Is BSV safe?

Pros

Cons

Is BSV Safe or Scam?

Introduction

BSV, or Bitcoin SV, is a cryptocurrency that emerged as a result of a hard fork from Bitcoin Cash in 2018. It was created with the intention of adhering closely to what its proponents claim is the original vision of Bitcoin as outlined by its pseudonymous creator, Satoshi Nakamoto. The platform aims to provide a scalable and efficient blockchain solution for digital transactions. However, with the rise of numerous trading platforms and brokers, traders must exercise caution and conduct thorough evaluations when selecting a broker for their forex trading activities. This careful assessment is essential to mitigate the risks associated with potential scams or unreliable trading platforms, as the landscape is rife with unregulated entities.

In this article, we will investigate the safety and legitimacy of BSV as a trading platform. Our evaluation will be based on a combination of regulatory analysis, company background research, trading conditions, customer experiences, and risk assessments. By employing a structured framework, we aim to provide a comprehensive view of whether BSV is safe for traders or if it raises red flags that warrant caution.

Regulation and Legitimacy

The regulatory status of a broker is a crucial determinant of its legitimacy and safety for traders. A well-regulated broker typically adheres to strict standards that protect investors and ensure fair trading practices. In the case of BSV, it is essential to analyze its regulatory framework thoroughly.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

As indicated in the table, BSV currently lacks valid regulatory oversight. This absence of regulation is a significant concern, as it suggests that the broker operates without the scrutiny of recognized financial authorities. Regulatory bodies are essential for safeguarding traders' interests, ensuring that brokers adhere to industry standards, and providing a mechanism for dispute resolution. The lack of regulation raises questions about the broker's compliance history and its commitment to protecting customer funds.

Furthermore, the absence of a verified regulatory license can expose traders to various risks, including the potential for fraud and the mismanagement of funds. Regulatory oversight is critical for ensuring that brokers are held accountable for their actions, and without it, traders may find themselves vulnerable to unscrupulous practices. Therefore, the lack of regulation is a significant factor to consider when evaluating whether BSV is safe for trading.

Company Background Investigation

Understanding a broker's company history, ownership structure, and management team is vital for assessing its reliability. BSV was established in 2018, but detailed information about its founders, management, and operational history is scarce. This lack of transparency can be a red flag for potential investors, as it raises concerns about the company's accountability and legitimacy.

The ownership structure of BSV remains unclear, which can hinder investors from understanding who is ultimately responsible for the broker's operations. A transparent ownership structure is essential for fostering trust among traders, as it allows them to know who is managing their investments. Furthermore, the absence of information regarding the management team's professional background and experience can lead to doubts about their ability to effectively oversee trading operations and protect customer interests.

In summary, the limited information available about BSV's company background raises concerns about its transparency and reliability. This lack of clarity is a significant factor when considering whether BSV is safe for trading. Without adequate information, traders may find it challenging to make informed decisions about their investments.

Trading Conditions Analysis

A broker's trading conditions, including fees and spreads, play a significant role in determining its overall attractiveness to traders. BSV claims to offer various trading instruments, including forex, precious metals, commodities, and indices. However, it is crucial to scrutinize the overall fee structure and any potential hidden costs associated with trading on the platform.

| Fee Type | BSV | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | Not Specified | 1-2 pips |

| Commission Model | Not Specified | Varies |

| Overnight Interest Range | Not Specified | Varies |

The table illustrates that BSV does not provide clear information about its trading costs, which can be a cause for concern. The lack of transparency regarding spreads and commissions may indicate that traders could face unexpected fees, which could significantly impact their profitability. In the forex trading industry, transparency in fee structures is essential for building trust with clients, and the absence of this transparency raises questions about the broker's integrity.

Moreover, the absence of specified overnight interest rates could lead to confusion among traders, especially those engaging in leveraged trading. Without clear information, traders may struggle to understand the true cost of their trades, which can result in unexpected losses. Therefore, the lack of clarity in BSV's trading conditions is a critical factor to consider when evaluating whether BSV is safe for trading.

Customer Funds Security

The safety of customer funds is a paramount concern for any trader. A reliable broker should implement robust security measures to protect client assets and ensure that funds are managed responsibly. In the case of BSV, it is essential to analyze its approach to fund security.

