TOP1 Group 2025 Review: Everything You Need to Know

Executive Summary

This comprehensive top1 group review examines a regulated forex broker that operates with mixed regulatory oversight. The broker raises both opportunities and concerns for potential traders who want to start trading with them. TOP1 Group presents itself as a global online trading provider specializing in CFD services across multiple asset classes. The broker offers MetaTrader 5 trading platform. It also supports trading in forex, indices, commodities, and cryptocurrencies through contracts for difference.

TOP1 GROUP LIMITED is registered in Samoa. Its subsidiaries operate under different regulatory frameworks - TOP 1 MARKETS PTY LTD holds ASIC regulation, and TOP 1 MARKETS LIMITED operates under VFSC oversight. However, the unregulated portions of its operations have generated safety concerns among traders. User feedback presents a mixed picture. The feedback draws particular attention to withdrawal difficulties and customer service challenges. The broker primarily targets global online traders seeking CFD trading opportunities. Potential clients should carefully consider the regulatory differences across different operational entities.

Overall, TOP1 Group receives a neutral evaluation. This rating reflects both its legitimate regulated operations and the concerns surrounding its unregulated components.

Important Notice

Regulatory Entity Variations: TOP1 Group operates through multiple entities across different jurisdictions with varying regulatory statuses. TOP1 GROUP LIMITED remains unregulated. TOP 1 MARKETS PTY LTD and TOP 1 MARKETS LIMITED maintain regulatory oversight under ASIC and VFSC respectively. Traders should verify which entity they are dealing with. They should also understand the corresponding regulatory protections that apply to their accounts.

Review Methodology: This evaluation is based on available public information, user feedback from various review platforms, and regulatory data. Due to limited transparency in certain operational aspects, some assessments reflect information gaps rather than definitive conclusions.

Rating Framework

Broker Overview

TOP1 Group emerged in 2018 as a global online trading provider headquartered in Hong Kong. The company focuses on CFD trading services across international markets. The company positions itself as a comprehensive trading solution for retail and institutional clients seeking exposure to diverse financial instruments. Their business model centers on providing access to forex, indices, commodities, and cryptocurrency markets through contracts for difference. This approach enables traders to speculate on price movements without owning underlying assets.

The broker operates through multiple corporate entities to serve different geographical regions. TOP1 GROUP LIMITED serves as the primary entity registered in Samoa. This structure allows the company to offer services across various jurisdictions while maintaining different regulatory relationships. TOP1 Group's primary trading infrastructure relies on the MetaTrader 5 platform. The platform provides clients with advanced charting capabilities, automated trading options, and comprehensive market analysis tools. Their asset coverage includes major and minor currency pairs, global stock indices, precious metals, energy commodities, and popular cryptocurrencies. All these assets are accessible through CFD trading mechanisms.

Regulatory Coverage: TOP1 GROUP LIMITED operates from Samoa without specific regulatory oversight. TOP 1 MARKETS PTY LTD maintains Australian Securities and Investments Commission regulation, and TOP 1 MARKETS LIMITED holds Vanuatu Financial Services Commission licensing. This multi-entity structure creates varying levels of investor protection depending on the specific entity handling client accounts.

Deposit and Withdrawal Methods: Specific information regarding supported payment methods is not detailed in available documentation. This requires direct inquiry with the broker for comprehensive payment options.

Minimum Deposit Requirements: Exact minimum deposit thresholds are not specified in available materials. This suggests potential variation across different account types or regulatory entities.

Promotional Offerings: Current bonus structures and promotional campaigns are not outlined in accessible documentation. This indicates either absence of such programs or limited marketing transparency.

