RiseHill 2025 In-Depth Review: Opportunity or Trap?

Executive Summary

RiseHill, a Hong Kong-based broker, operates in a challenging environment marked by a low trust rating of 1.60/10 on WikiFX, raised by numerous user complaints and a revoked regulatory status. Established in 2017, the broker primarily caters to new traders looking for low-cost trading options, often attracting individuals less concerned about regulatory compliance. However, the potential investor should weigh the risks: the absence of reliable regulatory oversight and increasing reports of withdrawal issues pose significant dangers for anyone considering engagement with this platform. Therefore, while RiseHill might appeal to inexperienced traders seeking affordable entry into the forex market, its associated risks make it a precarious choice for anyone with substantial capital at risk.

⚠️ Important Risk Advisory & Verification Steps

Risk Statement: Engaging with RiseHill poses considerable risk due to its low trust rating and multiple complaints regarding fund safety.

Potential Harms:

- Loss of funds: Investors may face challenges in withdrawing their funds.

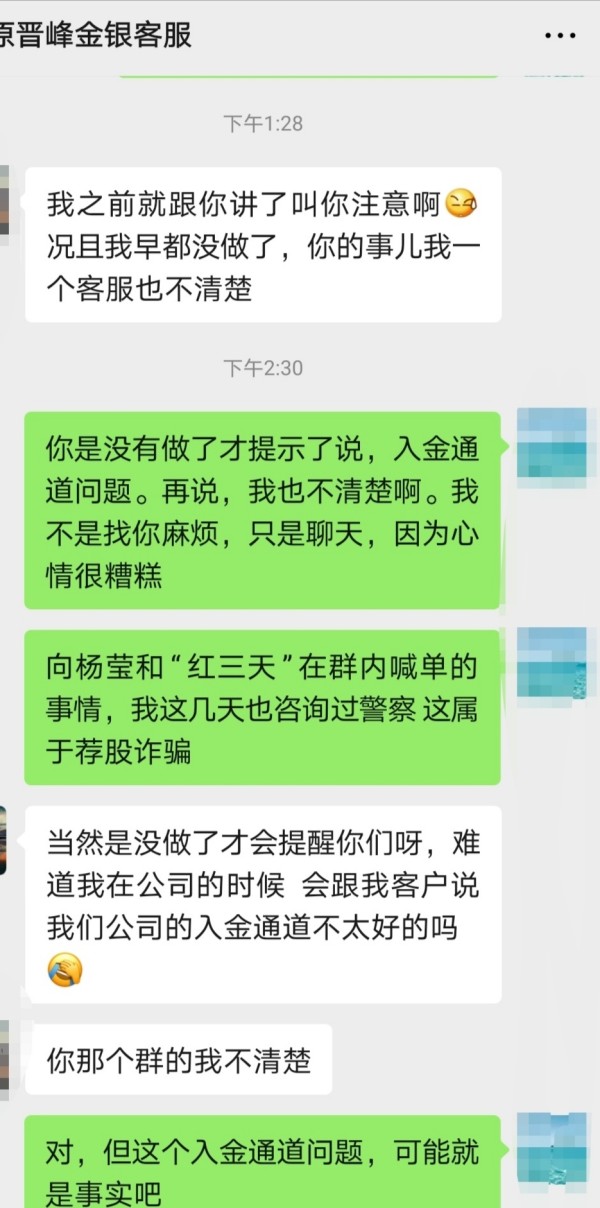

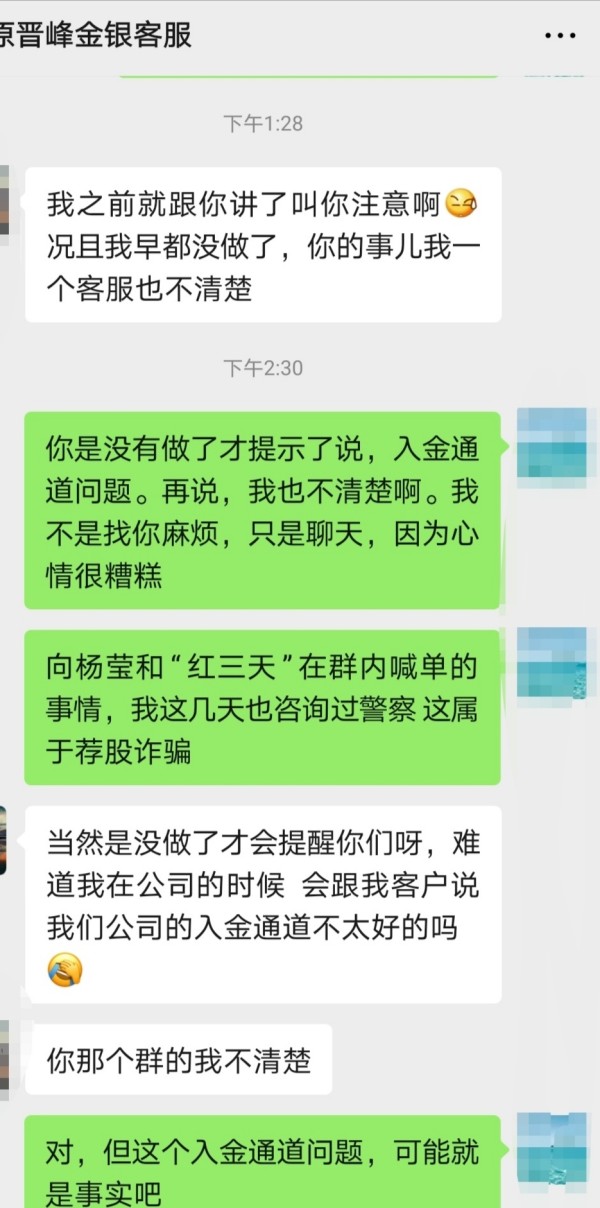

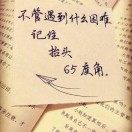

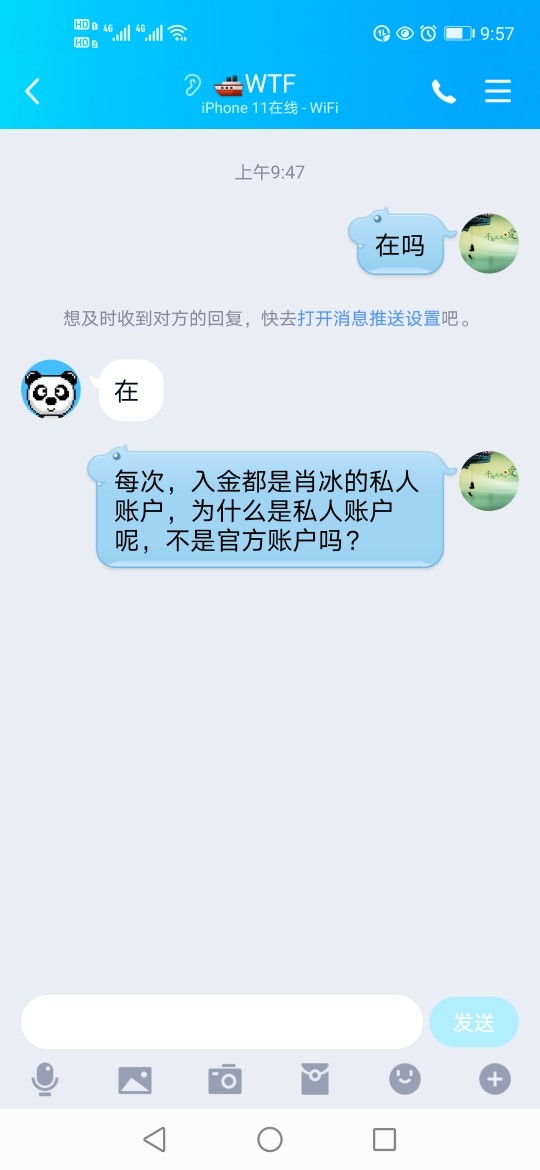

- Scams & Fraud: Incidents of deceitful practices have been reported by users, indicating a high level of operational risk.

