Is Utdmarket safe?

Business

License

Is UTDMarket A Scam?

Introduction

UTDMarket, established in 2017, has positioned itself as an online forex broker that offers a variety of trading instruments, including forex, commodities, and CFDs. As the online trading landscape continues to grow, traders must exercise caution and diligence when choosing a broker. The potential for scams in the forex market is significant, often leading to substantial financial losses for unprepared investors. Therefore, it is imperative to evaluate brokers like UTDMarket carefully.

This article aims to provide a comprehensive analysis of UTDMarket's credibility, focusing on its regulatory status, company background, trading conditions, customer fund security, customer experiences, platform performance, and overall risk assessment. The findings are based on extensive research, including reviews from reputable financial websites and user feedback.

Regulation and Legitimacy

The regulatory status of a broker is a crucial factor in determining its legitimacy. UTDMarket operates without regulation from any recognized financial authority, which raises significant concerns regarding its safety and trustworthiness. The absence of regulation means that traders have no legal recourse if issues arise, such as withdrawal problems or fraudulent activities.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of regulatory oversight is a red flag for potential traders. Regulated brokers are required to adhere to strict guidelines designed to protect investors, such as maintaining segregated accounts for client funds and providing transparent pricing. In contrast, UTDMarket's offshore status and unregulated nature suggest that it may not be subject to such protective measures. Consequently, traders should approach UTDMarket with caution, as the absence of regulatory oversight increases the risk of financial loss.

Company Background Investigation

UTDMarket is operated by United Market Ltd., with its headquarters located in the Marshall Islands. The company's relatively short history and offshore registration raise questions about its long-term viability and accountability. Typically, brokers based in offshore jurisdictions are often associated with higher risks, including less transparency and lower standards of corporate governance.

The management team of UTDMarket has not been publicly disclosed, which limits the ability to assess their qualifications and experience in the financial industry. A lack of transparency in company ownership and management can be indicative of potential issues, as it becomes challenging for traders to hold the company accountable.

Furthermore, the information available on UTDMarket is minimal, which can lead to skepticism about its operations. A transparent broker should provide detailed information about its history, management, and operational practices to build trust with its clients.

Trading Conditions Analysis

When evaluating a broker, the overall trading conditions, including fees and spreads, are critical components. UTDMarket offers a minimum deposit requirement of $200, which is relatively standard in the industry. However, the spreads on major currency pairs are reported to be higher than average, potentially impacting a trader's profitability.

| Fee Type | UTDMarket | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.4 pips | 1.0 - 1.5 pips |

| Commission Structure | None | Varies |

| Overnight Interest Range | N/A | 0.5% - 2.5% |

The higher spreads at UTDMarket could indicate a less competitive pricing structure, which may deter traders looking for cost-effective trading options. Additionally, the absence of a commission structure might initially appear attractive, but it is essential to consider the overall cost of trading, including spreads and potential hidden fees.

Traders should also be cautious of any unusual fee policies that may arise after opening an account. The lack of transparency regarding fees can lead to unexpected costs that could significantly affect trading outcomes.

Customer Fund Security

The safety of customer funds is of paramount importance when selecting a forex broker. UTDMarket's lack of regulation raises concerns regarding the security of client deposits. Regulated brokers are typically required to implement measures such as segregated accounts, which protect client funds in the event of the broker's insolvency.

Moreover, UTDMarket does not provide clear information regarding investor protection mechanisms or negative balance protection policies. The absence of such safeguards leaves traders vulnerable to significant financial losses, especially in volatile market conditions.

Historical data does not indicate any major fund security incidents associated with UTDMarket, but the lack of a regulatory framework means that traders have limited recourse if issues arise. For this reason, potential clients should weigh the risks of trading with an unregulated broker like UTDMarket against their financial goals.

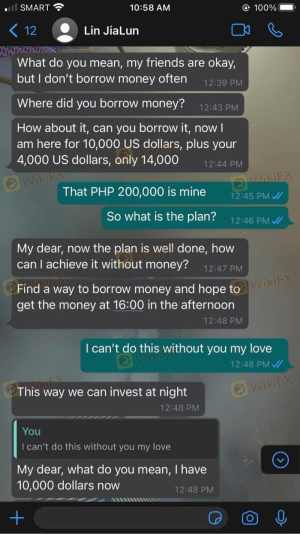

Customer Experience and Complaints

Customer feedback is a vital component of assessing a broker's reliability. Reviews of UTDMarket reveal a mixed bag of experiences, with several users expressing dissatisfaction regarding withdrawal processes and customer support responsiveness. Common complaints include delays in processing withdrawals and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Average |

For instance, one user reported a delay of over three weeks in withdrawing their funds, which is a significant concern for any trader. Such experiences can lead to frustration and distrust, further highlighting the importance of selecting a broker with a solid reputation for customer service.

Case Studies

-

Withdrawal Delay: A trader shared that after requesting a withdrawal, they received vague responses from customer support, leading to frustration and a loss of confidence in UTDMarket.

Poor Support: Another user noted that their inquiries were often met with delayed responses and inadequate solutions, which contributed to a negative trading experience.

Platform and Trade Execution

Evaluating the trading platform is essential for understanding the overall trading experience. UTDMarket offers the widely-used MetaTrader 4 platform, known for its user-friendly interface and robust functionality. However, the platform's performance, including execution quality and slippage, is crucial for successful trading.

Reports suggest that UTDMarket may experience higher slippage than competitors, which can adversely affect trade execution. Additionally, there have been no significant reports of platform manipulation, but the lack of regulatory oversight makes it challenging to ensure that trading practices are fair and transparent.

Risk Assessment

Traders considering UTDMarket should be aware of the following risks:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation, increasing risk of fraud. |

| Withdrawal Risk | Medium | Reports of withdrawal delays and issues. |

| Transparency Risk | High | Lack of company information and management details. |

To mitigate these risks, traders are advised to conduct thorough research before opening an account. It may also be prudent to start with a smaller deposit to assess the broker's reliability before committing larger amounts.

Conclusion and Recommendations

In conclusion, while UTDMarket may not explicitly appear to be a scam, its lack of regulation and transparency raises significant red flags. Traders should be particularly cautious when dealing with unregulated brokers, as the risks of financial loss are higher.

For those who prioritize safety and regulatory oversight, it may be wise to consider alternative brokers that are well-regulated and have a proven track record of reliability. Options such as eToro or Plus500 offer competitive trading conditions and robust regulatory frameworks, providing a safer trading environment.

In summary, is UTDMarket safe? The evidence suggests that potential traders should approach this broker with caution, weighing the risks against their trading objectives.

Is Utdmarket a scam, or is it legit?

The latest exposure and evaluation content of Utdmarket brokers.

Utdmarket Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Utdmarket latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.