Spring 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

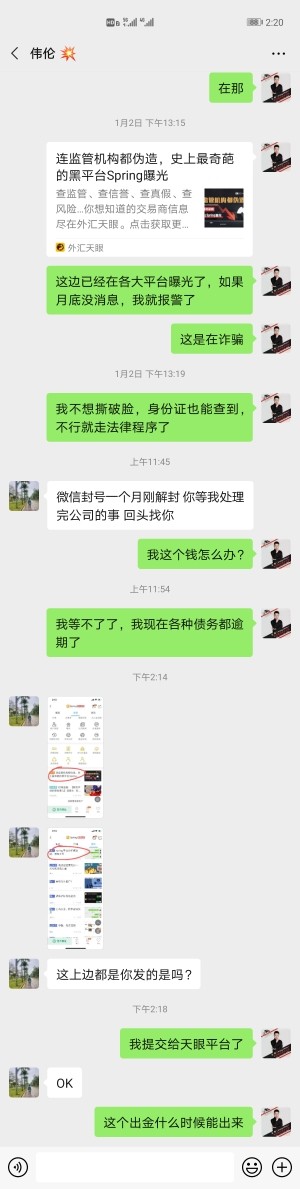

Spring brokers present a precarious landscape for potential investors, primarily characterized as unregulated entities that often prioritize high-risk, high-reward trading opportunities over safety and compliance. With numerous complaints surfacing about fund safety and withdrawal issues, as well as negative reviews labeling these platforms as scams, investors should proceed with caution. Ideal customers are typically individuals willing to overlook regulatory compliance in their pursuit of greater profits, often at the expense of their financial security. Conversely, cautious investors, those who prioritize fund security, and novice traders are advised to avoid engaging with these brokers altogether. The plethora of complaints regarding withdrawal difficulties and financial mishaps underscores a troubling trend that potential users must heed.

⚠️ Important Risk Advisory & Verification Steps

Engaging with Spring brokers involves several critical risk signals that potential investors should take seriously. Here are the risks to consider:

- Lack of Regulation: Spring brokers are often unregulated by reputable financial authorities such as the FCA or ASIC.

