SAGA Review 1

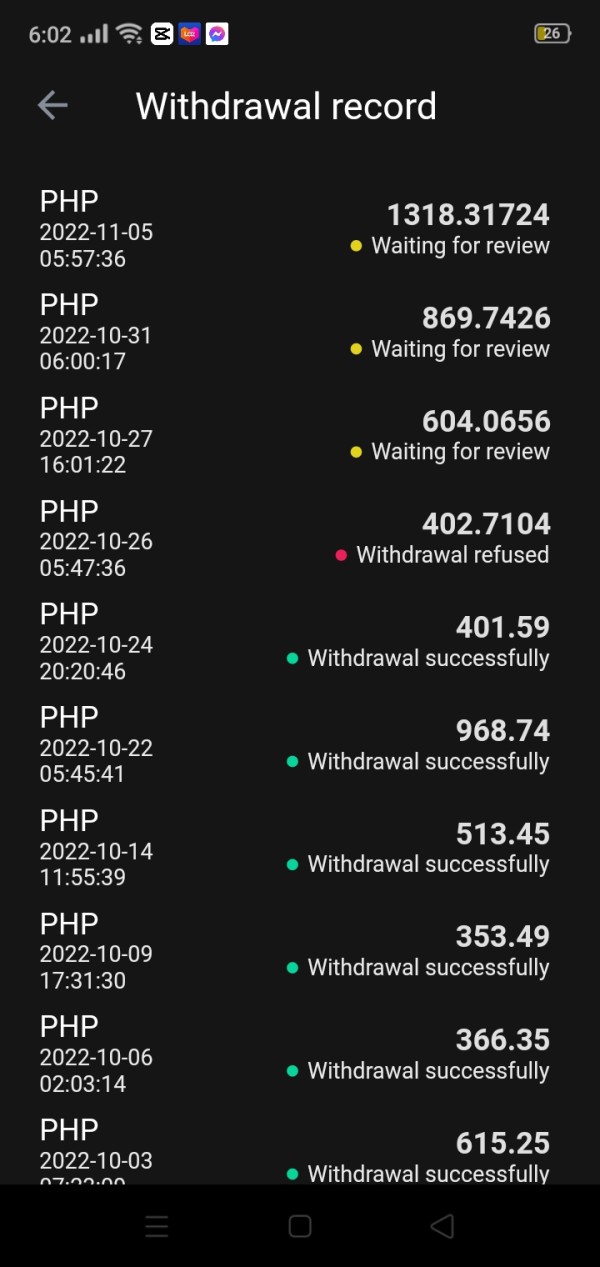

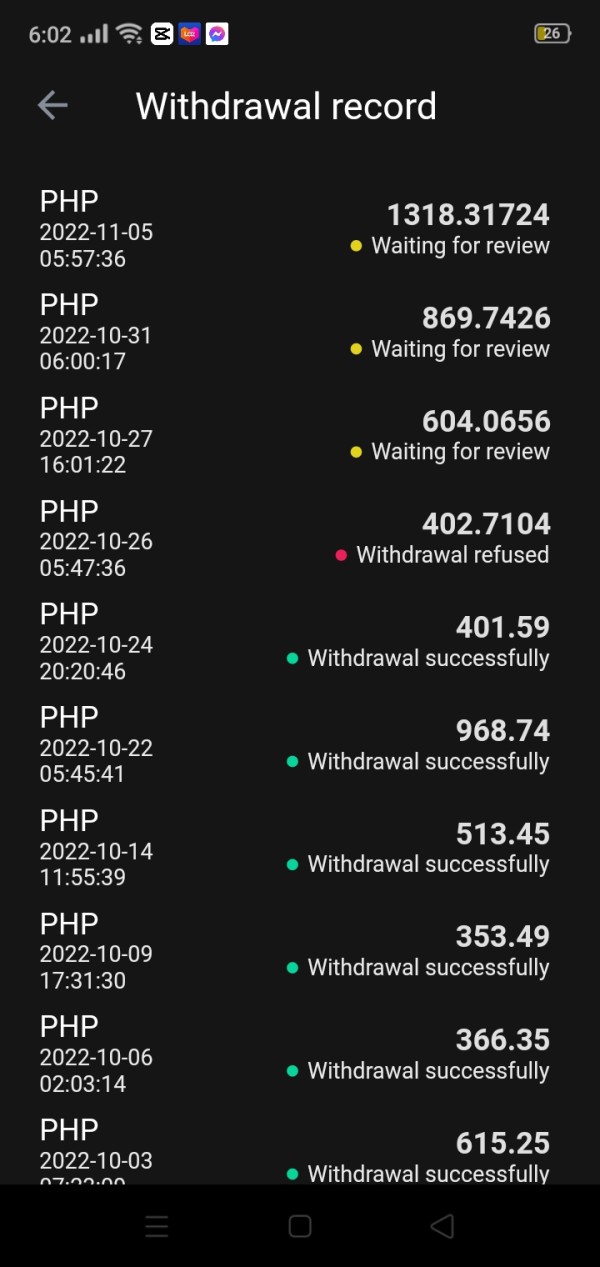

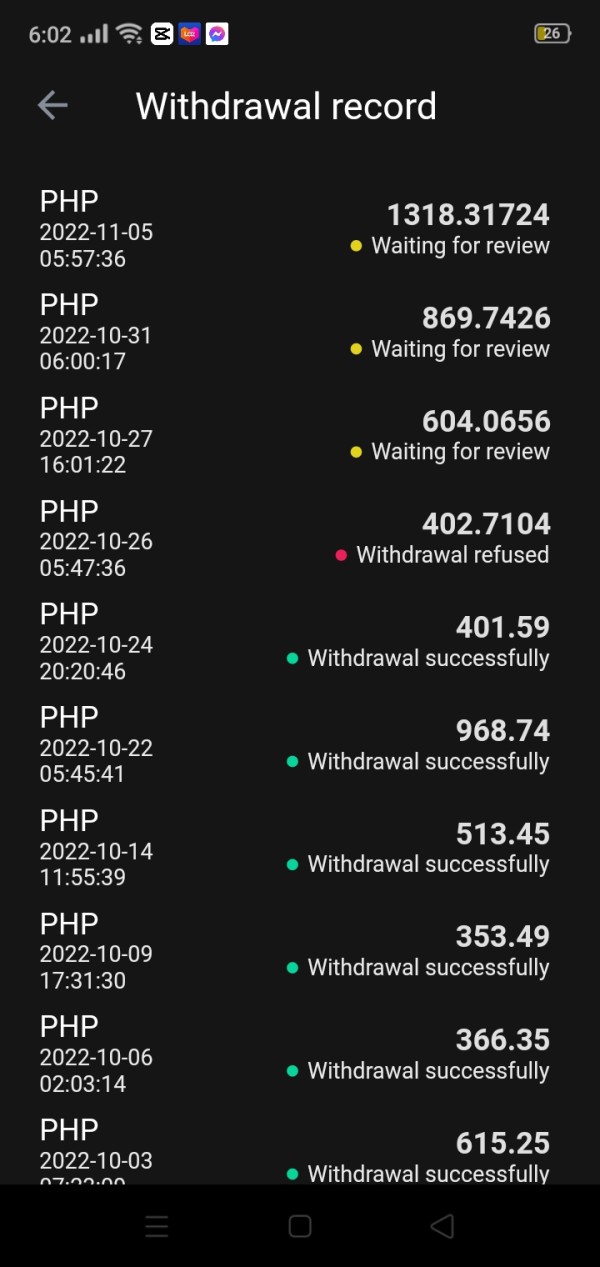

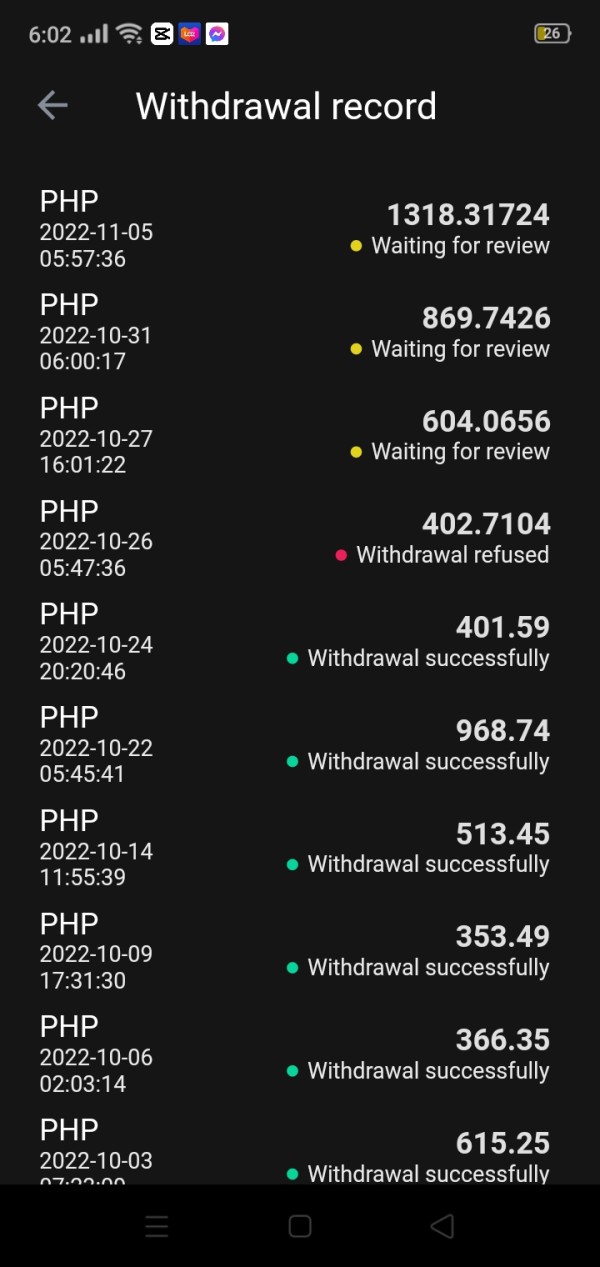

i cant reach my pay out

SAGA Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

Business

License

i cant reach my pay out

This comprehensive saga review examines a forex broker that has been operating since 2018. The company primarily serves markets in Japan and Australia. Based on available information, our assessment remains neutral due to significant gaps in critical operational data including regulatory oversight, trading conditions, and platform specifications.

Saga positions itself as a forex brokerage targeting investors interested in currency trading. The company has particular focus on Japanese and Australian markets. However, the lack of transparent information regarding licensing, account structures, trading costs, and platform offerings raises concerns about operational transparency.

While the company's seven-year operational history suggests some level of market presence, the absence of detailed regulatory information and trading specifications makes it challenging to provide a definitive recommendation. For potential traders considering Saga, we recommend conducting thorough due diligence to verify regulatory status, trading conditions, and platform capabilities before committing funds.

This review reflects the current state of publicly available information. It highlights areas where additional transparency would benefit potential clients.

Regional Entity Differences: Due to the absence of specific regulatory information in available sources, potential legal and compliance risks may vary significantly across different jurisdictions. Traders should verify local regulatory status and applicable protections in their specific region before engaging with this broker.

