Is USDC safe?

Pros

Cons

Is USDC Safe or a Scam?

Introduction

USDC, also known as USDC Investment Limited, has emerged as a player in the forex market, positioning itself as a broker that offers a wide range of trading services. With the increasing popularity of forex trading, it is essential for traders to carefully assess the legitimacy and safety of their chosen brokers. The forex market is rife with both opportunities and risks, making it crucial for investors to conduct thorough due diligence before committing their funds. This article aims to provide an objective analysis of USDC by evaluating its regulatory status, company background, trading conditions, customer fund security, client experiences, platform performance, and associated risks.

To gather information, this investigation has utilized various online resources, including reviews, regulatory databases, and user testimonials. The assessment framework focuses on key areas that define a broker's reliability, including regulation, customer feedback, and operational transparency, ultimately answering the question: Is USDC safe?

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in determining its safety and legitimacy. USDC claims to operate under regulatory frameworks; however, investigations reveal a lack of valid regulatory licenses. Below is a summary of the core regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

The absence of any valid regulatory oversight raises significant concerns about the safety of funds deposited with USDC. Regulatory bodies like the Financial Conduct Authority (FCA) or the National Futures Association (NFA) are crucial for ensuring that brokers adhere to strict operational standards and provide a level of investor protection. Unfortunately, USDC does not appear in the records of these regulatory authorities, indicating potential non-compliance with industry standards. This lack of oversight is alarming and suggests that USDC may not be a safe choice for traders.

Company Background Investigation

Understanding the background and ownership structure of USDC is essential in assessing its reliability. Established in 2021, USDC Investment Limited is purportedly based in the United Kingdom. However, there is skepticism regarding its actual registration and operational legitimacy. The company claims to be part of a larger entity, USDC Global, which has not been verified as a legitimate organization.

The management team behind USDC has not been widely documented, raising questions about their experience and credibility in the financial sector. Transparency is a significant issue, as potential clients cannot easily access information regarding the company's ownership or the professional backgrounds of its leaders. This lack of clarity further exacerbates concerns regarding the broker's trustworthiness. The absence of proper documentation or disclosure about its management makes it difficult to ascertain whether USDC operates with the integrity expected from a reputable broker.

Trading Conditions Analysis

An examination of the trading conditions offered by USDC reveals a mix of competitive features and potential red flags. The broker advertises a variety of account types, all with low minimum deposits, which may appear attractive to new traders. However, the overall fee structure and trading costs warrant closer scrutiny. Below is a comparison of key trading costs:

| Fee Type | USDC | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1.8 pips | 1.2 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | High | Moderate |

The spread offered by USDC is higher than the industry average, which could indicate that traders may incur higher costs when executing trades. Additionally, the lack of transparency regarding commission structures raises concerns about hidden fees that could further erode profitability. Traders should be cautious of brokers that do not clearly disclose their fee structures, as this can often lead to unexpected costs that impact overall trading performance.

Customer Fund Security

When assessing whether USDC is safe, the security of customer funds is paramount. USDC claims to implement various measures to protect client funds; however, the lack of regulation severely undermines these claims. Key security measures typically include segregated accounts for client funds, investor protection schemes, and negative balance protection. Unfortunately, USDC does not provide sufficient information about these practices, leaving potential investors in the dark regarding the safety of their deposits.

Furthermore, there have been numerous complaints from users regarding difficulties in withdrawing funds, which raises alarms about the broker's operational integrity. Historical issues related to fund security or withdrawal problems should be a red flag for any potential client. Without robust regulatory oversight, the likelihood of encountering such issues increases significantly, leading to the conclusion that USDC may not provide a safe environment for trading.

Customer Experience and Complaints

Customer feedback is a crucial aspect of evaluating any broker's reliability. A review of user experiences with USDC reveals a concerning pattern of complaints, particularly regarding withdrawal issues and poor customer service response. Below is a summary of the main complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow/Unresponsive |

| Lack of Transparency | Medium | Minimal Communication |

| High Fees | Medium | Ignored Complaints |

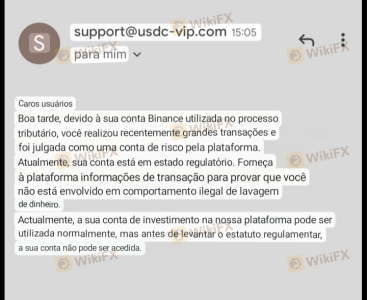

Many users have reported being unable to withdraw their funds after meeting the necessary conditions, often citing vague explanations from customer service. This lack of responsiveness is troubling and indicates a potential disregard for customer concerns. One notable case involved a trader who was repeatedly asked to pay additional fees before being allowed to withdraw their profits, raising suspicions of a scam-like operation.

Platform and Execution

The performance of the trading platform is another critical factor in determining whether USDC is safe. USDC offers access to various trading platforms, including proprietary software and popular options like MetaTrader 4 and 5. However, user reviews highlight issues with platform stability, order execution quality, and instances of slippage that could negatively impact trading outcomes.

Traders have reported experiencing high slippage during volatile market conditions, which can significantly affect profitability. Additionally, any signs of platform manipulation, such as refusal to execute trades or sudden changes in pricing, should be taken seriously. These factors contribute to an overall perception that USDC may not provide a reliable trading environment.

Risk Assessment

Utilizing USDC comes with inherent risks that potential traders must consider. Below is a risk scorecard summarizing key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight |

| Financial Risk | High | High fees and withdrawal issues |

| Operational Risk | Medium | Platform instability and execution issues |

To mitigate these risks, traders are advised to conduct thorough research, maintain a cautious approach, and consider using regulated brokers that offer greater transparency and security. It is crucial to avoid putting funds at risk with brokers lacking proper oversight and regulatory compliance.

Conclusion and Recommendations

In summary, the evidence gathered suggests that USDC is not a safe option for traders. The lack of valid regulation, numerous complaints regarding fund withdrawals, and questionable trading conditions all point toward a potentially scam-like operation. Traders are strongly advised to exercise caution and consider alternative brokers that are well-regulated and have a proven track record of reliability.

For those looking for safer trading options, consider brokers that are regulated by reputable authorities such as the FCA, ASIC, or NFA. These brokers not only provide better security for client funds but also offer a higher level of transparency and customer support. Ultimately, the question remains: Is USDC safe? Based on the analysis, it is prudent for traders to look elsewhere for their trading needs.

Is USDC a scam, or is it legit?

The latest exposure and evaluation content of USDC brokers.

USDC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

USDC latest industry rating score is 1.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.