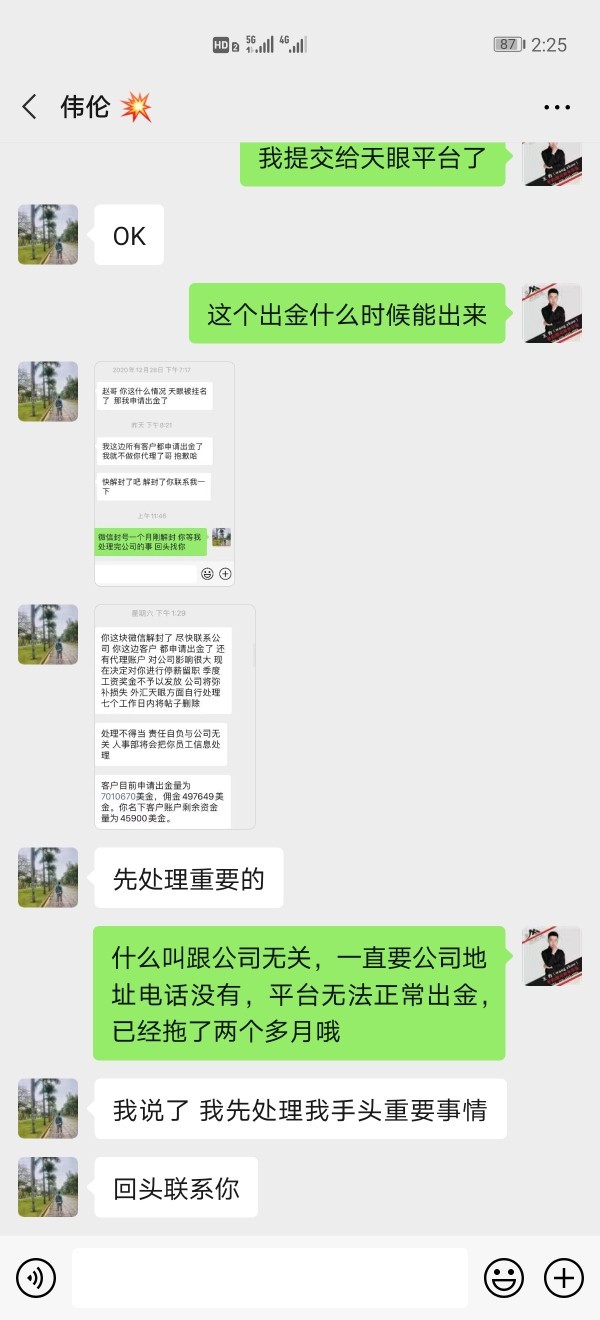

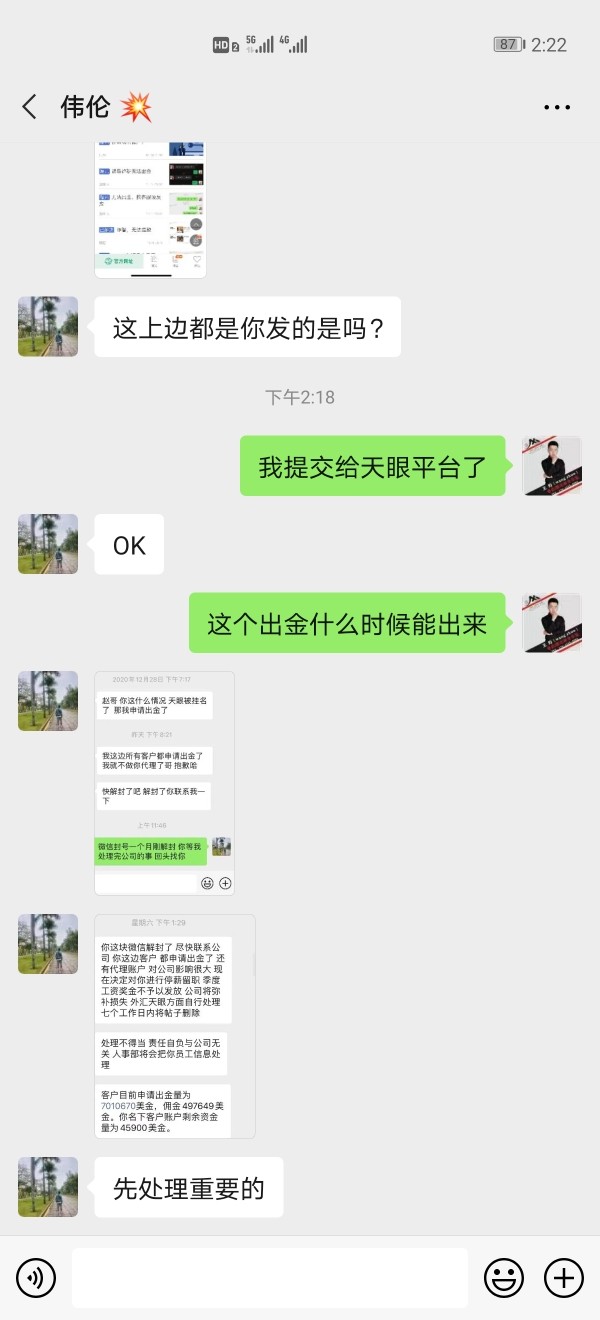

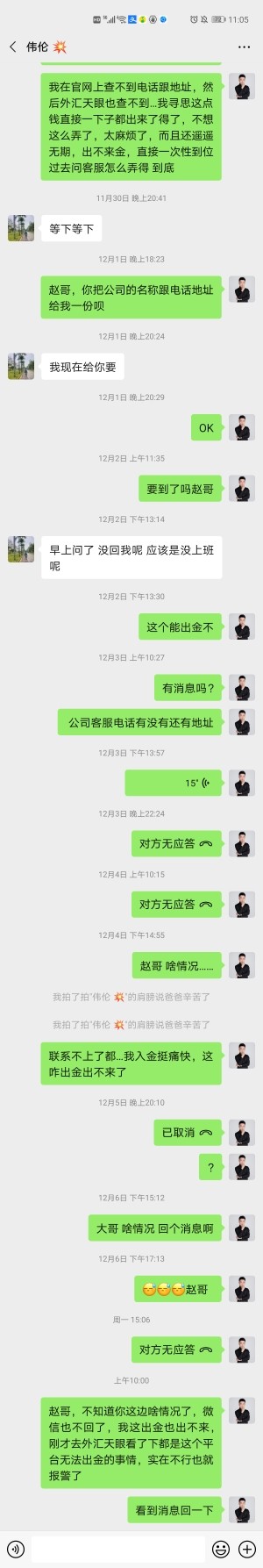

