Is Pulse Markets safe?

Pros

Cons

Is Pulse Markets Safe or Scam?

Introduction

Pulse Markets is a financial services provider that has positioned itself within the forex trading arena, offering a range of services aimed at both retail and institutional clients. As with any financial entity, especially in the volatile world of forex trading, it is crucial for traders to conduct thorough due diligence before engaging with a broker. The potential for fraud and mismanagement in this sector is significant, making it vital for traders to evaluate the legitimacy and reliability of their chosen broker. In this article, we will explore the safety of Pulse Markets by examining its regulatory status, company background, trading conditions, customer experience, and risk factors, ultimately answering the question: Is Pulse Markets safe?

Regulation and Legitimacy

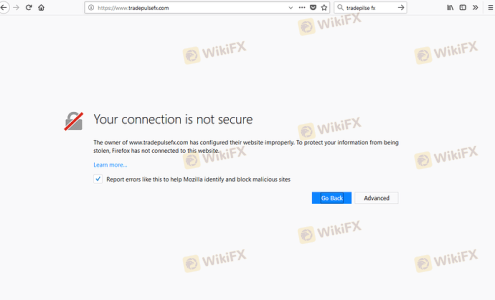

The regulatory environment is a fundamental aspect of any financial service provider's credibility. Pulse Markets claims to operate under certain regulatory frameworks; however, a closer look reveals significant gaps in its regulatory compliance. The absence of a robust regulatory license raises red flags about the safety of trading with this broker.

| Regulatory Body | License Number | Regulated Area | Verification Status |

|---|---|---|---|

| N/A | N/A | N/A | Not Verified |

The lack of valid regulatory information indicates that Pulse Markets may not be subject to the stringent oversight typical of reputable brokers. This absence of regulation is concerning, as it means that traders may not have the same protections as they would with a regulated broker. The lack of oversight can lead to potential malpractice and unethical practices, making it imperative for traders to be cautious. Is Pulse Markets safe? The answer leans towards skepticism, given the absence of regulatory backing.

Company Background Investigation

Pulse Markets was founded in 2001 and has since evolved into a diversified financial services operation. The company specializes in corporate advisory, derivatives, and wealth management, targeting sophisticated investors and institutional clients. Despite its longevity, the company's transparency regarding its ownership structure and management team remains questionable.

The management team at Pulse Markets consists of individuals with varying degrees of experience in the financial sector, but specific qualifications and backgrounds are not readily available. This lack of transparency raises concerns about the firm's commitment to ethical practices and investor protection. Furthermore, the company's history has been marred by allegations of questionable practices, which further complicates its credibility.

In summary, while Pulse Markets has been operational for over two decades, its lack of transparency and regulatory oversight leads to a cautious assessment regarding its safety. Is Pulse Markets safe? The evidence suggests that potential investors should proceed with caution.

Trading Conditions Analysis

When assessing the safety of a broker like Pulse Markets, it is essential to understand its trading conditions. The broker offers a variety of trading instruments, but the overall fee structure appears to be less competitive compared to industry standards.

| Fee Type | Pulse Markets | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.0 pips | 1.5 pips |

| Commission Model | Variable | Fixed/Variable |

| Overnight Interest Range | 2.5% | 1.0% |

The spreads offered by Pulse Markets are notably higher than the industry average, which can eat into traders' profits and raises questions about the broker's overall cost-effectiveness. Additionally, the commission structure lacks clarity, making it difficult for traders to ascertain the total costs associated with trading.

Overall, the trading conditions at Pulse Markets may not be conducive to a positive trading experience, further fueling concerns about its safety. Is Pulse Markets safe? Given the unfavorable trading conditions, traders may want to consider other options.

Customer Funds Security

The security of customer funds is paramount in assessing any broker's safety. Pulse Markets claims to implement measures for safeguarding client funds, but the specifics are vague and lack detail. Without robust information on fund segregation, investor protection schemes, or negative balance protection policies, traders may find themselves at risk.

Historically, brokers that lack transparency in their fund security measures have faced issues with client withdrawals and fund mismanagement. Without a clear outline of how Pulse Markets handles customer funds, it poses a significant risk to traders.

In conclusion, the safety of customer funds with Pulse Markets remains uncertain. Is Pulse Markets safe? The lack of transparency and detailed security measures suggests that traders should be wary before investing their capital.

Customer Experience and Complaints

Customer feedback is a crucial indicator of a broker's reliability. Pulse Markets has received a mixed bag of reviews, with numerous complaints regarding withdrawal issues and poor customer service. Common complaints include account blocking, delayed withdrawals, and inadequate responses from customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Account Blocking | Medium | Slow |

| Poor Customer Support | High | Inconsistent |

Several users have reported that their accounts were blocked after attempting to withdraw funds, leading to frustration and financial loss. The company's slow response to these issues raises further concerns about its commitment to customer service.

One notable case involved a trader who was unable to access funds after repeated attempts to withdraw, ultimately leading to a significant financial loss. Such experiences highlight the risks associated with trading through Pulse Markets.

In light of these complaints, it is clear that customer experience with Pulse Markets is far from satisfactory. Is Pulse Markets safe? Given the severity of the complaints and the company's lackluster response, potential traders should be cautious.

Platform and Trade Execution

The performance of a trading platform is vital for a smooth trading experience. Pulse Markets offers a trading platform that has been described as functional but lacking in advanced features. Users have reported issues with order execution, including slippage and rejected orders, which can significantly impact trading outcomes.

The absence of robust trading tools and analytics may hinder traders' ability to make informed decisions. Furthermore, indications of potential platform manipulation have emerged, with some users claiming that their trades were not executed fairly.

In summary, while the platform may serve basic trading needs, the execution quality and overall user experience raise concerns about its safety. Is Pulse Markets safe? The evidence suggests that traders may face challenges that could jeopardize their trading success.

Risk Assessment

Engaging with Pulse Markets involves several risks that traders should carefully consider. The absence of regulation, unfavorable trading conditions, and poor customer feedback all contribute to a heightened risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Lack of oversight leads to potential malpractice. |

| Financial Risk | Medium | High spreads and fees can erode profits. |

| Customer Service Risk | High | Poor responsiveness can exacerbate issues. |

To mitigate these risks, traders are advised to conduct thorough research, consider starting with a small investment, and explore alternative brokers with better regulatory backing and customer reviews.

Conclusion and Recommendations

In conclusion, the evidence suggests that Pulse Markets may not be a safe choice for traders. The lack of regulatory oversight, unfavorable trading conditions, and a poor track record of customer service raise significant concerns.

For traders looking for reliable alternatives, consider brokers that are well-regulated, offer competitive trading conditions, and have a strong reputation for customer service. Brokers such as [insert recommended brokers] provide a safer trading environment and may better meet your trading needs.

Ultimately, it is crucial for traders to prioritize safety and conduct thorough research before committing to any broker. Is Pulse Markets safe? The current evidence indicates that it may be prudent to explore other options.

Is Pulse Markets a scam, or is it legit?

The latest exposure and evaluation content of Pulse Markets brokers.

Pulse Markets Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Pulse Markets latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.