Trade Online Market 2025 Review: Everything You Need to Know

Executive Summary

Trade Online Market has become a notable player in the online brokerage space. The company has earned recognition from multiple reputable financial websites as one of the best online brokers for beginners. This trade online market review reveals a platform that prioritizes accessibility and user-friendly features. The platform makes itself particularly attractive to new traders entering the forex and CFD markets.

According to evaluations from various financial platforms, the broker offers comprehensive trading tools and educational resources. These resources are designed to support novice traders in their journey. The platform's strength lies in its beginner-focused approach. It provides educational content and tools that help new traders understand market dynamics.

However, our assessment reveals significant gaps in available information regarding regulatory oversight, specific trading conditions, and detailed cost structures. While Trade Online Market receives positive ratings for its educational resources and tool variety, the lack of transparent regulatory information and specific account details raises questions about overall transparency. Our evaluation positions Trade Online Market as a potentially suitable choice for beginners seeking educational support and diverse trading tools. Traders should exercise caution due to limited regulatory transparency.

The platform's recognition across multiple financial review sites suggests legitimate operations. However, the absence of detailed operational information warrants careful consideration before committing funds.

Important Disclaimers

Regulatory Variations Notice: This review is based on information available from multiple financial evaluation websites. Trade Online Market's regulatory status and operational details may vary significantly across different jurisdictions. Potential clients should verify the specific regulatory framework applicable to their region before opening an account. Regulatory oversight can differ substantially between countries and may affect available protections and services.

Review Methodology: Our assessment methodology combines analysis from multiple reputable financial websites, user feedback compilation, and industry standard evaluation criteria. Due to limited specific operational data available in public sources, some sections of this review indicate information gaps. Traders should address these gaps through direct broker contact before making investment decisions.

Rating Framework

Broker Overview

Trade Online Market operates as an online financial services provider specializing in forex trading and related financial instruments. According to multiple financial website evaluations, the platform has established itself as a beginner-friendly option in the competitive online brokerage landscape. The broker's business model focuses on providing accessible trading solutions combined with educational resources. This approach targets newcomers to the foreign exchange and CFD markets.

The platform's recognition across various financial review websites suggests a legitimate operational framework. However, specific details about the company's founding date, headquarters location, and corporate structure remain unclear in available public information. Trade Online Market appears to follow industry-standard practices in offering online trading services. The platform places particular emphasis on supporting traders who are new to financial markets.