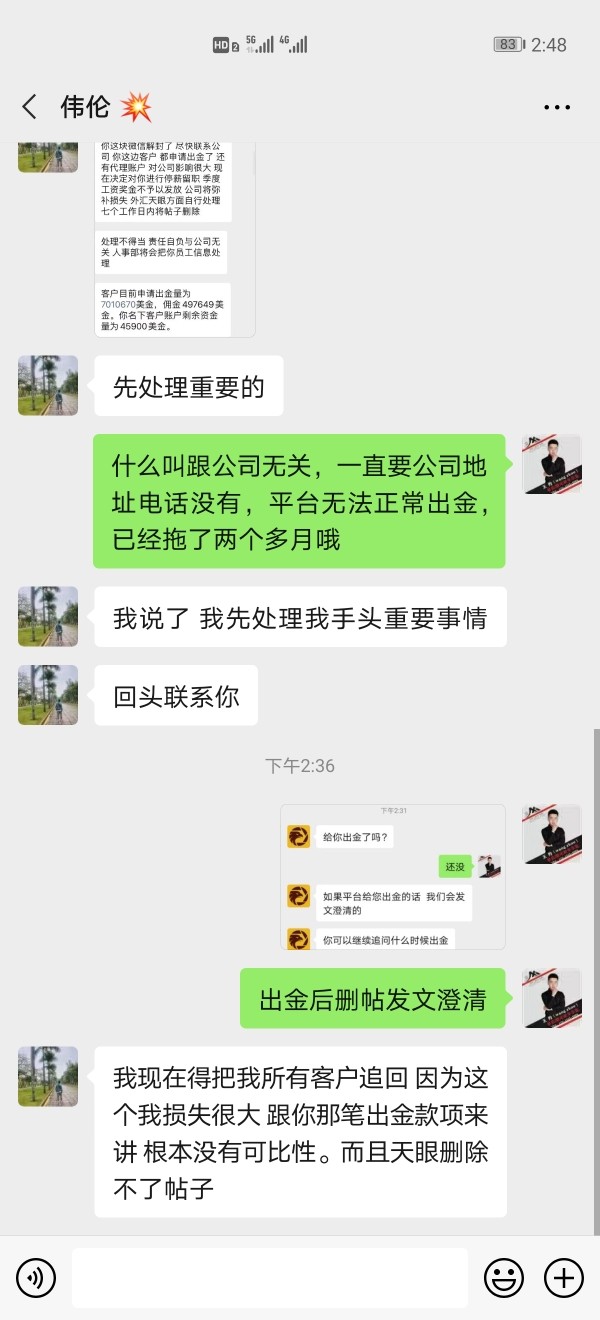

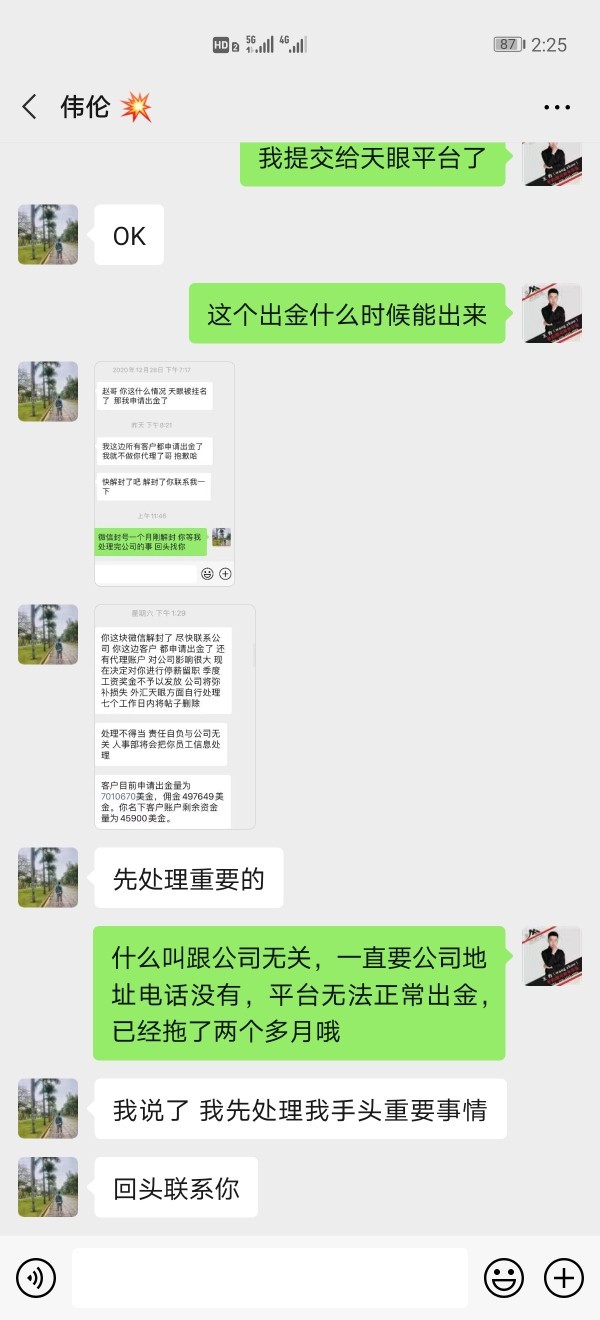

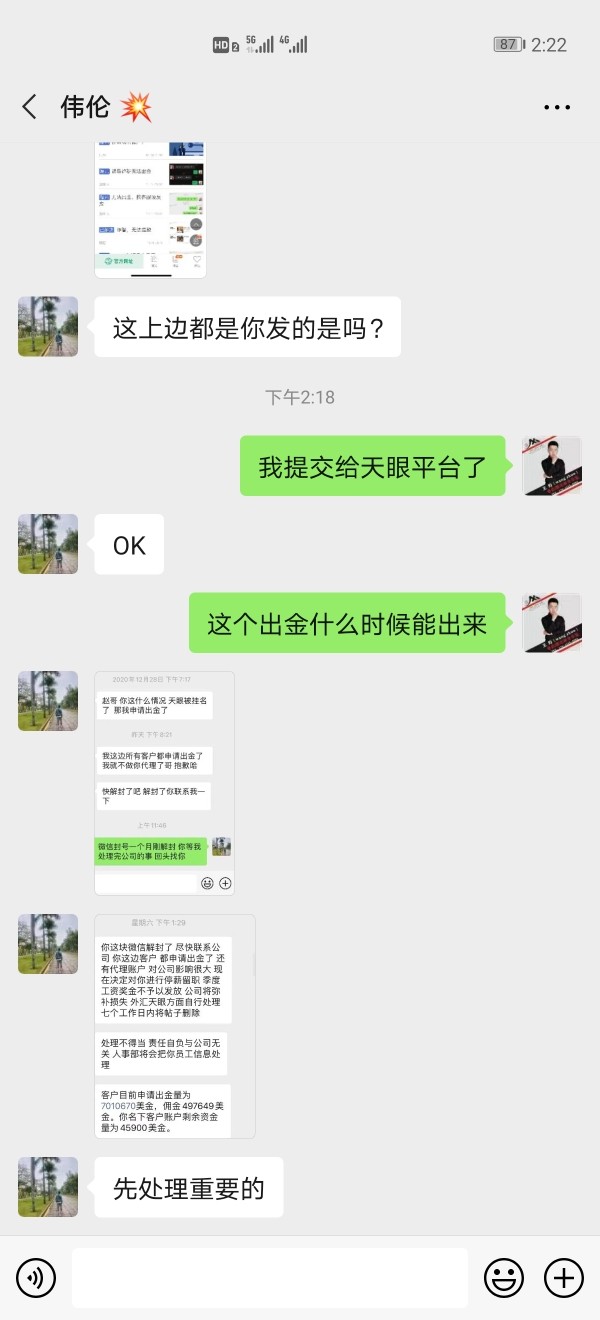

