Is TRADE ONLINE MARKET safe?

Business

License

Is Trade Online Market A Scam?

Introduction

Trade Online Market is a forex broker that has recently gained attention in the trading community. Positioned as an accessible platform for both novice and experienced traders, it promises a variety of trading options and competitive conditions. However, the growing prevalence of scams in the forex market makes it essential for traders to conduct thorough evaluations of brokers before committing their funds. This article aims to investigate whether Trade Online Market is a legitimate trading entity or a potential scam. To achieve this, we will analyze its regulatory status, company background, trading conditions, client experiences, and overall risk profile.

Regulation and Legitimacy

One of the most critical aspects of evaluating a forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards of conduct and financial integrity. Trade Online Market's lack of regulation raises significant concerns. Below is a summary of its regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of oversight from reputable regulatory bodies such as the Financial Conduct Authority (FCA) in the UK or the Securities and Exchange Commission (SEC) in the USA suggests that Trade Online Market operates in a high-risk environment. Unregulated brokers often lack the necessary compliance measures to protect clients funds, making them more susceptible to fraudulent practices. Furthermore, the lack of historical compliance records raises red flags about the broker's legitimacy. Traders should always prioritize brokers regulated by top-tier authorities to mitigate risks associated with potential scams.

Company Background Investigation

Trade Online Market's company history and ownership structure are crucial for assessing its reliability. Unfortunately, information about the broker's founding, development, and ownership is scarce. This lack of transparency can be indicative of a less trustworthy operation. A thorough investigation reveals that the company does not disclose its physical address, management team, or any relevant corporate history on its website, which is a significant concern for potential investors.

Furthermore, the management team's background is unknown, leading to questions about their experience and qualifications in the financial industry. A broker with a transparent and experienced management team typically instills more confidence among traders. The absence of such information about Trade Online Market further compounds the doubts surrounding its credibility. Transparency is a critical factor in establishing trust, and the lack of it in this case warrants caution.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for evaluating its overall value proposition. Trade Online Market claims to provide competitive spreads and trading fees, but the specifics are often vague and not clearly outlined. The following table summarizes the core trading costs associated with Trade Online Market:

| Fee Type | Trade Online Market | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Not Specified | 1.0 - 2.0 pips |

| Commission Model | Not Specified | Varies by broker |

| Overnight Interest Range | Not Specified | 2.5% - 5% |

The lack of detailed information regarding spreads, commissions, and overnight fees is concerning. Typically, reputable brokers are transparent about their fee structures, allowing traders to make informed decisions. The absence of this information at Trade Online Market could suggest potential hidden fees or unfavorable trading conditions. Traders should be wary of brokers that do not clearly communicate their fee structures, as this can lead to unexpected costs and reduced profitability.

Client Fund Security

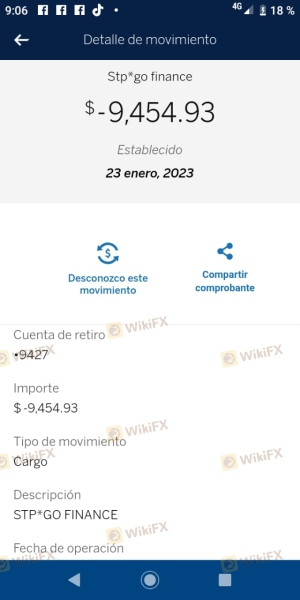

The safety of client funds is paramount when choosing a forex broker. Trade Online Market's security measures regarding client funds are not well-documented, raising concerns about the safety of investments. A reputable broker typically employs stringent security protocols, including fund segregation, investor protection schemes, and negative balance protection policies. Unfortunately, there is no evidence that Trade Online Market adheres to these standards.

Moreover, the lack of information about fund segregation practices is alarming. Clients should be able to ascertain that their funds are held in separate accounts from the broker's operational funds to reduce the risk of loss in case of insolvency. The absence of any historical issues related to fund security or disputes further complicates the evaluation process, as it is unclear whether clients have faced challenges in retrieving their funds. In light of these factors, traders should exercise extreme caution when considering Trade Online Market for their trading activities.

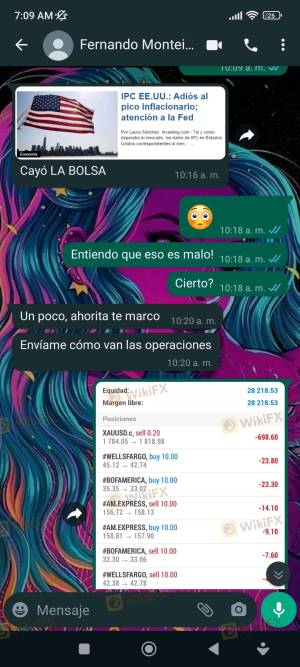

Customer Experience and Complaints

Analyzing customer feedback and experiences is crucial for assessing a broker's reliability. Trade Online Market has garnered a mix of reviews, with many users expressing dissatisfaction regarding their experiences. Common complaints revolve around withdrawal difficulties, lack of customer support, and issues with order execution. Below is a summary of the primary complaints and their severity:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Inadequate |

| Order Execution | High | Unresponsive |

Several users have reported being unable to withdraw their funds, which is a significant red flag. A broker's ability to facilitate withdrawals is a fundamental aspect of its legitimacy. Additionally, the quality of customer support has been criticized, with many users stating that their inquiries went unanswered or were met with delays. Such patterns of complaints suggest a lack of commitment to client service and may indicate deeper operational issues within Trade Online Market.

Platform and Trade Execution

The trading platform's performance is vital for a smooth trading experience. Users have reported mixed experiences with Trade Online Market's platform, citing stability issues and concerns regarding order execution quality. Problems such as slippage and high rejection rates have been noted, which can significantly impact trading outcomes.

Traders rely on efficient platforms to execute their strategies effectively, and any signs of manipulation or instability can erode trust. The absence of transparency regarding the platform's operational metrics further complicates the evaluation. Users should be cautious when engaging with platforms that do not provide clear insights into their execution processes and performance metrics.

Risk Assessment

Using Trade Online Market presents several risks that traders should be aware of. Below is a concise risk scorecard summarizing the critical risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated broker with no oversight. |

| Fund Security Risk | High | Lack of transparency regarding fund protection. |

| Customer Service Risk | Medium | Poor response to client complaints. |

| Trading Execution Risk | High | Reports of slippage and order rejections. |

Given the high-risk levels associated with Trade Online Market, potential traders should consider alternative options that offer better security, transparency, and regulatory oversight.

Conclusion and Recommendations

In conclusion, the evidence suggests that Trade Online Market raises multiple red flags that warrant caution. The lack of regulation, transparency, and poor customer feedback indicates that it may not be a safe choice for traders. While it may appeal to some due to its accessible platform, the risks associated with trading through this broker far outweigh any potential advantages.

For traders seeking more secure and reliable options, it is advisable to consider brokers regulated by top-tier authorities, such as the FCA or ASIC. These brokers typically offer better protection for client funds, transparent fee structures, and robust customer support. In light of the findings regarding Trade Online Market, it is prudent to exercise caution and conduct thorough research before committing funds to this broker.

Is TRADE ONLINE MARKET a scam, or is it legit?

The latest exposure and evaluation content of TRADE ONLINE MARKET brokers.

TRADE ONLINE MARKET Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TRADE ONLINE MARKET latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.