Is BullFx safe?

Pros

Cons

Is BullFX A Scam?

Introduction

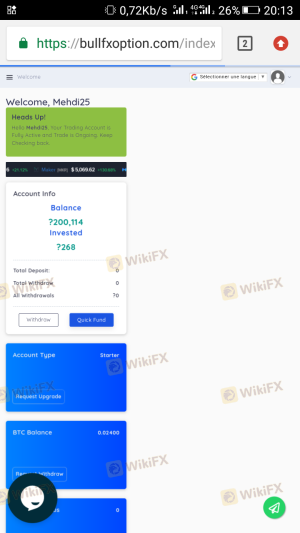

BullFX is an online forex broker that positions itself as a reliable player in the competitive foreign exchange market. Established in 2017 and headquartered in Vanuatu, BullFX claims to offer a range of trading services, including access to various financial instruments like forex, commodities, and cryptocurrencies. However, the rise of online trading has also led to an increase in fraudulent schemes, making it crucial for traders to conduct thorough evaluations of brokers before committing their funds. This article aims to assess whether BullFX is a safe trading platform or a potential scam. The evaluation is based on a comprehensive analysis of regulatory compliance, company background, trading conditions, customer feedback, and overall risk assessment.

Regulation and Legitimacy

Understanding the regulatory environment is essential for evaluating the safety of any forex broker. Regulation serves as a safeguard for traders, ensuring that brokers adhere to industry standards and protect client funds. BullFX claims to be regulated by the Vanuatu Financial Services Commission (VFSC). However, the effectiveness of regulation in Vanuatu has been questioned due to its reputation as a haven for offshore brokers.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Vanuatu Financial Services Commission | 014720 | Vanuatu | Verified |

The VFSC is known for having less stringent regulatory requirements compared to other jurisdictions such as the FCA or ASIC. This raises concerns about the level of investor protection offered by BullFX. While the broker has been operational for several years, its regulatory history and compliance record warrant scrutiny. Traders should be cautious, as the lack of robust regulation may expose them to higher risks, including potential difficulties in fund withdrawals or disputes.

Company Background Investigation

BullFX operates under the ownership of Red Bull Prime Limited. The company has been in the forex space for over eight years, but detailed information regarding its management team and operational history is sparse. Transparency is a critical factor in assessing the legitimacy of any broker, and BullFX's lack of readily available information about its ownership and management raises red flags.

The company's website contains minimal details about its leadership or operational structure, which could indicate a lack of accountability. Furthermore, the anonymity surrounding its ownership may deter potential clients from trusting the broker, especially in an industry where transparency is paramount. In contrast, reputable brokers typically provide detailed biographies of their management team, showcasing their experience and qualifications.

Trading Conditions Analysis

When evaluating whether BullFX is safe, it is essential to consider its trading conditions, including fees, spreads, and overall cost structure. The broker offers competitive spreads starting from 1 pip and a maximum leverage of 1:500, which can be attractive to traders seeking high-risk, high-reward opportunities. However, the actual costs can significantly impact trading profitability.

| Cost Type | BullFX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 1 pip | 1.5 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Varies | Varies |

While the spread appears competitive, traders should be wary of potential hidden fees or excessive withdrawal charges that could diminish their profits. The absence of clear information regarding commissions and overnight interest rates could also indicate a lack of transparency in the broker's fee structure, which is a common tactic employed by less reputable firms.

Client Fund Safety

The safety of client funds is a crucial aspect of assessing whether BullFX is a scam. The broker claims to implement various security measures, such as segregated accounts and negative balance protection. However, the effectiveness of these measures is contingent upon the broker's regulatory framework.

Traders should be aware that while BullFX asserts that client funds are kept in separate accounts, the lack of stringent oversight from a reputable regulatory body may compromise the safety of these funds. Additionally, historical complaints regarding fund withdrawals and accessibility further highlight the need for caution when trading with BullFX.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability. Reviews of BullFX reveal a mixed bag of experiences, with some users reporting satisfactory trading conditions, while others have raised serious concerns regarding withdrawal issues and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Customer Support | Medium | Average |

| Account Management | High | Inconsistent |

Common complaints include difficulties in accessing funds and unresponsive customer support. These issues can significantly impact a trader's experience and raise questions about the broker's operational integrity. One notable case involved a trader who reported being unable to withdraw funds for several months, leading to frustration and financial loss.

Platform and Execution

The trading platform offered by BullFX primarily includes MetaTrader 4, a widely recognized platform known for its user-friendly interface and advanced trading tools. However, the overall performance and reliability of the platform are critical in assessing whether BullFX is safe.

Traders have reported mixed experiences with order execution, with some claiming instances of slippage and rejected orders. Such issues can severely affect trading outcomes, particularly for those employing high-frequency trading strategies. There are also concerns about potential platform manipulation, which can further erode trust in the broker.

Risk Assessment

Engaging with BullFX carries inherent risks that traders must consider. The combination of limited regulatory oversight, mixed customer feedback, and questionable transparency raises concerns about the overall safety of trading with this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Limited oversight from a reputable authority. |

| Financial Risk | Medium | Potential withdrawal issues and hidden fees. |

| Operational Risk | High | Mixed platform performance and execution issues. |

To mitigate these risks, traders should exercise caution by starting with a small investment, thoroughly reviewing the broker's terms and conditions, and considering alternatives with stronger regulatory backing.

Conclusion and Recommendations

In conclusion, the investigation into BullFX raises significant concerns regarding its legitimacy and safety. While the broker claims to offer competitive trading conditions, the lack of robust regulatory oversight, coupled with mixed customer feedback and transparency issues, suggests that traders should approach this broker with caution.

Given the potential risks, it is advisable for traders, especially those new to the forex market, to consider more reputable alternatives that are regulated by recognized authorities such as the FCA or ASIC. Brokers like Pepperstone and IG offer a more secure trading environment with better customer support and transparency. Ultimately, ensuring the safety of your investments should be the top priority when selecting a forex broker.

Is BullFx a scam, or is it legit?

The latest exposure and evaluation content of BullFx brokers.

BullFx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

BullFx latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.