Is TOP1 GROUP safe?

Business

License

Is Top1 Group A Scam?

Introduction

Top1 Group is an online trading platform that has emerged in the forex market, offering a variety of trading instruments, including forex, commodities, and cryptocurrencies. As the financial landscape continues to evolve, traders must exercise caution when selecting a broker, as the risk of encountering scams or unregulated entities is ever-present. In this article, we will conduct a thorough investigation into Top1 Group's legitimacy, regulatory status, and overall trustworthiness. Our evaluation will be based on a combination of narrative analysis and structured data, drawing from various sources to provide a comprehensive overview of the broker's operations and reputation.

Regulation and Legitimacy

Understanding the regulatory framework within which a broker operates is crucial for assessing its legitimacy. Top1 Group claims to be regulated by the Australian Securities and Investments Commission (ASIC), which is a reputable regulatory body known for enforcing strict compliance among financial service providers. However, recent findings have raised concerns about the authenticity of this claim.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| ASIC | 001276870 | Australia | Suspicious Clone |

The verification status indicates that there are serious doubts regarding the legitimacy of Top1 Group's regulatory claims. Reports suggest that the license may be a "clone," meaning that it is being used fraudulently by an unregulated entity. This raises significant red flags for potential investors, as trading with an unregulated broker can expose them to substantial risks, including loss of funds and lack of legal recourse in the event of disputes.

Company Background Investigation

Top1 Group was established in 2018 and is registered in the Cayman Islands, a location known for its lenient regulatory environment. The ownership structure and management team of Top1 Group remain opaque, which is concerning for potential clients seeking transparency. The lack of publicly available information about the company's history and the backgrounds of its executives further complicates the assessment of its reliability.

The absence of a clear track record and detailed information about the management team can lead to skepticism about the broker's operations. A reputable broker typically offers insight into its leadership and corporate governance, fostering trust among its clients. In the case of Top1 Group, the lack of such information raises questions about its commitment to ethical practices and regulatory compliance.

Trading Conditions Analysis

When evaluating a broker, understanding its fee structure and trading conditions is essential. Top1 Group offers various trading accounts with different features, but the overall cost structure appears to be less competitive compared to industry standards.

| Fee Type | Top1 Group | Industry Average |

|---|---|---|

| Spread on Major Pairs | Variable | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest | High | Moderate |

Top1 Group's variable spreads may lead to unexpected costs for traders, especially during volatile market conditions. Additionally, reports indicate that the broker may impose high overnight interest rates, which could significantly impact trading profitability. Traders should be wary of these costs, as they can erode profits and lead to unfavorable trading experiences.

Client Funds Security

The safety of client funds is a primary concern for any trader. Top1 Group claims to implement various security measures, including segregated accounts and negative balance protection. However, the effectiveness of these measures is questionable given the broker's dubious regulatory status.

The lack of a robust regulatory framework means that there is no guarantee of client funds being protected in the event of insolvency or other financial issues. Furthermore, historical complaints and reports of clients facing difficulties withdrawing their funds add to the concerns regarding the safety of investments with Top1 Group.

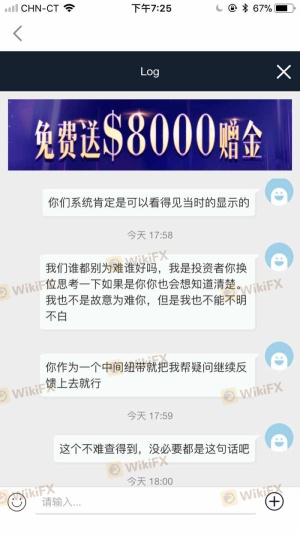

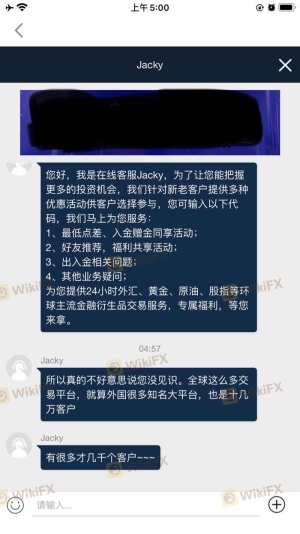

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Many reviews of Top1 Group highlight negative experiences, particularly concerning withdrawal issues and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Unresponsive Support | Medium | Poor |

| Account Manipulation | High | Non-existent |

Common complaints include excessive delays in processing withdrawals and a lack of communication from customer support. In some cases, clients have reported feeling misled by the broker regarding their account management, leading to significant financial losses. These patterns of complaints raise serious concerns about the broker's operational integrity and commitment to customer service.

Platform and Trade Execution

The trading platform offered by Top1 Group is reported to be user-friendly, but there are concerns regarding its stability and execution quality. Issues such as slippage and order rejections have been noted by users, which can adversely affect trading outcomes.

The quality of trade execution is critical for traders, as delays or errors can lead to missed opportunities and financial losses. Furthermore, any signs of platform manipulation, such as sudden price spikes or forced liquidations, can indicate deeper issues within the broker's operations.

Risk Assessment

Given the findings from our investigation, it is essential to evaluate the overall risk associated with trading through Top1 Group.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status raises concerns. |

| Financial Risk | High | High fees and poor withdrawal practices. |

| Operational Risk | Medium | Complaints about platform reliability. |

Traders should consider these risks carefully before engaging with Top1 Group. It is advisable to implement risk management strategies, such as only investing what one can afford to lose and diversifying across multiple brokers.

Conclusion and Recommendations

In conclusion, the investigation into Top1 Group raises significant concerns about its legitimacy and trustworthiness. The suspicious regulatory status, lack of transparency, and negative customer experiences suggest that traders should exercise extreme caution when considering this broker.

For those seeking a reliable trading environment, it may be prudent to explore alternatives that have established reputations and robust regulatory oversight. Brokers such as [Alternative Broker 1] and [Alternative Broker 2] offer safer trading conditions and a higher level of client protection.

Overall, while some traders may find the allure of high leverage and low initial deposits appealing, the potential risks associated with Top1 Group far outweigh the benefits. It is essential to prioritize safety and due diligence in the world of forex trading.

Is TOP1 GROUP a scam, or is it legit?

The latest exposure and evaluation content of TOP1 GROUP brokers.

TOP1 GROUP Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TOP1 GROUP latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.