Is Spring safe?

Pros

Cons

Is Spring Safe or Scam?

Introduction

Spring is a forex broker that has garnered attention for its purported investment opportunities in the foreign exchange market. As traders navigate this complex landscape, it is crucial to evaluate the credibility of brokers like Spring. The forex market is notorious for its volatility and the potential for scams, making it imperative for traders to conduct thorough due diligence before engaging with any broker. In this article, we will investigate whether Spring is safe or a scam by examining its regulatory status, company background, trading conditions, customer safety measures, and user experiences. Our evaluation will be based on data sourced from reputable financial websites and user reviews, ensuring a comprehensive and objective analysis.

Regulation and Legitimacy

The regulatory framework surrounding a forex broker is vital for assessing its legitimacy and safety. A broker that operates under the supervision of a recognized regulatory authority is generally considered more reliable. In the case of Spring, it is crucial to determine if it holds any licenses and the quality of the regulatory body overseeing its operations.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

As indicated in the table, Spring is not regulated by any top-tier financial authority such as the FCA (Financial Conduct Authority) in the UK or ASIC (Australian Securities and Investments Commission) in Australia. This lack of regulation raises significant concerns about the broker's legitimacy. Without regulatory oversight, traders have limited recourse in the event of disputes or issues related to fund security. Additionally, the absence of a regulatory framework may expose traders to potential fraud or unethical practices. Therefore, it is essential to approach Spring with caution, as the lack of regulation is a strong indicator that it might not be safe.

Company Background Investigation

Understanding the company behind a forex broker is essential in evaluating its trustworthiness. Spring's ownership structure, history, and operational transparency can provide insight into its reliability. Unfortunately, information regarding Spring's history and management team is sparse. Many users have reported difficulties in finding credible information about the company's background, which raises concerns about its transparency.

The management teams experience and qualifications are also critical factors in assessing a broker's reliability. A well-established team with a strong background in finance and trading can indicate a higher level of professionalism. However, due to the limited information available about Spring, it is challenging to assess the qualifications of its management team. This lack of transparency can further contribute to the perception that Spring may not be a safe choice for traders.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience and profitability. Spring's fee structure and trading conditions warrant close examination to determine if they align with industry standards.

| Fee Type | Spring | Industry Average |

|---|---|---|

| Major Currency Pair Spread | N/A | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The absence of specific data regarding Spring's trading costs is alarming. Typically, reputable brokers provide clear information about spreads, commissions, and overnight fees, enabling traders to make informed decisions. The lack of transparency in Spring's fee structure raises red flags, suggesting that traders may encounter hidden fees or unfavorable trading conditions. Such practices are often associated with less credible brokers, emphasizing the need for caution when considering Spring as a trading option.

Customer Fund Safety

The safety of customer funds is a paramount concern for any trader. A trustworthy broker should have robust measures in place to protect client funds. In the case of Spring, it is essential to evaluate its policies regarding fund segregation, investor protection, and negative balance protection.

Spring's website lacks detailed information about its funds' safety measures. Without clear communication regarding the segregation of client funds into separate accounts or any investor protection schemes, traders may be at risk of losing their investments. Additionally, the absence of negative balance protection could leave traders liable for losses exceeding their account balance, a situation that can be financially devastating. Historical incidents involving fund security issues further compound these concerns, underscoring the importance of verifying a broker's safety measures before investing.