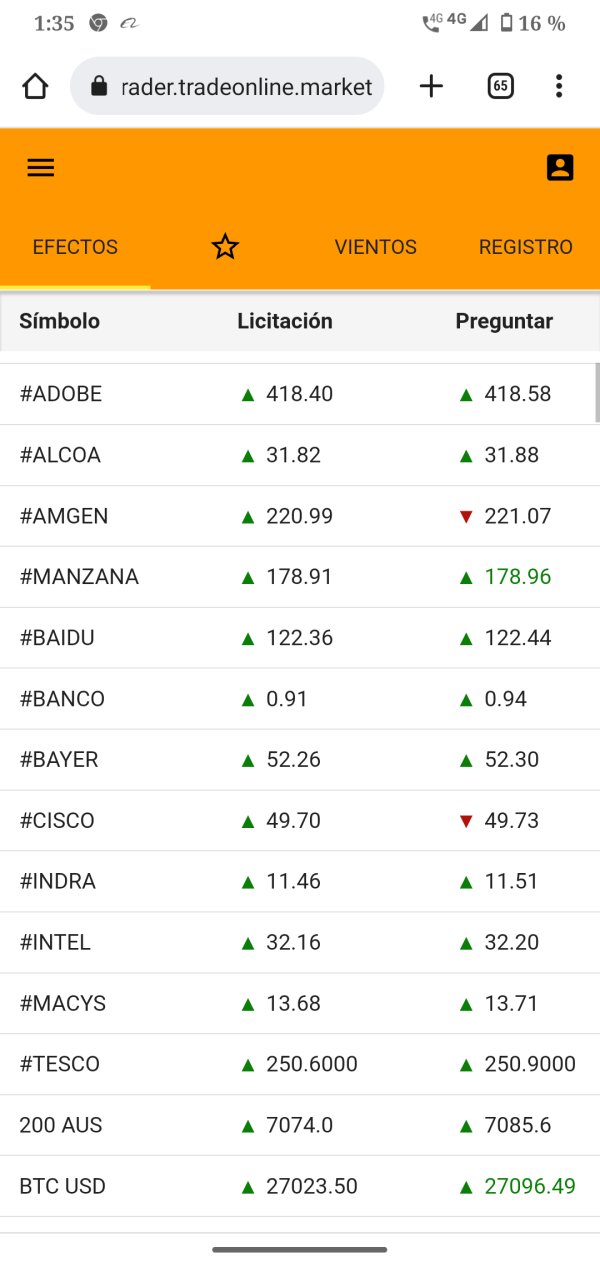

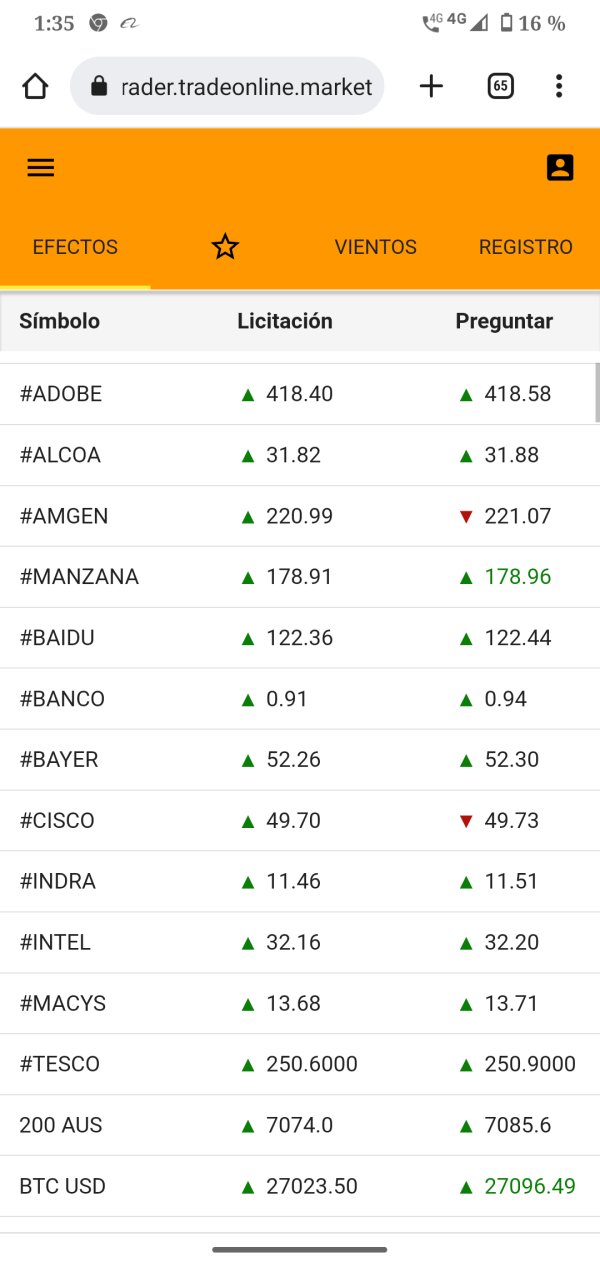

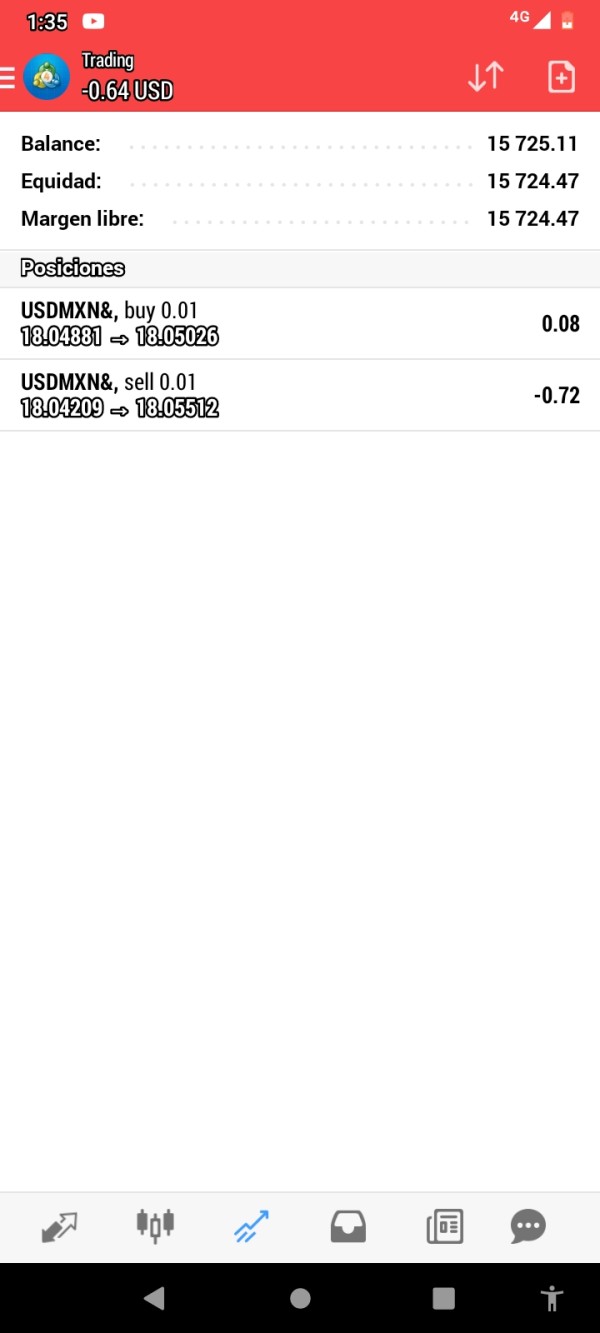

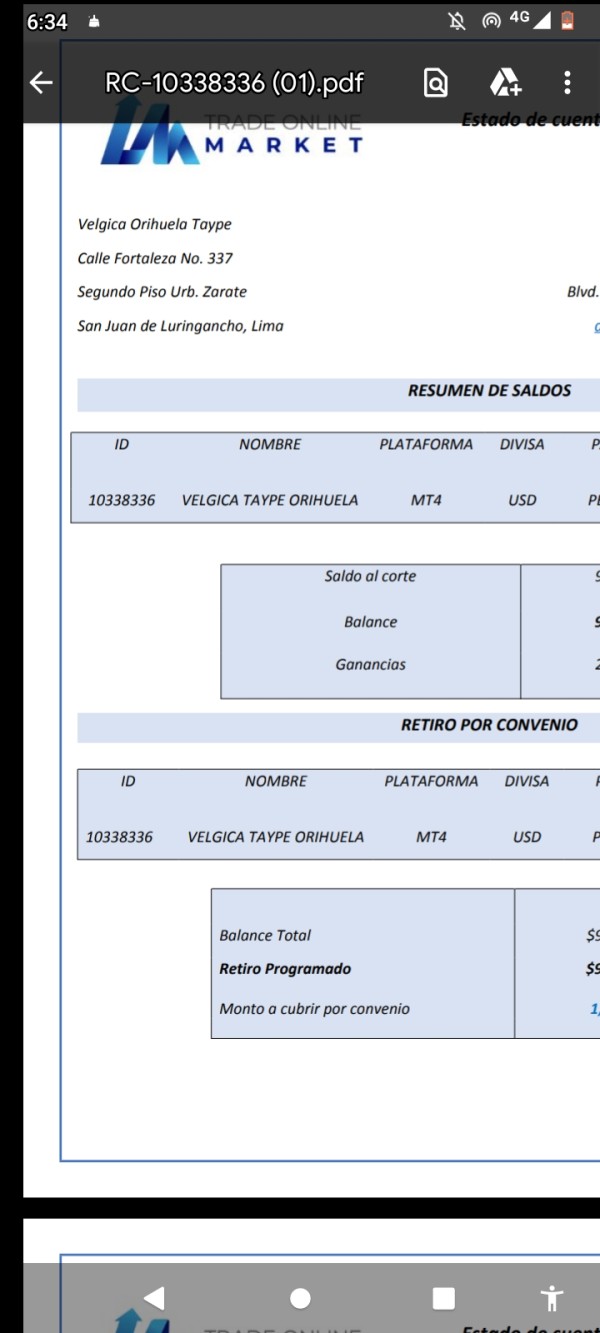

Based on available evaluations, Trade Online Market provides access to popular trading platforms including MT4 and MT5. These platforms enable traders to access forex pairs, CFDs, and other financial instruments. The broker's approach emphasizes educational support and tool variety, distinguishing it from competitors who may focus primarily on advanced trading features. This trade online market review indicates the platform's commitment to serving the beginner market segment through comprehensive learning resources and user-friendly trading environments.

Regulatory Jurisdiction: Specific regulatory information for Trade Online Market is not detailed in available sources. This represents a significant information gap that potential clients should address through direct inquiry with the broker.

