Regarding the legitimacy of TKFX forex brokers, it provides FSA, NFA, FCA and WikiBit, .

Is TKFX safe?

Pros

Cons

Is TKFX markets regulated?

The regulatory license is the strongest proof.

FSA Market Making License (MM)

Financial Services Agency

Financial Services Agency

Current Status:

UnverifiedLicense Type:

Market Making License (MM)

Licensed Entity:

めぶき証券株式会社

Effective Date:

2008-03-14Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

茨城県水戸市南町3-4-12Phone Number of Licensed Institution:

029-233-1628Licensed Institution Certified Documents:

NFA Forex Trading License (EP)

National Futures Association

National Futures Association

Current Status:

UnverifiedLicense Type:

Forex Trading License (EP)

Licensed Entity:

GAIN CAPITAL GROUP LLC

Effective Date:

2004-07-29Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

30 Independence Blv, 3rd Floor Warren, NJ 07059 United StatesPhone Number of Licensed Institution:

908-731-0750Licensed Institution Certified Documents:

FCA Forex Execution License (STP)

Financial Conduct Authority

Financial Conduct Authority

Current Status:

UnverifiedLicense Type:

Forex Execution License (STP)

Licensed Entity:

Pepperstone Limited

Effective Date:

2015-08-05Email Address of Licensed Institution:

londonoffice@pepperstone.com, compliance.uk@pepperstone.comSharing Status:

No SharingWebsite of Licensed Institution:

www.pepperstone.comExpiration Time:

--Address of Licensed Institution:

70 Gracechurch Street London EC3V 0HR UNITED KINGDOMPhone Number of Licensed Institution:

+448000465473Licensed Institution Certified Documents:

Is Tkfx Safe or Scam?

Introduction

Tkfx is a forex broker that has gained attention in the trading community for its diverse offerings and competitive trading conditions. However, with the rise of online trading platforms, traders must exercise caution and conduct thorough evaluations before committing their funds. The forex market is notorious for its volatility and the potential for scams, making it crucial for traders to assess the legitimacy and safety of their brokers. This article aims to provide a comprehensive analysis of Tkfx, focusing on its regulatory status, company background, trading conditions, customer experience, and overall risk profile. Our investigation is based on a review of multiple credible sources, including regulatory databases and user feedback, ensuring an objective assessment of whether Tkfx is safe or a potential scam.

Regulation and Legitimacy

Regulation plays a vital role in the safety and legitimacy of forex brokers. A regulated broker is subject to strict oversight, which helps protect traders from fraud and ensures fair trading practices. Unfortunately, Tkfx has been flagged as a "suspicious clone" with no valid regulatory licenses. This raises significant concerns about its operational legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The lack of regulation implies that Tkfx does not adhere to the stringent requirements set forth by reputable financial authorities. This absence of oversight can lead to various issues, including the potential for fraudulent activities and inadequate protection for traders' funds. Furthermore, past complaints indicate that traders have experienced difficulties with withdrawals, citing requests for additional fees or penalties before they could access their funds. Such practices are common among unregulated brokers, highlighting the importance of regulatory compliance in ensuring a safe trading environment. Therefore, it is crucial to consider these factors when evaluating whether Tkfx is safe or a scam.

Company Background Investigation

Tkfx operates under the name Kerry Sitar International Limited and is reportedly based in Hong Kong. However, the companys history and ownership structure remain vague, with limited information available regarding its management team and operational practices. This lack of transparency is concerning, as reputable brokers typically provide detailed information about their management and corporate governance.

The absence of a clear ownership structure raises questions about accountability and the broker's commitment to ethical trading practices. Moreover, the company's website has faced accessibility issues, further complicating efforts to verify its legitimacy. A reliable broker should maintain an informative and accessible online presence to foster trust among its clients. Given these factors, the overall transparency and information disclosure levels related to Tkfx are inadequate, contributing to the perception that it may not be a safe trading option.

Trading Conditions Analysis

Tkfx offers a variety of trading conditions that may appear attractive to potential traders. However, it is essential to scrutinize the overall fee structure and any unusual policies that might indicate underlying issues. The broker claims to provide competitive spreads and leverage, but the lack of regulatory oversight raises concerns about the reliability of these claims.

| Fee Type | Tkfx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | None specified | $5 per trade |

| Overnight Interest Range | Unknown | Varies by broker |

The absence of a clear commission structure and potential hidden fees can lead to unexpected costs for traders. Moreover, the lack of transparency regarding overnight interest rates adds to the uncertainty surrounding Tkfx's trading conditions. Traders should be cautious of brokers that do not openly disclose their fee structures, as this can often be a red flag. Overall, while Tkfx may present itself as a competitive trading option, the lack of clarity regarding fees and commissions raises concerns about its safety and reliability.

Customer Funds Security

The security of customer funds is a paramount concern for any trader. Tkfx's lack of regulatory oversight raises significant questions about its measures for safeguarding client funds. Reputable brokers typically implement strict security protocols, including segregated accounts for client funds and negative balance protection to prevent traders from losing more than their initial investment.