How to Self-Verify:

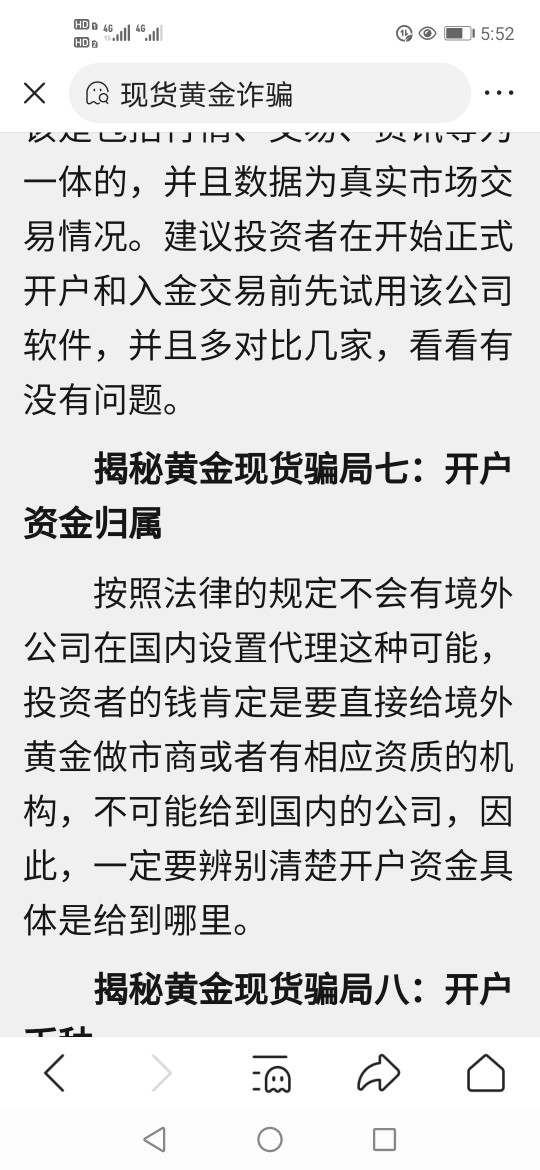

- Check their regulatory status using trusted financial bodies, such as the NFA or the FCA.

- Read user reviews on platforms like Reddit and WikiFX to understand other traders' experiences.

- Examine the broker's history to see any previous complaints against them.