Review Methodology: This evaluation is based on limited publicly available information. The assessment lacks comprehensive user feedback, detailed trading condition analysis, and verified regulatory documentation, which may impact the completeness of our evaluation.

| Dimension | Score | Rationale |

|---|---|---|

| Account Conditions | Information Not Available/10 | No specific account condition details found in available sources |

| Tools and Resources | Information Not Available/10 | Trading tools and educational resources not specified in source materials |

| Customer Service | Information Not Available/10 | Customer support information not detailed in available documentation |

| Trading Experience | Information Not Available/10 | Platform performance and execution quality data unavailable |

| Trust and Security | Information Not Available/10 | Regulatory oversight and security measures not specified |

| User Experience | Information Not Available/10 | User interface and overall experience feedback not documented |

Company Background and Establishment

Saga entered the forex brokerage market in 2018. The company established its operations with a focus on serving traders in Japan and Australia. The company has maintained its presence in these key Asian-Pacific markets for seven years, suggesting some level of operational stability and market adaptation.

As a forex-focused brokerage, Saga positions itself to serve the growing demand for currency trading services in these regions. The broker's business model centers on providing forex trading services, though specific details about their operational structure, parent company relationships, or expansion plans remain unclear from available sources.

This saga review notes that while the company has maintained operations since 2018, limited public information about corporate structure and ownership raises questions about transparency.

Trading Infrastructure and Asset Coverage

Available information does not specify the types of trading platforms offered by Saga. It also does not detail the range of tradeable assets beyond the general forex designation. The absence of information regarding supported trading platforms, asset categories, or technological infrastructure represents a significant information gap that potential clients would need to address through direct broker contact.

Similarly, regulatory oversight details are not specified in available sources. This represents a critical consideration for traders evaluating broker safety and compliance standards.

Regulatory Jurisdiction: Available sources do not specify the regulatory authorities overseeing Saga's operations. This occurs despite its presence in Japan and Australia where financial services are typically subject to strict regulatory oversight.

Deposit and Withdrawal Methods: Payment processing options and supported funding methods are not detailed in available documentation.

Minimum Deposit Requirements: Entry-level funding requirements for account opening are not specified in accessible sources.

Promotional Offers: Current bonus structures, promotional campaigns, or incentive programs are not documented in available materials.

Tradeable Assets: While identified as a forex broker, the specific currency pairs, exotic options, or additional asset classes remain unspecified.

Cost Structure: Critical trading costs including spreads, commissions, overnight financing charges, and additional fees are not detailed in this saga review due to information unavailability.

Leverage Ratios: Maximum leverage offerings and risk management parameters are not specified in source materials.

Platform Options: Trading platform selections, mobile applications, and technological offerings require direct broker verification.

Geographic Restrictions: Service availability limitations and restricted jurisdictions are not clearly documented.

Customer Support Languages: Available communication languages for client support are not specified.

The evaluation of Saga's account conditions faces significant limitations due to the absence of detailed information in available sources. Account type varieties, minimum deposit requirements, and special account features cannot be assessed based on current documentation.

This information gap prevents potential traders from understanding entry requirements, account progression options, or specialized services that might be available. Without specific details about account opening procedures, verification requirements, or document submission processes, prospective clients cannot adequately prepare for the onboarding experience.

The lack of information regarding Islamic accounts, professional trader classifications, or institutional account options further limits the assessment scope. User feedback regarding account setup experiences, deposit processing times, or account management quality is not available in reviewed sources.

This absence of client testimonials or experience reports makes it impossible to gauge real-world account condition satisfaction levels. Comparative analysis with industry standards becomes challenging without specific account parameter details.

This saga review emphasizes the need for direct broker consultation to obtain comprehensive account condition information before making trading decisions.

Assessment of trading tools and educational resources remains incomplete due to insufficient information in available sources. The quality and variety of analytical tools, charting capabilities, market research provisions, and educational content cannot be evaluated based on current documentation.

Modern forex trading typically requires access to advanced charting software, economic calendars, market analysis, and educational materials for trader development. However, Saga's specific offerings in these areas are not detailed in accessible sources, preventing meaningful evaluation of their competitive positioning in tool provision.

Automated trading support, expert advisor compatibility, and algorithmic trading capabilities represent important considerations for many traders, yet these features are not specified in available documentation. The absence of information about API access, third-party tool integration, or custom indicator support further limits the assessment.

