Is Solitix Fx safe?

Business

License

Is Solitix FX Safe or a Scam?

Introduction

Solitix FX is a relatively new entrant in the forex brokerage landscape, claiming to provide traders with access to a variety of financial instruments including forex, cryptocurrencies, indices, and shares. Established in South Africa, the broker positions itself as a facilitator for both novice and experienced traders. However, the forex market is rife with unregulated entities, making it imperative for traders to conduct thorough evaluations of brokers before committing their capital. This article aims to investigate the legitimacy and safety of Solitix FX by examining its regulatory status, company background, trading conditions, customer experiences, and risk factors. Our analysis is based on a comprehensive review of multiple sources, including user feedback and expert assessments.

Regulation and Legitimacy

The regulatory status of a forex broker is crucial in determining its reliability and safety for traders. Solitix FX claims to be associated with 1st Fintech Capital (Pty) Ltd, which is purportedly licensed by the Financial Sector Conduct Authority (FSCA) in South Africa. However, upon investigation, it appears that while 1st Fintech Capital is indeed licensed, Solitix FX itself lacks a valid regulatory license. This raises significant concerns regarding its operations.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | 51478 | South Africa | Not Verified |

The absence of a dedicated license for Solitix FX means that it operates without oversight from any regulatory authority, which is a significant red flag for potential investors. Regulatory bodies are designed to protect traders by enforcing rules that govern trading practices, ensuring the safety of client funds, and providing avenues for recourse in the event of disputes. Without such oversight, traders are exposed to increased risks, including the potential for fraud and mismanagement of funds.

Company Background Investigation

Solitix FX's operational history is relatively obscure. The company claims to have invested years in the industry and aims to empower investors through its trading platform. However, details regarding its ownership structure, management team, and overall transparency are lacking. The absence of comprehensive information about the company's founders and their professional backgrounds raises questions about its legitimacy.

Furthermore, the company's website has been reported as inactive, which can be indicative of instability or a lack of commitment to maintaining a professional online presence. Transparency is essential in the financial services industry, and the inability to find credible information about Solitix FXs operational history and leadership is concerning. These factors contribute to the skepticism surrounding whether Solitix FX is safe or a potential scam.

Trading Conditions Analysis

Solitix FX offers several account types, including student, ECN, standard, and bonus accounts, with varying features and requirements. The broker claims to have competitive trading conditions, such as no minimum deposit for certain accounts and leverage ratios of up to 1:500. However, the overall fee structure and trading conditions require careful scrutiny.

| Fee Type | Solitix FX | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.8 pips | 0.5 pips |

| Commission Model | $10 (for ECN only) | Varies (often $0) |

| Overnight Interest Range | N/A | N/A |

While the spreads may appear attractive, the high leverage offered is a significant concern. Leverage amplifies both potential gains and losses, and such high ratios are typically not offered by regulated brokers due to the associated risks. Additionally, the commission structure is not transparent, and the lack of clarity regarding overnight interest rates further complicates the evaluation of trading costs. Traders should be cautious and consider whether these conditions align with their risk tolerance and trading strategies.

Customer Funds Safety

The safety of customer funds is paramount when evaluating a broker. Solitix FX has not provided clear information regarding its fund security measures, such as client fund segregation or investor protection policies. Regulated brokers typically maintain segregated accounts to ensure that client funds are not used for operational expenses, providing an additional layer of security.

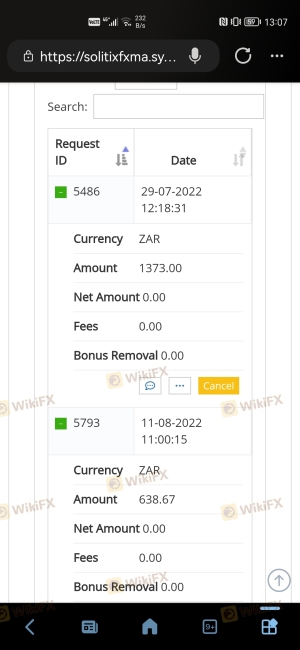

Unfortunately, the lack of regulatory oversight means that Solitix FX is not obligated to adhere to such standards. This raises significant concerns about the safety of client funds, especially in light of reports indicating that the broker may block withdrawals or impose unreasonable fees on clients seeking to access their funds. Historical issues related to fund security or withdrawal difficulties further exacerbate these concerns, making it challenging to ascertain whether Solitix FX is safe for traders.

Customer Experience and Complaints

Customer feedback is a critical indicator of a broker's reliability. Reviews of Solitix FX reveal a pattern of negative experiences among users. Common complaints include difficulties with fund withdrawals, lack of responsive customer support, and issues related to account management.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Account Management | High | Poor |

One notable case involved a trader who reported being unable to withdraw funds for several weeks, despite multiple attempts to contact customer support. This lack of responsiveness and the failure to address withdrawal issues are alarming signs that suggest Solitix FX may not prioritize customer service or satisfaction. Such complaints are significant red flags that potential traders should consider when evaluating whether Solitix FX is safe to use.

Platform and Execution

The trading platform offered by Solitix FX is the widely used MetaTrader 4 (MT4), known for its user-friendly interface and robust features. However, the performance and execution quality of the platform are critical factors that influence trading success. Reports from users indicate that while the platform is stable, there have been instances of slippage and order rejections, which can hinder trading performance.

The presence of any potential platform manipulation is a serious concern, particularly for an unregulated broker. Traders should be aware that the lack of oversight may lead to unethical practices that could adversely affect their trading outcomes. Therefore, it is essential to consider the platform's reliability and the broker's overall reputation when determining whether Solitix FX is safe for trading.

Risk Assessment

Engaging with Solitix FX carries several inherent risks, primarily due to its unregulated status and lack of transparency.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Safety Risk | High | Lack of fund segregation and protection |

| Customer Service Risk | Medium | Poor response to complaints |

| Trading Execution Risk | Medium | Possible slippage and order rejections |

To mitigate these risks, traders should conduct thorough due diligence and consider using regulated brokers with proven track records. Establishing a clear understanding of the risks associated with trading on unregulated platforms is vital for protecting one's investment.

Conclusion and Recommendations

In summary, the investigation into Solitix FX raises significant concerns about its legitimacy and safety. The lack of regulatory oversight, coupled with negative customer experiences and unclear trading conditions, suggests that traders should exercise caution when considering this broker. While Solitix FX may present attractive trading conditions, the associated risks and potential for fraud cannot be overlooked.

For traders seeking a reliable and secure trading environment, it is advisable to explore alternatives that are regulated by reputable authorities. Brokers such as IG, OANDA, and Forex.com are examples of established entities that prioritize client safety and adhere to strict regulatory standards. Ultimately, the question remains: Is Solitix FX safe? The evidence suggests that it may be more prudent to avoid this broker altogether.

Is Solitix Fx a scam, or is it legit?

The latest exposure and evaluation content of Solitix Fx brokers.

Solitix Fx Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Solitix Fx latest industry rating score is 1.47, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.47 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.