Regarding the legitimacy of Aronex forex brokers, it provides SERC and WikiBit, (also has a graphic survey regarding security).

Is Aronex safe?

Pros

Cons

Is Aronex markets regulated?

The regulatory license is the strongest proof.

SERC Derivatives Trading License (EP)

Securities and Exchange Regulator of Cambodia

Securities and Exchange Regulator of Cambodia

Current Status:

RevokedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

ARONEX Co., Ltd.

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

No.22, Street 78, Sangkat Tonle Basac, Khan Chamkarmorn, Phnom PenhPhone Number of Licensed Institution:

093 353 554Licensed Institution Certified Documents:

Is Aronex Safe or Scam?

Introduction

Aronex Corporation is a forex broker that positions itself as an educational service provider within the foreign exchange market. Established in Cambodia with operational offices in Seychelles, Aronex claims to offer a wide range of trading products and services. However, the forex market is notorious for its lack of regulation and the presence of unscrupulous brokers, making it imperative for traders to carefully assess the legitimacy and safety of their chosen broker. This article investigates whether Aronex is a scam or a safe trading option by examining its regulatory status, company background, trading conditions, customer fund security, user experiences, and overall risk profile.

Regulation and Legitimacy

One of the most critical aspects of evaluating any forex broker is its regulatory status. Regulation serves as a protective measure for traders, ensuring that brokers adhere to certain standards of conduct and financial practices. Aronex operates under a license from the Seychelles Financial Services Authority (FSA), a third-tier regulatory body. While it is technically regulated, the oversight provided by such authorities is often minimal, raising concerns about the broker's accountability.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| Seychelles FSA | Not disclosed | Seychelles | Active |

The quality of regulation is paramount, as brokers with low-tier licenses often lack stringent oversight, making them more susceptible to unethical practices. The history of Aronex's compliance remains unclear, with limited information available regarding its operational conduct and adherence to regulatory guidelines. This lack of transparency raises significant red flags, leading to questions about whether Aronex is genuinely safe for traders.

Company Background Investigation

Aronex Corporation was established in Cambodia, with claims of providing robust trading solutions and educational resources to retail and institutional clients. However, the companys history and ownership structure are somewhat opaque. Limited information is available about the management team, which hinders the ability to assess their qualifications and experience in the financial industry.

The broker has been noted for its lack of transparency, as essential details regarding its operations, including financial disclosures and compliance history, are not readily available to the public. This opacity is concerning, particularly for potential clients who are seeking a trustworthy broker. The inability to easily access information about the company's management and operational practices further complicates the evaluation of whether Aronex is a safe trading platform.

Trading Conditions Analysis

Aronex offers two primary account types: the Classic and the Privilege accounts, with a minimum deposit requirement of $200 for the Classic account and $10,000 for the Privilege account. However, the broker does not clearly disclose its fee structure, including spreads and commissions, which is a significant concern for potential traders.

| Fee Type | Aronex | Industry Average |

|---|---|---|

| Spread for Major Currency Pairs | Not disclosed | 1-2 pips |

| Commission Model | Not disclosed | 0-0.5% |

| Overnight Interest Range | Not disclosed | Varies |

The lack of transparency regarding trading costs can lead to unexpected expenses, which may deter traders from using the platform. Additionally, the absence of detailed information about any unusual or problematic fee policies raises questions about the broker's integrity. Traders should be cautious and consider these factors when evaluating whether Aronex is safe for their trading needs.

Customer Fund Security

The security of customer funds is a critical factor when determining the safety of a forex broker. Aronex claims to implement measures to protect client funds, but details on specific security protocols, such as fund segregation and investor protection schemes, are lacking.

While the broker may have some security measures in place, the absence of independent oversight and a clearly defined policy for negative balance protection raises concerns. Historical cases of fund mismanagement or disputes involving customer withdrawals further exacerbate these worries. Therefore, potential clients must weigh the risks associated with trading through Aronex, especially given the limited information available regarding its fund security measures.

Customer Experience and Complaints

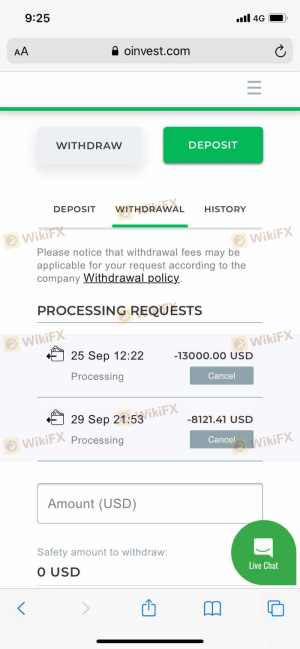

User feedback is an essential component of assessing a broker's reputation. Reviews of Aronex reveal a mix of experiences, with some users reporting difficulties in fund withdrawals and poor customer service. Common complaint patterns include delayed order execution and a lack of responsiveness from the support team.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Order Execution Delays | Medium | Fair |

| Customer Service Accessibility | High | Poor |

For instance, several users have reported being unable to withdraw their funds, citing technical difficulties as the company's response. Such patterns of complaints are alarming and suggest that Aronex may not prioritize customer satisfaction or transparency. This raises further doubts about whether Aronex is a safe and reliable trading platform.

Platform and Trade Execution

The trading platform offered by Aronex is primarily the MetaTrader 4 (MT4), a widely used platform in the forex industry. However, user experiences highlight concerns regarding the platform's performance, including stability issues and slippage during order execution.

Traders have reported instances of significant delays in order processing, with some experiencing slippage that adversely affects their trading outcomes. These execution problems could indicate potential manipulation or inefficiencies within the broker's trading infrastructure, which is a critical factor in assessing whether Aronex is safe to trade with.

Risk Assessment

Evaluating the overall risk associated with trading through Aronex is essential for potential clients. The following risk assessment summarizes key risk areas for traders considering this broker:

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Operates under low-tier regulation. |

| Financial Transparency | High | Limited information available on fees and operations. |

| Customer Service Reliability | Medium | Reports of poor response times and unresolved complaints. |

Given these factors, traders should approach Aronex with caution. It is advisable to consider risk mitigation strategies, such as starting with a small deposit or utilizing demo accounts to test the platform before committing significant capital.

Conclusion and Recommendations

In conclusion, the investigation into Aronex reveals several concerning factors that may indicate it is not a safe trading option. The broker's lack of robust regulation, opaque company background, unclear trading conditions, and mixed customer feedback collectively raise significant red flags. While Aronex may offer some educational resources and trading tools, the overall assessment suggests that potential traders should exercise caution.

For those seeking reliable forex trading options, it may be prudent to consider alternative brokers with higher regulatory standards and proven track records. Brokers with strong oversight, transparent fee structures, and positive customer feedback would be more suitable for traders looking for a safe and trustworthy trading environment.

Is Aronex a scam, or is it legit?

The latest exposure and evaluation content of Aronex brokers.

Aronex Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Aronex latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.