Rating Framework

Broker Overview

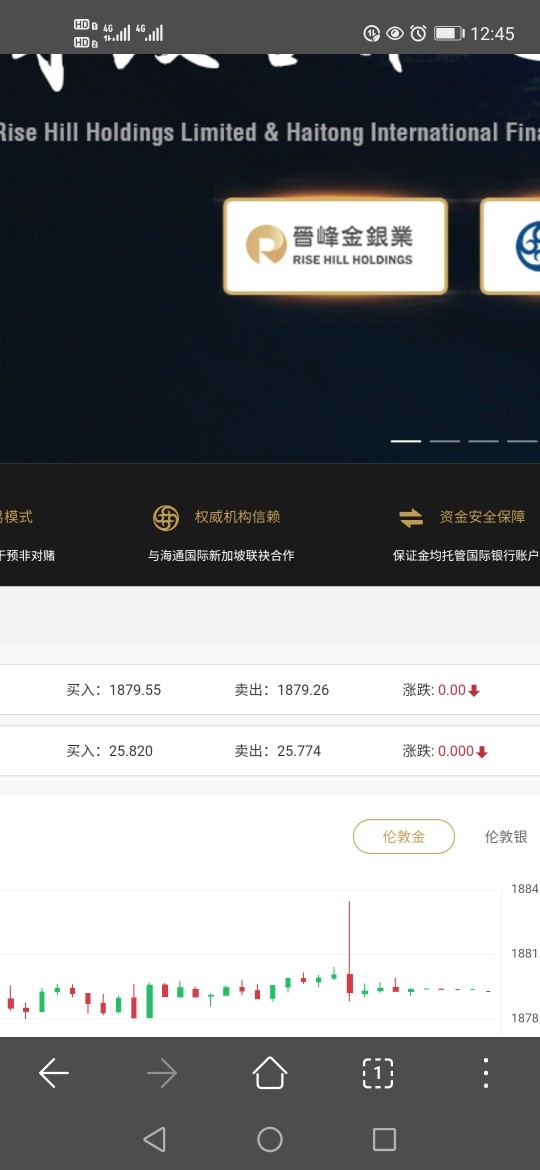

Company Background and Positioning

RiseHill was established in 2017 and is headquartered in Hong Kong. With its inception, RiseHill aimed to offer low-cost trading solutions, primarily targeting inexperienced traders. However, its recent operational developments, including a revoked regulatory status with the Hong Kong Gold Exchange (HK GX), mark it as a high-risk entity. The revocation raises serious concerns among potential investors regarding the broker's credibility and reliability in safeguarding user funds.

Core Business Overview

RiseHill offers a range of trading services, including forex trading, but notably lacks support for cryptocurrencies and algorithmic (EA) trading. This limited offering affects its appeal, especially compared to its competitors, who provide broader asset access and tools. Moreover, RiseHill's claims of regulatory compliance have been called into question due to its revoked status, further complicating its market positioning.

Quick-Look Details Table

In-Depth Analysis of Each Dimension

Trustworthiness Analysis

Navigating the world of online trading requires understanding the potential pitfalls, and with brokers like RiseHill, managing uncertainty becomes key.

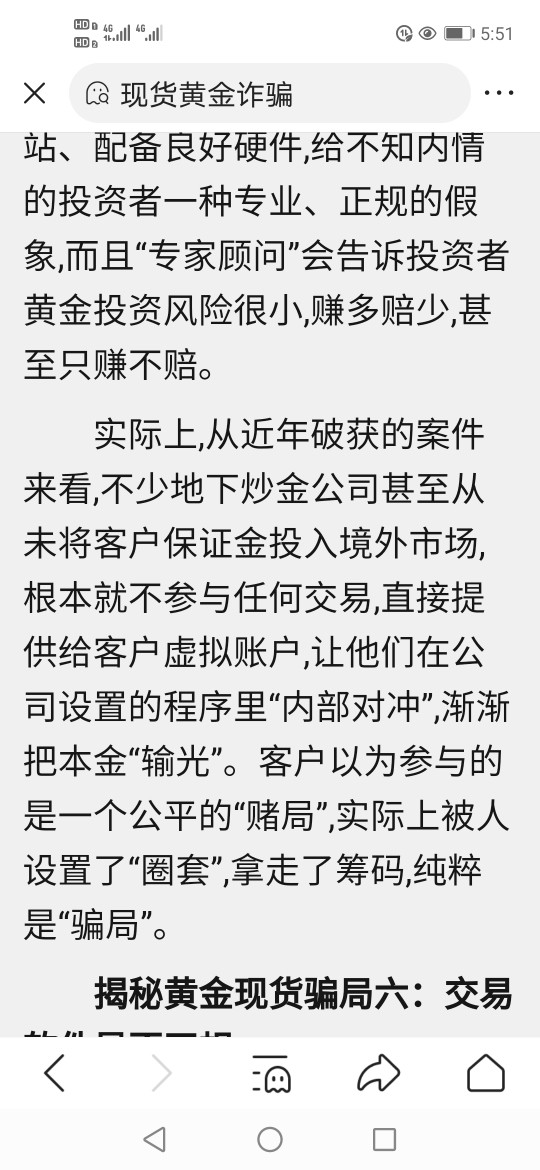

Discrepancies in regulatory information on RiseHill have raised alarm regarding user safety. The broker's revoked status amplifies this concern, indicating possible non-compliance with essential trading regulations. This absence of governance allows room for questionable practices that could jeopardize users' investments.

