Is Shi Jin Investment safe?

Business

License

Is Shi Jin Investment Safe or Scam?

Introduction

Shi Jin Investment has emerged as a player in the forex market, primarily targeting the Chinese trading community. As with any financial service provider, it is crucial for traders to carefully assess the legitimacy and safety of a broker before committing their funds. The forex market is rife with opportunities but also poses significant risks, especially with the presence of unregulated or potentially fraudulent entities. This article aims to provide an objective analysis of Shi Jin Investment, focusing on its regulatory status, company background, trading conditions, and customer experiences. We will utilize a combination of qualitative assessments and quantitative data to evaluate whether Shi Jin Investment is safe or a scam.

Regulation and Legitimacy

Regulation is a cornerstone of a broker's credibility and safety. A regulated broker is typically subjected to stringent oversight, which can help protect traders from fraud and malpractice. Unfortunately, Shi Jin Investment lacks valid regulatory information, raising significant concerns about its legitimacy.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulatory oversight means that Shi Jin Investment is not bound by the same standards of accountability as regulated brokers. This lack of regulation can lead to a higher risk of fraud and financial misconduct. Historical compliance records and regulatory scrutiny are essential indicators of a broker's reliability, and the absence of such oversight for Shi Jin Investment raises red flags.

Company Background Investigation

Shi Jin Investment, registered in China, has a relatively short operational history, which can be a cause for concern. The company appears to have undergone name changes and has been associated with various complaints and allegations of fraud. The management team, led by individuals who have been linked to previous scams, further complicates the assessment of its credibility.

The transparency of Shi Jin Investment is questionable, with limited information available regarding its ownership structure and operational practices. Such opacity can be a significant factor in determining whether Shi Jin Investment is safe or a scam, as trustworthy brokers typically provide clear and accessible information about their management and operational practices.

Trading Conditions Analysis

When evaluating a broker, the trading conditions they offer are crucial. Shi Jin Investment presents a fee structure that may appear competitive but includes several unusual policies that warrant scrutiny.

| Fee Type | Shi Jin Investment | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Variable | 1.0 - 1.5 pips |

| Commission Structure | None | $5 - $10 per lot |

| Overnight Interest Range | High | Low to Moderate |

The variable spreads can potentially lead to higher trading costs, especially during volatile market conditions. Furthermore, the absence of a clear commission structure could imply hidden fees that are not immediately apparent to traders. This lack of transparency in trading conditions raises questions about whether Shi Jin Investment is safe or a scam, as traders may find themselves facing unexpected costs.

Client Fund Safety

The safety of client funds is a paramount concern for any trader. Shi Jin Investment does not provide sufficient information regarding its fund safety measures. The absence of client fund segregation, investor protection schemes, and negative balance protection policies can expose traders to significant risks.

Moreover, there have been historical complaints from clients who reported difficulties in withdrawing their funds, a common issue associated with fraudulent brokers. The lack of transparency regarding fund safety measures further complicates the assessment of whether Shi Jin Investment is safe or a scam. Traders should be aware of these potential risks before engaging with the broker.

Customer Experience and Complaints

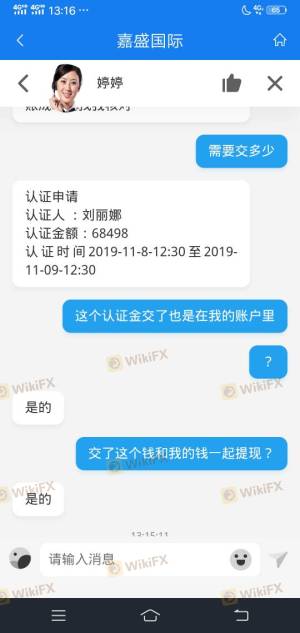

Customer feedback is invaluable in assessing a broker's reliability. Reviews and testimonials regarding Shi Jin Investment reveal a troubling pattern of complaints. Many users have reported issues related to fund withdrawals, aggressive sales tactics, and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Misleading Promotions | Medium | Slow |

| Customer Service Quality | High | Unresponsive |

Typical case studies indicate that clients were lured into trading with promises of high returns, only to face significant losses and difficulties withdrawing their funds. These complaints suggest a concerning trend that aligns with the characteristics of a scam, leading to the conclusion that Shi Jin Investment is not safe.

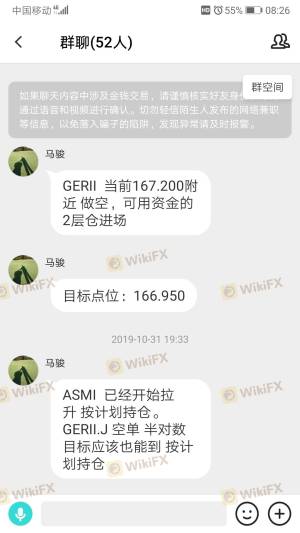

Platform and Execution

The trading platform utilized by Shi Jin Investment has been reported to have performance issues, including frequent downtimes and slow execution speeds. These factors can significantly impact a trader's ability to execute orders effectively. Additionally, there have been allegations of market manipulation, which raises further concerns about the integrity of the trading environment provided by Shi Jin Investment.

Risk Assessment

Engaging with Shi Jin Investment involves several risks that traders should be aware of.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation, high potential for fraud. |

| Financial Risk | High | Unclear fee structure and withdrawal issues. |

| Operational Risk | Medium | Platform performance issues and potential manipulation. |

To mitigate these risks, traders are advised to conduct thorough research, consider using regulated brokers, and remain vigilant about their trading activities.

Conclusion and Recommendations

In summary, the evidence suggests that Shi Jin Investment is not safe. The lack of regulatory oversight, numerous client complaints, and questionable trading conditions all point toward a potentially fraudulent operation. Traders should exercise extreme caution and consider alternative, regulated brokers for their trading activities. For those seeking reliable options, brokers like OANDA, IG, or Forex.com offer a more secure trading environment backed by regulatory protections.

Is Shi Jin Investment a scam, or is it legit?

The latest exposure and evaluation content of Shi Jin Investment brokers.

Shi Jin Investment Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Shi Jin Investment latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.