, company background, trading conditions, customer fund safety, client experiences, platform performance, and overall risk assessment. Our investigation is based on a thorough review of various sources, including user feedback and expert analyses, to determine if Vistabrokers is safe for traders.

Regulation and Legitimacy

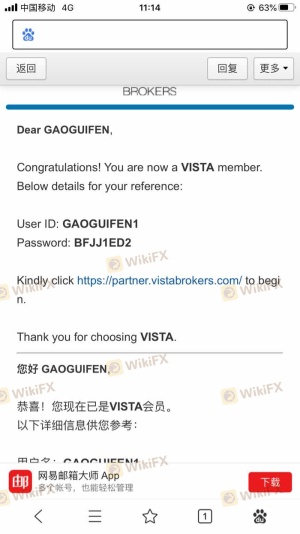

The regulatory framework surrounding a broker is a crucial aspect that helps determine its legitimacy and safety for traders. Vistabrokers claims to be regulated by the Cyprus Securities and Exchange Commission (CySEC), which is a reputable regulatory body within the European Union. Regulation by CySEC generally indicates that the broker adheres to specific operational standards, including the segregation of client funds and maintaining a minimum capital requirement.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Cyprus Securities and Exchange Commission (CySEC) | 190/13 | Cyprus | Verified |

CySEC requires its licensed firms to maintain a minimum of €1 million in operating capital and to keep client funds in segregated accounts. This provides a layer of protection for traders, ensuring that their funds are not misused for the broker's operational expenses. Furthermore, CySEC-regulated firms are also part of the Investor Compensation Fund (ICF), which offers compensation to clients in the event of the broker's insolvency. However, while Vistabrokers claims to comply with these regulations, it is essential to evaluate its historical compliance and any past regulatory issues. Reports indicate that Vistabrokers has faced scrutiny regarding its operational practices, raising questions about its overall regulatory quality.

Company Background Investigation

Vistabrokers was established in 2012 and operates under the name Vistabrokers CIF Ltd. The company is registered in Limassol, Cyprus. Despite its relatively recent inception in the brokerage industry, Vistabrokers aims to present itself as a trustworthy entity with a focus on customer service. However, the ownership structure and management team details remain somewhat opaque, which can be a red flag for potential investors.

The management team consists of individuals with varying degrees of experience in the financial sector, but specific qualifications and backgrounds are not extensively disclosed. This lack of transparency may hinder traders' ability to assess the broker's reliability. Additionally, the quality of information disclosure is critical; a broker that is forthcoming about its operations and management instills greater confidence in potential clients. Vistabrokers does provide some educational resources and market analyses, but the extent of transparency regarding its operational practices remains questionable.

Trading Conditions Analysis

Evaluating the trading conditions offered by Vistabrokers is vital for understanding its attractiveness to traders. The broker provides several account types, including basic, advanced, and pro accounts, each with different minimum deposit requirements and fee structures. The overall fee structure appears to be somewhat higher than industry standards, which could deter cost-sensitive traders.

| Fee Type | Vistabrokers | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.5 pips | 1.2 pips |

| Commission Model | $15 per 100k | $10 per 100k |

| Overnight Interest Range | 0.5% - 1% | 0.3% - 0.5% |

The spreads on major currency pairs are slightly above the industry average, which could affect profitability for active traders. Additionally, the commission structure is not particularly competitive, especially for those who trade larger volumes. Vistabrokers also imposes overnight interest fees that may vary significantly, depending on market conditions. Such policies could be viewed as a disadvantage, particularly for traders who prefer low-cost trading environments. Overall, the trading conditions at Vistabrokers raise concerns about whether it is truly a cost-effective option for traders.

Customer Fund Safety

The safety of customer funds is paramount when evaluating a broker's credibility. Vistabrokers claims to implement several measures to protect client funds, including the segregation of accounts and participation in the ICF. Segregated accounts ensure that client funds are kept separate from the broker's operational capital, providing a layer of security in case of financial difficulties.

