Is Richness Empire safe?

Business

License

Is Richness Empire Safe or Scam?

Introduction

Richness Empire, also known as Richness Forex, positions itself as an online trading brokerage that caters to forex and cryptocurrency traders. With the allure of high leverage and a wide array of trading instruments, it attracts a diverse audience, particularly those looking to capitalize on the forex market's volatility. However, the importance of conducting thorough due diligence before engaging with any forex broker cannot be overstated. A trader's financial security and investment success are heavily influenced by the broker's regulatory status, operational transparency, and customer service quality. This article aims to provide a comprehensive evaluation of Richness Empire by analyzing its regulatory compliance, company background, trading conditions, customer experiences, and overall safety. The investigation draws on various online sources, user reviews, and regulatory alerts to present an objective view of whether Richness Empire is safe for traders.

Regulation and Legitimacy

The regulatory status of a brokerage is crucial in determining its legitimacy and trustworthiness. Richness Empire claims to operate from the UK; however, it has been blacklisted by several regulatory authorities, including the UK's Financial Conduct Authority (FCA) and the Financial Markets Authority (FMA) in New Zealand. These warnings indicate that Richness Empire is not authorized to provide financial services, which raises significant concerns about its operations. Below is a summary of the key regulatory information regarding Richness Empire:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Blacklisted |

| FMA | N/A | New Zealand | Blacklisted |

The absence of a valid regulatory license is a major red flag. Regulatory bodies like the FCA impose strict guidelines to protect investors, including requirements for capital adequacy, transparency, and fair treatment of clients. Richness Empire's lack of regulation means that traders have little to no recourse in the event of disputes or financial losses. Furthermore, the broker's history of non-compliance raises additional concerns about its operational integrity. The combination of high leverage offerings (up to 1:1000) and unregulated status suggests that Richness Empire operates in a high-risk environment, making it imperative for traders to exercise caution.

Company Background Investigation

Richness Empire's company background reveals a lack of transparency that is concerning for potential investors. The broker is associated with Business Choice Partners Group Ltd, a company that appears to have no credible history or substantial presence in the financial services industry. Additionally, claims of affiliation with other entities, such as Sing United Trading Co. Ltd., lack verification and raise questions about the broker's legitimacy.

The management team behind Richness Empire is not publicly disclosed, further complicating the ability to assess the broker's credibility. A reputable broker typically provides detailed information about its ownership structure and management team, including their qualifications and experience in the financial markets. In the case of Richness Empire, the absence of such information suggests a lack of accountability and transparency, which are vital components of a trustworthy brokerage.

Overall, the company's obscure background, coupled with its dubious claims and lack of regulatory oversight, leads to the conclusion that Richness Empire is not a safe option for traders seeking a reliable trading partner.

Trading Conditions Analysis

When evaluating a broker's trading conditions, it is essential to consider the overall fee structure and any unusual policies that may affect traders' profitability. Richness Empire advertises competitive trading conditions, including high leverage and access to various trading instruments. However, the lack of transparency regarding fees and spreads raises concerns about potential hidden costs.

The following table summarizes the core trading costs associated with Richness Empire:

| Fee Type | Richness Empire | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips | 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | Varies | Varies |

The spreads offered by Richness Empire, particularly on major currency pairs, are notably higher than the industry average. This discrepancy could significantly impact traders' overall profitability, especially for those engaging in high-frequency trading. Moreover, the absence of a clear commission structure raises concerns about possible undisclosed fees that could be charged, further complicating the cost of trading with this broker.

Given these factors, potential investors should carefully assess whether the trading conditions at Richness Empire align with their trading strategies and risk tolerance. The elevated costs and unclear fee structures contribute to the overall impression that Richness Empire may not be a safe choice for traders looking for transparent and fair trading conditions.

Customer Fund Safety

The safety of customer funds is a paramount concern for any trader. Richness Empire's approach to fund security is questionable, as it lacks essential protections typically offered by regulated brokers. For instance, reputable brokers often implement segregated accounts to ensure that clients' funds are kept separate from the company's operational funds. However, there is no evidence that Richness Empire employs such measures.

Additionally, the broker does not provide information on investor protection schemes or negative balance protection policies, which are crucial for safeguarding traders from losing more than their initial investment. The absence of these safety nets increases the risk of significant financial losses, particularly in the volatile forex market.

