Is PXE safe?

Pros

Cons

Is PXE Safe or Scam?

Introduction

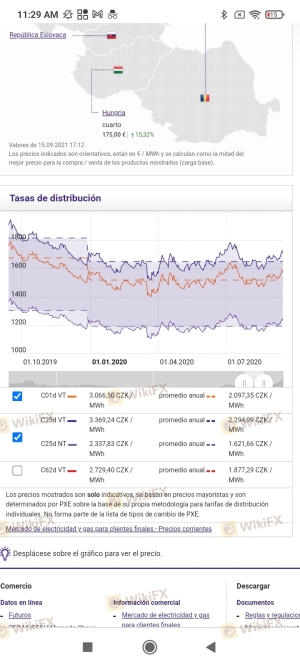

PXE, or Power Exchange Central Europe, is a forex broker established in 2019 and based in the Czech Republic. It aims to facilitate trading in various financial instruments, primarily targeting traders in Austria, France, South Korea, and Slovakia. However, the forex market is fraught with risks, and traders must exercise caution when selecting a broker. The potential for scams is significant, as many unregulated brokers operate without adequate oversight, which can lead to issues such as withdrawal problems and lack of customer support. In this article, we will investigate whether PXE is a safe option for traders or if it poses significant risks. Our assessment is based on various sources, including user reviews, regulatory information, and trading conditions.

Regulation and Legitimacy

One of the most critical factors in determining the safety of a forex broker is its regulatory status. Regulation ensures that brokers adhere to certain standards, providing a layer of protection for traders. Unfortunately, PXE has not been found to be regulated by any recognized financial authority. This lack of regulation raises serious concerns about its legitimacy and the safety of client funds.

| Regulatory Authority | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Not Verified |

The absence of regulation means that if issues arise, traders may have limited recourse. Licensed brokers are typically required to follow strict guidelines that protect clients, including maintaining segregated accounts and providing transparency in their operations. The lack of oversight for PXE suggests that it may not be a safe trading environment, making it essential for potential clients to consider these factors carefully.

Company Background Investigation

PXE was founded in 2019, and while it has had a relatively short operational history, it is essential to delve into its background. The company claims to offer a range of trading services, but the transparency surrounding its ownership structure and management team is lacking. Effective management is crucial for any broker, as experienced leaders can navigate the complexities of the forex market and provide valuable support to traders.

The management team‘s background and professional experience play a significant role in determining the broker's credibility. However, there is limited information available regarding the qualifications and history of PXE’s leadership. This lack of transparency can be a red flag, as it raises questions about the broker's accountability and operational integrity.

Trading Conditions Analysis

When evaluating a forex broker, understanding the trading conditions they offer is vital. PXE presents a range of trading fees and costs, but some of these may not align with industry standards. A clear and competitive fee structure is essential for traders to maximize their profits.

| Fee Type | PXE | Industry Average |

|---|---|---|

| Major Currency Pair Spread | Varies | 1.0 - 2.0 pips |

| Commission Model | N/A | $5 - $10 per lot |

| Overnight Interest Range | N/A | Varies |

The absence of clear commission structures and spread information can lead to unexpected costs for traders. Additionally, any unusual fees or hidden charges can significantly impact trading performance. Traders should be wary of brokers that do not provide transparent information regarding their fee structures.

Client Funds Security

The security of client funds is a paramount concern for any trader. PXE's lack of regulation raises significant questions about its measures to protect client assets. Effective brokers typically implement robust security protocols, including fund segregation, investor protection schemes, and negative balance protection policies.

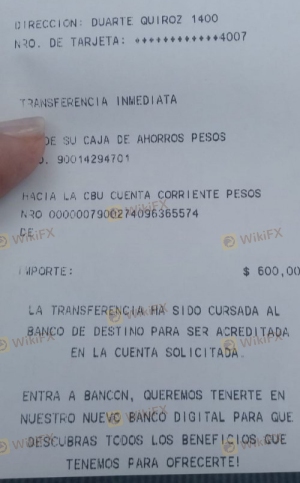

However, without regulatory oversight, it is unclear what measures PXE has in place to safeguard client funds. Historical issues related to fund security can also be indicative of a broker's reliability. Reports of clients experiencing difficulties in withdrawing funds raise alarms about the broker's commitment to ensuring the safety of their clients' investments.

Customer Experience and Complaints

Analyzing customer feedback is crucial in assessing the reliability of a broker. User experiences with PXE have been mixed, with several complaints surfacing regarding withdrawal issues and poor customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Support Delays | Medium | Poor |

| Platform Malfunctions | High | Inadequate |

A notable trend in complaints includes users reporting difficulties in withdrawing their funds, with some claiming that their accounts were frozen or that they faced unresponsive customer service. These issues can be detrimental to a trader's experience and raise concerns about the broker's operational integrity.

Platform and Execution

The trading platform is a critical component of a trader's experience. PXE's platform performance, stability, and user experience are essential factors to evaluate. Reports of slippage, order rejections, and other execution issues can indicate potential manipulation or inefficiencies within the broker's trading environment.

Traders should also be cautious of any signs of platform manipulation, as this can severely impact their trading outcomes. A thorough assessment of the platform's reliability and execution quality is necessary to ensure a positive trading experience.

Risk Assessment

Using PXE as a forex broker presents several risks that traders should be aware of. The lack of regulation, unclear trading conditions, and negative customer experiences contribute to a high-risk environment.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight |

| Financial Risk | High | Potential withdrawal issues |

| Operational Risk | Medium | Customer service and platform issues |

To mitigate these risks, traders should conduct thorough research before engaging with PXE. Seeking out regulated alternatives and maintaining a cautious approach can help protect investments.

Conclusion and Recommendations

In conclusion, the evidence suggests that PXE poses significant risks for potential traders. The lack of regulation, coupled with negative customer feedback and unclear trading conditions, raises red flags about its legitimacy.

Traders should exercise caution and consider alternative brokers that are regulated and have established reputations. Recommended alternatives include brokers that are overseen by top-tier financial regulators, ensuring a safer trading environment.

In summary, while PXE may offer trading opportunities, the risks associated with its unregulated status and customer complaints warrant a careful approach. Always prioritize safety and transparency when selecting a forex broker.

In this analysis, we have consistently highlighted the question: Is PXE safe? The answer, based on the available evidence, leans towards a cautious "no."

Is PXE a scam, or is it legit?

The latest exposure and evaluation content of PXE brokers.

PXE Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PXE latest industry rating score is 1.55, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.55 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.