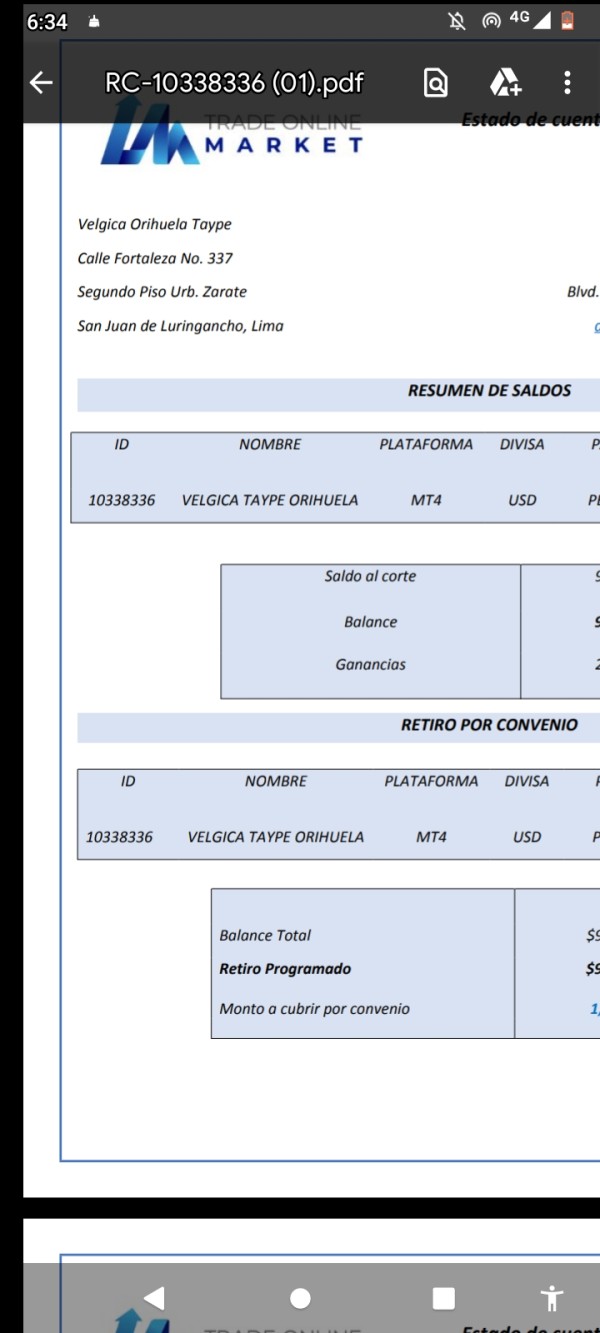

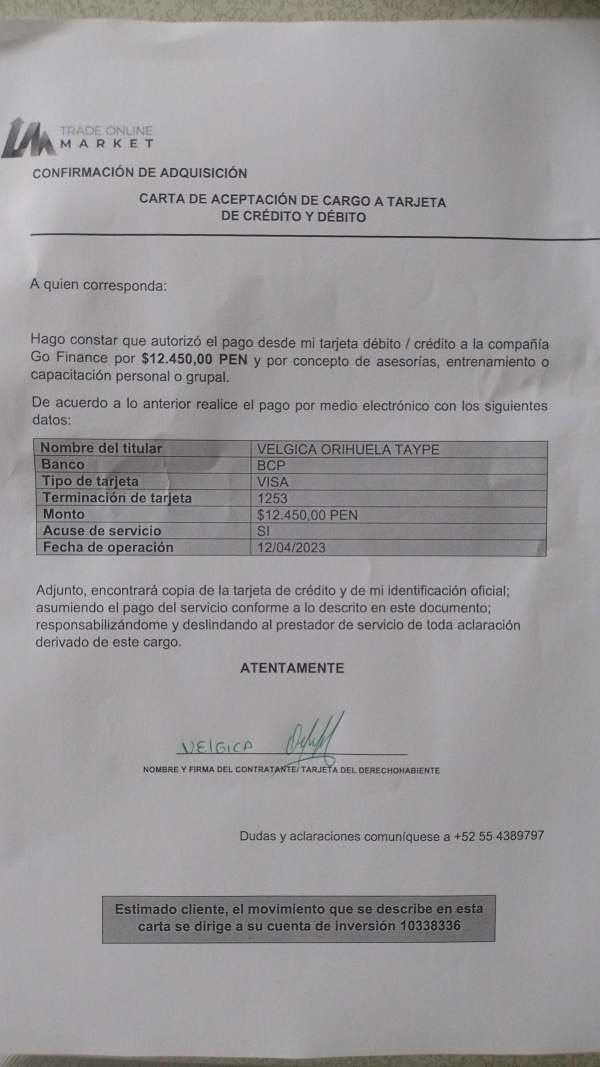

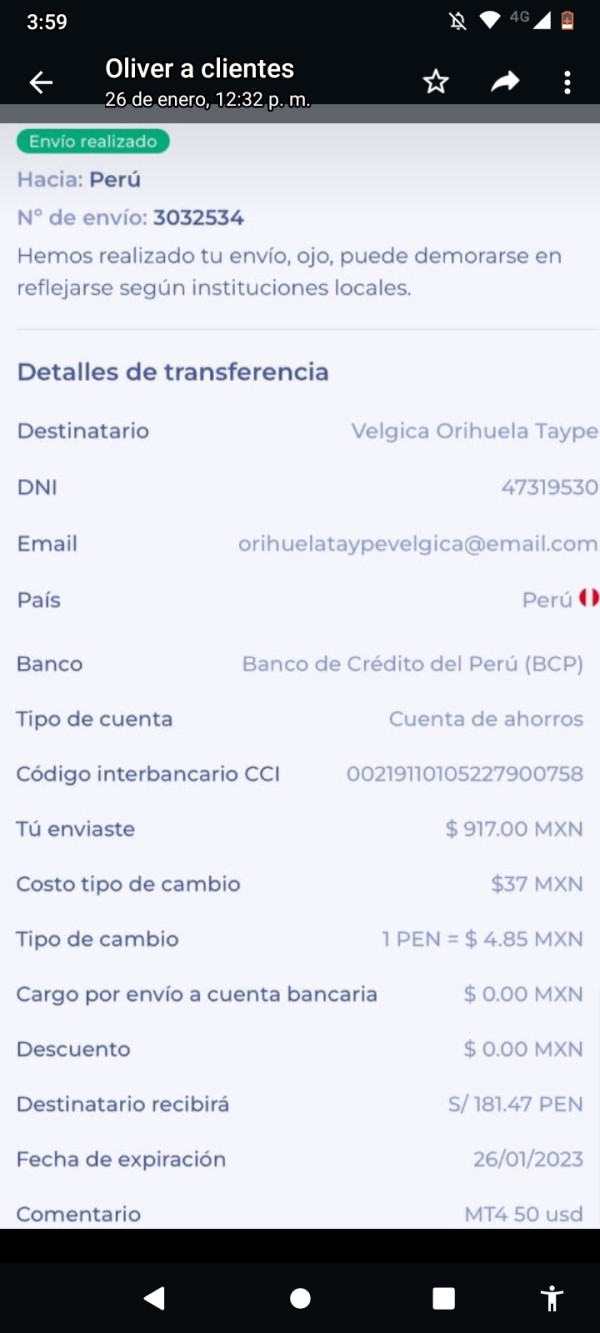

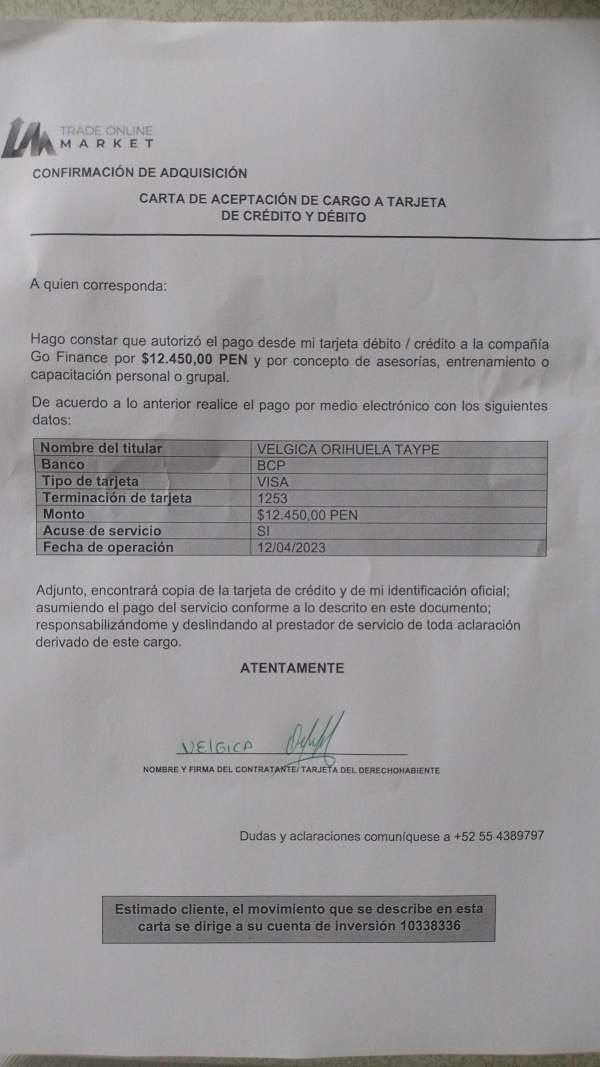

Deposit and Withdrawal Methods: Available funding options and withdrawal processes are not specified in the reviewed sources. Direct verification with the broker is required for accurate information.

Minimum Deposit Requirements: Specific minimum deposit amounts and account funding requirements are not provided in available evaluation materials.