User Self-Verification Guide:

- Visit the WikiFX website: Input "RiseHill" to check for trust scores.

- Consult financial regulatory databases: Evaluate any historical licenses or actions against the broker.

- Review forums and discussions: Check for community experiences, especially regarding fund safety.

The industry reputation of RiseHill starkly contrasts with more reputable brokers. Feedback from traders largely emphasizes concerns over fund safety and withdrawal difficulties. User comments indicate a dire need for self-verification to navigate potential risks effectively.

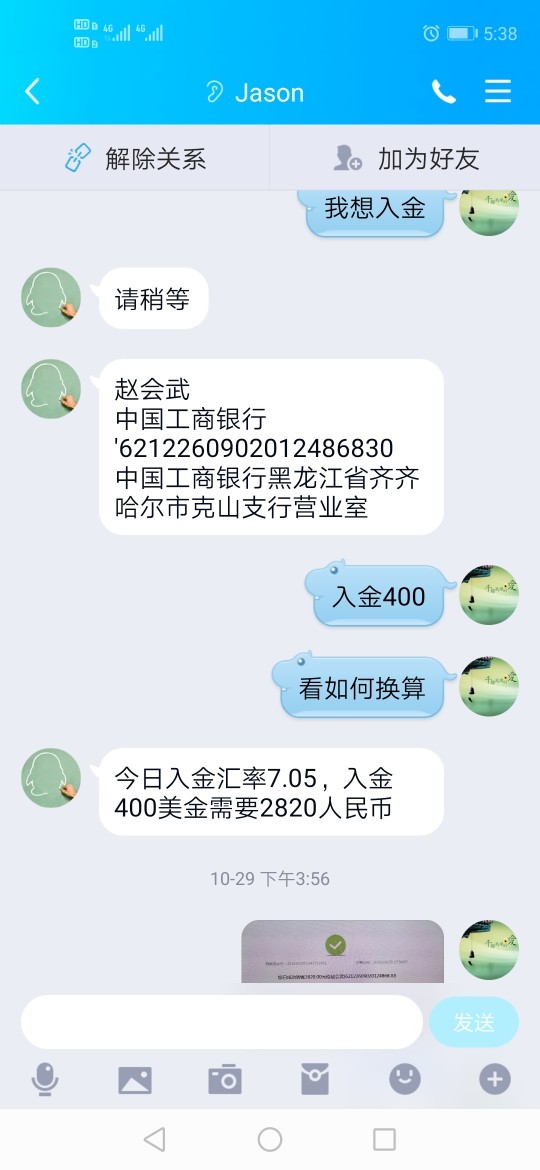

Trading Costs Analysis

The trading cost structure at RiseHill presents a dual-edged sword for traders.

