Regarding the legitimacy of RiseHill forex brokers, it provides HKGX and WikiBit, (also has a graphic survey regarding security).

Is RiseHill safe?

Pros

Cons

Is RiseHill markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

UnverifiedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

黃河控股集團有限公司

Effective Date:

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

香港上環德輔道中268號岑氏大廈15樓D室Phone Number of Licensed Institution:

37031548Licensed Institution Certified Documents:

Is Risehill Safe or Scam?

Introduction

Risehill is a forex broker based in Hong Kong, established in 2017, and primarily operates within the Asian trading market. As with any financial service provider, its crucial for traders to thoroughly evaluate the trustworthiness and reliability of brokers before committing their funds. The foreign exchange market is fraught with risks, and the presence of unscrupulous brokers can lead to significant financial losses. Therefore, traders must conduct due diligence to ensure they are engaging with a legitimate platform. This article investigates Risehill through various lenses, including regulatory compliance, company background, trading conditions, customer experiences, and risk assessment, to determine whether Risehill is safe or a potential scam.

Regulation and Legitimacy

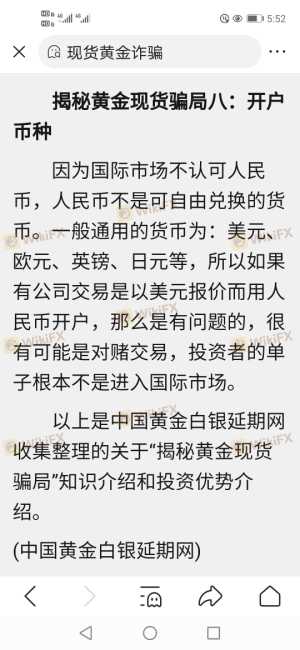

Regulation plays a pivotal role in safeguarding traders' interests and ensuring that brokers operate within legal frameworks. Risehill is purportedly regulated by the Chinese Gold & Silver Exchange Society (CGSE), but this regulation has been revoked. The lack of robust regulatory oversight raises concerns about the broker's legitimacy and operational practices. Below is a summary of the core regulatory information:

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CGSE | 196 | Hong Kong | Revoked |

The revocation of its license by CGSE is a significant red flag, suggesting that the broker may not adhere to industry standards or regulations. A regulated broker typically provides a layer of security for traders, ensuring that their funds are protected and that the broker operates transparently. The absence of a valid regulatory framework for Risehill amplifies the need for caution among potential investors, as it may indicate a higher risk of fraudulent activities.

Company Background Investigation

Risehill was founded in 2017, and its ownership structure is somewhat opaque, contributing to concerns regarding its transparency. The company operates under the name 晋峰 金银 业 有限 公司, but detailed information about its management team and operational history is limited. A reliable broker should provide clear information about its leadership and operational practices, as this builds trust with its clients.

The lack of transparency surrounding Risehill's ownership and management raises questions about its credibility. A broker with a well-established history and a clear ownership structure tends to inspire more confidence among traders. Given the limited information available, potential clients should be wary and consider this a risk factor when evaluating whether Risehill is safe for trading.

Trading Conditions Analysis

Understanding the trading conditions offered by a broker is essential for traders to make informed decisions. Risehill utilizes the MetaTrader 4 platform, which is widely recognized for its user-friendly interface and advanced trading tools. However, the overall fee structure and trading conditions are crucial indicators of a broker's reliability.

| Fee Type | Risehill | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

While the specific trading costs associated with Risehill are not detailed, it is vital for traders to be cautious of any unusual or hidden fees. Brokers that impose excessive charges or have non-standard commission structures may not have the best interests of their clients in mind. Traders should always compare any broker's fees against industry averages to ensure they are getting a fair deal. The lack of transparency regarding trading conditions at Risehill raises further concerns about whether Risehill is safe for traders.

Client Funds Security

The security of client funds is paramount when selecting a forex broker. Risehill claims to implement certain measures to protect client funds, but the specifics of these measures are not clearly outlined. A reputable broker typically segregates client funds from operational funds, ensuring that clients' money is safe even in the event of the broker facing financial difficulties.

