Regarding the legitimacy of Safe Gold Bullion forex brokers, it provides HKGX and WikiBit, (also has a graphic survey regarding security).

Is Safe Gold Bullion safe?

Business

License

Is Safe Gold Bullion markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

UnverifiedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

鼎展金業有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

九龍觀塘興業街23號寶業大廈10字樓1016室Phone Number of Licensed Institution:

(852) 35425053Licensed Institution Certified Documents:

Is Safe Gold Bullion A Scam?

Introduction

Safe Gold Bullion is a Hong Kong-based forex broker established in 2017, primarily focusing on trading precious metals such as gold, silver, platinum, and palladium. As the demand for trading platforms continues to grow, traders must exercise caution and thoroughly evaluate the legitimacy and reliability of brokers like Safe Gold Bullion. The forex market is rife with scams and unregulated entities, making it essential for traders to conduct due diligence before committing their funds. In this article, we will investigate the safety and integrity of Safe Gold Bullion by analyzing its regulatory status, company background, trading conditions, client safety measures, customer experiences, platform performance, and associated risks.

Regulation and Legitimacy

A broker's regulatory status is a critical factor in determining its safety. Regulation serves to protect investors, ensuring that brokers adhere to stringent compliance standards, thus maintaining market integrity. Unfortunately, Safe Gold Bullion operates without valid regulation, raising significant concerns about its legitimacy. Below is a summary of the core regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | Hong Kong | Unregulated |

The lack of oversight from recognized regulatory authorities means that Safe Gold Bullion may not be subject to regular audits or compliance checks. This absence of regulation increases the risk of potential fraud and mismanagement of client funds. Furthermore, reports indicate that Safe Gold Bullion has received numerous complaints from users, suggesting that it may not be adhering to fair trading practices. In the past three months alone, WikiFX has recorded over 42 complaints against the broker, indicating a troubling pattern of user dissatisfaction and a lack of accountability.

Company Background Investigation

Safe Gold Bullion, founded in 2017, positions itself as a trading platform for precious metals. However, the company's background raises several red flags. The ownership structure is not transparently disclosed, and there is limited information available regarding the management team's qualifications and experience. A broker's transparency is crucial for building trust, and the lack of clear information about the company's ownership and management can be a significant concern for potential investors.

The absence of comprehensive information about the company's history and the individuals behind it further complicates the assessment of its reliability. Potential clients should be wary of engaging with a broker that does not provide adequate transparency regarding its operations and ownership structure. In light of these factors, traders must proceed with caution when considering Safe Gold Bullion as a trading option.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions, including fees and commissions, is vital. Safe Gold Bullion employs a commission-based model, charging a commission of 0.50% on all trades. However, the absence of a clearly defined fee structure and the lack of competitive trading costs may deter potential clients. Below is a comparison of core trading costs:

| Fee Type | Safe Gold Bullion | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable (0.50%) | 0.1% - 1.0% |

| Commission Model | 0.50% | 0% - 0.5% |

| Overnight Interest Range | N/A | 0.5% - 1.5% |

Safe Gold Bullion's trading fees appear to be on the higher end, which could impact the overall profitability of trades. Additionally, the lack of leverage options may limit trading opportunities for those seeking higher potential returns. Traders should carefully assess these costs and consider whether they align with their trading strategies.

Client Fund Security

The security of client funds is a paramount concern for any trader. Safe Gold Bullion claims to implement measures to ensure the safety of client funds; however, the lack of regulatory oversight raises questions about the effectiveness of these measures. The broker does not provide clear information regarding fund segregation, investor protection, or negative balance protection policies.

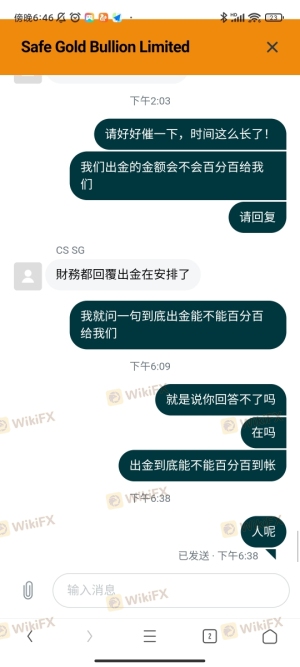

Without a regulatory framework, clients may find themselves vulnerable to potential fraud or mismanagement of their funds. Historical complaints regarding withdrawal issues further exacerbate these concerns, as clients have reported difficulties accessing their funds. Traders must be cautious and consider the potential risks associated with entrusting their money to an unregulated broker like Safe Gold Bullion.

Customer Experience and Complaints

Customer feedback plays a crucial role in assessing a broker's reliability. An analysis of user experiences with Safe Gold Bullion reveals a pattern of dissatisfaction, with many clients reporting issues related to withdrawals and overall service quality. The following table summarizes the most common complaint types and their severity:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Poor Customer Support | Medium | Inadequate |

| Misleading Information | High | Unresponsive |

Several users have reported being unable to withdraw their funds, which is a significant red flag for any broker. One user mentioned depositing $800 but experiencing difficulties in accessing their money after trading for two years. Such complaints not only highlight the operational challenges faced by Safe Gold Bullion but also raise concerns about the broker's commitment to customer service.

Platform and Trade Execution

The performance and stability of a trading platform are critical for a seamless trading experience. Safe Gold Bullion offers a web-based trading platform that supports multiple languages, but there are concerns regarding its execution quality. Users have reported issues with slippage and order rejections, which can significantly impact trading outcomes.

The absence of a robust trading infrastructure may indicate potential platform manipulation or inefficiencies. Traders should remain vigilant and consider the implications of using a platform that lacks transparency and reliability in trade execution.

Risk Assessment

Engaging with Safe Gold Bullion presents several risks that potential clients should be aware of. Below is a summary of the key risk areas:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases fraud risk. |

| Financial Risk | High | Withdrawal issues reported by clients. |

| Operational Risk | Medium | Concerns about platform performance. |

To mitigate these risks, traders should conduct thorough research and consider alternative brokers that offer regulatory protections and a proven track record of reliability. Seeking out brokers with transparent operations and positive client feedback can help safeguard investments.

Conclusion and Recommendations

In conclusion, Safe Gold Bullion presents several concerning indicators that suggest it may not be a safe option for traders. The lack of regulatory oversight, transparency issues, and a high volume of client complaints raise significant red flags. While the broker offers a range of trading options for precious metals, the associated risks may outweigh the potential benefits.

Traders are advised to exercise caution and consider alternative, regulated brokers that prioritize client safety and offer robust trading conditions. Some reputable alternatives include brokers with established regulatory frameworks and positive user experiences. Ultimately, due diligence is essential for anyone looking to engage in forex trading, and choosing a reliable broker is critical for long-term success in the market.

Is Safe Gold Bullion a scam, or is it legit?

The latest exposure and evaluation content of Safe Gold Bullion brokers.

Safe Gold Bullion Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Safe Gold Bullion latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.