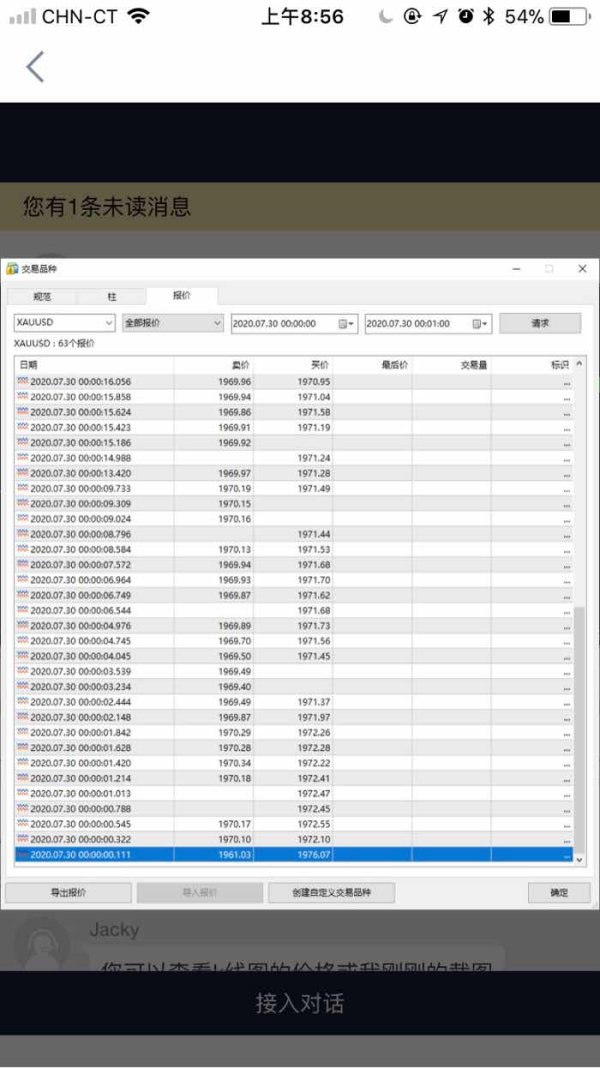

Tradeable Assets: The broker provides access to forex pairs, global indices, commodities including precious metals and energy products, and cryptocurrency CFDs. This top1 group review notes that all trading occurs through contracts for difference rather than direct asset ownership.

Cost Structure: Detailed information regarding spreads, commissions, overnight financing charges, and other trading costs lacks transparency in available documentation. This represents a significant information gap for potential clients evaluating total trading expenses.

Leverage Ratios: Specific leverage offerings are not detailed in accessible materials. These likely vary based on asset class and applicable regulatory requirements.

Platform Options: MetaTrader 5 serves as the primary trading platform. The platform offers advanced technical analysis tools, algorithmic trading capabilities, and comprehensive market access.

Geographic Restrictions: Specific country limitations are not detailed in available documentation.

Customer Support Languages: Available language support options are not specified in accessible materials.

Detailed Rating Analysis

Account Conditions Analysis (5/10)

The account conditions evaluation for TOP1 Group faces significant limitations due to insufficient transparency regarding specific account types, features, and requirements. Available documentation does not provide clear information about different account tiers, minimum deposit requirements, or special account features that might benefit different trader categories. This lack of transparency makes it challenging for potential clients to make informed decisions about account selection.

The absence of detailed information about Islamic accounts, professional trading accounts, or beginner-friendly options suggests either limited account variety or poor communication of available features. Without clear documentation of account opening procedures, verification requirements, or processing timeframes, prospective traders cannot adequately assess the accessibility and convenience of beginning their trading relationship with TOP1 Group.

The regulatory complexity across different entities adds another layer of uncertainty to account conditions. Terms and protections may vary significantly depending on which corporate entity manages a particular account. This top1 group review identifies the need for greater transparency in account-related information to enable proper evaluation of the broker's offerings in this critical area.

TOP1 Group demonstrates strength in its technology infrastructure by providing MetaTrader 5, a sophisticated trading platform recognized throughout the industry for its comprehensive analytical capabilities and automated trading support. The platform offers advanced charting tools, technical indicators, and expert advisor functionality that appeals to both novice and experienced traders seeking robust trading technology.

