Is SUMMA PIPS safe?

Business

License

Is Summa Pips A Scam?

Introduction

Summa Pips is an online forex broker that has gained attention in the trading community since its inception in 2020. Positioned as a platform for trading various assets, including forex, commodities, and cryptocurrencies, it claims to offer competitive trading conditions. However, the rise of unregulated brokers has led to a growing need for traders to exercise caution when selecting a trading partner. The potential for scams in the forex market is significant, making it essential for traders to conduct thorough evaluations of brokers like Summa Pips. This article aims to provide a comprehensive analysis of Summa Pips, assessing its safety, regulatory status, trading conditions, and overall trustworthiness.

Regulation and Legitimacy

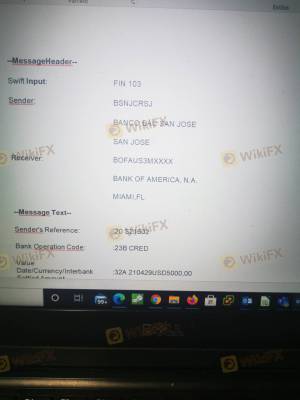

The regulatory status of any forex broker is a critical factor in determining its legitimacy and safety. Summa Pips operates without a license from any major regulatory authority, which raises significant concerns. The absence of regulation implies that traders may not be afforded the same protections as those trading with regulated brokers. Below is a summary of the regulatory information related to Summa Pips:

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulatory oversight means that Summa Pips does not have to adhere to stringent financial standards or transparency requirements. This situation poses a considerable risk to traders, as unregulated brokers can engage in practices that may not align with ethical trading standards. Furthermore, the Spanish financial regulator, CNMV, has issued warnings against Summa Pips, indicating that it operates without authorization. This lack of oversight is a significant red flag for potential clients who are considering whether Summa Pips is safe for their investments.

Company Background Investigation

Understanding the background of a broker can provide insights into its reliability and operational integrity. Summa Pips is owned by DMF Markets Ltd, a company that claims to be based in Saint Vincent and the Grenadines. However, the jurisdiction is known for its lenient regulatory environment, which has made it a hotspot for unregulated brokers.

The companys history is relatively short, having been established in 2020, which raises questions about its stability and longevity in the market. Additionally, there is a notable lack of transparency regarding the management team behind Summa Pips. The absence of publicly available information about the key personnel involved in the company further exacerbates concerns about its credibility. Without clear information on the management's experience and qualifications, it is difficult for potential clients to assess the broker's trustworthiness.

In conclusion, the opaque ownership structure and limited public information about the company's management team contribute to the perception that Summa Pips is not safe for traders seeking a reliable broker.

Trading Conditions Analysis

When evaluating a forex broker, the trading conditions they offer are crucial. Summa Pips advertises competitive trading conditions, including low spreads. However, the overall fee structure remains unclear, with many essential details obscured or hidden behind registration walls.

The following table outlines the core trading costs associated with Summa Pips:

| Fee Type | Summa Pips | Industry Average |

|---|---|---|

| Spread for Major Pairs | 0.4 pips | 0.5 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While the spreads for major currency pairs appear competitive, the lack of transparency regarding commissions and overnight interest rates raises concerns. Traders are often left in the dark about the total costs they might incur, which can lead to unexpected expenses and losses. This lack of clarity is particularly troubling in the context of an unregulated broker, as it suggests that Summa Pips may not be safe for traders who value transparency and fair pricing.

Client Fund Security

The security of client funds is a paramount concern for any trader. Summa Pips does not provide adequate information regarding its fund security measures. The broker operates without segregated accounts, which means that client funds may not be kept separate from the company's operational funds. This lack of segregation is a significant risk factor, as it exposes traders to potential losses in the event of the broker's insolvency.

Additionally, there is no evidence to suggest that Summa Pips offers any form of investor protection, such as compensation schemes for clients in the event of financial misconduct. The absence of negative balance protection further exacerbates the risks associated with trading with this broker. Given these factors, it is clear that Summa Pips is not safe for traders who prioritize the security of their investments.

Customer Experience and Complaints

Customer feedback is a vital component in assessing a broker's reputation. Reviews of Summa Pips reveal a pattern of complaints regarding withdrawal issues and a lack of responsiveness from customer support. Many users report difficulties in accessing their funds, with some claiming that their withdrawal requests have gone unanswered for extended periods.

The following table summarizes the main types of complaints received about Summa Pips:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Poor |

| Unclear Trading Conditions | High | Poor |

One typical case involved a trader who reported being unable to withdraw their funds for over a month, leading to frustration and financial stress. Such experiences indicate that Summa Pips may not be a safe option for traders who require reliable access to their funds and prompt customer support.

Platform and Trade Execution

The trading platform provided by Summa Pips is based on MetaTrader 5, a widely recognized trading platform known for its advanced features. However, user experiences regarding platform performance have been mixed. Reports of slippage and order rejections have surfaced, raising concerns about the execution quality.

Traders have noted that during volatile market conditions, their orders were either executed at unfavorable prices or not executed at all, which can significantly impact trading outcomes. The presence of such issues suggests that Summa Pips might not be safe for traders who rely on efficient trade execution.

Risk Assessment

Engaging with unregulated brokers like Summa Pips inherently carries risks. Below is a risk scorecard summarizing the key risk areas associated with this broker:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation or oversight |

| Financial Risk | High | No segregation of client funds |

| Withdrawal Risk | High | Complaints about withdrawal delays |

| Platform Risk | Medium | Reports of slippage and rejections |

To mitigate these risks, traders should consider using regulated brokers that provide clear information about their operations, offer investor protection, and ensure transparent trading conditions.

Conclusion and Recommendations

In conclusion, the evidence suggests that Summa Pips is not safe for traders. The broker's lack of regulation, coupled with a history of customer complaints and unclear trading conditions, raises significant red flags. Traders looking for a reliable and trustworthy forex broker should exercise caution and consider alternatives that are regulated and offer better security measures.

For those seeking safer trading options, it is advisable to explore brokers that are licensed by reputable regulatory authorities, such as the FCA or ASIC, which provide a higher level of investor protection and transparency. Ultimately, thorough research and careful consideration are essential for safeguarding investments in the volatile world of forex trading.

Is SUMMA PIPS a scam, or is it legit?

The latest exposure and evaluation content of SUMMA PIPS brokers.

SUMMA PIPS Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SUMMA PIPS latest industry rating score is 1.53, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.53 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.