PXE 2025 Review: Everything You Need to Know

Executive Summary

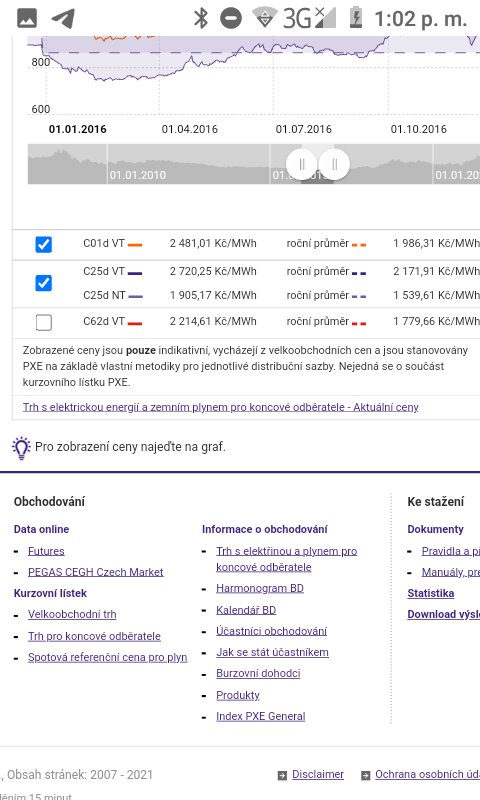

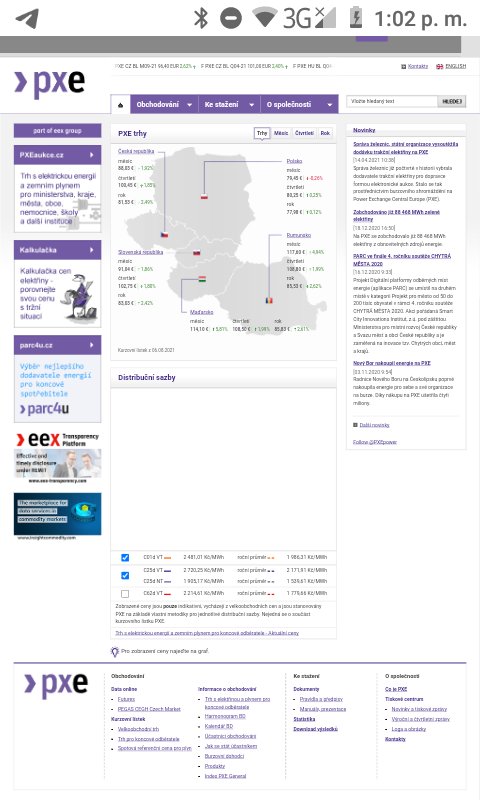

This pxe review gives traders a deep look at PXE as a trading platform for 2025. Our research shows big gaps in information about how this company works as a forex broker. PXE lacks the basic setup and rules that real financial companies need to have.

The information we found shows PXE connects to computer networks, not forex trading. Most search results talk about "Preboot Execution Environment" which helps computers start up over networks. This makes us worry that PXE is not a real forex broker.

We cannot find basic broker details like licenses, trading rules, or platform information. No trading services, customer reviews, or government oversight exist that we can check. This pxe review takes a negative view and tells traders to find other brokers that follow proper rules.

Important Notice

This review uses public information from 2025. Different companies in different places might use similar names, so this review only covers the PXE we researched. We judge brokers on rules they follow, trading conditions, platform reliability, and user feedback - areas where PXE fails badly.

Since we found no real information about PXE working as a forex broker, traders should be very careful. Any company using this name without proper licenses should be avoided.

Rating Framework

Based on our full analysis, here are the ratings for PXE across six key areas:

Broker Overview

Company Background and Establishment

We found no clear start date or company history for PXE as a forex broker. Search results only show technical computer uses, mainly the "Preboot Execution Environment" for network management. This big difference between what we expected and what we found makes us question if PXE is a real financial company.

Basic company details like founding date, main office location, or business registration are missing. Real brokers show clear company structures with easy-to-find information, regulatory filings, and business histories.

Business Model and Trading Infrastructure

The second big problem in this pxe review is that no trading setup exists that we can identify. Real forex brokers run complex platforms that support many types of assets and give clear details about how they execute trades. None of these parts seem to exist for PXE based on our research.

There is no proof of the technology needed for forex trading like trading servers, price feeds, or execution systems. Search results show GitLab repositories and technical documents about network booting systems instead. These have nothing to do with financial trading services.

Regulatory Status and Compliance: No regulatory information exists in our source materials. Real forex brokers must get licenses from recognized financial authorities like the FCA, ASIC, CySEC, or similar groups. The lack of any regulatory mentions is a major warning sign.

Deposit and Withdrawal Methods: Payment method details are not available in our materials. Standard brokers offer multiple funding options including bank transfers, credit cards, and e-wallets.

Minimum Deposit Requirements: Minimum deposit information does not appear in our source materials. Real brokers usually display this basic trading condition prominently.

Promotional Offers and Bonuses: No bonus or promotional information appears in available resources. While not required, most competitive brokers offer some form of trading incentives.

Available Trading Assets: The range of tradeable instruments is not detailed in source materials. Professional brokers usually offer forex pairs, commodities, indices, and sometimes cryptocurrencies or stocks.

Cost Structure and Fees: Detailed pricing information including spreads, commissions, and overnight fees is not available in our source materials. This pxe review cannot judge competitiveness without this important data.