The broker's asset coverage across forex, indices, commodities, and cryptocurrencies provides traders with diversification opportunities within a single platform environment. This multi-asset approach enables portfolio diversification and cross-market trading strategies that many traders find valuable for risk management and opportunity maximization.

However, available information does not detail additional research resources, market analysis publications, educational materials, or proprietary trading tools that might enhance the overall trading experience. The absence of information about economic calendars, market news feeds, sentiment indicators, or educational webinars suggests potential gaps in comprehensive trader support beyond the core platform functionality.

Customer Service and Support Analysis (4/10)

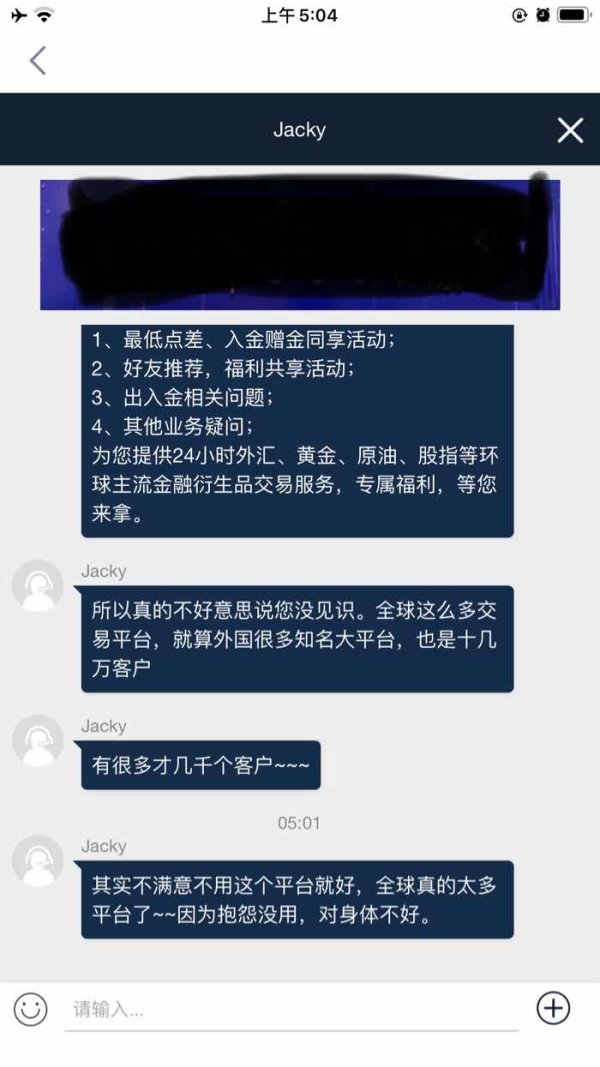

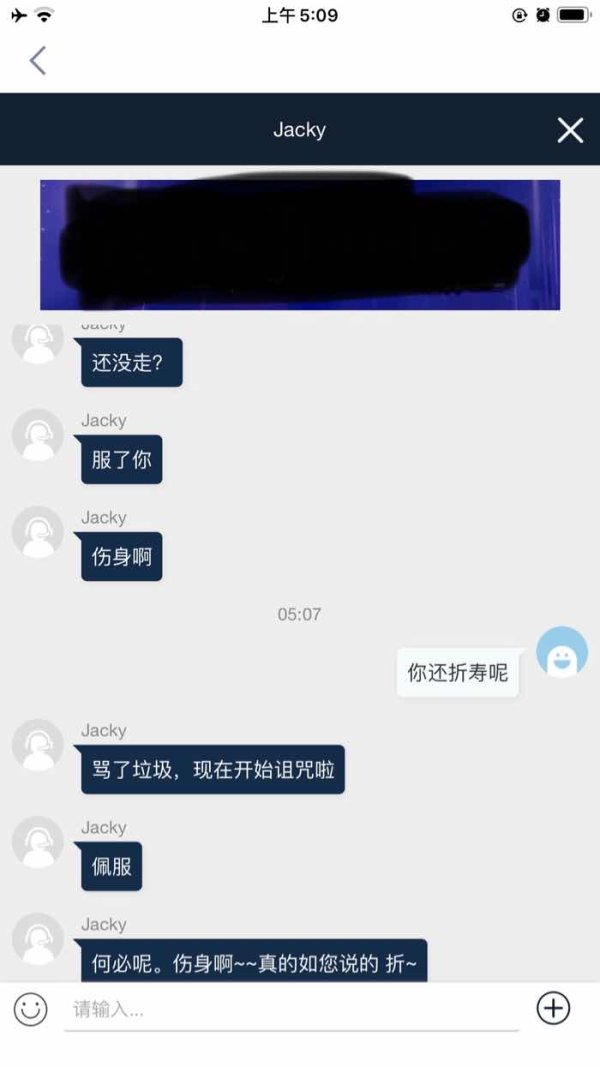

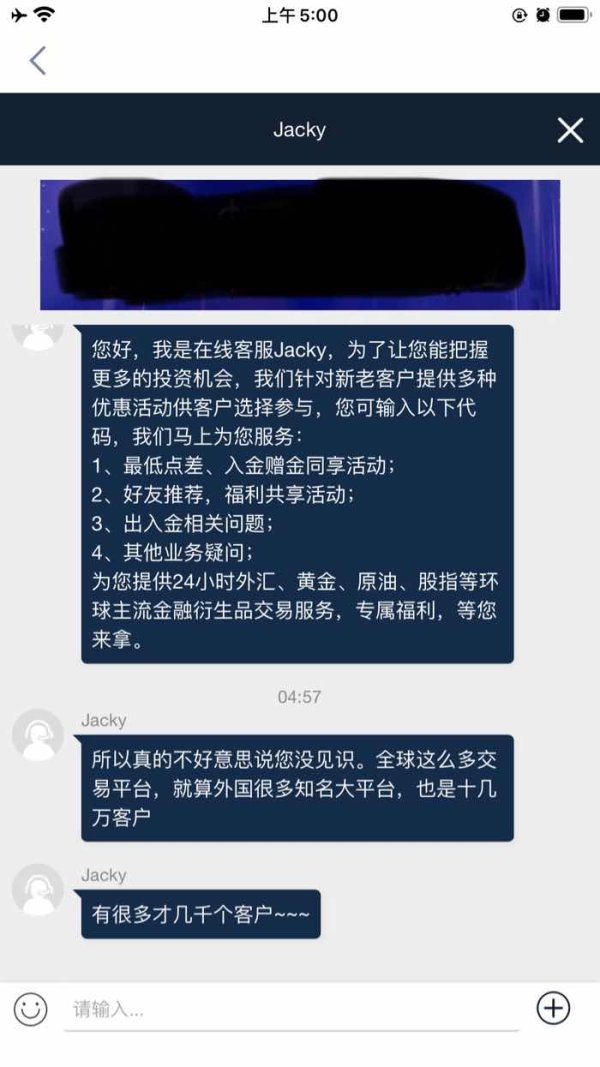

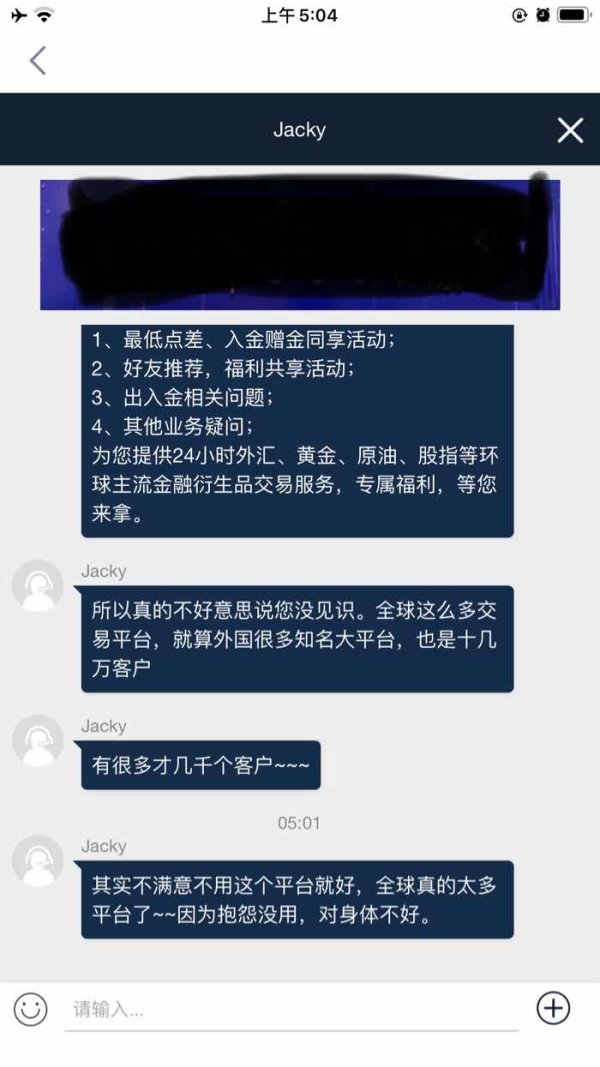

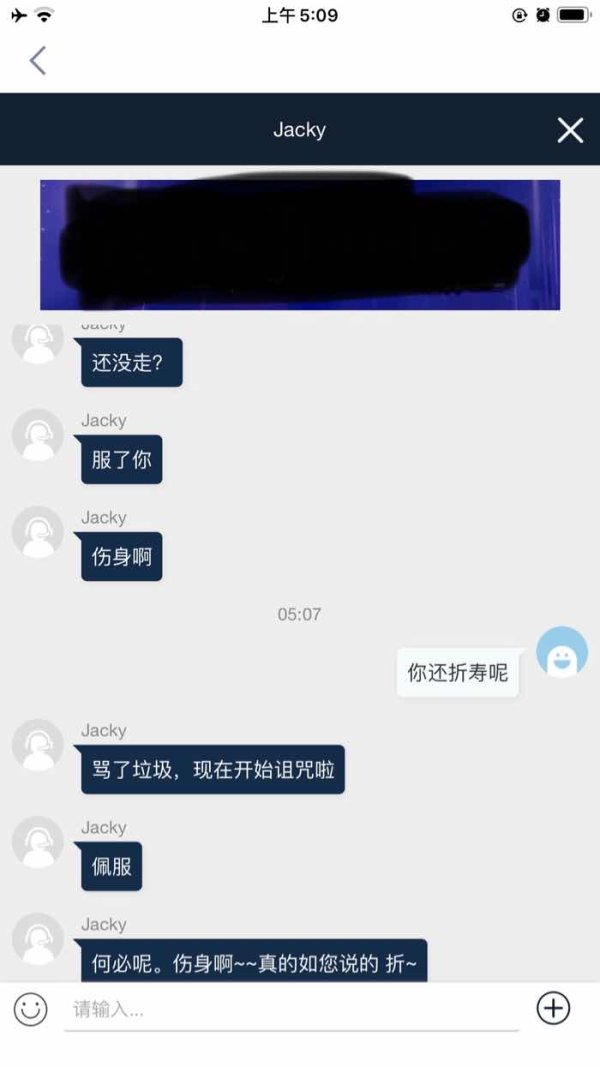

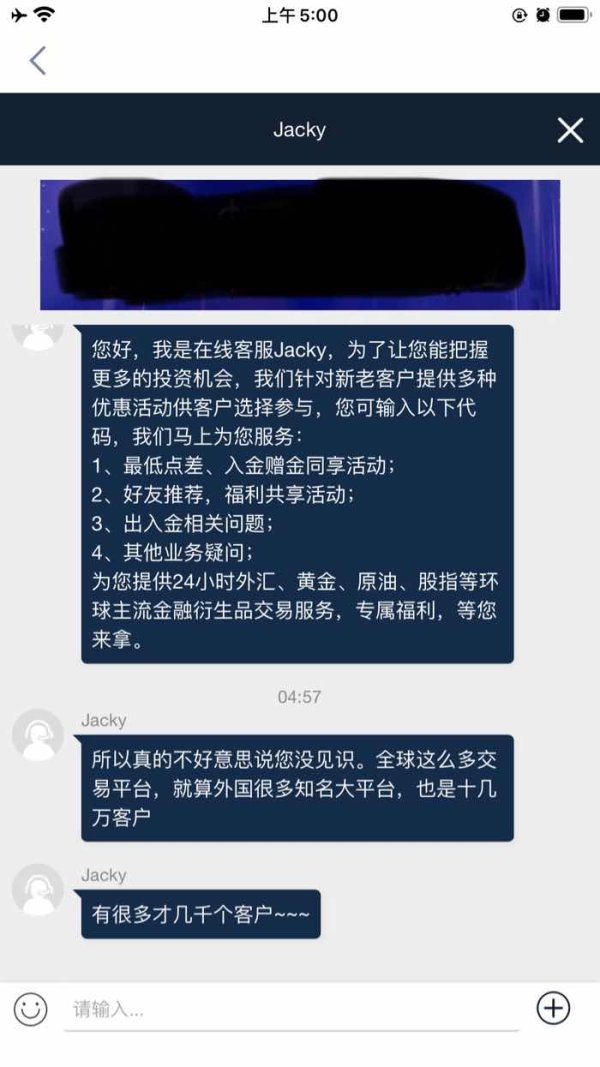

