Is OPG safe?

Pros

Cons

Is OPG Safe or Scam?

Introduction

OPG Securities Pvt. Ltd. is a brokerage firm based in India, primarily engaged in stock trading and investment services. Established in 1990, OPG has positioned itself as a significant player in the Indian financial markets, offering services across various segments, including equity, derivatives, and commodities. However, the rise of online trading has led to an influx of brokers, making it crucial for traders to exercise caution when evaluating potential partners. The foreign exchange market, in particular, is rife with risks, and choosing the wrong broker can lead to significant financial losses. This article aims to assess whether OPG is a safe trading option or a potential scam, utilizing a comprehensive evaluation framework that includes regulatory compliance, company background, trading conditions, customer feedback, and risk assessment.

Regulation and Legitimacy

The regulatory status of a brokerage is one of the most critical factors in determining its legitimacy. OPG Securities operates in a highly regulated environment, yet it appears to lack proper oversight from recognized financial authorities. This absence of regulation raises significant concerns about the safety of client funds and the overall integrity of the brokerage.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | India | Unregulated |

The lack of a valid license indicates that OPG does not adhere to the stringent requirements imposed by top-tier regulatory bodies, such as the Securities and Exchange Board of India (SEBI). This absence of oversight can lead to questionable business practices and a lack of transparency. Furthermore, regulatory compliance is essential for protecting investors, and brokers operating without regulation may engage in activities that could jeopardize client funds. Given these factors, the question remains: Is OPG safe? The evidence suggests that potential clients should proceed with caution.

Company Background Investigation

OPG Securities has been in operation for over three decades, providing a range of financial services. Founded by O.P. Gupta, the company has evolved significantly, expanding its services and client base. The current management team, led by Sanjay Gupta, is said to have extensive experience in the financial markets. However, the transparency of the company's operations and its ownership structure raises questions.

The company's historical performance shows a commitment to growth, but the absence of detailed disclosures about its financial health and operational practices makes it difficult to assess its credibility fully. Transparency in operations is critical for building trust with clients, and OPG's limited information may deter potential investors. Given these factors, it is essential to consider whether OPG's long-standing presence in the market equates to reliability or if it masks underlying issues.

Trading Conditions Analysis

When evaluating a brokerage, understanding its fee structure and trading conditions is vital. OPG Securities claims to offer competitive trading conditions, yet the details surrounding its fees remain somewhat opaque. Traders should be cautious of hidden fees that could impact their profitability.

| Fee Type | OPG Securities | Industry Average |

|---|---|---|

| Spread on Major Pairs | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The ambiguity surrounding these fees may indicate potential issues. Traders often encounter unexpected costs that can erode profits, especially in a market as volatile as Forex. The lack of clarity in OPG's fee structure raises concerns about its overall value proposition. Therefore, it is essential for potential clients to inquire directly about these costs before proceeding.

Client Funds Security

The security of client funds is paramount when assessing a brokerage's credibility. OPG Securities, however, has not provided sufficient information regarding its client fund protection measures. A reliable broker typically segregates client funds from its operational accounts, ensuring that clients' money is safeguarded even in the event of financial difficulties.

Moreover, the absence of investor protection mechanisms, such as compensation schemes, further exacerbates the risks associated with trading through OPG. Without these safeguards, clients may face significant challenges in recovering their funds in the event of a dispute or financial mismanagement. Historical issues related to fund security can also tarnish a broker's reputation, and OPG's lack of transparency in this area raises red flags. Consequently, the question of whether OPG is safe becomes increasingly pertinent.

Customer Experience and Complaints

Analyzing customer feedback is essential for understanding the overall service quality of a brokerage. Reviews regarding OPG have been mixed, with some users reporting satisfactory experiences, while others have raised concerns about the firm's responsiveness and handling of complaints. Common issues include delayed withdrawals and lack of communication from customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Poor Customer Support | Medium | Average |

Two notable cases highlight these issues. One trader reported significant delays in withdrawing funds, leading to frustration and financial strain. Another user expressed dissatisfaction with the customer service, stating that their inquiries went unanswered for extended periods. These complaints indicate a potential lack of operational efficiency and customer care, which could impact traders' experiences significantly. Thus, it is crucial for prospective clients to weigh these factors carefully before deciding to engage with OPG.

Platform and Trade Execution

The performance of a trading platform is another vital component of a broker's appeal. OPG Securities offers a trading platform that is reportedly user-friendly, but the execution quality has come under scrutiny. Traders often experience slippage and order rejections, which can be detrimental in fast-moving markets like Forex.

The potential for platform manipulation is also a concern, especially if traders suspect that their orders are not being executed fairly. The overall user experience, including the platform's stability and responsiveness, can significantly affect trading outcomes. Therefore, it's essential for traders to conduct thorough research and possibly test the platform through demo accounts before committing real funds.

Risk Assessment

Using OPG Securities comes with inherent risks that traders must consider. The absence of regulatory oversight, coupled with the company's unclear fee structure and customer service issues, contributes to a high-risk profile.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation from recognized authorities. |

| Operational Risk | Medium | Complaints regarding withdrawal delays and customer service. |

| Financial Risk | High | Lack of transparency in fee structures and fund security. |

Traders are encouraged to mitigate these risks by conducting due diligence, seeking alternative brokers with better regulatory standing, and ensuring they understand the fee structures before trading.

Conclusion and Recommendations

In conclusion, the evidence suggests that OPG Securities may not be the safest option for traders seeking a reliable brokerage. The lack of regulatory oversight, coupled with mixed customer feedback and concerns about fund security, raises significant red flags. Therefore, potential clients should approach OPG with caution and consider alternative options that offer better protection and transparency.

For traders looking for safer alternatives, it is advisable to explore brokers regulated by top-tier authorities, such as those under the oversight of the Securities and Exchange Board of India (SEBI) or other reputable financial regulators. This approach will help ensure that their trading activities are conducted in a secure environment, thus minimizing the risks associated with trading in the Forex market. Ultimately, the question remains: Is OPG safe? The prevailing evidence suggests that traders should remain vigilant and thoroughly evaluate their options before proceeding.

Is OPG a scam, or is it legit?

The latest exposure and evaluation content of OPG brokers.

OPG Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

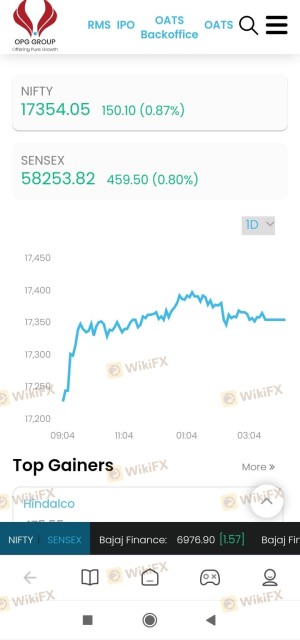

OPG latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.