Leverage Ratios: Maximum leverage information does not appear in available materials. Leverage limits are usually regulated and clearly stated by legitimate brokers.

Platform Options: No trading platform information exists in our source materials, despite this being fundamental to any brokerage operation.

Geographic Restrictions: Regional availability and restrictions are not specified in available documentation.

Customer Support Languages: Multi-language support information is not detailed in our source materials.

Detailed Rating Analysis

Account Conditions Analysis (Score: 2/10)

The account conditions check for PXE shows no standard brokerage account structures exist. Real forex brokers offer multiple account levels like micro, standard, and premium accounts with different features, minimum deposits, and trading conditions. Our research found no proof of any account types, trading specifications, or client signup processes for PXE.

Standard industry practice includes giving detailed information about account opening procedures, required documents for verification, and clear service terms. The lack of these basic elements suggests that PXE does not work as a normal forex broker. Without access to account comparison charts, fee structures, or minimum balance requirements, potential clients cannot make smart decisions about their trading setup.

The absence of special account features like Islamic accounts for Sharia-compliant trading, demo accounts for practice, or managed account options makes our concerns about PXE's legitimacy stronger. This pxe review must give a very low score due to the complete lack of account condition information we can verify.

Trading tools and educational resources are critical parts of any serious forex brokerage operation. Professional brokers spend heavily on giving clients market analysis, economic calendars, technical indicators, and automated trading capabilities. Our investigation into PXE's offerings shows a complete absence of these essential trading resources.

Established brokers provide comprehensive charting packages, real-time market data, news feeds, and research reports from professional analysts. Educational components usually include webinars, trading guides, video tutorials, and market commentary to help traders improve their skills. None of these resources appear to connect with PXE based on available information.

The lack of automated trading support like Expert Advisor compatibility or copy trading features makes PXE less appealing to modern traders who rely on algorithmic strategies. Without access to fundamental and technical analysis tools, traders would be severely limited in making informed trading decisions.

Customer Service and Support Analysis (Score: 1/10)

Customer service quality often separates professional brokers from questionable operators. Industry standards include multiple contact channels like live chat, telephone support, email assistance, and comprehensive FAQ sections. Our research found no evidence of customer support infrastructure connected with PXE as a forex broker.

Professional brokers offer 24/5 support during market hours with multilingual assistance for international clients. Response time benchmarks, escalation procedures, and dedicated account managers for larger accounts are standard features that appear to be entirely absent from PXE's operations.

The inability to locate customer service contact information, support ticket systems, or client communication channels raises serious concerns. Traders would have no way to resolve issues, seek assistance, or access their accounts if problems arise. This fundamental lack of support infrastructure makes PXE unsuitable for serious trading activities.

Trading Experience Analysis (Score: 1/10)

The trading experience includes platform stability, execution speed, order management capabilities, and overall user interface quality. Professional forex brokers invest significantly in robust trading infrastructure to ensure reliable order execution and minimal slippage during volatile market conditions.

Our pxe review found no evidence of trading platform availability through proprietary software, MetaTrader integration, or web-based interfaces. Without access to actual trading functionality, it becomes impossible to assess execution quality, platform stability, or mobile trading capabilities that modern traders expect.

Key performance indicators like average execution speeds, requote frequencies, and platform uptime statistics are typically published by legitimate brokers. These show their technological capabilities. The complete absence of such data, combined with no identifiable trading platform, results in the lowest possible score for trading experience.

Trust and Security Analysis (Score: 1/10)

Trust and security form the foundation of any legitimate financial services relationship. Regulated forex brokers must comply with strict capital adequacy requirements, maintain segregated client funds, and submit to regular regulatory audits. Our investigation found no evidence of regulatory oversight or security measures associated with PXE.

Legitimate brokers hold licenses from recognized financial authorities and participate in compensation schemes that protect client funds. They also implement advanced security protocols including SSL encryption, two-factor authentication, and secure fund storage practices.

The absence of regulatory registration numbers, compliance statements, or security certifications represents a critical risk factor for potential clients. Without proper regulatory oversight, traders have no recourse if disputes arise or if the entity fails to honor withdrawal requests.

User Experience Analysis (Score: 1/10)

User experience evaluation typically covers website design, account registration processes, platform navigation, and overall client satisfaction metrics. Professional brokers invest in user-friendly interfaces that make smooth onboarding and efficient trading workflows possible.

Based on available information, no user-facing trading interface or client portal connects with PXE as a forex broker. The absence of user testimonials, satisfaction surveys, or community feedback further indicates a lack of active client base or trading operations.

Standard user experience features include intuitive platform design, efficient order placement procedures, clear account management tools, and responsive customer interfaces across desktop and mobile devices. The complete absence of these elements results in the minimum possible score for user experience evaluation.

Conclusion

This comprehensive pxe review concludes with significant concerns about the entity's legitimacy as a forex broker. The complete absence of standard brokerage infrastructure, regulatory oversight, trading platforms, and customer support systems suggests that PXE does not operate as a conventional financial services provider.

Based on our analysis, PXE appears unsuitable for any category of trader, whether beginner or experienced. The lack of verifiable trading conditions, regulatory protection, and operational transparency creates unacceptable risks for potential clients. Traders seeking reliable forex services should consider established, properly regulated brokers with transparent operations and proven track records.

The primary recommendation from this evaluation is to avoid PXE entirely. Instead, focus on brokers with clear regulatory standing, comprehensive trading infrastructure, and verifiable client support systems.