Is Trustmarkettrade safe?

Business

License

Is TrustMarketTrade Safe or a Scam?

Introduction

TrustMarketTrade has emerged as a player in the forex trading market, promoting itself as a platform for both seasoned traders and newcomers alike. As the online trading landscape continues to expand, the need for traders to carefully evaluate the credibility of forex brokers like TrustMarketTrade has never been more critical. With numerous reports of fraudulent activities and scams in the industry, it is paramount for traders to conduct thorough due diligence before committing their funds. This article aims to provide a comprehensive analysis of TrustMarketTrade, assessing its regulatory status, company background, trading conditions, client fund security, customer experiences, platform performance, and associated risks. Our investigation is based on a review of multiple online resources, user feedback, and industry standards to determine whether TrustMarketTrade is safe or a potential scam.

Regulation and Legitimacy

Regulatory oversight is a cornerstone of a broker's legitimacy and is crucial for ensuring the safety of traders' funds. TrustMarketTrade has been flagged for its lack of regulation, which raises significant concerns for potential investors. Without a regulatory framework, brokers can operate without accountability, increasing the risk of fraudulent activities.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of any regulatory oversight means that TrustMarketTrade is not held to any standards that protect traders. Legitimate brokers are typically regulated by recognized authorities such as the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC). The lack of regulation raises a critical red flag, suggesting that TrustMarketTrade may not be safe for investors looking to secure their funds. Furthermore, the absence of historical compliance records and transparency regarding its operations only heightens the concerns surrounding this broker.

Company Background Investigation

TrustMarketTrade's history and ownership structure are essential factors in evaluating its credibility. However, information regarding the company's establishment, ownership, and operational history is scarce. This lack of transparency is troubling, as it hinders potential clients from understanding who is managing their investments. Additionally, the management team's qualifications and experience in the financial markets remain unclear, which is a significant concern for potential investors.

The absence of detailed information on the company's leadership and operational practices suggests a lack of accountability, making it difficult for traders to assess the legitimacy of TrustMarketTrade. Without a clear understanding of the company's background, it is challenging to ascertain whether TrustMarketTrade is safe for investment.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience and profitability. TrustMarketTrade claims to provide competitive trading conditions; however, the details surrounding its fee structure and potential hidden costs are concerning.

| Fee Type | TrustMarketTrade | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 pips |

| Commission Model | $7 per lot | $5 per lot |

| Overnight Interest Range | High | Low to Moderate |

Reports indicate that TrustMarketTrade may impose high withdrawal fees and other unexpected charges, which can erode profits and deter traders from accessing their funds. Such practices are indicative of brokers that prioritize profit over client satisfaction, further questioning the safety of trading with TrustMarketTrade. The overall lack of clarity regarding fees and commissions is a significant concern, suggesting that TrustMarketTrade may not be a safe option for traders seeking transparent and fair trading conditions.

Client Fund Security

The security of client funds is a vital aspect of any trading platform. TrustMarketTrade's lack of regulatory oversight raises alarms about the safety of deposited funds. Generally, reputable brokers are required to segregate client funds from their operational capital, ensuring that traders' money is protected even in the event of the company's insolvency.

However, TrustMarketTrade has not provided clear information regarding its fund security measures, including whether client funds are held in segregated accounts or if there are any investor protection schemes in place. This lack of information is troubling and suggests that traders' funds may not be secure, heightening the risk of financial loss. The absence of any historical incidents related to fund security further complicates the evaluation of TrustMarketTrade's safety. As such, potential investors should approach with caution, as TrustMarketTrade may not be safe for trading.

Customer Experience and Complaints

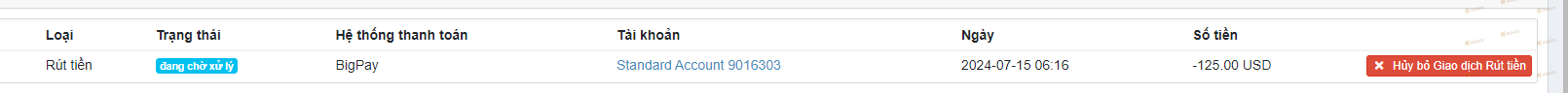

Customer feedback is a valuable resource for assessing a broker's reliability. Unfortunately, TrustMarketTrade has garnered numerous negative reviews, highlighting various issues faced by clients. Common complaints include difficulties in withdrawing funds, unresponsive customer support, and unexpected fees.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Issues | Medium | Poor |

| Hidden Fees | High | Unresolved |

Many users have reported that once they attempt to withdraw their funds, they encounter various obstacles, including high fees and evasive responses from customer support. These patterns of complaints indicate a troubling trend that suggests TrustMarketTrade may not be a reliable broker. The lack of effective resolution to these issues raises serious concerns about the company's commitment to customer satisfaction and transparency.

Platform and Execution

The trading platform is another critical component of the trading experience. TrustMarketTrade claims to utilize advanced trading technology; however, user reports suggest that the platform may suffer from performance issues, including slow execution times and slippage during trades.

Traders have expressed dissatisfaction with the quality of order execution, which can significantly impact trading outcomes. Instances of rejected orders and manipulation have also been reported, further questioning the integrity of the trading environment provided by TrustMarketTrade. Such performance issues contribute to the overall perception that TrustMarketTrade may not be safe for traders seeking a reliable and efficient trading experience.

Risk Assessment

Engaging with TrustMarketTrade presents various risks that potential investors should consider. The lack of regulation, transparency issues, and numerous customer complaints indicate a high-risk environment for trading.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Unclear fund protection measures |

| Customer Service Risk | Medium | Poor response to complaints |

To mitigate these risks, traders should exercise extreme caution when considering TrustMarketTrade as a trading option. It is advisable to conduct thorough research, read user reviews, and consider alternative brokers with established regulatory frameworks and positive reputations.

Conclusion and Recommendation

In conclusion, the evidence gathered raises significant concerns about the safety and legitimacy of TrustMarketTrade. The lack of regulatory oversight, combined with numerous customer complaints and transparency issues, suggests that TrustMarketTrade may not be a safe option for traders.

For those considering entering the forex market, it is crucial to choose a broker that is regulated and has a proven track record of reliability and customer satisfaction. Alternative brokers such as Forex.com, IG, or OANDA, which are well-regulated and have positive reputations, may offer a more secure trading environment. Ultimately, traders should prioritize their safety and opt for brokers that provide transparency, regulatory protection, and a commitment to customer service.

Is Trustmarkettrade a scam, or is it legit?

The latest exposure and evaluation content of Trustmarkettrade brokers.

Trustmarkettrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Trustmarkettrade latest industry rating score is 1.39, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.39 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.