Is Ridge Corporation safe?

Pros

Cons

Is Ridge Corporation A Scam?

Introduction

Ridge Corporation is a forex broker that has emerged in the trading landscape, claiming to offer a variety of financial instruments and trading opportunities. However, the rise of unregulated brokers has made it imperative for traders to thoroughly evaluate the legitimacy and safety of their chosen trading platforms. In this analysis, we will explore whether Ridge Corporation is a safe option for traders or if it raises red flags indicating potential scams. Our investigation will focus on several key aspects: regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

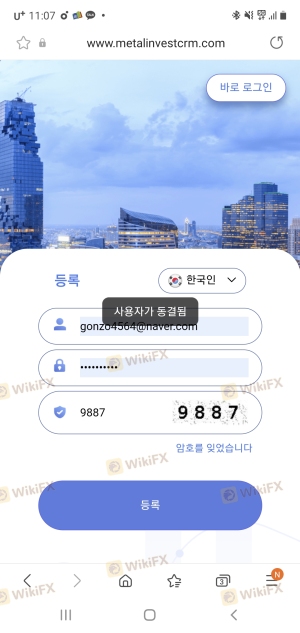

The regulatory status of a broker is one of the most critical factors in determining its legitimacy. Ridge Corporation claims to operate in Japan but lacks any valid regulatory licenses from recognized financial authorities. This absence of regulation is a significant concern for potential traders, as it suggests a lack of oversight that could jeopardize their investments.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Regulated |

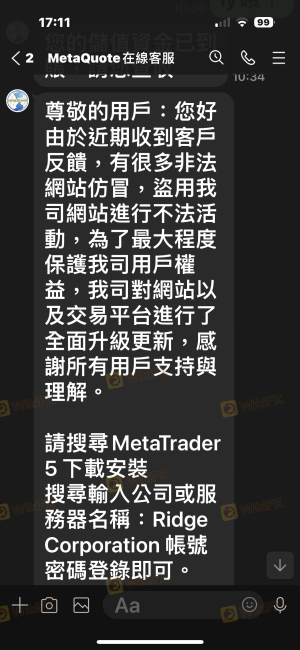

The lack of regulation implies that Ridge Corporation is not held accountable for its operations, which can lead to potential fraudulent practices. Furthermore, the company's previous claims of being regulated by the National Futures Association (NFA) have been debunked, indicating a history of misleading information. This raises serious questions about the broker's transparency and ethical standards, making it crucial for traders to exercise caution when considering Ridge Corporation as a trading partner.

Company Background Investigation

Ridge Corporation is a relatively new entrant in the forex market, established within the last year. The company operates without a clear ownership structure or detailed information about its management team. This lack of transparency can be alarming for potential investors, as it raises concerns about who is managing their funds and making critical business decisions.

The absence of a physical office location and verifiable contact information further complicates the assessment of Ridge Corporation's legitimacy. A trustworthy broker typically provides clear information about its management team, regulatory affiliations, and operational history. In this case, the lack of such disclosures points to a potential risk for traders, as they may be dealing with an anonymous entity that could vanish without notice.

Trading Conditions Analysis

When evaluating a broker, it's essential to consider the trading conditions they offer, including fees and commissions. Ridge Corporation advertises competitive spreads and a straightforward fee structure; however, the lack of transparency regarding specific costs raises concerns.

| Fee Type | Ridge Corporation | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.2 pips | 0.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

While the advertised spread for the USD/JPY currency pair is 0.2 pips, it is essential to note that actual spreads may vary for individual clients, and there are no guarantees regarding the spreads displayed in advertisements. Additionally, the absence of a clear commission structure and overnight interest rates adds to the uncertainty surrounding the broker's trading conditions. Traders should be wary of any hidden fees that could erode their profits.

Customer Fund Safety

The safety of customer funds is paramount when choosing a forex broker. Ridge Corporation's lack of regulation raises significant concerns about the security measures in place to protect client deposits. Without a regulatory framework, there is no assurance that the broker is adhering to industry standards for fund segregation or investor protection.

