Trustmarkettrade Review 1

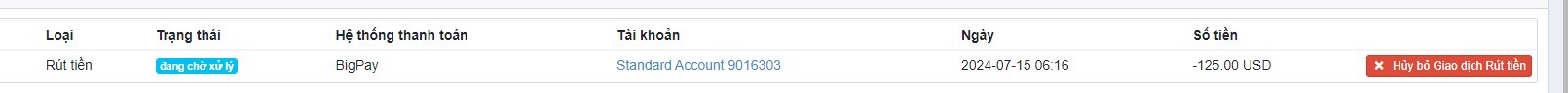

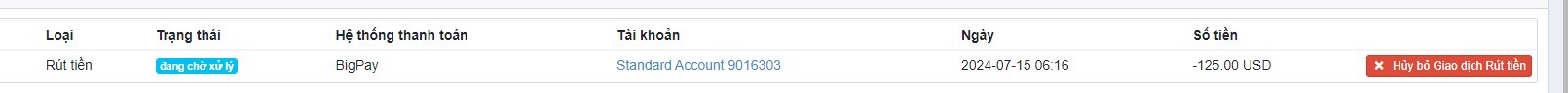

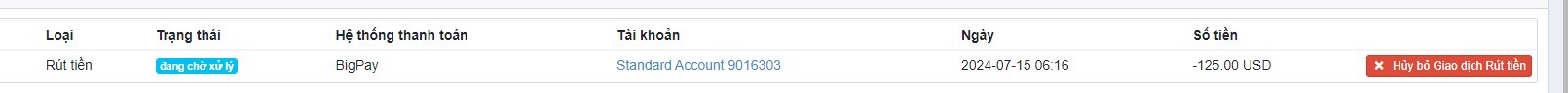

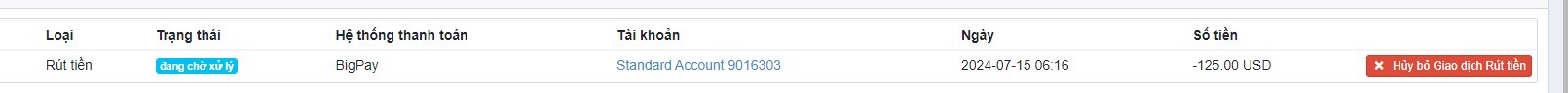

Please note that this platform only allows deposits. Withdrawals are not allowed, regardless of the amount. This is a fraudulent platform.

Trustmarkettrade Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

Please note that this platform only allows deposits. Withdrawals are not allowed, regardless of the amount. This is a fraudulent platform.

This trustmarkettrade review looks at a new forex broker. Trustmarkettrade started in 2021 and wants to help both new and experienced traders with easy trading experiences. The broker lets you trade forex, crypto, and stocks, plus they offer 24-hour online support.

Our research shows big concerns about how safe this platform is. Trustmarkettrade says they offer good trading deals, but users worry about hidden fees and security problems. The broker has only been around for a short time, and they don't share much about their rules and oversight.

The platform wants to serve everyone from beginners to expert traders. They offer many types of investments and support all day, but people don't trust them much. This hurts their reputation and makes traders worried.

Regional Variations: This trustmarkettrade review uses public information, and trading rules change in different countries. Trustmarkettrade doesn't share much about their legal oversight, so people in different places might have different levels of protection and risk. You should check your local laws before using this platform.

Review Methodology: We got this information from public sources and user comments. Trustmarkettrade is new and doesn't share much detail, so this review might miss some things. The information might not be complete, so you should do more research before investing.

| Dimension | Score | Rating |

|---|---|---|

| Account Conditions | 4/10 | Below Average |

| Tools and Resources | 6/10 | Average |

| Customer Service | 7/10 | Good |

| Trading Experience | 5/10 | Average |

| Trust Factor | 3/10 | Poor |

| User Experience | 4/10 | Below Average |

Trustmarkettrade joined the forex market in 2021. The company wants to make trading easy for all types of traders by offering forex, crypto, and stocks. They try to stand out by covering many assets and giving support all the time.

The broker focuses on easy-to-use websites and simple trading for both new and experienced traders. But since they're so new, people wonder if they'll last and if they can be trusted. Their website talks about good trading deals, but they don't share many details about fees and rules.

Trustmarkettrade works mainly as an online forex platform. We don't know much about their technology, trading software, or if they follow proper rules. This lack of clear information is a big problem for traders who want to know about their broker's standards.

Regulatory Status: We can't find which authorities watch over Trustmarkettrade, which is a big red flag. Rules and oversight protect traders and make operations clear.

Deposit and Withdrawal Methods: They don't share details about payment options, how long it takes, or what fees you pay. This makes it hard to know about funding costs and ease.

Minimum Deposit Requirements: They don't say how much money you need to start trading. New traders can't plan their first investment.

