Is INTERGROUP safe?

Pros

Cons

Is Intergroup Safe or a Scam?

Introduction

Intergroup is a forex broker that has garnered attention in the trading community, primarily for its claims of offering a wide range of trading instruments and favorable trading conditions. However, as with any financial service, it is crucial for traders to conduct thorough due diligence before entrusting their money to any broker. The forex market is rife with scams and unregulated entities, making it essential for traders to be vigilant and discerning. This article aims to provide an objective analysis of Intergroup's safety and legitimacy based on regulatory status, company background, trading conditions, client safety measures, customer experiences, and overall risk assessment.

Regulation and Legitimacy

One of the most critical factors in determining whether a broker is safe is its regulatory status. A regulated broker is typically subject to stringent oversight, which helps protect clients from potential fraud. Unfortunately, Intergroup is not regulated by any top-tier financial authority, which raises significant red flags.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Unverified |

The absence of regulation means that Intergroup does not adhere to the same strict standards that regulated brokers must follow. This lack of oversight can lead to questionable practices, including unfair pricing and inadequate client protection. Furthermore, warnings have been issued by various financial authorities regarding unregulated brokers like Intergroup, advising traders to exercise caution. The quality of regulation is paramount; brokers regulated by top-tier authorities, such as the FCA (UK) or ASIC (Australia), provide a safer trading environment. In contrast, brokers operating under low-tier or no regulation expose clients to higher risks of fraud and financial loss.

Company Background Investigation

Intergroup claims to have a solid operational foundation; however, the lack of transparency surrounding its ownership and management raises concerns. The company appears to be registered in an offshore jurisdiction, which often lacks the rigorous regulatory frameworks found in more established financial centers. This offshore status can be a tactic employed by unscrupulous brokers to evade regulatory scrutiny.

The management teams background is also crucial in assessing the broker's credibility. A team with extensive experience in finance and trading can enhance a broker's reliability. Unfortunately, detailed information regarding the management team of Intergroup is scarce, and the company does not provide sufficient disclosures about its operations. This opacity can be a warning sign, as reputable brokers typically offer comprehensive information about their leadership and corporate structure.

Trading Conditions Analysis

When evaluating whether Intergroup is safe, it is vital to analyze its trading conditions. A broker's fee structure can significantly impact a trader's profitability. Intergroup promotes various account types with different minimum deposit requirements, but the specific costs associated with trading are not clearly outlined.

| Fee Type | Intergroup | Industry Average |

|---|---|---|

| Spread on Major Pairs | 1.6 pips | 1.0 - 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | High | Moderate |

The spreads offered by Intergroup are on the higher end of the spectrum, which could eat into traders' profits. Additionally, the lack of clarity about commission structures and other fees raises concerns about potential hidden costs. Traders should be wary of brokers that do not provide transparent information about their fees, as this can lead to unexpected charges and diminished returns.

Client Fund Safety

Another critical aspect of determining whether Intergroup is safe revolves around how it handles client funds. A trustworthy broker should have robust measures in place for the security of client deposits. This includes segregating client funds from the broker's operational funds and offering investor protection mechanisms.

Unfortunately, Intergroup does not provide clear information regarding its policies on fund safety. The absence of data on fund segregation and investor protection raises alarms about the potential risks involved in trading with them. Additionally, there have been reports of clients experiencing difficulties when attempting to withdraw their funds, which is a significant warning sign. Historical incidents involving unregulated brokers often show a pattern of delayed or denied withdrawals, leaving traders at risk of losing their investments.

Customer Experience and Complaints

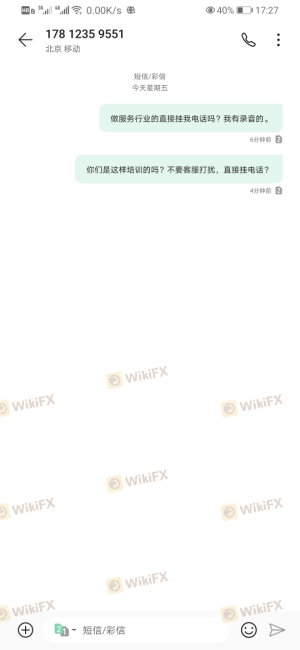

Customer feedback is an invaluable resource when assessing a broker's reliability. Reviews and testimonials from actual users can provide insights into the broker's service quality and responsiveness to issues. In the case of Intergroup, numerous complaints have surfaced, highlighting a range of issues.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Poor |

| Account Blocking | Medium | Poor |

| Misleading Marketing Practices | High | Poor |

Many users report difficulties in withdrawing their funds, with some claiming that their accounts were inexplicably blocked. The company's response to these complaints has been largely unsatisfactory, further eroding trust among its client base. Such patterns of negative feedback are indicative of a broker that may not prioritize customer service or ethical trading practices.

Platform and Trade Execution

The trading platform's performance is another crucial element in evaluating whether Intergroup is safe. A reliable platform should be stable, user-friendly, and capable of executing trades efficiently. However, reports suggest that Intergroup's platform suffers from technical issues, including slow execution speeds and occasional outages.

Moreover, the quality of order execution is paramount; traders require assurance that their orders will be filled at the expected prices. Instances of slippage and rejected orders can signal potential manipulation or inefficiencies within the trading system. Given the concerns surrounding Intergroup's platform, traders should be cautious and consider whether they can rely on the broker for consistent performance.

Risk Assessment

Engaging with any broker carries inherent risks, and understanding these risks is vital for traders. In the case of Intergroup, the overall risk profile appears concerning.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulation leads to potential fraud and misconduct. |

| Financial Risk | High | Lack of transparency regarding fees and fund safety. |

| Operational Risk | Medium | Technical issues with the trading platform affect reliability. |

To mitigate these risks, traders should consider using only regulated brokers with a proven track record of transparency and customer satisfaction. Conducting thorough research, reading reviews, and seeking recommendations can also help in identifying safer trading options.

Conclusion and Recommendations

In summary, the analysis indicates that Intergroup is not a safe broker. The absence of regulation, coupled with a lack of transparency, high fees, and negative customer feedback, suggests that traders should exercise extreme caution when considering this broker. While there may be some attractive features, the potential risks outweigh the benefits.

For traders seeking reliable alternatives, it is advisable to consider brokers regulated by top-tier authorities such as the FCA or ASIC. These brokers provide enhanced safety measures, transparent fee structures, and a commitment to ethical trading practices. Ultimately, prioritizing safety and regulatory compliance is essential for a successful trading experience.

Is INTERGROUP a scam, or is it legit?

The latest exposure and evaluation content of INTERGROUP brokers.

INTERGROUP Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

INTERGROUP latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.