Regarding the legitimacy of ProvidentTrade forex brokers, it provides FSCA and WikiBit, .

Is ProvidentTrade safe?

Business

License

Is ProvidentTrade markets regulated?

The regulatory license is the strongest proof.

FSCA Derivatives Trading License (EP)

Financial Sector Conduct Authority

Financial Sector Conduct Authority

Current Status:

UnverifiedLicense Type:

Derivatives Trading License (EP)

Licensed Entity:

Red Pine Capital (PTY) LTD

Effective Date:

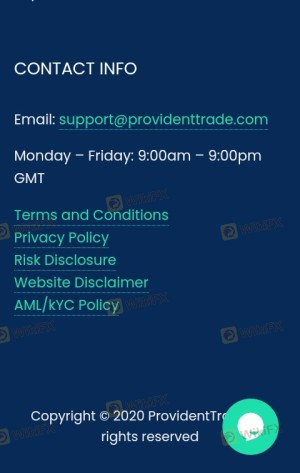

2015-12-08Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

FLOOR 9,ATRIUM ON 5TH5TH STREETSANDTON,GAUTENG2196Phone Number of Licensed Institution:

010 9003184Licensed Institution Certified Documents:

Is Provident Trade A Scam?

Introduction

Provident Trade has emerged as a notable player in the forex market, positioning itself as a South African broker that offers a variety of trading services. With the allure of high leverage and a user-friendly platform, it has attracted the attention of both novice and experienced traders. However, the forex market is rife with potential pitfalls, and traders must exercise caution when evaluating brokers. The importance of thorough due diligence cannot be overstated, as the consequences of engaging with an unreliable broker can be severe, including loss of funds and poor trading experiences. In this article, we will investigate whether Provident Trade is safe or a scam by examining its regulatory status, company background, trading conditions, client fund security, and customer experiences.

Regulation and Legitimacy

A broker's regulatory status is a critical factor in determining its legitimacy. Provident Trade claims to be regulated by the Financial Sector Conduct Authority (FSCA) in South Africa. This regulatory body is responsible for overseeing financial entities operating within the region, ensuring compliance with relevant laws and protecting consumer interests. However, the FSCA's regulatory framework is often considered weaker compared to other jurisdictions such as the UK or the EU, where stricter measures are in place to safeguard traders.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| FSCA | 46044 | South Africa | Verified |

While Provident Trade is listed under the FSCA, the lack of stringent oversight raises questions about its operational practices. Reports suggest that the broker may be exceeding its regulatory boundaries by offering services such as automated trading without proper authorization. Furthermore, the FSCA does not disclose the trading names of licensed firms, which complicates the verification process and raises concerns about potential clone firms operating under a similar guise. Overall, while Provident Trade does hold a license, the quality of regulation and the historical compliance of the company remain ambiguous.

Company Background Investigation

Provident Trade is operated by Red Pine Capital (Pty) Ltd, a company that has been linked to several other forex brands that have faced scrutiny and allegations of fraudulent practices. Established in 2015, the company is based in Johannesburg, South Africa. However, inconsistencies regarding its registered address have been noted, with some sources indicating that the actual location is in Gauteng, not Johannesburg as claimed on their website.

The management team‘s background is another area of concern. Limited information is available regarding the qualifications and professional experience of the individuals behind Provident Trade. This lack of transparency can be a red flag for potential investors, as a strong management team with relevant industry experience is crucial for the credibility of a trading platform. The absence of detailed disclosures about the company’s operations and its leadership further exacerbates the uncertainty surrounding its legitimacy.

Trading Conditions Analysis

When assessing whether Provident Trade is safe, it is essential to analyze its trading conditions. The broker offers a minimum deposit requirement of $50, which is relatively competitive in the industry. However, the maximum leverage is set at an astonishing 1:500, which is significantly higher than what is permitted by many reputable regulatory bodies. Such high leverage can amplify both gains and losses, posing a substantial risk to traders, especially those who are inexperienced.

| Fee Type | Provident Trade | Industry Average |

|---|---|---|

| Spread on Major Pairs | 0.4 - 1.5 pips | 0.1 - 0.5 pips |

| Commission Structure | None specified | Varies |

| Overnight Interest Range | Not disclosed | Varies |

The spread offered by Provident Trade is also not competitive compared to industry standards, which could indicate a profit-driven model that may not be in the best interest of traders. Furthermore, the lack of clarity regarding commissions and overnight interest rates raises concerns about hidden fees, which can erode traders' profits over time.

Client Fund Security

The safety of client funds is a paramount concern for any trader. Provident Trade claims to implement various measures to protect client assets, including segregated accounts and investor protection policies. However, the specifics of these measures are not clearly outlined on their website, leading to skepticism about their effectiveness.

The absence of a robust investor compensation scheme, similar to those provided by regulators in the EU or the UK, poses additional risks for traders. If the broker were to engage in fraudulent activities or become insolvent, traders might find themselves without recourse to recover their funds. Historical issues concerning fund safety have not been widely reported, but the lack of transparency is a significant concern that traders should consider.

Customer Experience and Complaints

Customer feedback is a vital indicator of a broker's reliability. Reviews of Provident Trade highlight a mixed bag of experiences, with some users praising the platform's interface and trading features, while others have voiced serious complaints regarding withdrawal delays and unresponsive customer support.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow response |

| Account Management Issues | Medium | Limited support |

| Lack of Transparency | High | No clear answers |

Several users have reported difficulties in withdrawing their funds, which is a common complaint among brokers with questionable practices. In some cases, clients have experienced significant delays, leading to frustration and loss of trust in the platform. These complaints should serve as a warning for potential traders considering whether Provident Trade is safe.

Platform and Execution

The trading platform offered by Provident Trade is based on the widely used MetaTrader 4 and 5, known for their user-friendly interface and comprehensive trading tools. However, the quality of order execution remains a critical consideration. Reports of slippage and rejected orders have been noted, which can significantly impact trading outcomes.

Additionally, there are concerns about potential platform manipulation, particularly given the high leverage and spreads offered. Traders should remain vigilant and conduct thorough testing before committing significant funds to the platform.

Risk Assessment

Using Provident Trade carries a range of risks that traders must acknowledge. From regulatory uncertainties to potential issues with fund security and customer service, the risk factors are notable.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Compliance | High | Weak oversight from FSCA |

| Fund Security | High | Lack of investor protection |

| Customer Support | Medium | Mixed feedback on responsiveness |

| Trading Conditions | High | High leverage and unclear fees |

To mitigate these risks, traders should consider starting with a small investment, conducting extensive research, and exploring alternative brokers with stronger regulatory oversight and better customer reviews.

Conclusion and Recommendations

In summary, the investigation into Provident Trade raises several concerns regarding its legitimacy and safety. While the broker is regulated by the FSCA, the quality of this regulation is questionable, and the companys history of association with other dubious brands further complicates its credibility. The high leverage, unclear fee structures, and mixed customer feedback indicate that traders should exercise caution.

For those considering trading with Provident Trade, it is advisable to weigh the risks carefully and perhaps explore more reputable alternatives. Brokers with stronger regulatory frameworks, transparent fee structures, and positive customer experiences may provide a safer trading environment. Ultimately, the key to successful trading lies in thorough research and informed decision-making.

Is ProvidentTrade a scam, or is it legit?

The latest exposure and evaluation content of ProvidentTrade brokers.

ProvidentTrade Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

ProvidentTrade latest industry rating score is 1.52, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.52 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.