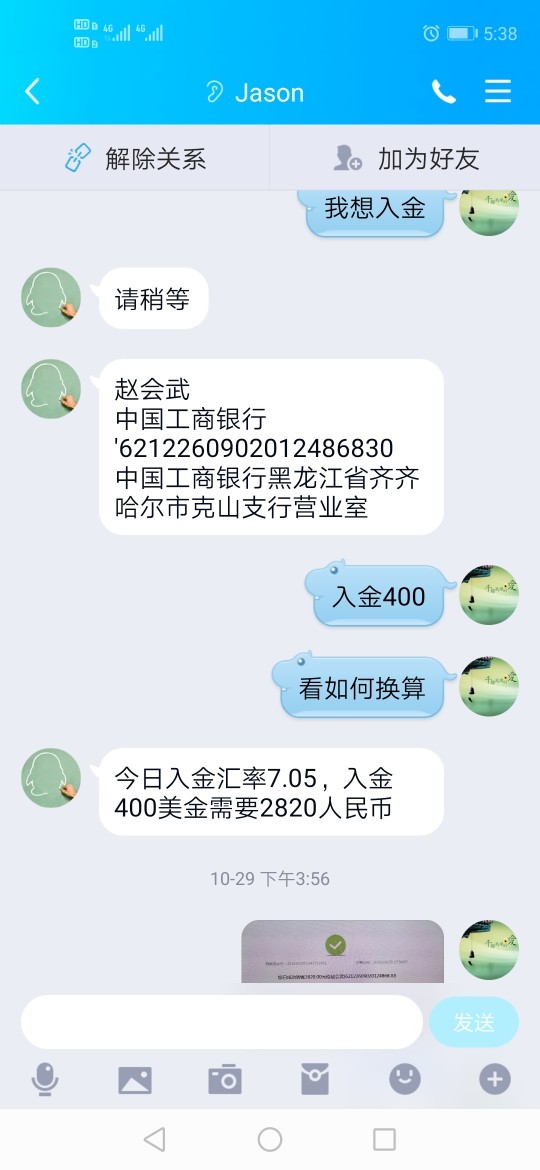

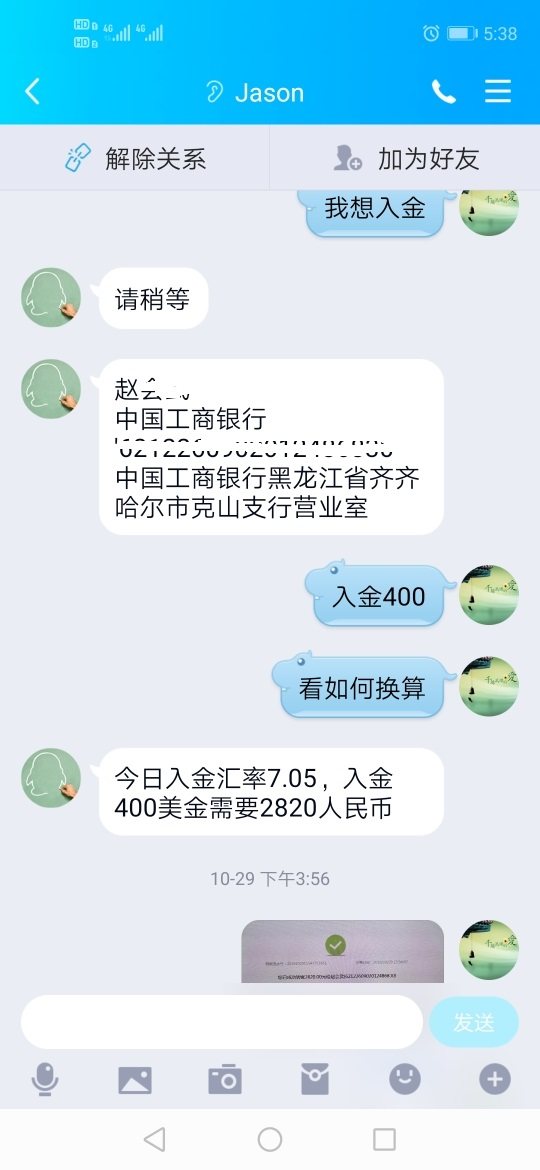

While the broker advertises low commissions, the hidden fees attached to withdrawals and other services are alarming. For instance, several users have reported high withdrawal fees, with one user noting a $30 fee being taken for cashing out, which significantly reduces overall trading profitability.

In summary, while the broker's appealing commission rates can attract new traders, the additional hidden costs pose serious disadvantages, making it unfit for traders seeking cost-effective conditions in the long run.

When assessing brokers like RiseHill, one must reconcile the tradeoff between professional depth and beginner-friendly interfaces.

RiseHill's primary platform features are modest, lacking advanced charting tools essential for serious traders. The absence of support for algorithmic trading (EA) further emphasizes the platform's limitations, alienating more advanced users who might seek an efficient trading environment.

User feedback has criticized the overall usability, with many expressing frustrations over the platform's operational complexities. A user remarked, "It's hard to find the right tools; the site is less than intuitive."

