Is Queeninv safe?

Business

License

Is Queeninv A Scam?

Introduction

Queeninv is a broker that offers trading services in the foreign exchange (forex) and contracts for difference (CFD) markets. As a relatively new player in the forex industry, it aims to attract traders with promises of competitive trading conditions and a user-friendly platform. However, the forex market is notoriously rife with scams and unregulated brokers, making it essential for traders to conduct thorough due diligence before committing their funds. This article aims to evaluate the safety and legitimacy of Queeninv by examining its regulatory status, company background, trading conditions, client experiences, and overall risk profile. The investigation is based on a review of various online resources, trader testimonials, and regulatory warnings.

Regulatory and Legitimacy

When assessing the safety of any forex broker, regulatory oversight is a crucial factor. Regulation provides a layer of protection for traders, ensuring that brokers adhere to certain operational standards and ethical practices. In the case of Queeninv, there are significant concerns regarding its regulatory status. The broker claims to operate under Bulgarian jurisdiction; however, no verifiable records exist indicating that it holds a valid license from any reputable regulatory authority. Furthermore, the Financial Market Supervisory Authority (FINMA) in Switzerland has flagged Queeninv, indicating potential issues with its operations.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FINMA | N/A | Switzerland | Flagged for warning |

| Bulgarian Authority | N/A | Bulgaria | No record found |

The absence of regulation is a major red flag for potential investors. Unregulated brokers often lack accountability and can engage in practices that jeopardize clients' funds. Without regulatory oversight, clients have little recourse in the event of disputes or fund mismanagement. It is vital for traders to be aware that engaging with an unregulated broker such as Queeninv poses a high risk to their investments.

Company Background Investigation

Queeninv is operated by Queeninv Group Ltd., but details about the company's history, ownership structure, and management team remain opaque. A lack of transparency is concerning, as it raises questions about the broker's legitimacy and the integrity of its operations. The absence of publicly available information about key personnel and their qualifications further compounds these concerns.

The company's website does not provide adequate details about its operational history or the experience of its management team, which is a common characteristic of potentially fraudulent brokers. A reliable broker typically offers clear information about its founders, management, and the company's journey in the financial industry. In Queeninv's case, the lack of such information is indicative of a potential scam.

Trading Conditions Analysis

Queeninv's trading conditions, including fees and spreads, are another critical aspect to evaluate. While the broker promotes competitive trading conditions, traders should be cautious of any hidden fees or unfavorable terms that may not be immediately apparent.

| Fee Type | Queeninv | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | TBD | TBD |

| Commission Model | TBD | TBD |

| Overnight Interest Range | TBD | TBD |

The lack of specific data regarding trading costs raises concerns about transparency. Traders may encounter unexpected charges that could erode their profits. Furthermore, unregulated brokers often have the flexibility to impose arbitrary fees, which can lead to significant financial losses for clients. Therefore, it is crucial for traders to thoroughly understand the fee structure before engaging with Queeninv.

Client Fund Security

The safety of client funds is paramount when choosing a forex broker. Reputable brokers typically implement measures such as segregated accounts, investor protection schemes, and negative balance protection to safeguard clients' investments. Unfortunately, there is limited information available regarding Queeninv's security measures.

Concerns have been raised about the lack of fund segregation and whether clients' funds are held in secure, separate accounts. Additionally, the absence of any investor protection schemes increases the risk for traders, as they may not be compensated in the event of the broker's insolvency. Historical complaints from users indicate that there have been issues with fund withdrawals, further highlighting the potential risks associated with trading with Queeninv.

Customer Experience and Complaints

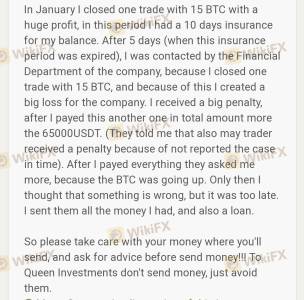

Analyzing customer feedback is essential in assessing a broker's reliability. Many reviews of Queeninv indicate a pattern of complaints regarding withdrawal issues and poor customer service. Traders have reported difficulties in accessing their funds, with some claiming that their withdrawal requests were ignored or delayed for extended periods.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Quality | Medium | Poor |

One notable case involved a trader who was initially able to withdraw funds but later faced significant challenges when attempting to access larger amounts. This kind of feedback raises serious concerns about the broker's operational integrity and the overall client experience. The repeated complaints about withdrawal issues suggest that potential traders should exercise extreme caution when considering Queeninv.

Platform and Execution

The trading platform offered by Queeninv is another critical component to evaluate. Traders expect reliable, stable, and user-friendly platforms for executing their trades. However, reports indicate that users have experienced issues with platform stability, including slippage and order rejections. Such problems can significantly impact trading performance and lead to frustration among users.

In addition, any signs of potential manipulation or unfair practices should be thoroughly investigated. Traders have expressed concerns regarding the execution quality of their orders, which is a critical aspect of any trading experience. A broker's willingness to address these issues transparently is essential for building trust with its clients.

Risk Assessment

Using an unregulated broker like Queeninv carries inherent risks. Traders must be aware of these risks and take appropriate measures to protect their investments.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulation |

| Fund Security Risk | High | Lack of protection |

| Withdrawal Risk | High | Complaints reported |

To mitigate these risks, it is advisable for traders to avoid investing significant amounts with unregulated brokers. Conducting thorough research and considering regulated alternatives can help safeguard investments and ensure a more secure trading experience.

Conclusion and Recommendations

In conclusion, the evidence suggests that Queeninv is not a safe option for traders. The lack of regulation, transparency, and numerous complaints regarding withdrawal issues raise significant red flags about the broker's legitimacy. Traders should exercise extreme caution when considering Queeninv and may want to seek out more reputable, regulated alternatives.

For those looking for reliable trading options, brokers regulated by top-tier authorities such as the FCA, ASIC, or FINRA are recommended. These brokers are subject to stringent oversight, providing a safer environment for trading. Ultimately, ensuring the safety of your investments should always be the top priority when selecting a forex broker.

Is Queeninv a scam, or is it legit?

The latest exposure and evaluation content of Queeninv brokers.

Queeninv Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Queeninv latest industry rating score is 1.51, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.51 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.