Historically, unregulated brokers like Richness Empire have faced numerous allegations related to fund mismanagement and fraudulent activities. These issues further compound the risks associated with trading with such entities. Therefore, traders must consider the potential consequences of entrusting their funds to Richness Empire, as the lack of robust safety measures suggests that their money may not be secure.

Customer Experience and Complaints

Customer feedback is a valuable indicator of a broker's reliability and service quality. Reviews of Richness Empire reveal a pattern of negative experiences, with many users reporting difficulties in withdrawing funds and poor customer support. Common complaints include:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Lack of Communication | Medium | Poor |

| High Pressure Sales Tactics | High | Poor |

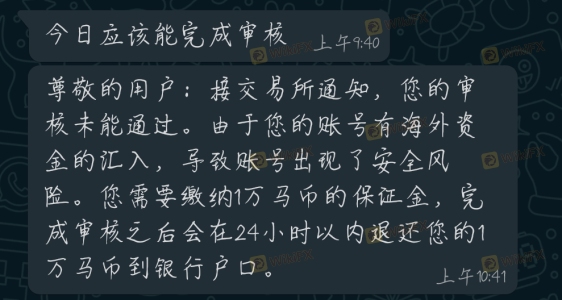

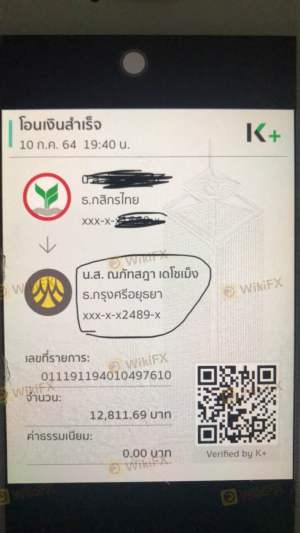

Many users have expressed frustration over the broker's reluctance to process withdrawal requests, often citing excessive delays and unresponsive customer service. In some cases, traders reported being pressured to deposit more funds before they could access their existing balances, a tactic commonly employed by fraudulent brokers.

For example, one user recounted their experience of requesting a withdrawal only to be met with repeated delays and requests for additional documentation. After several weeks of waiting, they were ultimately unable to access their funds. Such experiences highlight the significant risks associated with trading with Richness Empire and underscore the need for potential investors to exercise caution.

Platform and Trade Execution

The trading platform offered by Richness Empire is another critical factor in assessing its safety. While the broker claims to provide access to the widely used MetaTrader 5 (MT5) platform, user reviews suggest that the platform's performance is inconsistent. Traders have reported issues with order execution, including slippage and rejections, which can adversely affect trading outcomes.

Additionally, there are concerns regarding the potential for platform manipulation, a common issue with unregulated brokers. Traders have reported instances where their trades were executed at unfavorable prices or where the platform appeared to freeze during critical market movements, leading to significant losses.

Given these factors, the overall user experience on the Richness Empire platform raises red flags. Traders should be wary of the potential for execution issues and platform instability, as these factors can severely impact trading performance and profitability.

Risk Assessment

Engaging with Richness Empire comes with a range of risks that potential investors should carefully consider. The following risk assessment summarizes the key areas of concern:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation, high potential for fraud. |

| Financial Risk | High | Lack of fund protection and high leverage. |

| Operational Risk | Medium | Issues with platform stability and execution. |

| Customer Service Risk | High | Poor response to complaints and withdrawal issues. |

To mitigate these risks, traders are advised to conduct thorough research before engaging with Richness Empire. Seeking out regulated brokers with transparent practices and robust customer support can help ensure a safer trading experience.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Richness Empire is not a safe broker. The combination of its unregulated status, opaque fee structures, negative customer experiences, and questionable fund safety measures raises serious concerns. Traders should approach this broker with extreme caution, as the potential for financial loss is significant.

For those seeking safer alternatives, it is advisable to consider brokers that are well-regulated and have a proven track record of customer satisfaction. Options such as brokers regulated by the FCA or other reputable authorities can provide the necessary protections and transparency that Richness Empire lacks. Ultimately, the safety of your investments should always take precedence, and choosing the right broker is a critical step in achieving trading success.

Is Richness Empire a scam, or is it legit?

The latest exposure and evaluation content of Richness Empire brokers.

Richness Empire Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Richness Empire latest industry rating score is 1.54, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.54 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.