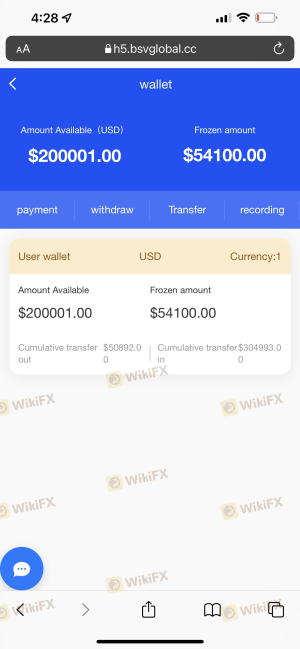

BSV's website does not provide detailed information regarding its fund security measures, such as the segregation of client funds, investor protection schemes, or negative balance protection policies. This lack of information can be alarming for traders, as it raises questions about how their funds are being handled and whether they are adequately protected against potential losses.

The absence of fund segregation, where client funds are held separately from the broker's operational funds, can expose traders to significant risks. In the event of the broker's insolvency, traders may find it challenging to recover their assets. Additionally, the lack of investor protection schemes means that traders may not have recourse if the broker engages in fraudulent activities.

Given the historical issues surrounding many unregulated brokers, the lack of clarity regarding BSV's fund security measures is a significant concern. Therefore, traders must carefully consider whether BSV is safe for holding their funds.

Customer Experience and Complaints

Customer feedback and experiences provide valuable insights into a broker's reliability and service quality. Analyzing customer reviews can help identify common complaints and gauge the broker's responsiveness to issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Fund Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Slow |

| Lack of Transparency | High | Unresponsive |

The table summarizes some of the primary complaints associated with BSV. Many users have reported difficulties with fund withdrawals, with some alleging that their requests were ignored or delayed. Such issues can severely impact traders' trust in the broker, as timely access to funds is critical for any trading operation.

Additionally, complaints regarding slow customer service responses indicate a lack of support for clients facing issues. A responsive customer service team is essential for addressing traders' concerns and providing assistance when needed. The combination of fund withdrawal issues and poor customer service raises significant red flags regarding BSV's operational integrity.

In light of this feedback, it is crucial for potential traders to consider whether BSV is safe for trading, given the reported complaints and the company's apparent inability to address them effectively.

Platform and Execution

The performance and reliability of a trading platform are critical factors that can impact a trader's success. A robust trading platform should offer stability, fast execution speeds, and a user-friendly interface. For BSV, evaluating its platform performance is essential to determine whether it meets these criteria.

While BSV claims to offer a trading platform, there is limited information available regarding its performance, stability, and user experience. Traders need to understand the order execution quality, including potential slippage and rejection rates, as these factors can significantly affect trading outcomes.

If the platform exhibits signs of manipulation or frequent technical issues, it can severely hinder traders' ability to execute their strategies effectively. Moreover, any indications of platform instability could lead to significant financial losses for traders.

Given the lack of detailed insights into BSV's platform performance, it is essential for traders to approach this broker with caution. The uncertainty surrounding the platform's reliability raises concerns about whether BSV is safe for trading activities.

Risk Assessment

Engaging with any trading platform carries inherent risks, and it is essential to assess these risks comprehensively. For BSV, evaluating the overall risk profile can help traders make informed decisions about their investments.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of regulatory oversight |

| Operational Risk | High | Poor customer service and support |

| Financial Risk | High | Unclear fee and cost structures |

The table summarizes the key risk areas associated with BSV. The absence of regulatory oversight poses a high risk to traders, as it leaves them vulnerable to potential fraud and mismanagement. Additionally, operational risks stemming from poor customer service and support further exacerbate the overall risk profile of the broker.

To mitigate these risks, traders should exercise caution and conduct thorough due diligence before engaging with BSV. Seeking alternative, well-regulated brokers with transparent fee structures and reliable customer support can help minimize exposure to potential losses.

Conclusion and Recommendations

In conclusion, the investigation into BSV raises several significant concerns regarding its safety and legitimacy as a trading platform. The lack of regulatory oversight, limited transparency in company operations, unclear trading conditions, and negative customer feedback all suggest that traders should approach this broker with caution.

Given the findings, it is prudent to conclude that BSV is not safe for trading, and potential investors should consider alternative options that offer better regulatory protection and customer support. For those seeking reliable trading platforms, brokers with established regulatory frameworks, transparent fee structures, and positive customer experiences are recommended.

In summary, while BSV may offer certain trading opportunities, the associated risks and concerns make it a less favorable choice for traders looking for a secure and trustworthy trading environment.

Is BSV a scam, or is it legit?

The latest exposure and evaluation content of BSV brokers.

BSV Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BSV latest industry rating score is 1.48, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.48 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.