Bonuses and Promotions: Details regarding welcome bonuses, promotional offers, or incentive programs are not mentioned in the available source materials.

Tradeable Assets: Based on platform evaluations, Trade Online Market offers access to forex currency pairs and CFD instruments. However, the complete range of available assets requires direct confirmation.

Cost Structure: Specific information regarding spreads, commissions, overnight fees, and other trading costs is not detailed in available sources. This represents a crucial information gap for potential traders.

Leverage Ratios: Maximum leverage offerings and leverage restrictions are not specified in the reviewed evaluation materials.

Platform Options: The broker reportedly provides access to MT4 and MT5 trading platforms, according to trade online market review sources. These platforms offer standard industry trading technology.

Geographic Restrictions: Specific information about country restrictions or regional availability limitations is not provided in available sources.

Customer Support Languages: Details regarding multilingual support options are not specified in the reviewed materials.

Detailed Rating Analysis

Account Conditions Analysis

The evaluation of Trade Online Market's account conditions faces significant limitations due to insufficient specific information in available sources. Standard industry practice suggests multiple account types catering to different trader experience levels. However, the broker's specific offerings remain unclear.

Account opening procedures, verification requirements, and approval timeframes are not detailed in reviewed materials. Minimum deposit requirements, which significantly impact accessibility for new traders, are not specified in available sources. This information gap is particularly concerning given the broker's positioning as beginner-friendly. New traders typically prioritize low-barrier entry options.

The absence of clear account tier structures, benefits comparison, and upgrade pathways makes it difficult to assess the broker's competitiveness in this crucial area. Special account features such as Islamic accounts for Muslim traders, demo account availability, and educational account options are not mentioned in available evaluations. Given the broker's focus on beginners, the lack of detailed information about practice accounts and learning-oriented features represents a significant transparency concern.

This trade online market review cannot provide definitive guidance on account suitability without more comprehensive information from the broker directly. The absence of detailed account condition information suggests potential clients should prioritize direct communication with Trade Online Market. Traders need to understand specific terms, requirements, and available account options before proceeding with registration.

Trade Online Market receives strong recognition for its tools and resources, earning an 8/10 rating based on evaluations from financial review websites. The broker's strength in this area stems from its comprehensive educational content designed specifically for beginning traders. Multiple financial platforms highlight the broker's commitment to providing learning resources that help new traders understand market fundamentals and trading strategies.

The platform reportedly offers diverse trading tools that support various trading styles and analytical approaches. While specific tool details are not elaborated in available sources, the consistent positive evaluation across multiple review sites suggests robust functionality. Educational resources appear to be a particular strength, with content structured to guide beginners through the learning process systematically.

Research and analysis capabilities, while not detailed in available sources, appear to meet industry standards based on the broker's overall positive evaluation for tools and resources. The platform's recognition for beginner suitability suggests that analytical tools are presented in an accessible format. This approach doesn't overwhelm new traders with excessive complexity.

Automated trading support and advanced analytical features are not specifically mentioned in available evaluations. The broker's focus on beginners may indicate a deliberate emphasis on fundamental tools rather than advanced automation features. However, this requires direct verification with the platform.

Customer Service and Support Analysis

Customer service evaluation for Trade Online Market faces significant limitations due to lack of specific information in available sources. Standard industry practice includes multiple contact channels such as live chat, email, and phone support. However, the broker's specific offerings are not detailed in reviewed materials.

Response time expectations, service quality metrics, and support availability hours remain unclear. The absence of customer service details is particularly concerning given the broker's positioning as beginner-friendly. New traders typically require more support and guidance, making responsive customer service crucial for this target market.

Without specific information about support quality, multilingual capabilities, or problem resolution processes, potential clients cannot adequately assess this critical service aspect. User feedback regarding customer service experiences is not available in the reviewed sources. This prevents assessment of real-world service quality.

