Is COMETA safe?

Pros

Cons

Is Cometa Safe or Scam?

Introduction

Cometa is a newly established online trading platform that specializes in contract for differences (CFD) trading, offering a range of financial instruments including forex, precious metals, crude oil, indices, and cryptocurrencies. Launched in 2024, it aims to attract traders with competitive trading conditions and advanced technology. However, the rapid emergence of such platforms in the forex market necessitates a careful evaluation by potential users. Traders must be vigilant in assessing the legitimacy and safety of their brokers to avoid falling victim to scams or unregulated entities. This article will explore the safety of Cometa through a comprehensive analysis of its regulatory status, company background, trading conditions, customer experience, and risk factors, ultimately addressing the question: Is Cometa safe?

Regulatory and Legality

The regulatory environment is a critical factor in determining the safety of any trading platform. Cometa claims to be regulated by the United States Financial Crimes Enforcement Network (FinCEN) and asserts its operational base in London, UK. However, upon investigation, there appears to be a lack of concrete regulatory oversight, as no registration information for Cometa Global Limited could be found with the UK Companies House. This raises concerns about the legitimacy of its claims.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FinCEN | MSB Number 31000283715409 | USA | Unverified |

The absence of a reputable regulatory body such as the Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC) raises red flags. These authorities are known for their stringent oversight and consumer protection measures. Without clear regulatory backing, the safety of funds and the integrity of trading practices cannot be guaranteed. This lack of regulation is a significant factor when considering whether Cometa is safe or potentially a scam.

Company Background Investigation

Cometa Global Limited, the company behind the trading platform, was established in 2024, which raises questions about its experience and reliability. The company's website lacks transparency regarding its ownership structure and management team. There is no detailed information about the individuals running the company, which is a common practice among legitimate brokers. Transparency is crucial in establishing trust, and the absence of such information may indicate a lack of accountability.

Furthermore, the company's claims of being headquartered in London are contradicted by its operational ties to the United States. The lack of a clear operational base and the ambiguous nature of its registration contribute to the uncertainty surrounding its credibility. Without a well-documented history and a transparent ownership structure, potential traders must exercise caution when evaluating whether Cometa is safe for their investments.

Trading Conditions Analysis

Cometa offers a variety of trading instruments with claims of competitive spreads and low transaction costs. However, the platform does not provide sufficient information regarding its fee structure, including trading commissions, overnight interest rates, and minimum deposit requirements. This lack of transparency can be concerning for traders who rely on clear and predictable fee structures.

| Fee Type | Cometa | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Unspecified | 1-2 pips |

| Commission Model | Unclear | Varies |

| Overnight Interest Range | Unspecified | Varies |

The absence of clear information about trading costs can lead to unexpected expenses, making it difficult for traders to manage their risk effectively. Furthermore, the platform's claims of spreads starting from 0 points may not be as advantageous as they seem, especially if hidden fees are involved. This lack of clarity raises concerns about whether Cometa is safe for traders seeking a reliable and transparent trading environment.

Customer Fund Safety

The safety of customer funds is paramount when evaluating any trading platform. Cometa's website does not provide detailed information regarding its fund security measures, such as segregated accounts, investor protection schemes, or negative balance protection policies. These elements are essential for safeguarding traders' investments and ensuring that they are not liable for losses exceeding their account balance.

Historically, many unregulated brokers have faced issues related to fund security, leading to significant losses for traders. Without robust security measures in place, traders may find themselves at risk of losing their funds without any recourse. Therefore, it is crucial to investigate whether Cometa is safe in terms of protecting customer funds.

Customer Experience and Complaints

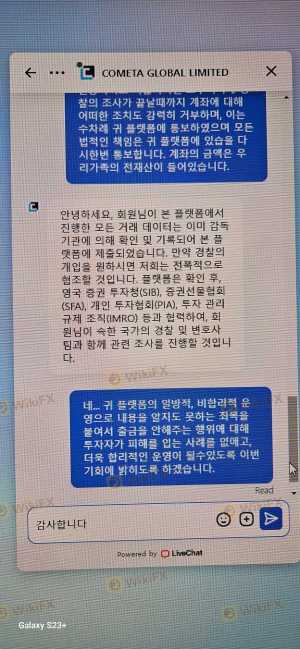

Customer feedback is an important indicator of a broker's reliability and service quality. Reviews of Cometa indicate a mix of experiences, with numerous complaints regarding the platform's lack of responsiveness and transparency. Common complaints include difficulties in withdrawing funds, unclear fee structures, and inadequate customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Fee Transparency | Medium | Inconsistent |

| Customer Support | High | Unresponsive |

Two typical case studies illustrate these issues. One user reported being unable to withdraw funds after reaching the minimum withdrawal limit, citing vague explanations from customer support. Another user expressed frustration over hidden fees that were not disclosed during the account opening process. These patterns of complaints contribute to the overall perception of whether Cometa is safe and highlight potential risks for prospective traders.

Platform and Execution

The performance and reliability of the trading platform are critical for a successful trading experience. Cometa claims to offer a sophisticated trading platform with advanced charting tools and multiple indicators. However, there are concerns regarding the platform's stability and order execution quality. Reports of slippage, delayed order processing, and rejected orders have surfaced, raising questions about the platform's overall integrity.

Traders rely on timely execution to capitalize on market opportunities, and any signs of manipulation or inefficiency can severely impact their trading outcomes. Therefore, it is essential to assess whether Cometa is safe in terms of providing a reliable trading environment.

Risk Assessment

Using Cometa involves several risks that potential traders should consider. The lack of regulatory oversight, unclear trading conditions, and poor customer feedback contribute to a high-risk profile for this broker.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Unregulated status raises concerns. |

| Fund Security | High | Lack of transparency on fund safety measures. |

| Customer Support | Medium | Numerous complaints about support responsiveness. |

To mitigate these risks, traders should conduct thorough research, avoid investing large sums initially, and consider using a demo account to test the platform before committing real funds. Understanding the potential pitfalls is crucial in determining whether Cometa is safe for trading.

Conclusion and Recommendations

In conclusion, while Cometa presents itself as a promising trading platform, significant concerns regarding its regulatory status, company transparency, trading conditions, and customer feedback raise serious questions about its safety. The lack of clear regulatory oversight and numerous complaints from users suggest that traders should exercise caution.

For those considering trading with Cometa, it is advisable to start with small investments, thoroughly review all terms and conditions, and remain vigilant for any signs of issues. Additionally, traders may want to explore alternative, well-regulated brokers that offer clear transparency and robust customer support to ensure a safer trading experience. Ultimately, the question remains: Is Cometa safe? Based on the available evidence, potential traders should approach with caution and consider the risks involved.

Is COMETA a scam, or is it legit?

The latest exposure and evaluation content of COMETA brokers.

COMETA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

COMETA latest industry rating score is 1.26, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.26 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.