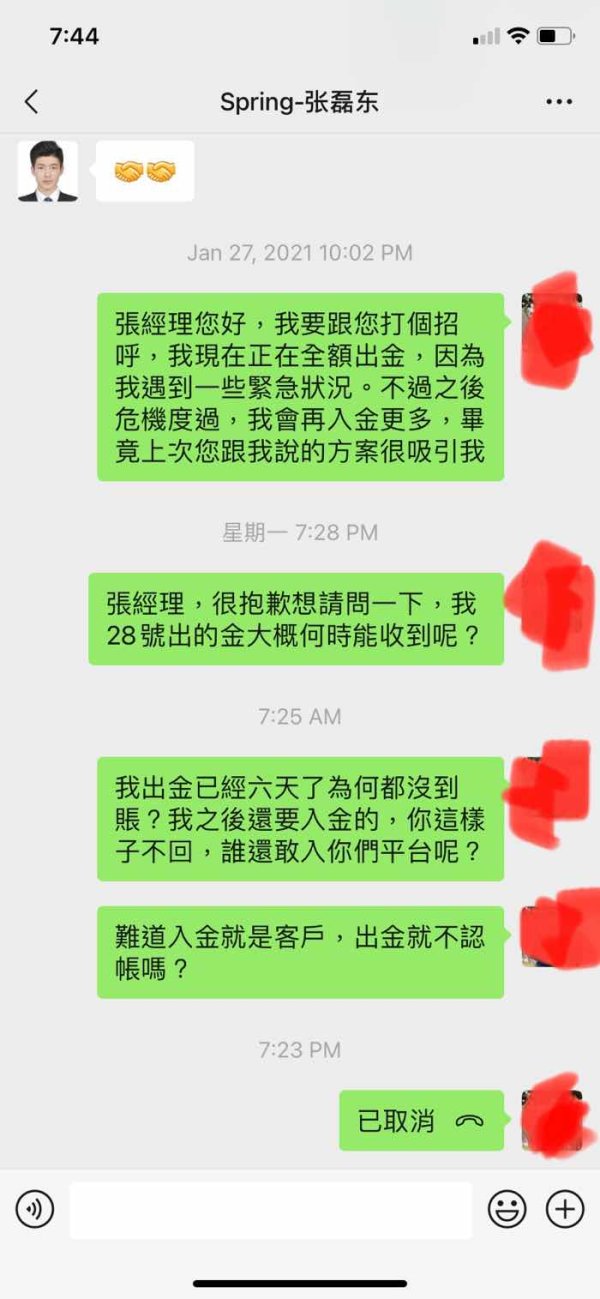

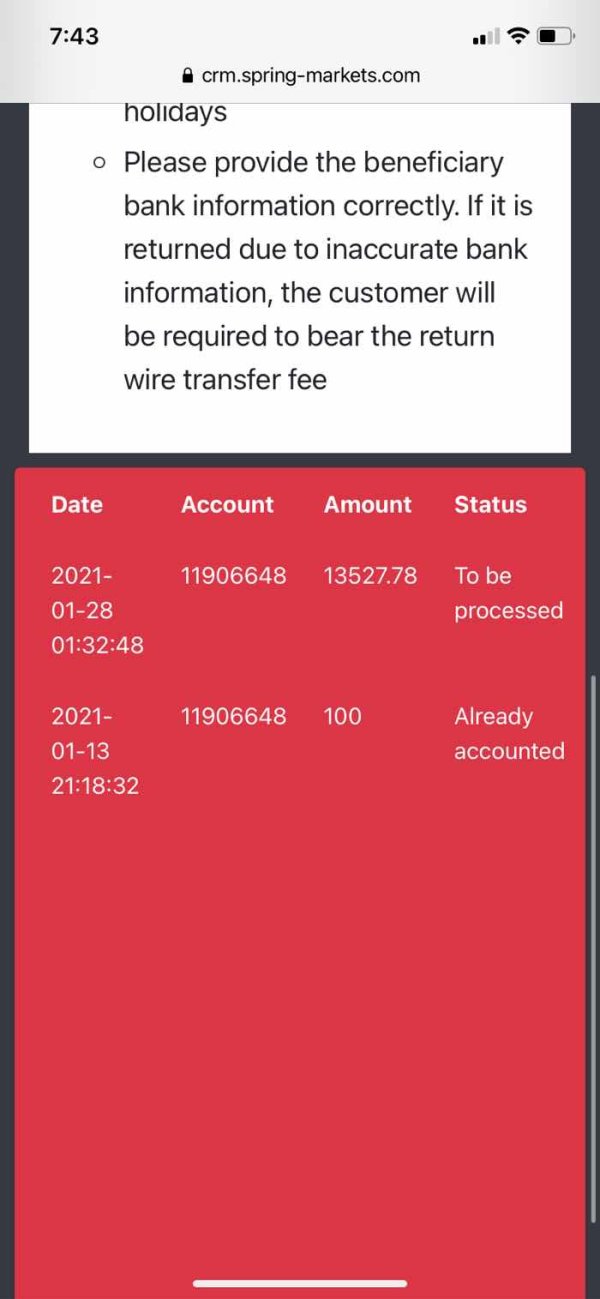

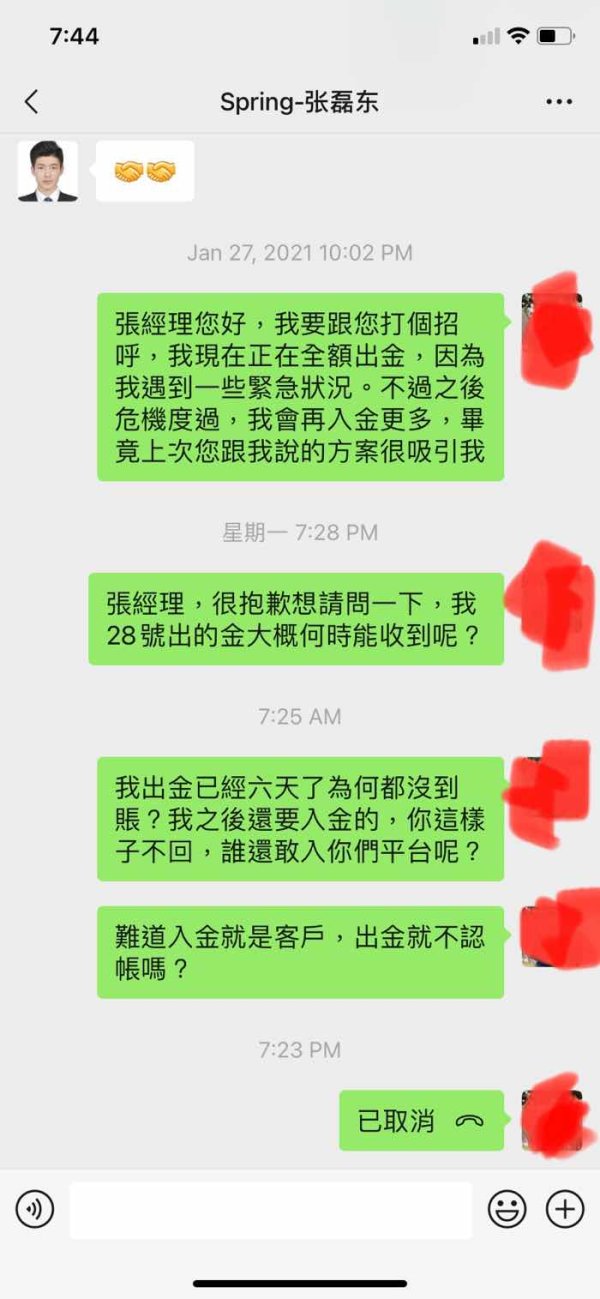