Industry-standard support features such as FAQ sections, video tutorials, and self-service options are not mentioned in available evaluations. The lack of customer service information represents a significant transparency gap that potential clients should address through direct testing of support channels before committing to the platform. Prospective traders should consider contacting the broker's support team to evaluate responsiveness and service quality firsthand.

Trading Experience Analysis

The trading experience evaluation for Trade Online Market is limited by insufficient specific information in available sources. Platform stability, execution speed, and order processing quality are not detailed in the reviewed materials. These factors are crucial for trader satisfaction and success.

Based on available information, the broker provides access to MT4 and MT5 platforms, which are industry-standard trading technologies known for reliability and functionality. However, specific implementation quality, customization options, and platform performance metrics are not provided in the evaluation sources. Mobile trading capabilities, which are increasingly important for modern traders, are not specifically addressed in available materials.

The absence of mobile app reviews, functionality descriptions, or cross-device synchronization details represents a significant information gap for traders who prioritize mobile accessibility. Order execution quality, including slippage rates, rejection frequencies, and fill speeds, is not documented in available sources. These technical performance metrics are crucial for trader success but cannot be assessed based on current information availability.

This trade online market review cannot provide definitive guidance on trading experience quality without more comprehensive performance data.

Trust and Regulation Analysis

The trust and regulation assessment for Trade Online Market reveals significant concerns due to the absence of specific regulatory information in available sources. Regulatory oversight is fundamental to broker trustworthiness. The lack of clear regulatory details represents a major transparency issue that potential clients must address.

Without specific regulatory authority information, it's impossible to verify the legal framework governing the broker's operations, client fund protection measures, or dispute resolution mechanisms. This absence of regulatory transparency contrasts sharply with industry best practices. Reputable brokers prominently display regulatory credentials and compliance information.

Fund safety measures, segregated account practices, and investor protection schemes cannot be evaluated due to insufficient information in available sources. These protections are crucial for trader security, particularly for beginners who may be less familiar with industry risk factors and protection standards. Industry reputation and third-party verification are not detailed in available evaluations.

The broker's recognition across multiple financial review websites suggests some level of legitimate operation. However, without specific regulatory backing and transparency measures, the trust assessment remains incomplete and concerning.

User Experience Analysis

User experience evaluation for Trade Online Market is constrained by limited specific feedback and detailed interface information in available sources. Overall user satisfaction metrics, interface design quality, and usability assessments are not provided in the reviewed materials. This makes comprehensive user experience evaluation challenging.

Registration and account verification processes are not detailed in available sources, though these initial interactions significantly impact user perception and satisfaction. The absence of specific information about document requirements, verification timeframes, and onboarding support represents an important evaluation gap. Funding and withdrawal experience details are not available in reviewed sources.

These operations are critical touchpoints for user satisfaction. Processing times, fee structures, and transaction convenience cannot be assessed without more specific information. Common user complaints and satisfaction patterns are not documented in available evaluations.

This prevents identification of recurring issues or particularly strong performance areas. The lack of detailed user feedback compilation limits the ability to provide prospective clients with realistic expectations about the trading experience.

Conclusion

This trade online market review reveals a broker with mixed prospects for potential clients. While Trade Online Market receives positive recognition from multiple financial websites for its beginner-friendly approach and educational resources, significant transparency gaps raise important concerns. The broker's strength in providing tools and resources for new traders is noteworthy.

It earns strong ratings in this crucial area. However, the absence of detailed regulatory information, specific trading conditions, and comprehensive operational details creates substantial uncertainty. For a broker targeting beginners, this lack of transparency is particularly concerning.

New traders require clear, accessible information to make informed decisions. Trade Online Market may be suitable for beginners seeking educational support and diverse trading tools, but only after thorough due diligence to address the information gaps identified in this review. Prospective clients should prioritize direct communication with the broker to verify regulatory status, trading conditions, and service quality before committing funds to the platform.