Is RC safe?

Business

License

Is RC Safe or Scam?

Introduction

RC Global Financial, commonly referred to as RC, has positioned itself in the foreign exchange market as a broker that promises attractive trading opportunities. Established in 2018 and registered in Belize, RC aims to cater to traders looking for a platform to engage in forex and CFD trading. However, the legitimacy and safety of this broker have come under scrutiny, prompting traders to exercise caution when considering their options. Given the prevalence of scams in the forex industry, it is crucial for traders to thoroughly evaluate brokers before committing their funds. This article investigates whether RC is a safe trading option or a potential scam by examining its regulatory status, company background, trading conditions, customer fund security, client experiences, platform performance, and overall risk assessment.

Regulation and Legitimacy

The regulatory status of a broker is a critical aspect that determines its legitimacy and safety. RC claims to hold a license from the International Financial Services Commission (IFSC) of Belize; however, the quality of this regulation is questionable. Offshore licenses, such as those from Belize, often lack the stringent oversight found in more reputable jurisdictions. Below is a summary of RC's regulatory information:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| IFSC Belize | Unreleased | Belize | Not Verified |

The IFSC is known for its lenient regulatory framework, which raises concerns about the protection of client funds. Moreover, it has been reported that RC is in the process of surrendering its license, which further complicates its regulatory standing. A broker's lack of oversight from a recognized authority can lead to high-risk trading environments, as these firms may operate without accountability. The absence of a robust regulatory framework is a significant red flag for potential investors, indicating that they should approach trading with RC with extreme caution.

Company Background Investigation

RC Global Financial was founded in 2018, and its ownership structure remains somewhat opaque. The company operates under the name RC Global Financial Ltd., but detailed information about its management team and operational history is scarce. This lack of transparency raises concerns about the broker's credibility.

The management team's qualifications and experience are crucial in assessing a broker's reliability. However, due to the limited information available about RC, it is challenging to evaluate the expertise of its leadership. Transparency in business operations is essential for building trust with clients, and the absence of clear information regarding the company's ownership and management may deter potential traders.

Trading Conditions Analysis

Assessing the trading conditions offered by a broker is vital for understanding the overall cost of trading and the potential profitability for traders. RC's fee structure appears to be competitive, but there are concerns regarding hidden fees and unusual policies. Below is a comparison of key trading costs:

| Fee Type | RC Global Financial | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Variable | 1.0 - 2.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | High | Moderate |

While RC claims to offer competitive spreads, traders should be wary of potential hidden costs that may arise during trading. The absence of a commission model may seem attractive, but it could also indicate that the broker compensates for this through wider spreads or additional fees. Traders are advised to read the fine print and seek clarification on any ambiguous fee structures to fully understand the costs associated with trading on this platform.

Client Fund Security

The safety of client funds is paramount when evaluating a broker's trustworthiness. RC claims to implement various security measures to protect client funds, including segregated accounts and investor protection policies. However, the effectiveness of these measures is questionable, given the broker's regulatory status.

Segregated accounts are essential for ensuring that client funds are kept separate from the broker's operational funds, providing a layer of security in the event of financial difficulties. Additionally, investor protection measures can help safeguard traders' investments. However, the lack of oversight from a reputable regulatory authority raises concerns about the actual implementation of these security measures. Historical issues related to fund security or disputes can further complicate the assessment of a broker's reliability.

Customer Experience and Complaints

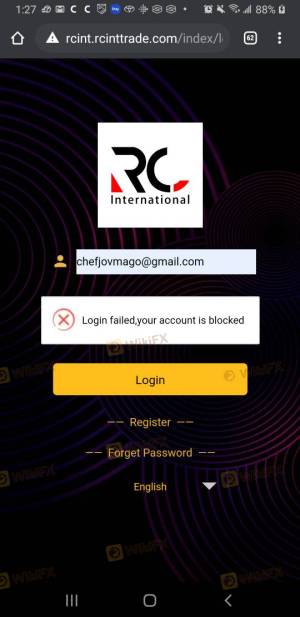

Analyzing customer feedback is crucial for understanding the overall experience of traders with a broker. Reports indicate that RC has received complaints regarding withdrawal issues and account freezes. Below is a summary of common complaint types:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Freezes | High | Poor |

One notable complaint involved a trader who reported being unable to withdraw funds after paying significant fees to "lift risks" associated with their account. Such experiences raise serious concerns about the broker's practices and customer service quality. The inability to access funds can lead to significant financial losses and frustration for traders, highlighting the importance of evaluating a broker's responsiveness and reliability.

Platform and Trade Execution

A broker's trading platform is a crucial factor in determining the overall trading experience. RC offers a trading platform that claims to be user-friendly, but the performance and stability of the platform have been questioned. Factors such as order execution quality, slippage, and rejection rates are essential for ensuring a smooth trading experience.

Traders have reported instances of slippage and order rejections, which can negatively impact trading outcomes. If a broker's platform exhibits signs of manipulation or poor execution, it can lead to significant losses. Therefore, potential traders should carefully assess the platform's performance and seek user reviews to gauge its reliability.

Risk Assessment

Using RC as a trading platform comes with inherent risks. Below is a risk assessment summary:

| Risk Category | Risk Level (Low/Medium/High) | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of proper oversight |

| Fund Security Risk | High | Uncertain security measures |

| Customer Service Risk | High | Poor response to complaints |

The high-risk levels associated with RC suggest that traders should exercise extreme caution when considering this broker. To mitigate risks, traders should consider using regulated brokers with established reputations and robust security measures.

Conclusion and Recommendations

In conclusion, the evidence suggests that RC Global Financial poses significant risks to traders. The lack of reputable regulation, opaque company background, questionable trading conditions, and poor customer feedback all contribute to the perception that RC may not be a safe trading option.

For traders seeking a reliable and secure trading experience, it is advisable to explore alternatives with strong regulatory oversight and positive customer reviews. Brokers regulated by authorities such as the FCA in the UK or ASIC in Australia are generally considered safer options. In light of the findings, it is prudent for traders to avoid RC and seek out more trustworthy alternatives in the forex market.

In summary, is RC safe? The overwhelming evidence points to a conclusion that traders should approach this broker with caution, if not outright avoidance.

Is RC a scam, or is it legit?

The latest exposure and evaluation content of RC brokers.

RC Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RC latest industry rating score is 1.58, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.58 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.