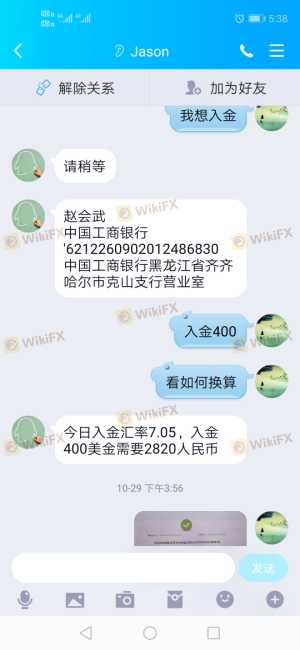

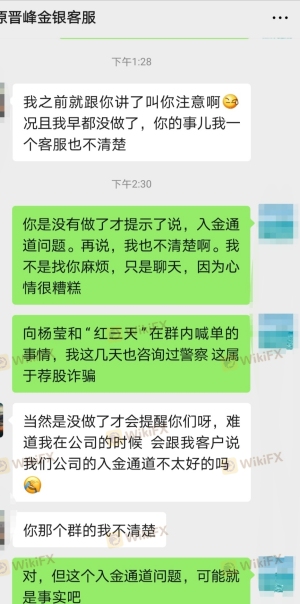

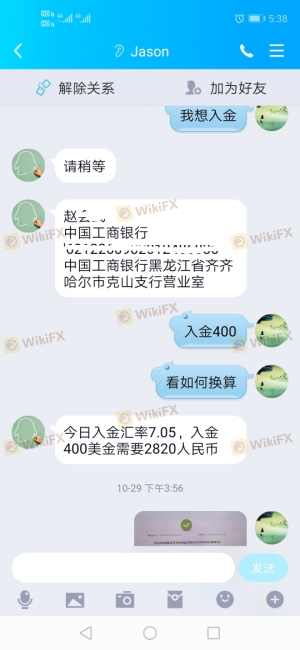

Additionally, investor protection policies, such as negative balance protection, are essential features that can safeguard traders from losing more than their initial investment. However, without clear disclosures regarding these policies, potential clients may find themselves at risk. Historical issues regarding the safety of funds can also be indicative of a broker's reliability. Reports of complaints and issues related to fund withdrawals at Risehill suggest that clients may face difficulties when trying to access their money. This uncertainty raises significant concerns about whether Risehill is safe for trading.

Customer Experience and Complaints

Customer feedback is a crucial component in assessing a broker's performance. Analysis of user experiences with Risehill reveals a pattern of complaints, particularly regarding withdrawals and customer service responsiveness. Many users have reported difficulties in withdrawing their funds, which is a significant red flag when evaluating a broker's trustworthiness.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Delays | Medium | Poor |

Two notable complaints include reports of users being unable to access their funds after multiple attempts and long wait times for customer service responses. These issues not only indicate a lack of effective support but also suggest that the broker may not prioritize customer satisfaction. The overall negative sentiment surrounding customer experiences with Risehill further raises the question of whether Risehill is safe and worth the risk for potential traders.

Platform and Trade Execution

The performance of a trading platform is critical for successful trading. Risehill offers the MetaTrader 4 platform, which is generally regarded as stable and reliable. However, the quality of order execution, including slippage and rejection rates, can significantly impact a trader's experience. If a broker frequently experiences slippage or rejects orders, it may indicate underlying issues with their trading infrastructure.

While specific metrics regarding execution quality at Risehill are not readily available, the absence of complaints related to platform manipulation or execution issues is a positive sign. Nonetheless, traders should remain vigilant and monitor their experiences closely. The overall performance of the platform, combined with the previously discussed concerns, leads to further scrutiny regarding whether Risehill is safe for trading.

Risk Assessment

Engaging with any forex broker involves inherent risks, and Risehill is no exception. Evaluating the overall risk associated with this broker is essential for potential investors.

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Revoked license raises concerns. |

| Fund Security Risk | High | Lack of transparency in fund protection measures. |

| Customer Service Risk | Medium | Reports of poor responsiveness and withdrawal issues. |

To mitigate these risks, traders should consider starting with a small investment, if they choose to engage with Risehill. Additionally, conducting thorough research and monitoring any changes in the broker's operational practices is advisable. Given the significant risks identified, traders should carefully weigh their options before deciding to trade with Risehill.

Conclusion and Recommendations

In conclusion, the evidence gathered raises substantial concerns about the safety and reliability of Risehill as a forex broker. The revoked regulatory status, lack of transparency in company operations, and numerous customer complaints suggest that traders should exercise extreme caution. While some users may have had positive experiences, the overall sentiment indicates that Risehill is not safe for trading.

For traders seeking reliable alternatives, it is advisable to consider well-regulated brokers with a proven track record of customer satisfaction and transparent operations. Brokers such as OANDA, IG, or Forex.com are examples of platforms that have established reputations and regulatory oversight, providing a safer trading environment. Ultimately, the decision to engage with any broker should be made with careful consideration of the associated risks and the broker's overall credibility.

Is RiseHill a scam, or is it legit?

The latest exposure and evaluation content of RiseHill brokers.

RiseHill Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RiseHill latest industry rating score is 1.62, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.62 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.