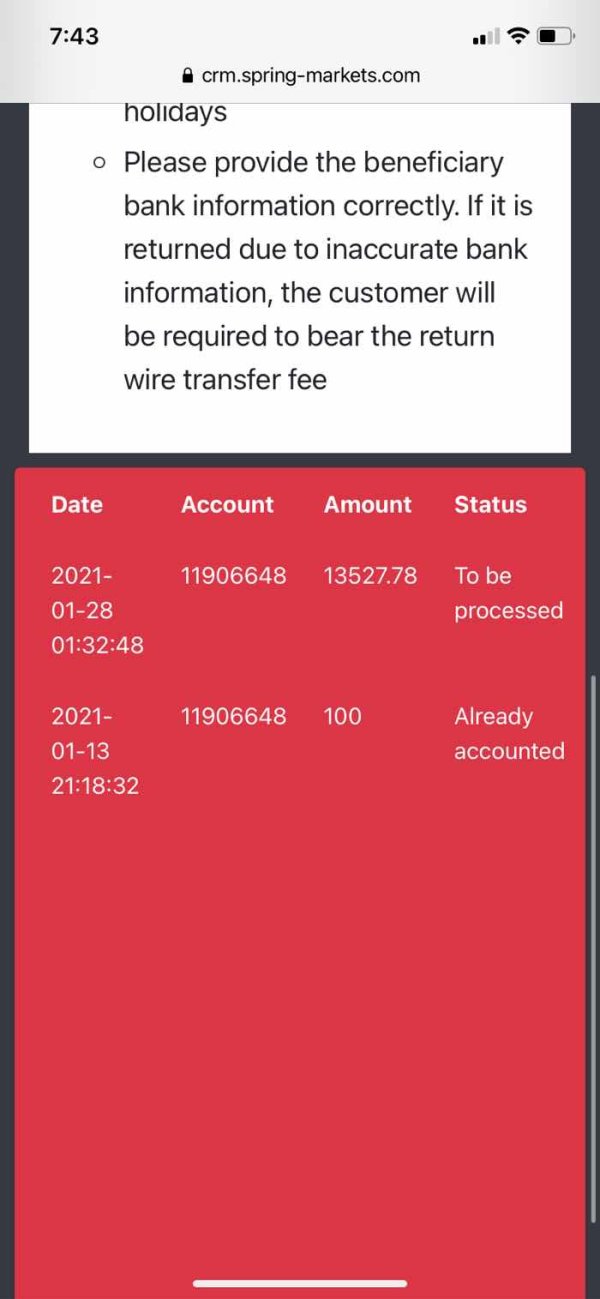

- Withdrawal Issues: Complaints about delayed or impossible withdrawals abound, raising concerns about fund safety.

- Negative Reviews: Consistent reports from users highlighting scam-like behaviors are prevalent.

