Regarding the legitimacy of Royal forex brokers, it provides ASIC, CYSEC and WikiBit, .

Is Royal safe?

Business

License

Is Royal markets regulated?

The regulatory license is the strongest proof.

ASIC Inst Market Making (MM)

Australia Securities & Investment Commission

Australia Securities & Investment Commission

Current Status:

Clone FirmLicense Type:

Inst Market Making (MM)

Licensed Entity:

Royal Financial Trading Pty Ltd

Effective Date: Change Record

2012-06-22Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

L 15 60 MARGARET ST SYDNEY NSW 2000Phone Number of Licensed Institution:

--Licensed Institution Certified Documents:

CYSEC Forex Execution License (STP)

Cyprus Securities and Exchange Commission

Cyprus Securities and Exchange Commission

Current Status:

Clone FirmLicense Type:

Forex Execution License (STP)

Licensed Entity:

Royal Financial Trading (Cy) Ltd

Effective Date:

2016-08-10Email Address of Licensed Institution:

Compliance@oneroyal.com.cySharing Status:

No SharingWebsite of Licensed Institution:

www.oneroyal.euExpiration Time:

--Address of Licensed Institution:

152 Fragklinou Rousvelt, 3045 Limassol, CyprusPhone Number of Licensed Institution:

+357 25 080 880Licensed Institution Certified Documents:

Is Royal Safe or Scam?

Introduction

Royal is a trading platform that positions itself within the competitive landscape of the forex market, offering a range of trading services including forex, CFDs, and cryptocurrency trading. As the online trading environment becomes increasingly crowded, traders must exercise caution when selecting a broker. The potential for fraud in the forex market necessitates a thorough evaluation of brokers to ensure the safety of investments. This article aims to assess whether Royal is a legitimate broker or a potential scam by analyzing its regulatory framework, company background, trading conditions, customer fund safety, and user experiences. Our investigation is based on a comprehensive review of multiple sources, including regulatory databases, user feedback, and industry reports.

Regulation and Legitimacy

One of the most critical aspects of evaluating a broker's reliability is its regulatory status. Royal claims to be regulated by several authorities, including the International Financial Services Commission (IFSC) of Belize and the British Virgin Islands Financial Services Commission (BVIFSC). However, upon reviewing the registries of these regulatory bodies, there is no mention of Royal or its parent company, Goldman Global Group. This absence raises significant concerns regarding the broker's legitimacy.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| IFSC | N/A | Belize | Not Verified |

| BVIFSC | N/A | British Virgin Islands | Not Verified |

The lack of proper licensing and regulation is a red flag for potential investors. Regulated brokers are required to adhere to strict guidelines that protect clients' interests, such as maintaining segregated accounts and providing investor compensation schemes. Conversely, unregulated brokers like Royal expose traders to higher risks, including potential fraud and the inability to recover funds in case of insolvency. The absence of legitimate regulatory oversight raises the question: Is Royal safe? The evidence suggests that it may not be.

Company Background Investigation

Royal operates under the umbrella of Goldman Global Group, which claims to have been founded in 2005. However, detailed information about the company's ownership structure and management team is scarce. A credible broker should provide transparent information about its leadership and operational history to foster trust among clients. The lack of detailed disclosures about the management team raises concerns about the broker's credibility.

A strong management team with relevant experience is crucial for ensuring effective operations and compliance with regulatory standards. Moreover, the absence of transparency regarding the companys operations may indicate a willingness to obscure information that could potentially harm its reputation. Given these factors, potential clients should be cautious when considering whether Royal is safe for trading.

