Is RAC FX safe?

Business

License

Is Rac FX A Scam?

Introduction

Rac FX is a relatively new player in the forex trading market, claiming to offer a wide range of trading instruments and competitive trading conditions. Established in 2021, the broker purports to cater to a global audience, asserting a substantial trading volume and numerous active clients. However, the forex market is rife with unregulated brokers, making it crucial for traders to exercise caution when selecting a trading partner. Evaluating the credibility of a forex broker involves scrutinizing its regulatory status, company background, trading conditions, and customer feedback. This article aims to provide an objective assessment of Rac FX, utilizing data from various online reviews and regulatory sources.

Regulation and Legitimacy

Regulation is a critical factor in determining the safety and reliability of a forex broker. A regulated broker is subject to oversight by financial authorities, which helps protect traders' funds and ensures compliance with industry standards. In the case of Rac FX, it is essential to examine its regulatory status and the implications of being unregulated.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| FCA | N/A | UK | Not Registered |

Rac FX claims to operate from the UK, a region known for its stringent financial regulations enforced by the Financial Conduct Authority (FCA). However, a thorough search reveals that Rac FX is not listed in the FCA's registry, indicating that it operates without a legitimate license. This lack of regulation raises significant concerns regarding the safety of traders' funds. Unregulated brokers like Rac FX can engage in dubious practices, as they are not held accountable to any regulatory body. Therefore, it is prudent for potential clients to consider the risks associated with trading on an unregulated platform, as their funds may not be protected.

Company Background Investigation

Rac FX presents itself as a reputable broker with a strong market presence. However, a closer examination of its history and ownership structure reveals several red flags. The broker is registered as Rac FX Co., Ltd., with an address in London, but the lack of transparency regarding its ownership and management team is concerning.

The absence of publicly available information about the company's founders and their professional backgrounds raises questions about its credibility. In reputable financial firms, transparency and accountability are paramount, as they help build trust with clients. Unfortunately, Rac FX does not meet these standards, which could signal potential risks for traders. The company's claims of being a significant player in the forex market, with over 180,000 clients, lack substantiation, further clouding its legitimacy.

Trading Conditions Analysis

Understanding the trading conditions a broker offers is essential for determining its overall competitiveness and fairness. Rac FX claims to provide attractive trading conditions, including low spreads and high leverage. However, the absence of transparency regarding its fee structure raises concerns.

| Fee Type | Rac FX | Industry Average |

|---|---|---|

| Spread for Major Pairs | 0.0 - 1.8 pips | 1.0 - 2.0 pips |

| Commission Model | Varies | Standardized |

| Overnight Interest Range | Not Disclosed | 0.5 - 1.5% |

Rac FX offers spreads as low as 0.0 pips for its raw account, which may seem appealing. However, the lack of a clearly defined commission structure and the absence of information on overnight interest rates are concerning. Furthermore, the broker's maximum leverage of 1:500 significantly exceeds the regulatory limits imposed in many jurisdictions, which typically cap leverage at 1:30. While high leverage can amplify profits, it also increases the risk of substantial losses, particularly for inexperienced traders. This aggressive approach to leverage is a common tactic used by unregulated brokers to attract clients, but it often leads to devastating financial consequences.

Client Fund Security

The security of client funds is a paramount concern when evaluating a forex broker. Rac FX's claims regarding fund safety and segregation of client accounts are ambiguous at best. A legitimate broker is expected to maintain client funds in segregated accounts, ensuring that traders' money is protected in the event of the broker's insolvency.

Rac FX does not provide clear information about its fund security measures. The absence of investor protection schemes and guarantees raises significant concerns about the safety of clients' deposits. Furthermore, the lack of transparency surrounding the company's financial practices makes it difficult to ascertain whether client funds are being handled responsibly. Historical data and user complaints suggest that Rac FX has faced issues related to fund withdrawals, which is a major red flag for potential investors.

Customer Experience and Complaints

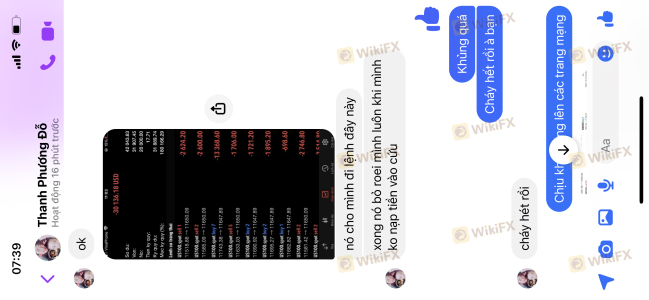

Analyzing customer feedback is crucial for assessing the overall reputation of a broker. Rac FX has garnered a mix of reviews from users, with many expressing dissatisfaction regarding their trading experiences. Common complaints include difficulty withdrawing funds, lack of responsive customer support, and aggressive sales tactics.

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support | Medium | Poor |

| Misleading Promotions | High | Unresponsive |

Several users have reported being unable to withdraw their funds after making deposits, with some citing excessive fees and delays as the primary issues. Additionally, the company's customer support has been criticized for being unresponsive and unhelpful when addressing concerns. These patterns of complaints indicate a troubling trend that potential clients should consider before engaging with Rac FX.

Platform and Trade Execution

The trading platform offered by Rac FX is another critical aspect of its service. The broker claims to provide access to the MetaTrader 5 (MT5) platform, which is well-regarded in the industry for its user-friendly interface and advanced trading features. However, users have reported difficulties accessing the platform and executing trades.

Issues related to order execution quality, including slippage and order rejections, have been noted by some users. These factors can significantly impact a trader's performance and profitability, making it essential to evaluate the reliability of the platform before committing funds. Furthermore, any signs of platform manipulation or irregularities in trade execution should raise concerns about the broker's integrity.

Risk Assessment

Using Rac FX carries inherent risks that potential traders must understand. The combination of its unregulated status, aggressive leverage offerings, and negative customer feedback contributes to a high-risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Fund Security Risk | High | Lack of fund segregation |

| Customer Service Risk | Medium | Poor response to complaints |

To mitigate these risks, traders should conduct thorough research before investing with Rac FX. It is advisable to start with a demo account, if available, to test the platform's functionality and assess the broker's responsiveness. Additionally, traders should consider diversifying their investments and only committing funds they can afford to lose.

Conclusion and Recommendations

In conclusion, the evidence strongly suggests that Rac FX operates as an unregulated broker, raising significant concerns about its legitimacy and the safety of client funds. The lack of regulatory oversight, coupled with a troubling history of customer complaints, indicates that traders should approach this broker with caution.

For those considering forex trading, it is advisable to seek out regulated brokers with a proven track record of reliability and trustworthiness. Alternatives may include reputable brokers that are licensed by recognized regulatory authorities, ensuring a higher level of protection for traders' investments. Ultimately, the question remains: Is Rac FX safe? Based on the available evidence, it is prudent to exercise extreme caution and consider other options for trading in the forex market.

Is RAC FX a scam, or is it legit?

The latest exposure and evaluation content of RAC FX brokers.

RAC FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

RAC FX latest industry rating score is 1.43, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.43 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.