Promotional Offers: We can't find information about welcome bonuses or special deals.

Tradeable Assets: Trustmarkettrade lets you trade forex, crypto, and stocks. This gives good variety for traders who want different investments.

Cost Structure: They claim to offer good trading deals, but they don't share detailed fee information. People worry about hidden costs, which makes the true trading cost unclear.

Leverage Options: They don't share specific leverage amounts or margin rules.

Platform Selection: We don't know what trading software they use or what options are available.

Geographic Restrictions: They don't say which countries they serve or avoid.

Customer Support Languages: We only know they offer English support.

Trustmarkettrade's accounts have several problems that make them below average. They don't share details about account types, minimum deposits, or trading rules, so traders can't make good choices.

We can't find information about different account levels or special benefits for bigger deposits. This is bad for traders who need to know what services they'll get before putting money in the platform.

They don't explain how to open accounts, what papers you need, or how long it takes. Plus, worries about hidden fees and unclear costs make their accounts less attractive.

Traders can't figure out the real cost of keeping an account because they hide management fees and other charges. This lack of honesty hurts their value and gives them a low rating.

Trustmarkettrade gets an average score because they offer forex, crypto, and stock trading. This variety lets traders explore different markets and try various strategies.

But they seem limited compared to what established brokers offer. We can't find details about research tools, market analysis, or learning materials that help traders make decisions.

They don't share information about charts, technical tools, automated trading, or third-party connections. Modern traders expect advanced tools and educational resources.

The basic multi-asset trading helps some, but the lack of tool information and missing advanced features stops them from getting higher scores. Traders who want strong analysis tools might find their offerings weak.

Trustmarkettrade gets their best score for customer service because they claim 24-hour online support. All-day support helps traders in different time zones or those who trade at unusual hours.

Continuous support shows they understand how important quick customer service is for building trust and solving urgent problems. This can really help new traders who need guidance when starting out.

But we can't judge quality without detailed user feedback about response times and problem-solving success. Without user reviews or service metrics, we can't tell if their promised support actually works well.

We don't know about communication options, response time standards, or language support. This stops us from fully judging how effective their customer service really is.

The trading experience gets an average score because we have limited information about platform performance and user interface design. They claim good trading conditions, but we can't verify these claims without specific data and user feedback.

Platform stability, order speed, and slippage rates matter a lot for trading success, but we don't have detailed information about these things. Traders can't judge platform reliability without execution statistics or user reports.

Mobile trading has become very important, but we don't have information about their mobile experience. We also don't know about advanced order types, trading automation, or platform customization.

They mention competitive spreads and conditions but don't provide specific data or comparisons. This trustmarkettrade review can't give clear conclusions about trading costs without detailed pricing information and real-time spread data.

Trustmarkettrade gets the lowest score for trust because of serious concerns about oversight, transparency, and credibility. The lack of clear regulatory information is a basic weakness that hurts trader confidence and legal protection.

Good regulatory frameworks protect trader funds, solve disputes, and ensure proper operations. Without documented oversight, people worry about fund security, accountability, and options for solving problems.

User concerns about safety and legitimacy make trust issues worse. These concerns, plus the broker being new with limited history, create big credibility problems that experienced traders usually avoid.

They don't share details about fund separation, insurance protection, audits, and corporate governance. This stops traders from judging their commitment to transparency and user protection.

The user experience score reflects concerns about platform usability, registration, and general satisfaction. They target both new and experienced traders, but limited user feedback and interface documentation make assessment hard.

Registration and verification processes aren't well documented, so users don't know how complex or time-consuming account setup is. Efficient onboarding is crucial for satisfaction, especially for new traders choosing their first broker.

Fund management operations like deposits, withdrawals, processing times, and fees lack detailed documentation. These operations greatly impact satisfaction and convenience, but we don't have enough information for thorough evaluation.

Negative feedback indicators and limited positive reviews suggest potential user experience problems. Without comprehensive satisfaction data, this trustmarkettrade review can't give clear conclusions about their ability to meet different trader needs.

This trustmarkettrade review shows a broker with big challenges in building market credibility and trader confidence. Trustmarkettrade offers multi-asset trading and 24-hour support, but basic concerns about oversight, transparency, and safety greatly limit their appeal to informed traders.

The platform might attract new traders seeking diverse trading opportunities, but the lack of regulatory clarity and limited transparency make it wrong for traders who prioritize security and regulatory protection. Experienced traders will likely find the missing information about trading conditions, fees, and platform capabilities problematic for making informed investment decisions.

Main advantages include multi-asset trading capabilities and continuous customer support availability, while big disadvantages include regulatory uncertainty, potential hidden fees, and limited operational transparency. Potential traders should be very careful and do thorough additional research before considering Trustmarkettrade for their trading activities.

FX Broker Capital Trading Markets Review