Trading Conditions Analysis

When evaluating whether Royal is a safe option for traders, it is essential to examine its trading conditions. The broker has a minimum deposit requirement of $250, which is notably high compared to industry standards where many reputable brokers allow minimum deposits as low as $50. Additionally, Royal claims to offer leverage ratios of up to 1:1000, which is excessively high and poses significant risks, especially for inexperienced traders. High leverage can lead to substantial losses, and regulators in various jurisdictions limit leverage to protect traders from such risks.

| Fee Type | Royal | Industry Average |

|---|---|---|

| Spread on Major Pairs | 44.2 pips | 1 pip |

| Commission Model | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

The spread offered by Royal on major currency pairs is alarmingly high at 44.2 pips, while the industry average is typically around 1 pip. Such exorbitant spreads indicate that the broker may prioritize profit over the interests of its clients, further questioning its legitimacy. Traders should be aware of these trading conditions when assessing whether Royal is safe for their investments.

Customer Fund Safety

The safety of client funds is paramount when determining whether a broker is a safe choice. Royal claims to implement various security measures, such as segregated accounts and negative balance protection. However, the lack of regulatory oversight significantly undermines the effectiveness of these measures. Without proper regulation, there is no guarantee that client funds will be protected in the event of insolvency or fraudulent activities.

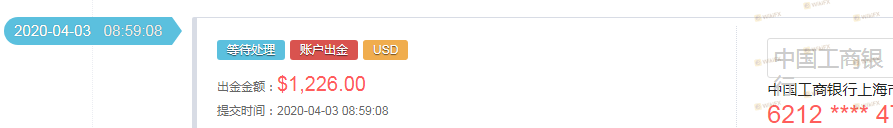

The absence of investor compensation schemes means that traders could potentially lose their entire investment without recourse. Historical issues related to fund security have been reported, with users claiming difficulties in withdrawing their funds, a common tactic employed by fraudulent brokers. Given these factors, potential clients should seriously consider whether Royal is safe for their trading activities.

Customer Experience and Complaints

User feedback provides valuable insights into the overall reliability of a broker. Numerous reviews about Royal highlight a range of complaints, including difficulties in withdrawing funds, high fees, and poor customer service. The following table summarizes the main types of complaints received:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| High Fees | Medium | Average |

| Customer Service | High | Poor |

Common complaints revolve around the inability to withdraw funds promptly, with some users reporting delays of several weeks or even months. This pattern of behavior is a significant concern, as it suggests that the broker may engage in practices designed to retain client funds indefinitely, raising questions about its legitimacy. For those considering whether Royal is safe, these complaints should not be taken lightly.

Platform and Trade Execution

The trading platform offered by Royal has received mixed reviews regarding its performance and user experience. While the platform may provide basic trading functionalities, users have reported issues related to execution quality, including slippage and order rejections. Without a reliable platform, traders face increased risks of executing trades at unfavorable prices, which can lead to significant financial losses. The absence of robust trading tools and features typically offered by reputable brokers further diminishes the overall trading experience. Therefore, potential clients should carefully consider whether Royal is safe before committing their funds.

Risk Assessment

Engaging with Royal comes with a variety of risks that potential clients should consider. The absence of regulation, high fees, and poor customer service contribute to a high-risk profile for this broker.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated operations pose significant risks. |

| Financial Risk | High | High leverage and fees can lead to substantial losses. |

| Customer Support Risk | Medium | Poor customer service may hinder issue resolution. |

To mitigate these risks, potential clients should conduct thorough research and consider trading with regulated brokers that offer better protections and services. Ultimately, understanding these risks is crucial for determining whether Royal is safe for trading.

Conclusion and Recommendations

In conclusion, the investigation into Royal reveals several red flags that suggest this broker may not be a safe option for traders. The lack of regulatory oversight, high fees, and numerous user complaints indicate that Royal is likely a scam. For traders seeking reliable alternatives, it is advisable to consider brokers regulated by reputable authorities such as the FCA or ASIC. These brokers typically offer better investor protection, lower fees, and a more transparent trading environment. Ultimately, conducting thorough research and due diligence is crucial when selecting a forex broker to ensure the safety of your investments. Therefore, potential clients should be cautious and vigilant when assessing whether Royal is safe for their trading activities.

Is Royal a scam, or is it legit?

The latest exposure and evaluation content of Royal brokers.

Royal Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Royal latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.