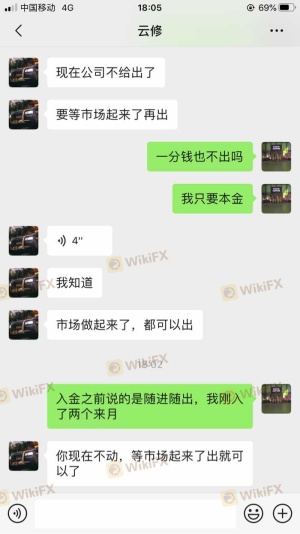

Moreover, the ICF offers compensation of up to €20,000 per client in the event of the broker's insolvency. However, it is essential to investigate any past incidents involving fund safety, as these could impact the broker's reputation. Some users have reported difficulties in withdrawing funds, which raises concerns about the broker's commitment to fund safety. Such issues could indicate potential risks associated with using Vistabrokers, making it crucial for traders to weigh these factors carefully.

Customer Experience and Complaints

Customer feedback is an essential component in assessing the reliability of a broker. Vistabrokers has received mixed reviews from users, with some praising its platform and customer service, while others express concerns about withdrawal processes and customer support quality.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Account Management | Medium | Average support |

| Trading Conditions | Low | Limited action |

Common complaints include difficulties in withdrawing funds and delays in customer support responses. Some users have reported that their withdrawal requests were either delayed or denied without clear explanations. These complaints suggest a potential pattern of issues that could undermine trust in Vistabrokers. The company's response to these complaints has been described as slow, leading to frustration among clients.

Case Studies

One user reported a significant delay in their withdrawal request, leading to frustration and a lack of trust in the broker's operations. Another trader expressed dissatisfaction with the company's handling of account management issues, indicating a lack of proactive support. These cases exemplify the challenges that some clients face when dealing with Vistabrokers.

Platform and Trade Execution

The trading platform provided by Vistabrokers is based on the widely used MetaTrader 4 (MT4), which is known for its reliability and user-friendly interface. However, the performance and stability of the platform are critical for traders, especially in fast-moving markets. Users have reported mixed experiences with the platform's execution quality, with some noting instances of slippage and order rejections.

The execution quality is a vital factor that can significantly impact trading outcomes. If traders frequently encounter slippage or rejected orders, it can lead to frustration and potential losses. There have been some reports of platform manipulation, which could further compromise the integrity of the trading environment. Therefore, it is essential for traders to assess their experiences with the platform before committing significant capital.

Risk Assessment

Engaging with Vistabrokers entails certain risks that traders must consider. The combination of regulatory concerns, customer complaints, and potential issues with fund safety creates a complex risk landscape.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Potential compliance issues |

| Fund Safety | High | History of withdrawal complaints |

| Trading Conditions | Medium | Higher fees than average |

Risk Mitigation Suggestions

To mitigate risks associated with trading with Vistabrokers, traders should consider starting with a small investment to gauge the broker's reliability. It is also advisable to maintain a diversified trading portfolio and avoid investing more than one can afford to lose. Additionally, traders should stay informed about the broker's operational practices and any regulatory developments that may affect their trading experience.

Conclusion and Recommendations

In conclusion, while Vistabrokers presents itself as a regulated broker with a range of trading options, there are several concerns that potential clients should be aware of. The regulatory framework, while established, raises questions about compliance and operational practices. Customer experiences indicate issues with fund withdrawals and customer support, which further complicate the broker's reputation.

Given these factors, traders should approach Vistabrokers with caution. It is essential to conduct thorough research and consider alternative brokers with stronger reputations and proven track records. For those seeking reliable trading options, brokers regulated by top-tier authorities such as the FCA or ASIC may offer a safer trading environment. Ultimately, the question remains: Is Vistabrokers safe? The evidence suggests that while it may not be outright a scam, there are significant risks involved that warrant careful consideration.

Is Vistabrokers a scam, or is it legit?

The latest exposure and evaluation content of Vistabrokers brokers.

Vistabrokers Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Vistabrokers latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.