Customer Experience and Complaints

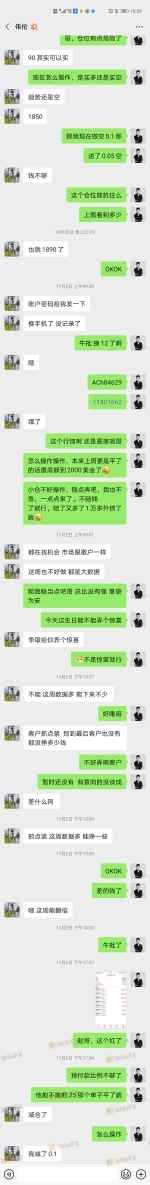

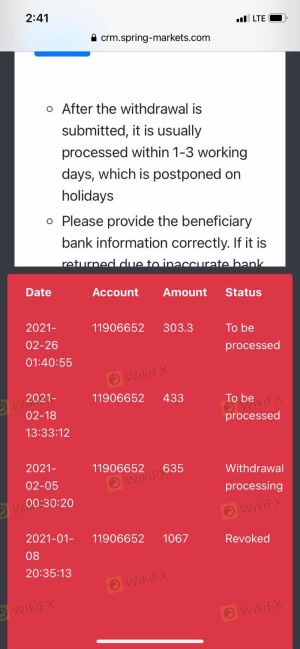

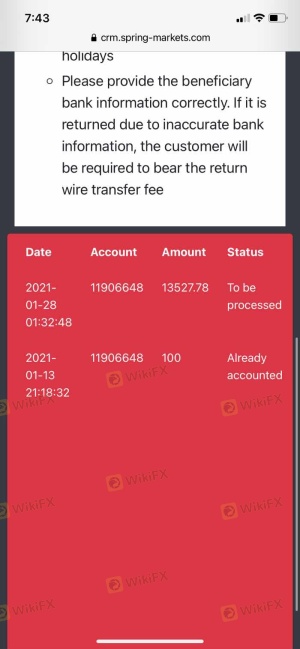

Customer feedback is a valuable resource for assessing a broker's reliability and service quality. A review of user experiences with Spring reveals a mixed bag of reviews, with several complaints surfacing regarding withdrawal issues and customer service responsiveness.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Lack of Communication | Medium | Inconsistent |

| Account Blocking | High | Poor |

Many users have reported significant delays in withdrawing funds, which is a common red flag for potential scams. Additionally, complaints about inadequate customer support and lack of communication further exacerbate the situation. In some cases, traders have found their accounts blocked without clear explanations, leading to frustration and financial loss. These patterns of complaints reflect a troubling trend that suggests Spring may not be a safe choice for traders seeking reliable and responsive service.

Platform and Execution

The performance of a trading platform is crucial for a trader's success. Spring's platform stability, execution quality, and user experience warrant careful evaluation. Reports from users indicate that the platform may suffer from performance issues, including slow execution times and occasional outages.

Traders have also expressed concerns about slippage and the frequency of rejected orders, which can hinder trading strategies and lead to financial losses. If there are indications of platform manipulation, such as consistent slippage during high volatility, it raises serious questions about the broker's integrity. A reliable broker should provide a seamless trading experience, ensuring that orders are executed promptly and accurately.

Risk Assessment

Engaging with a broker like Spring carries inherent risks that traders must consider. A comprehensive risk assessment can help identify key areas of concern.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | High | Lack of transparency |

| Execution Risk | Medium | Performance issues reported |

| Customer Service Risk | High | Poor feedback from users |

Given the high-risk levels associated with regulatory and fund safety issues, traders should approach Spring with extreme caution. It is advisable to consider alternative options that offer clearer regulatory oversight and better customer feedback. Traders should also implement risk mitigation strategies, such as limiting investment amounts and diversifying their trading portfolio.

Conclusion and Recommendations

In conclusion, the investigation into Spring reveals several concerning factors that suggest it may not be a safe choice for traders. The lack of regulatory oversight, unclear trading conditions, and negative customer feedback raise significant red flags. Traders should be vigilant and consider alternative brokers that adhere to strict regulatory standards and provide transparent trading conditions.

For those seeking reliable trading options, consider brokers that are regulated by top-tier authorities, have a solid reputation for customer service, and offer transparent fee structures. It is crucial to prioritize safety and reliability in the forex market to protect your investments effectively. Overall, the evidence suggests that Spring may not be safe, and traders should exercise caution when considering this broker.

Is Spring a scam, or is it legit?

The latest exposure and evaluation content of Spring brokers.

Spring Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Spring latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.