Risk Warning: Engaging with unregulated brokers can lead to significant losses, and you may have limited recourse to recover your funds.

Self-Verification Steps:

- Check Regulatory Status:

- Consult official websites of key regulatory bodies like the FCA, ASIC, and others to verify if the broker has a valid operating license.

- Research User Feedback:

- Search online databases and forums for user reviews and complaints.

- Identify Contact Information:

- Ensure the broker provides verifiable contact details and a physical address.

- Assess Trading Features:

- Investigate the trading platforms and tools offered, verifying that they are credible and meet industry standards.

- Explore Withdrawal Policies:

- Delve into the broker's withdrawal procedures and potential fees to understand what to expect when withdrawing funds.

Rating Framework

Broker Overview

Company Background and Positioning

Founded as an offshore broker without effective regulatory oversight, Spring brokers operate in a murky operational environment that deters many cautious investors. These entities often claim legitimacy through dubious certifications and misrepresentations regarding regulatory compliance, leading to heightened risk exposure for investors. Their promises of high returns and significant benefits appeal to risk-tolerant audiences, yet they mask potential shortcomings inherent to unregulated trading environments. Understanding the operational context and positioning is crucial for potential users before making any investment decisions.

Core Business Overview

Spring brokers offer a range of services typically associated with high-risk trading platforms that operate in various asset classes, including forex, commodities, and cryptocurrencies. Their primary business offerings often revolve around enticing traders with low commissions and high leverage opportunities, which may lead users to overlook the critical aspect of fund safety. Unfortunately, many platforms struggle with functionality and reliability, leading to user dissatisfaction, particularly regarding the execution of trades and the availability of reliable tools and resources.

Quick-Look Details Table

In-depth Analysis of Each Dimension

Trustworthiness Analysis

The lack of regulatory oversight raises significant concerns for potential investors. Regulatory Information Conflicts suggest that many Spring brokers utilize false claims regarding their licensing to attract customers. This can lead to a complete absence of recourse for clients in cases of mismanagement or loss of funds.

Identify Regulatory Conflicts:

Review websites of recognized regulatory agencies, where many complaints against Spring brokers are filed. Users should note discrepancies in claims made by the brokers regarding their legitimacy.

User Self-Verification Guide:

To assess legitimacy, follow these steps:

Start with the financial authoritys official registry.

Cross-check the broker name and registration number.

Analyze user reviews for additional insights.

Discuss findings with knowledgeable peers or trading communities.

Gather any complaints to assess patterns of issues that others have faced.

Industry Reputation and Summary:

Negative feedback highlights significant apprehensions about fund security. Users have stated:

