Is Onew safe?

Pros

Cons

Is Onew A Scam?

Introduction

In the increasingly complex world of forex trading, brokers play a pivotal role in facilitating transactions and providing traders with the necessary tools to succeed. One such broker is Onew, which has gained attention for its offerings in the forex market. However, the question arises: Is Onew safe, or is it a scam? Traders must exercise caution when assessing forex brokers, as the landscape is rife with both legitimate entities and fraudulent schemes. This article aims to provide a comprehensive analysis of Onew, examining its regulatory status, company background, trading conditions, customer safety measures, user experiences, and overall risk profile. The evaluation is based on data collected from various online sources, including regulatory bodies, customer reviews, and expert analyses.

Regulation and Legitimacy

The regulation of forex brokers is crucial for ensuring the safety of traders' funds and maintaining market integrity. A well-regulated broker is typically subject to stringent oversight, which helps protect clients from potential fraud and malpractice. Onew's regulatory status is a significant point of concern. According to multiple sources, Onew is not regulated by any recognized financial authority, which raises red flags regarding its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The absence of regulatory oversight means that Onew operates outside the protective measures that regulated brokers must adhere to. This lack of regulation can lead to issues such as unfair trading practices, withdrawal problems, and inadequate customer support. Moreover, the historical compliance of Onew remains questionable, as there are no records indicating that it has ever been subject to the scrutiny of a reputable regulatory body. This situation creates significant risks for traders, making it imperative to consider other options or exercise extreme caution when dealing with Onew.

Company Background Investigation

Understanding the history and ownership structure of a broker can provide valuable insights into its reliability. Onew, operating under Onew Technology Co. Ltd, has a relatively short history in the forex market, having been established for a few years. The management teams background is also crucial; however, details regarding their professional experience and qualifications are scarce. This lack of transparency raises concerns about the broker's commitment to ethical business practices.

The opacity surrounding Onew's ownership and management structure further complicates the situation. Without clear information about who is behind the broker and their track record in the financial industry, traders are left in the dark. Such ambiguity can often be indicative of a less-than-reputable operation, heightening the need for traders to remain vigilant.

Trading Conditions Analysis

When evaluating a forex broker, the trading conditions it offers are critical. Onew claims to provide competitive trading fees and a range of trading instruments. However, without regulatory oversight, it is challenging to verify these claims. Traders need to be aware of the cost structures they may encounter when using Onew's services.

| Fee Type | Onew | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | Not Disclosed | 1-3 pips |

| Commission Model | Not Disclosed | Varies |

| Overnight Interest Range | Not Disclosed | Varies |

The lack of transparency regarding fees is concerning. Many traders have reported hidden costs and unexpected charges from unregulated brokers, which can significantly impact profitability. Onew's failure to provide clear information about its trading conditions may indicate potential issues that traders should consider before opening an account.

Customer Funds Safety

The safety of customer funds is a paramount concern for any trader. Onew's approach to safeguarding client funds is unclear, given its unregulated status. Traders should be aware of the importance of fund segregation, investor protection mechanisms, and negative balance protection policies.

Onew's website does not provide adequate information regarding its policies on fund security. This lack of clarity can lead to significant risks, as unregulated brokers may not implement robust measures to protect clients' funds. Furthermore, any historical incidents involving fund security issues or disputes should be scrutinized. The absence of such information only adds to the uncertainty surrounding Onew's operations.

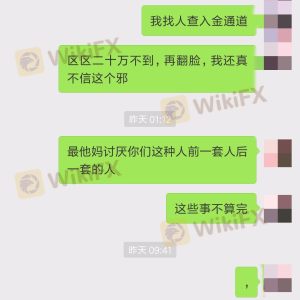

Customer Experience and Complaints

Analyzing customer feedback is essential in assessing a broker's reliability. Onew has garnered mixed reviews from users, with some praising its trading platform while others express frustration over withdrawal issues and customer service responsiveness. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow Response |

| Poor Customer Support | Medium | Unresponsive |

| Hidden Fees | High | No Clear Policy |

The severity of these complaints indicates significant areas of concern for potential traders. The experiences of existing users suggest that Onew may not prioritize customer satisfaction, which can be detrimental for traders relying on timely support and transparent operations.

Platform and Trade Execution

The performance of a broker's trading platform is crucial for a seamless trading experience. Onew's platform has received mixed reviews, with some users reporting stability issues and concerns over order execution quality. Problems such as slippage and order rejections can severely impact trading outcomes, especially in volatile market conditions.

The potential for platform manipulation is another risk traders should consider. Reports of unregulated brokers engaging in unethical practices, such as manipulating prices or executing trades against clients, raise alarms about Onew's operational integrity.

Risk Assessment

Using Onew presents a range of risks that traders must evaluate before proceeding. Below is a summary of key risk areas associated with this broker:

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight, increasing fraud risk. |

| Financial Transparency | High | Lack of clear information on fees and conditions. |

| Fund Security | High | Unclear policies on fund protection measures. |

| Customer Support | Medium | Reports of slow response and unresolved complaints. |

To mitigate these risks, traders are advised to conduct thorough research, consider alternative brokers with strong regulatory oversight, and avoid investing significant amounts until they are confident in the broker's reliability.

Conclusion and Recommendations

In conclusion, the evidence suggests that Onew may not be a safe choice for forex trading. Its lack of regulatory oversight, unclear trading conditions, and mixed customer feedback raise significant concerns about its legitimacy. Traders should be especially cautious and consider seeking alternatives that are well-regulated and have a proven track record of customer satisfaction.

For those already considering Onew, it is advisable to start with a small investment and closely monitor experiences. Alternatively, traders may want to explore reputable brokers that are regulated by top-tier authorities, ensuring a safer trading environment. Ultimately, ensuring the safety of investments should be a top priority for any trader in the forex market.

Is Onew a scam, or is it legit?

The latest exposure and evaluation content of Onew brokers.

Onew Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Onew latest industry rating score is 1.59, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.59 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.