User experiences with tool functionality, educational resource quality, or research accuracy are not documented in reviewed sources. Without client feedback on tool performance and usefulness, potential traders cannot gauge the practical value of Saga's resource offerings.

Customer service evaluation faces substantial limitations due to the absence of support quality information in available sources. Contact methods, response timeframes, service availability hours, and support quality standards cannot be assessed based on current documentation.

Effective customer support typically includes multiple communication channels such as live chat, telephone support, email assistance, and comprehensive FAQ resources. However, Saga's specific support infrastructure and service quality metrics are not detailed in accessible materials.

Multilingual support capabilities, particularly for Japanese and Australian markets, would be expected given the broker's regional focus, yet language support details are not specified in available sources. This information gap affects potential clients' ability to assess communication compatibility.

User testimonials regarding support responsiveness, problem resolution effectiveness, or service quality satisfaction are not documented in reviewed sources. The absence of client feedback on support experiences prevents meaningful evaluation of service standards and reliability.

Platform stability, execution speed, and overall trading environment quality cannot be adequately assessed due to limited information availability. Modern forex trading demands reliable platform performance, fast order execution, and minimal technical disruptions, yet Saga's performance in these areas remains undocumented.

Order execution quality, including slippage rates, rejection frequencies, and fill accuracy, represents critical factors for trader success. However, specific performance metrics or user experiences regarding execution quality are not available in reviewed sources.

Mobile trading capabilities and cross-device synchronization features have become essential for contemporary forex trading, yet details about Saga's mobile platform offerings or technological capabilities are not specified in this saga review. Trading environment feedback from actual users, including platform reliability reports, execution satisfaction levels, or technical issue experiences, are not documented in available sources.

This absence of real-world performance data limits potential traders' ability to assess platform suitability.

Regulatory compliance and financial security measures represent critical evaluation factors that remain unclear due to information limitations. Despite operating in Japan and Australia, where financial services face strict regulatory oversight, specific regulatory authorities and compliance standards are not detailed in available sources.

Fund security protocols, segregated account arrangements, and investor protection measures typically required in regulated markets are not specified in accessible documentation. This information gap raises important questions about client fund safety and regulatory compliance status.

Company transparency regarding ownership structure, financial reporting, and operational oversight cannot be assessed based on current information availability. Industry reputation, third-party ratings, or regulatory standing reports are similarly absent from reviewed sources.

Incident handling procedures, dispute resolution mechanisms, or negative event responses are not documented, preventing evaluation of the broker's crisis management capabilities and client protection measures.

Overall user satisfaction levels and interface design quality cannot be evaluated due to the absence of user feedback in available sources. Modern trading platforms require intuitive navigation, responsive design, and comprehensive functionality, yet Saga's performance in these areas remains undocumented.

Registration processes, account verification procedures, and onboarding experiences typically influence initial user impressions, but specific details about these processes are not available in reviewed sources. Funding and withdrawal experiences, including processing speeds, fee structures, and transaction convenience, represent important user experience factors that are not detailed in accessible documentation.

Common user complaints, satisfaction trends, or improvement suggestions from actual clients are not documented, limiting the assessment of real-world user experience quality and areas for potential enhancement.

Based on available information, this saga review concludes with a neutral assessment of Saga forex broker due to significant information gaps across critical evaluation areas. While the company's seven-year operational history since 2018 suggests market presence, the lack of transparent information regarding regulatory oversight, trading conditions, and service specifications prevents a definitive recommendation.

The absence of detailed user feedback, regulatory documentation, and operational transparency makes it challenging to identify specific user types who would benefit most from Saga's services. Potential traders should conduct thorough independent research and direct broker consultation before making account opening decisions.

Primary advantages include established market presence since 2018, while significant disadvantages center on limited information transparency across essential broker evaluation criteria. Prospective clients are advised to verify all trading conditions, regulatory status, and service specifications directly with the broker before committing funds.

FX Broker Capital Trading Markets Review