Is Transworld Futures safe?

Business

License

Is Transworld Futures Safe or a Scam?

Introduction

Transworld Futures is a U.S.-based brokerage firm that specializes in futures and options trading. Established in 2018, it aims to provide a service-oriented approach to commodity trading. However, as with any financial service provider, traders must exercise caution and conduct thorough evaluations before engaging with the broker. The foreign exchange market is rife with risks, and the choice of a broker can significantly impact a trader's success or failure. Therefore, it is essential to assess the credibility and safety of Transworld Futures. This article employs a comprehensive investigative framework, analyzing the broker's regulatory status, company background, trading conditions, customer experiences, and risk factors to determine whether Transworld Futures is safe or potentially a scam.

Regulatory and Legitimacy

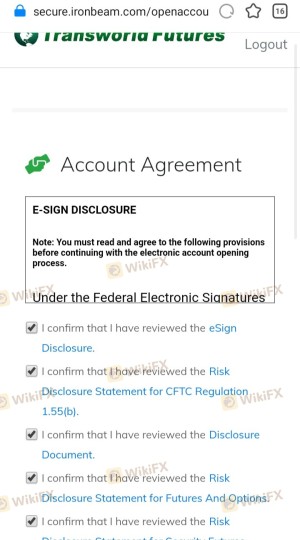

The regulatory environment is a critical factor in assessing the safety of any brokerage. Transworld Futures claims to be a member of the National Futures Association (NFA) and is registered with the Commodity Futures Trading Commission (CFTC). This regulatory oversight is crucial as it ensures that the broker adheres to established standards of conduct and provides a level of investor protection.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0393957 | United States | Verified |

While the presence of regulatory oversight from the NFA and CFTC is a positive sign, it is important to evaluate the quality of this regulation. The NFA is known for its stringent rules and compliance requirements, which enhances the credibility of brokers under its jurisdiction. However, some reviews have pointed out that Transworld Futures may be a "suspicious clone," suggesting that it might not be operating under the highest standards of integrity. Therefore, while the regulatory status indicates that Transworld Futures is not a scam at face value, further scrutiny is warranted.

Company Background Investigation

Transworld Futures has a relatively short history, having been founded in 2018. The company is headquartered in Valparaiso, Indiana, and operates as an introducing broker. Its ownership structure is not explicitly detailed in available resources, which raises concerns about transparency.

The management teams background is also a significant factor in assessing the company's credibility. While some sources indicate that the team consists of experienced brokers, there is a lack of detailed information regarding their qualifications and prior experience in the financial industry. A lack of transparency in management can be a red flag for potential investors. Overall, while the company's regulatory membership is a positive aspect, the limited information about its history and management may lead to questions about its reliability.

Trading Conditions Analysis

Transworld Futures offers a variety of trading accounts, each tailored to different types of traders. The overall fee structure includes spreads, commissions, and overnight interest rates. However, as with many brokers, it is essential to evaluate whether these fees are competitive and transparent.

| Fee Type | Transworld Futures | Industry Average |

|---|---|---|

| Major Currency Pairs Spread | Variable | 1.0 - 2.0 pips |

| Commission Structure | $0.50 per contract | $0.50 - $1.00 |

| Overnight Interest Range | 0.5% - 1.5% | 0.5% - 1.5% |

While the commission structure appears standard, the variability in spreads can be a cause for concern. Traders should be wary of any hidden fees or unusual policies that could affect their trading costs. Transparency in fee structures is essential for building trust, and any ambiguity could signal potential issues.

Customer Funds Safety

The safety of customer funds is paramount when evaluating a broker's credibility. Transworld Futures claims to keep client funds in segregated accounts at BMO Harris Bank, which is a positive sign. This practice helps protect client funds from being misused in the event of the broker's financial difficulties.

Additionally, the broker states that it offers negative balance protection, which ensures that clients cannot lose more than their initial investment. However, there have been complaints from users regarding withdrawal difficulties, raising questions about the brokers commitment to fund safety. Any historical issues related to fund safety should be thoroughly investigated before committing funds.

Customer Experience and Complaints

Customer feedback provides valuable insights into a broker's operational integrity. Transworld Futures has received mixed reviews, with some users praising its customer service while others report issues related to fund withdrawals and transparency.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Lack of Transparency | Medium | Unclear |

One notable complaint involved a user who claimed to have met all withdrawal requirements but was unable to access their funds, resulting in a loss of $1,450. This type of complaint is particularly concerning as it raises red flags about the broker's operational practices. While some complaints are expected in any business, a pattern of similar issues can indicate deeper systemic problems.

Platform and Execution

Transworld Futures offers a range of trading platforms, including MetaTrader 4 and proprietary solutions. The performance and stability of these platforms are crucial for traders, as they directly impact order execution quality.

However, there have been reports of slippage and order rejections, which can significantly affect trading outcomes. Traders should be cautious and consider testing the platform with a demo account to evaluate its performance before committing real funds. Any signs of platform manipulation or instability could indicate potential risks associated with using Transworld Futures.

Risk Assessment

Using Transworld Futures presents several risks that traders should consider. While the regulatory oversight is a positive aspect, the complaints regarding fund withdrawals and transparency issues cannot be overlooked.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | Medium | Potential issues with regulatory compliance |

| Withdrawal Risk | High | Complaints about fund access and withdrawals |

| Transparency Risk | Medium | Limited information about management and fees |

Traders should exercise caution and consider these risks when deciding whether to engage with Transworld Futures. Conducting thorough research and possibly opting for a more established broker may mitigate some of these risks.

Conclusion and Recommendations

In conclusion, while Transworld Futures does have regulatory oversight and offers a range of trading services, there are significant concerns regarding its operational practices and customer feedback. The presence of complaints related to fund withdrawals and transparency issues raises questions about whether Transworld Futures is entirely safe.

For traders considering this broker, it is crucial to weigh the potential risks against the benefits. If you are risk-averse or new to trading, it may be advisable to explore more established brokers with a proven track record of safety and reliability. Some reputable alternatives include brokers regulated by top-tier authorities, such as the FCA or ASIC, which have demonstrated a commitment to investor protection and transparency. Overall, while Transworld Futures may not be a scam, it is essential to approach trading with caution and awareness of the potential risks involved.

Is Transworld Futures a scam, or is it legit?

The latest exposure and evaluation content of Transworld Futures brokers.

Transworld Futures Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Transworld Futures latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.