Is Aly Financial safe?

Pros

Cons

Is Aly Financial Safe or a Scam?

Introduction

Aly Financial is a relatively new player in the forex market, offering a range of trading services and financial instruments. As traders increasingly seek opportunities in the global marketplace, the importance of selecting a trustworthy forex broker cannot be overstated. Unscrupulous brokers can lead to significant financial losses, making it essential for traders to conduct thorough research before committing their funds. In this article, we will evaluate Aly Financial's legitimacy by examining its regulatory status, company background, trading conditions, customer safety measures, user experiences, platform performance, and overall risk profile. Our investigation is based on data collected from various reputable sources and industry reviews to provide a comprehensive assessment of whether Aly Financial is safe or a potential scam.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor in determining its credibility and safety. Brokers operating under the oversight of reputable regulatory bodies are subject to strict compliance standards, which help protect clients' investments. Unfortunately, Aly Financial lacks regulation from any recognized authority, raising significant concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulatory oversight means that Aly Financial does not adhere to the stringent requirements imposed by top-tier regulators. This lack of regulation can lead to unfair practices, inadequate investor protection, and potential fraud. For instance, many traders have reported issues with fund withdrawals and transparency, further solidifying the notion that Aly Financial is not safe. As a result, traders should exercise extreme caution when considering this broker for their trading activities.

Company Background Investigation

Aly Financial was established in 2020, positioning itself as an online forex broker offering various financial products, including foreign exchange, precious metals, and crude oil trading. However, the company has not provided a clear outline of its ownership structure or management team, which are essential indicators of credibility.

The lack of transparency regarding its operational history and the absence of a well-defined corporate structure raises red flags. Additionally, Aly Financial's online presence is limited, with minimal information available about its founders or key executives. This opacity is concerning as it suggests a potential lack of accountability and oversight, further questioning whether Aly Financial is safe for traders.

Trading Conditions Analysis

Aly Financial's trading conditions also warrant scrutiny. The broker offers a minimum deposit of $100 and claims to provide leverage of up to 1:100. However, the absence of detailed information regarding spreads, commissions, and other trading costs is troubling.

| Cost Type | Aly Financial | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | N/A | 1-2 pips |

| Commission Structure | N/A | $0-10 per trade |

| Overnight Interest Rates | N/A | Varies by broker |

The lack of transparency surrounding trading fees can lead to unexpected costs for traders, which is a common tactic used by unscrupulous brokers. As such, potential clients should be wary of the overall cost structure and ensure they fully understand what they might incur when trading with Aly Financial. Many reports indicate that Aly Financial is not safe, as hidden fees and unclear commission policies can significantly impact trading profitability.

Customer Funds Safety

The safety of clients' funds is paramount when selecting a forex broker. Aly Financial's lack of regulation raises concerns about its client fund management practices. Reputable brokers typically segregate client funds from their operational funds, ensuring that client money is protected in the event of financial difficulties. However, Aly Financial has not provided any information regarding such measures.

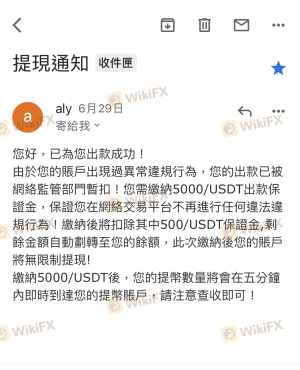

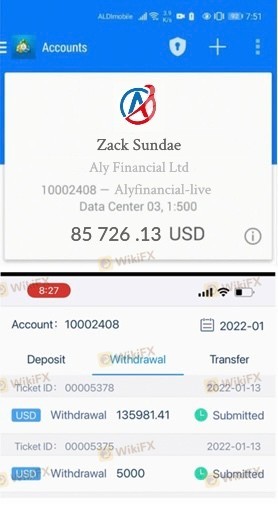

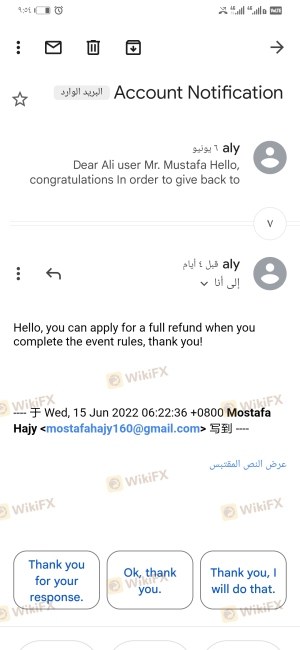

Investors should be aware that without regulatory oversight, there is no guarantee that their funds are secure. Additionally, there have been reports of clients facing difficulties in withdrawing their funds, which is a significant warning sign that Aly Financial is not safe. Traders should prioritize brokers that offer clear fund protection policies and are subject to regulatory scrutiny to mitigate the risk of loss.

Customer Experience and Complaints

User feedback is an essential component of assessing a broker's reliability. Unfortunately, Aly Financial has garnered numerous negative reviews from clients. Common complaints include issues with fund withdrawals, lack of customer support, and unclear trading conditions.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Inadequate |

| Transparency | High | Lacking |

Many users have reported feeling misled by the broker's promises of easy access to their funds, only to encounter significant hurdles when attempting to withdraw. These complaints highlight a concerning pattern that suggests Aly Financial is a scam rather than a legitimate trading platform. It is imperative for traders to consider these experiences when evaluating whether to engage with this broker.

Platform and Trade Execution

The trading platform provided by Aly Financial is another area of concern. Users have reported issues with platform stability, order execution quality, and instances of slippage. A reliable trading platform should offer seamless execution and minimal delays, but the feedback suggests that Aly Financial may not meet these expectations.

Traders have expressed frustration with the platform's performance, which can lead to missed opportunities and financial losses. Additionally, there are no indications of potential platform manipulation, but the combination of poor execution quality and instability raises doubts about the overall trading experience. Therefore, traders should approach Aly Financial with caution, as it may not provide the reliable trading environment they seek.

Risk Assessment

Using Aly Financial carries several inherent risks that potential clients should be aware of. The lack of regulation, combined with negative user experiences, creates a high-risk environment for traders.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Fund Security Risk | High | Potential for fund mismanagement. |

| Trading Environment Risk | Medium | Unstable platform and execution issues. |

To mitigate the risks associated with trading with Aly Financial, potential clients should consider the following recommendations: avoid investing significant capital until more information is available, conduct thorough research on alternative brokers, and prioritize regulated firms with a proven track record of client satisfaction.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Aly Financial is not safe for traders. The absence of regulatory oversight, coupled with numerous complaints from users, indicates that this broker may engage in practices that put clients' funds at risk. As such, we advise traders to exercise extreme caution and consider alternative, regulated brokers that offer better transparency and client protection.

For those seeking reliable trading options, we recommend exploring well-established brokers with strong regulatory backgrounds, such as IG Group, OANDA, or TD Ameritrade. These firms provide the safety and security that traders need to engage in the forex market confidently. Ultimately, ensuring the safety of your investments should be the top priority when selecting a forex broker.

Is Aly Financial a scam, or is it legit?

The latest exposure and evaluation content of Aly Financial brokers.

Aly Financial Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Aly Financial latest industry rating score is 1.46, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.46 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.