Is SAGA safe?

Business

License

Is Saga Safe or a Scam?

Introduction

Saga, a forex broker established in 2018, primarily operates in Japan and Australia. As trading in the foreign exchange market becomes increasingly popular, it is essential for traders to exercise caution and conduct thorough evaluations of brokers before engaging in trading activities. Given the prevalence of scams and unregulated brokers in the forex industry, understanding the legitimacy and reliability of a trading platform like Saga is crucial for protecting investments and ensuring a safe trading environment.

This article will investigate the safety and legitimacy of Saga by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, platform performance, and associated risks. The analysis will be based on various sources, including regulatory bodies, user reviews, and industry assessments, to provide a comprehensive overview of whether Saga is safe or a scam.

Regulation and Legitimacy

The regulatory landscape is a critical aspect of any trading broker, as it provides a framework for accountability and client protection. A regulated broker is typically required to adhere to strict guidelines that ensure transparency and the safeguarding of client funds. Unfortunately, Saga does not hold any licenses from recognized regulatory authorities, which raises significant concerns regarding its legitimacy and operational practices.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The lack of regulation means that Saga is not subject to oversight by any financial authority, making it difficult for clients to seek recourse in the event of disputes or fraudulent activities. Additionally, unregulated brokers often lack the necessary safeguards that protect clients, such as segregated accounts and negative balance protection. The absence of a regulatory framework surrounding Saga significantly heightens the risk for potential investors.

Company Background Investigation

Saga was founded in 2018, but limited information is available regarding its ownership structure and management team. The lack of transparency surrounding the broker's corporate identity is concerning, as reputable brokers typically provide detailed information about their leadership and operational history.

The management teams background is crucial in assessing a broker's reliability, as experienced professionals can contribute to a trustworthy trading environment. However, the absence of such information raises red flags about the broker's legitimacy. Furthermore, the company's communication channels appear to be limited, making it challenging for potential clients to obtain necessary information before committing funds.

In summary, the lack of transparency and information about Saga's management team and ownership structure contributes to the perception that it may not be a trustworthy broker. This lack of disclosure is a significant factor in determining if Saga is safe or a scam.

Trading Conditions Analysis

When assessing a broker's credibility, understanding its trading conditions is paramount. Saga claims to offer competitive trading conditions, but the absence of regulatory oversight raises questions about the validity of its claims.

The following table outlines the core trading costs associated with Saga:

| Cost Type | Saga | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

Sagas fee structure appears to lack clarity, as the absence of a defined commission model can lead to unexpected costs for traders. Additionally, the variability in spreads may indicate a lack of consistency in pricing, which can negatively impact trading strategies. Traders should be wary of brokers that do not provide transparent information about their fee structures, as this could be a sign of deceptive practices.

Customer Fund Security

The security of client funds is a primary concern for any trader. A reputable broker should implement robust measures to protect customer deposits. However, Saga's lack of regulation raises serious questions about its fund security practices.

Without regulatory oversight, Saga is not required to maintain segregated accounts, which are essential for keeping client funds separate from the broker's operational funds. This separation is crucial in the event of financial difficulties or insolvency, as it ensures that clients can recover their funds. Furthermore, the absence of negative balance protection means that traders could potentially lose more than their initial investment, further increasing the risk associated with trading through Saga.

In light of these factors, it is clear that Saga does not prioritize the safety of client funds, raising significant concerns about whether Saga is safe or a scam.

Customer Experience and Complaints

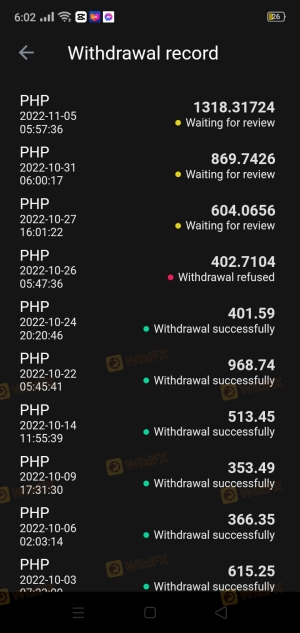

User feedback plays a vital role in assessing the credibility of a broker. Unfortunately, reviews and complaints regarding Saga indicate a pattern of negative experiences among clients. Common complaints include difficulties in withdrawing funds, lack of responsive customer support, and issues related to account management.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Account Management | High | Poor |

One notable case involved a trader who reported being unable to withdraw their funds after multiple requests, leading to frustration and financial loss. Such complaints highlight significant operational issues within Saga and suggest that the broker may not be equipped to handle customer needs effectively.

Platform and Trade Execution

The trading platform is another critical aspect of a broker's offering. A reliable platform should provide a seamless trading experience with minimal downtime and efficient execution of orders. However, reports indicate that Sagas platform may not meet these expectations. Users have reported issues with order execution, including slippage and rejected orders, which can hinder trading performance.

Furthermore, the platform's stability and user experience are essential for traders looking to engage in the forex market. If a broker's platform is prone to crashes or delays, it can lead to significant financial losses for traders. The potential for platform manipulation is another concern, particularly for unregulated brokers like Saga, where oversight is lacking.

Risk Assessment

In conclusion, the overall risk associated with using Saga as a trading platform is high. The following risk assessment summarizes key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight. |

| Fund Security Risk | High | Lack of segregated accounts and investor protection. |

| Customer Service Risk | High | Poor response to complaints and withdrawal issues. |

| Platform Risk | Medium | Issues with execution and potential manipulation. |

To mitigate these risks, traders should consider using well-regulated brokers that offer transparent trading conditions, robust security measures, and responsive customer support.

Conclusion and Recommendations

Based on the evidence presented, it is clear that Saga is not a safe trading option. The lack of regulation, transparency, and poor customer experiences suggest that traders should exercise extreme caution when considering this broker. There are numerous red flags indicating that Saga may engage in practices that could be detrimental to clients, leading to the conclusion that Saga is likely a scam.

For traders seeking a reliable forex trading experience, it is advisable to explore well-regulated alternatives that prioritize client safety and offer transparent trading conditions. Brokers with established reputations and regulatory oversight can provide a safer environment for trading, ensuring that clients' funds are protected and that they have access to responsive customer support.

In summary, if you are considering trading with Saga, it is strongly recommended to look for safer, more reputable options in the forex market.

Is SAGA a scam, or is it legit?

The latest exposure and evaluation content of SAGA brokers.

SAGA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

SAGA latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.