Customer service represents a significant concern area for TOP1 Group based on available user feedback indicating substandard service quality and responsiveness. User reports consistently mention difficulties in obtaining timely and effective support. These difficulties particularly affect account-related issues and withdrawal processing concerns.

The lack of detailed information about available support channels, operating hours, and language capabilities further compounds service accessibility concerns. Professional forex brokers typically provide multiple contact methods including live chat, phone support, and email assistance with clearly defined response time commitments. Such details are not readily available for TOP1 Group.

User feedback specifically highlights inadequate response times and insufficient professional expertise among customer service representatives. These service quality issues create additional friction for traders who require assistance with technical problems, account management, or dispute resolution. The absence of comprehensive support infrastructure details suggests potential limitations in the broker's commitment to customer service excellence.

Trading Experience Analysis (6/10)

The trading experience evaluation reveals a mixed assessment based on platform capabilities versus operational transparency. MetaTrader 5 provides a solid foundation for trading execution with its reliable order management system, comprehensive charting capabilities, and support for automated trading strategies. Users generally report acceptable platform stability and functionality for conducting trading activities.

However, the lack of detailed information about execution quality metrics such as average execution speeds, slippage statistics, or requote frequency prevents thorough assessment of the actual trading environment quality. Professional traders require transparency about execution conditions to evaluate whether the broker can meet their performance expectations.

The absence of specific information about trading costs, including spreads, commissions, and overnight financing charges, creates uncertainty about the true cost of trading with TOP1 Group. This information gap significantly impacts the ability to assess overall trading value and competitiveness compared to alternative brokers in the market.

Trust and Reliability Analysis (5/10)

Trust assessment for TOP1 Group presents a complex picture due to the mixed regulatory status across its operational entities. While TOP 1 MARKETS PTY LTD operates under ASIC regulation and TOP 1 MARKETS LIMITED holds VFSC licensing, the unregulated status of TOP1 GROUP LIMITED creates potential safety concerns for client funds and regulatory protection.

The regulatory complexity requires traders to carefully understand which entity handles their account and what level of investor protection applies to their specific situation. This multi-entity structure, while potentially legitimate for international operations, creates confusion about applicable regulations and dispute resolution procedures.

User feedback includes concerns about fund safety and withdrawal processing, which directly impact trust levels. The broker's response to negative feedback demonstrates willingness to engage with client concerns. However, the underlying issues require resolution rather than just communication. The absence of detailed information about client fund segregation, insurance coverage, or compensation schemes further limits trust assessment capabilities.