Unfortunately, there is little information available regarding Tkfx's policies on fund segregation and investor protection. This lack of clarity is alarming, especially considering that some users have reported issues with withdrawing their funds, suggesting that Tkfx may not prioritize the security of client assets. Historical complaints about difficulties in accessing funds further exacerbate concerns about the broker's commitment to safeguarding customer investments. In light of these factors, it is crucial for traders to carefully consider whether Tkfx is safe, as the potential risks associated with fund security remain significant.

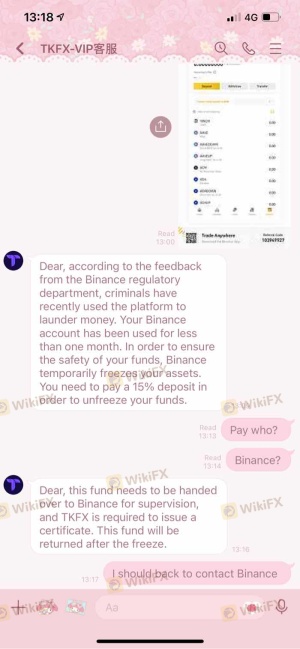

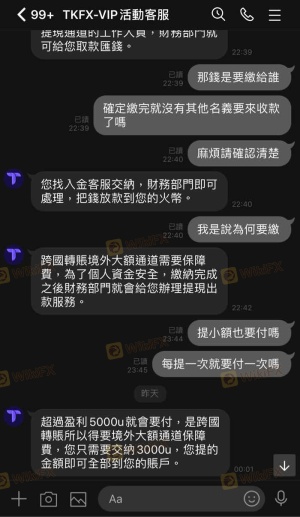

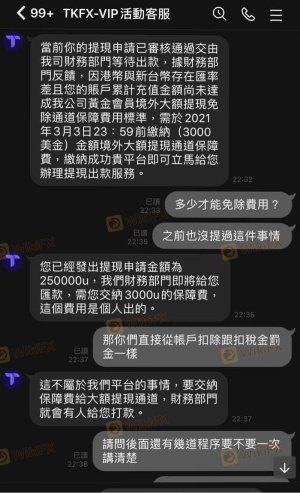

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. In the case of Tkfx, numerous complaints have surfaced, primarily centered around withdrawal issues and unexpected fees. Many users reported being unable to access their funds without paying additional fees or penalties, which is a common tactic among unregulated brokers.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Unclear Fee Structure | Medium | Inadequate |

| Customer Support Delays | High | Poor |

These complaints suggest a troubling pattern of behavior that raises concerns about Tkfx's credibility. For instance, one user reported being asked to pay a tax fee before being allowed to withdraw their funds, while another mentioned ongoing requests for additional payments. Such practices are often indicative of fraudulent operations, further supporting the notion that Tkfx may not be a safe broker. The overall customer experience appears to be fraught with challenges, making it essential for potential traders to remain vigilant and consider alternative options.

Platform and Execution Quality

The trading platform offered by Tkfx is another critical aspect of its service. A reliable and efficient platform is essential for successful trading, as it directly impacts order execution quality and user experience. However, there is limited information available regarding the performance and stability of Tkfx's trading platform. Traders have reported issues related to order execution, including slippage and rejections, which can significantly affect trading outcomes.

Furthermore, the absence of transparency regarding the platform's operational capabilities raises concerns about potential manipulation or unfair practices. Traders should be wary of platforms that do not provide clear information about their execution quality, as this can lead to significant losses. In light of these factors, it is essential to evaluate whether Tkfx is safe based on its platform performance and execution standards.

Risk Assessment

Using Tkfx entails various risks that potential traders should carefully consider. The lack of regulation, unclear fee structures, and reported withdrawal issues contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | No valid regulatory oversight |

| Fund Security | High | Unclear policies on fund protection |

| Customer Support Issues | Medium | Numerous complaints regarding support |

| Withdrawal Difficulties | High | Historical issues with accessing funds |

To mitigate these risks, traders should conduct thorough research and consider using alternative brokers that offer better regulatory oversight and customer protection. It is crucial to prioritize safety and reliability when selecting a trading platform, especially in a market as volatile as forex.

Conclusion and Recommendations

In conclusion, the evidence gathered suggests that Tkfx exhibits several red flags that indicate it may not be a safe trading option. The lack of regulatory oversight, coupled with numerous complaints regarding withdrawal issues and unclear fee structures, raises significant concerns about the broker's legitimacy. Therefore, it is advisable for traders to exercise caution and consider alternative options that are regulated and have a proven track record of safety and reliability.

For traders seeking trustworthy alternatives, brokers regulated by top-tier authorities such as the FCA or ASIC are recommended. These brokers typically offer robust security measures, transparent fee structures, and responsive customer support, ensuring a safer trading experience. Ultimately, it is essential for traders to prioritize safety and conduct thorough evaluations before committing their funds, as the risks associated with unregulated brokers like Tkfx can be substantial.

Is TKFX a scam, or is it legit?

The latest exposure and evaluation content of TKFX brokers.

TKFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TKFX latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.