Is Trade Principal safe?

Pros

Cons

Is Trade Principal Safe or a Scam?

Introduction

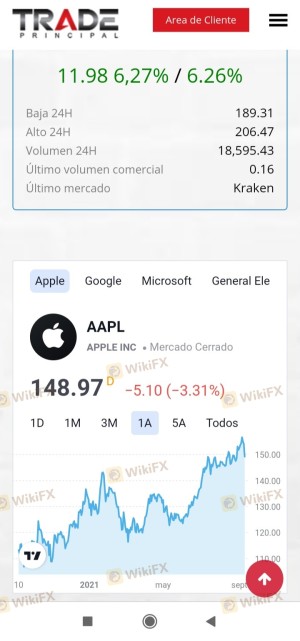

Trade Principal is an online forex and CFD broker that positions itself as a platform catering to both novice and experienced traders. With a wide array of trading instruments, including currencies, commodities, and cryptocurrencies, it aims to attract a diverse clientele. However, as the online trading environment becomes increasingly saturated, it is crucial for traders to carefully evaluate the legitimacy and reliability of brokers like Trade Principal. The potential for scams in the forex market is significant, making it essential for investors to conduct thorough due diligence before committing their funds. This article aims to provide an objective assessment of Trade Principal, utilizing various sources and evaluations to determine whether it is safe or a scam.

Regulation and Legitimacy

The regulatory status of a broker is one of the most critical factors in assessing its legitimacy. A well-regulated broker is typically subject to strict oversight, ensuring that it adheres to high standards of conduct. In the case of Trade Principal, it claims to operate under Trade Principal Ltd, based in Saint Vincent and the Grenadines. However, upon further investigation, it becomes evident that Trade Principal is not regulated by any recognized financial authority.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation raises significant concerns about the safety of funds and the overall trading environment provided by Trade Principal. Regulatory bodies such as the FCA, ASIC, and CySEC have not issued any licenses to this broker, which is a crucial red flag for potential investors. The lack of oversight means that traders have little recourse if issues arise, such as withdrawal problems or disputes over trading conditions.

Company Background Investigation

Trade Principal's company background is equally troubling. The broker claims to be registered in Saint Vincent and the Grenadines, a jurisdiction known for its lax regulatory framework, which often attracts unlicensed brokers. The lack of transparency regarding its ownership structure is also concerning. There is no clear information about the individuals behind Trade Principal, making it difficult for traders to assess the credibility of the management team.

The company has not provided any substantial details regarding its history or development, which further diminishes its trustworthiness. Transparency is crucial in the financial sector; without it, potential clients are left in the dark about the broker's operations, financial health, and overall intentions. This absence of information leads to the conclusion that Trade Principal may not be a safe option for traders looking to invest their money.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions it offers is vital. Trade Principal presents various account types, including Bronze, Silver, and Gold accounts, each requiring substantial minimum deposits ranging from $1,000 to $10,000. This fee structure is not uncommon in the industry, but the lack of competitive advantages raises questions about the value offered.

| Fee Type | Trade Principal | Industry Average |

|---|---|---|

| Spread on Major Currency Pairs | Variable (not disclosed) | 1-2 pips |

| Commission Structure | N/A | Varies widely |

| Overnight Interest Range | Not specified | 0.5% - 1% |

The lack of clarity regarding spreads and fees suggests that there may be hidden costs associated with trading on this platform. Additionally, the absence of a transparent commission structure further complicates the evaluation of its trading conditions. Traders should be wary of any broker that does not clearly disclose its fee structure, as this could indicate potential for exploitation.

Client Fund Security

The security of client funds is paramount when considering whether a broker is safe. Trade Principal claims to implement various security measures; however, the lack of regulatory oversight raises serious concerns about the effectiveness of these measures. The broker does not provide information on whether it employs segregated accounts for client funds or any investor protection schemes.

Historically, unregulated brokers have been known to mishandle client funds, leading to significant losses for traders. Without proper oversight, there is no guarantee that funds deposited with Trade Principal are secure. The absence of transparency regarding how client funds are managed is a significant risk factor that potential investors should consider.

Customer Experience and Complaints

Customer feedback is another critical aspect of evaluating a broker's reliability. A review of user experiences with Trade Principal reveals a pattern of complaints, primarily centered around difficulties in withdrawing funds. Many users report being unable to access their money, leading to frustration and distrust.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Customer Support | Medium | Inconsistent |

| Misleading Promotions | High | Ignored |

Several complaints highlight that clients have been pressured to deposit more funds without being allowed to withdraw existing balances. This behavior is often indicative of a scam, where brokers aim to keep clients trapped within their system. The overall lack of responsiveness from Trade Principal regarding these issues further exacerbates concerns about its legitimacy.

Platform and Execution

The trading platform offered by Trade Principal has been described as user-friendly, but its stability and execution quality remain in question. Traders have reported instances of slippage and order rejections, which can significantly impact trading outcomes.

The absence of a reputable trading platform, such as MetaTrader 4 or 5, is a downside, as these platforms are industry standards known for their reliability and functionality. Moreover, any signs of platform manipulation, such as unusual price movements or execution delays, should raise red flags for traders.

Risk Assessment

Using Trade Principal presents several risks that potential traders must acknowledge.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases exposure to fraud. |

| Withdrawal Risk | High | Numerous complaints about withdrawal issues. |

| Transparency Risk | Medium | Lack of information about ownership and operations. |

| Trading Condition Risk | Medium | Unclear fee structure and potential hidden costs. |

To mitigate these risks, traders should consider using regulated brokers, as they offer a safer trading environment and recourse in case of disputes.

Conclusion and Recommendations

In conclusion, the evidence suggests that Trade Principal is not a safe option for traders. The absence of regulation, poor customer feedback, and a lack of transparency all point towards a potentially fraudulent operation. It is advisable for traders to exercise extreme caution and consider alternative brokers that are well-regulated and have a proven track record of reliability.

For those seeking safer trading options, consider brokers regulated by top-tier authorities such as the FCA or ASIC. These brokers not only provide a secure trading environment but also offer clear information about their fees and conditions, ensuring a more transparent trading experience. Always prioritize safety and due diligence to protect your investments in the volatile world of forex trading.

Is Trade Principal a scam, or is it legit?

The latest exposure and evaluation content of Trade Principal brokers.

Trade Principal Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Trade Principal latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.