User Experience Analysis (6/10)

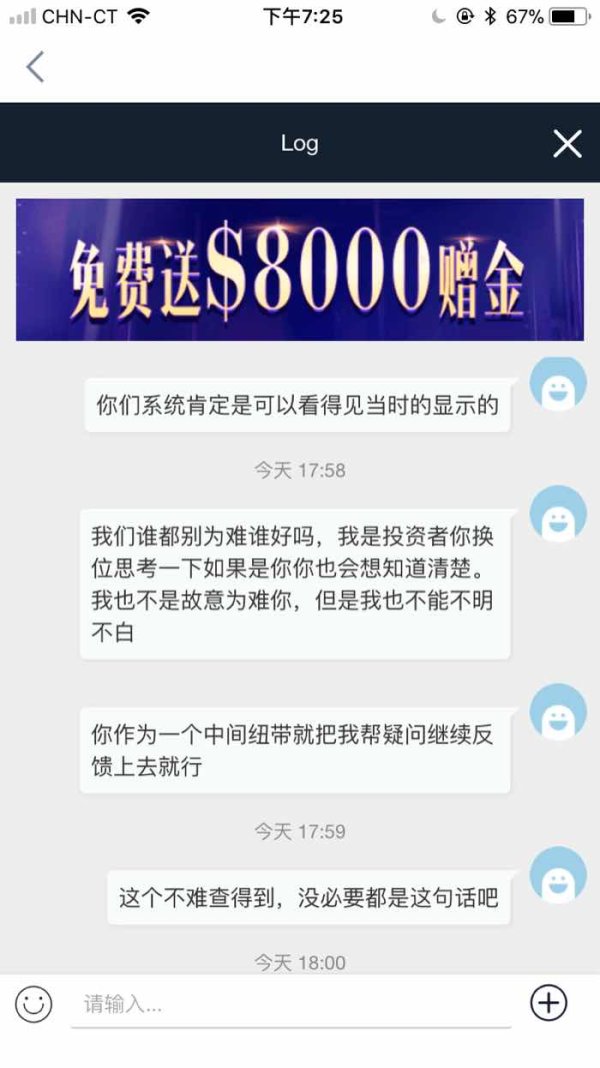

Overall user experience with TOP1 Group reflects a mixed satisfaction profile with notable areas requiring improvement. User feedback indicates particular frustration with withdrawal processes. This suggests systematic issues in fund processing that negatively impact the overall client experience.

The platform interface through MetaTrader 5 generally receives positive feedback for functionality and ease of use. However, specific information about mobile trading capabilities, account management interfaces, or proprietary platform enhancements is not readily available. This limits the ability to assess the complete user experience across different devices and interaction points.

Common user complaints center on withdrawal difficulties and customer service quality, indicating systematic operational issues that affect client satisfaction. The broker's target audience of CFD traders seeking multi-asset exposure may find value in the platform capabilities. However, operational friction in critical areas like fund management creates significant user experience challenges that require attention.

Conclusion

This top1 group review concludes that TOP1 Group presents a mixed proposition for potential traders. The broker offers legitimate trading capabilities through regulated entities while maintaining concerning unregulated operations that create safety considerations. The broker demonstrates strength in platform technology through MetaTrader 5 and provides access to diverse asset classes suitable for CFD trading strategies.

However, significant concerns regarding customer service quality, withdrawal processing, and operational transparency limit the broker's appeal for traders prioritizing reliable service and clear operational procedures. The complex regulatory structure requires careful consideration by potential clients to understand applicable protections and regulatory oversight.

TOP1 Group may suit traders specifically seeking multi-asset CFD trading capabilities who can navigate the regulatory complexity and accept the associated service limitations. However, traders prioritizing transparent operations, reliable customer service, and straightforward withdrawal processes may find better alternatives in the competitive forex broker landscape.