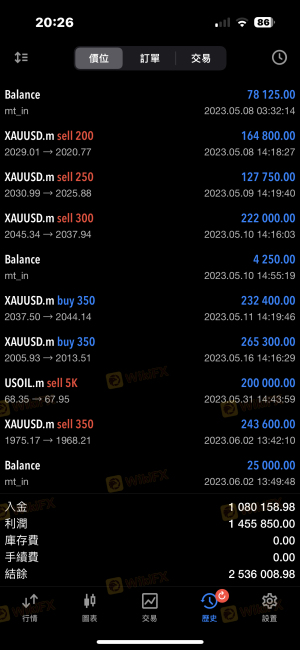

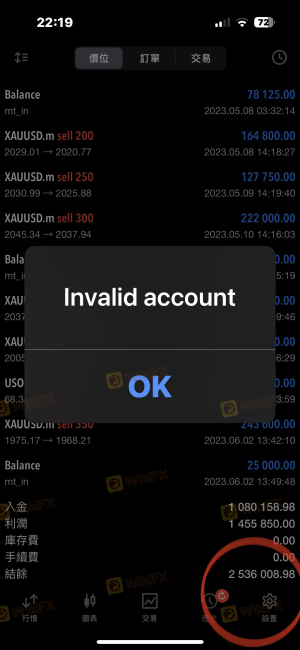

Ridge Corporation does not provide any clear information regarding its fund safety protocols, including whether client funds are kept in segregated accounts. This lack of transparency can be alarming for potential investors, as unregulated brokers often do not offer the same level of protection that regulated firms are required to provide. Additionally, there have been reports of withdrawal issues, where clients have faced challenges in accessing their funds, further highlighting the potential risks associated with trading with Ridge Corporation.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reports from users of Ridge Corporation suggest a pattern of negative experiences, including difficulties in withdrawing funds and inadequate customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Fair |

Many users have reported that once they made an initial deposit, communication with the broker deteriorated, and their requests for withdrawals were either ignored or met with unreasonable delays. This pattern of behavior is characteristic of scam brokers, who often employ high-pressure sales tactics to extract as much money as possible from their clients before cutting off communication.

One notable case involved a trader who requested a withdrawal after experiencing initial success but found their account suddenly blocked, with no response from Ridge Corporation's support team. Such incidents underscore the importance of choosing a broker with a solid reputation for customer service and reliable operations.

Platform and Trade Execution

The trading platform is a critical component of the trading experience, impacting order execution quality and user satisfaction. Ridge Corporation claims to provide a user-friendly platform; however, the lack of detailed information regarding its performance raises concerns. Traders need a stable and efficient platform to execute trades effectively, and any signs of slippage or order rejections can lead to significant financial losses.

Moreover, there have been allegations of potential platform manipulation, where brokers may interfere with trade execution to benefit their interests. This possibility adds another layer of risk for traders considering Ridge Corporation as their trading partner.

Risk Assessment

Using Ridge Corporation as a trading platform involves several risks that potential traders should be aware of.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight increases the likelihood of fraud. |

| Fund Safety Risk | High | Lack of fund segregation and transparency raises concerns. |

| Customer Service Risk | Medium | Reports of poor customer support and withdrawal issues. |

| Platform Risk | Medium | Potential for execution issues and manipulation. |

To mitigate these risks, traders should conduct thorough due diligence before engaging with Ridge Corporation. Seeking alternatives with robust regulatory oversight and positive user reviews is advisable for those looking to enter the forex market safely.

Conclusion and Recommendations

In conclusion, the evidence suggests that Ridge Corporation raises several red flags that warrant caution. The lack of regulation, transparency issues, and negative user experiences indicate that the broker may not be a safe option for traders.

For those considering trading with Ridge Corporation, it is crucial to weigh the potential risks against the benefits. If you are a trader seeking a reliable and secure trading environment, it is advisable to choose brokers that are regulated by reputable authorities and have a proven track record of customer satisfaction.

Ultimately, traders should prioritize their security and choose platforms that offer clear regulatory oversight, transparent fees, and responsive customer support. By doing so, they can minimize the risks associated with trading and ensure a safer trading experience.

Is Ridge Corporation a scam, or is it legit?

The latest exposure and evaluation content of Ridge Corporation brokers.

Ridge Corporation Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Ridge Corporation latest industry rating score is 1.41, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.41 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.