User Experience Analysis

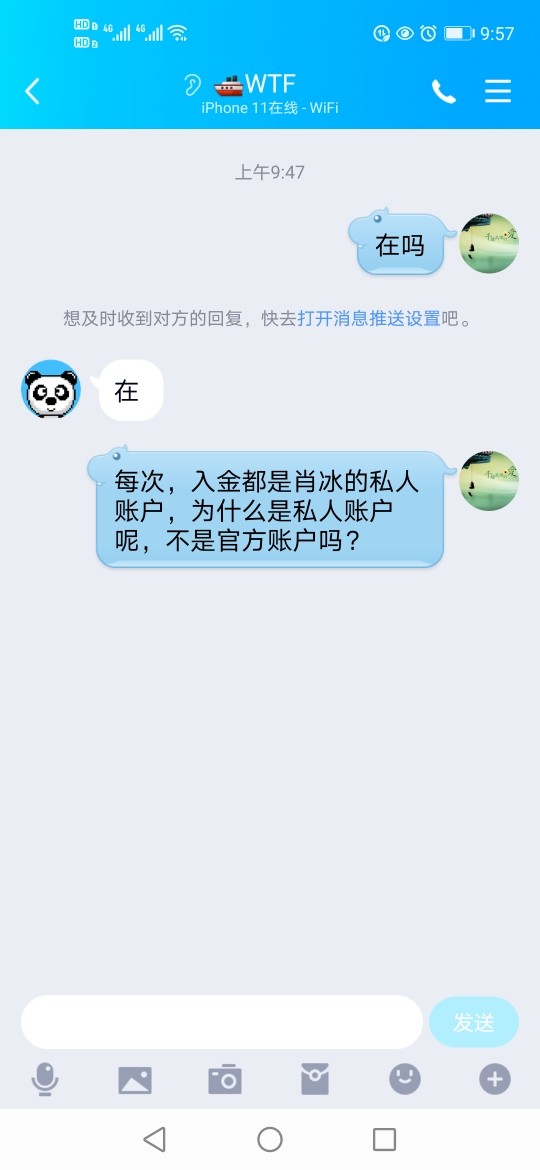

Examining the user experience at RiseHill reveals a collection of mixed feedback.

In light of multiple complaints concerning withdrawal issues, potential investors must tread with caution. Despite some users praising the low-cost offers, an overwhelming sentiment of discontent persists due to the platform's withdrawal challenges, pushing the user experience rating low.

Feedback about the broker's interface has been predominantly negative, with traders highlighting difficulties in navigation and withdrawal procedures. One review stated, "Getting my funds out has been a battle—it's frustrating and draining."

Customer Support Analysis

Reflecting on customer support at RiseHill raises considerable concerns for potential clients.

Feedback from users indicates a sluggish and often unresponsive support system. Many users express dissatisfaction with delayed responses or unhelpful assistance, further aggravating their trading experience.

Comments from the community have voiced significant dissatisfaction: "Trying to get help is like pulling teeth—they never respond in a timely manner."

Account Conditions Analysis

The account conditions at RiseHill present a perilous play for interested traders.

With vague information surrounding operational terms and conditions, plus an alarming withdrawal fee of $30, potential clients face a landscape where costs may outweigh benefits. Moreover, without clarity on minimum deposit requirements, potential investors may encounter unexpected hurdles.

User experiences validate these concerns, with traders voicing frustrations over the unclear account setup processes. The consensus highlights a collective feeling of being misled about what to expect.

Conclusion

In conclusion, while RiseHill markets itself as an attractive entry point for new traders seeking low-cost avenues, the associated risks, including a low trust rating, multiple user complaints, and a revoked license, paint a concerning picture. Prospective investors must conduct thorough research and self-verification before considering engaging with this broker. Ultimately, the financial safety and success of one's investments rely on choosing transparent and well-regulated trading platforms, which RiseHill currently does not represent.

Weighing the pros and cons, one must tread carefully within the investment landscape, particularly regarding brokers like RiseHill.