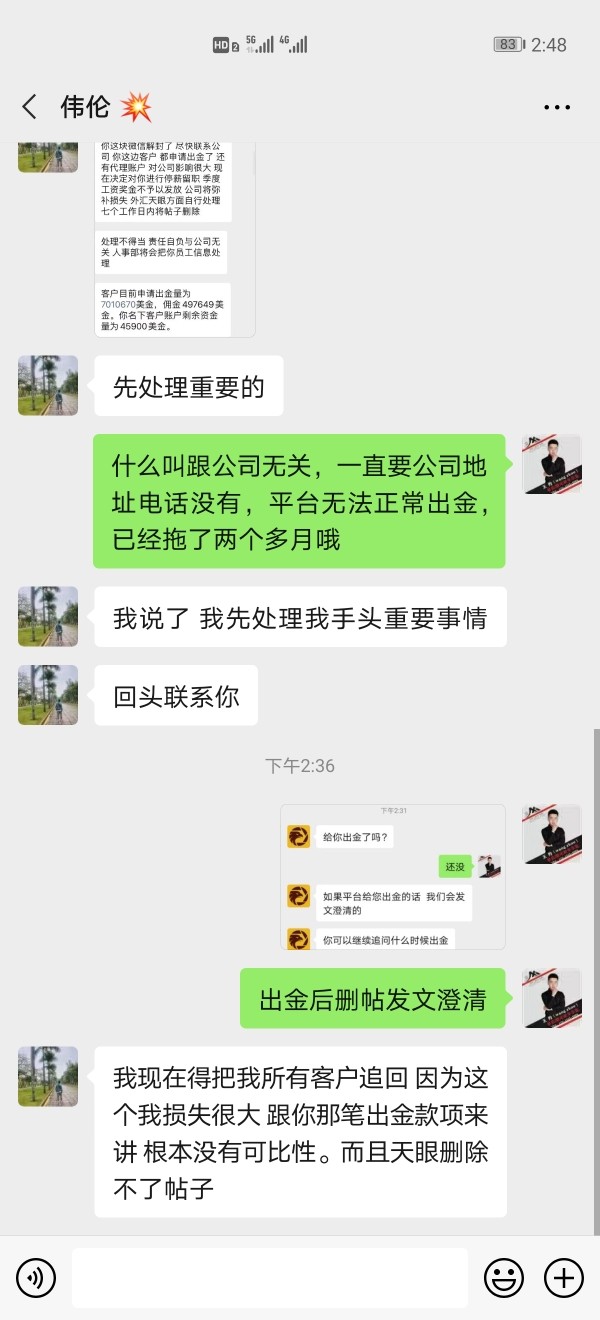

"I tried to withdraw my funds, but their rules kept changing, and my account was eventually blocked."

Trading Costs Analysis

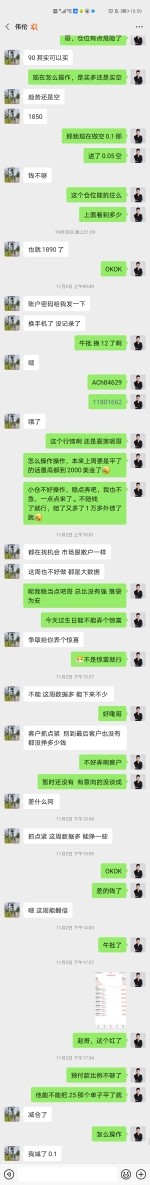

Spring brokers often utilize a "double-edged sword" effect regarding trading costs, presenting low commissions while burying higher withdrawal fees in their terms and conditions.

Advantages in Commissions:

Many platforms promote low commission structures to attract traders, allowing for more competitive trading.

The "Traps" of Non-Trading Fees:

Reports detailing hidden costs demonstrate that while trading costs may appear low, withdrawal fees can be astonishingly high. For example, one user reported a $50 fee just to withdraw their profits, significantly undermining the benefits of low initial commissions.

Cost Structure Summary:

Many traders may find that while initial costs are low, exiting positions or withdrawing can incur steep charges that lead to compounded losses.

With respect to "Professional depth vs. beginner-friendliness," Spring brokers generally cater more towards risk-oriented traders, but their platforms often lack the depth and functionality necessary for effective trading.

Platform Diversity:

Most Spring brokers offer standard trading platforms, such as MetaTrader 4, but reports of malfunctioning software and outages are common.

Quality of Tools and Resources:

Users have raised concerns about the quality and reliability of charting tools and educational materials offered by Spring brokers. Many found the provided resources to be scarce and lacking in comprehensive detail.

Platform Experience Summary:

Feedback from users reflects operational challenges, leading to the following sentiment:

“The tools just dont work most of the time, and it results in missed trading opportunities.”

User Experience Analysis

User experience with Spring brokers often elicits a frustrating narrative.

Account Setup and Navigation:

Many clients report difficulties when attempting to navigate registration processes, compounded by complex verification protocols.

Trading Experience:

Traders have expressed dissatisfaction with trading execution and software stability, impacting overall satisfaction negatively.

User Feedback Summary:

The overall sentiment, as expressed by multiple users, indicates:

“Customer support is nearly impossible to reach, and queries often go unanswered.”

Customer Support Analysis

From the perspective of "Customer Support," the quality of assistance available presents significant issues.

Availability:

Users report that support services are not readily accessible; delayed responses and unhelpful guidance lead to frustration.

Quality of Assistance:

Reviews indicate lack of knowledgeable staff, with many complaints reflecting a failure to address concerns adequately.

Overall Impression:

The absence of meaningful customer service creates a daunting challenge for traders:

“Every time I attempt to reach support, the responses are robotic, and real assistance is non-existent.”

Account Conditions Analysis

The "Account Conditions" that Spring brokers typically present are often cloaked with vague terms.

Transparency Issues:

Users frequently report that the conditions linked to withdrawals and bonuses are convoluted.

Risk Exposure:

Many accounts include conditions that can exacerbate losses, especially relating to withdrawal protocols and suggested trading strategies.

Final Assessment:

Clients often express this worry:

“With all the hoops required to withdraw money, it feels like theyre never going to let me cash out.”

Through careful analysis, it becomes evident that engaging with Spring brokers comes with substantial risks that should not be ignored. Whether its their lack of regulation, numerous user complaints concerning fund safety, or substance shortcomings in trading support, would-be investors need to remain vigilant in their decision-making. Recognizing these elements is essential for anyone venturing into this tumultuous trading terrain, and exhaustive research is paramount.