Is Profit FX safe?

Business

License

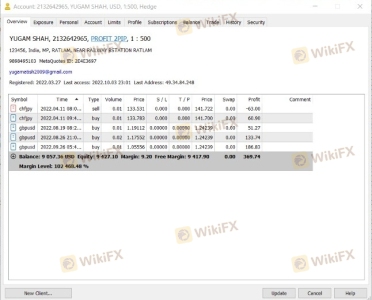

Is Profit Fx Safe or Scam?

Introduction

Profit Fx is a forex brokerage that has emerged in the crowded online trading landscape, claiming to offer a range of trading services, including forex, CFDs, and commodities. As with any financial service provider, it is crucial for traders to conduct thorough due diligence before committing their funds. The forex market is rife with both legitimate brokers and potential scams, making it essential for traders to evaluate the credibility and reliability of their chosen platform. This article aims to provide an objective analysis of Profit Fx, examining its regulatory status, company background, trading conditions, customer safety measures, and user experiences. The evaluation will be based on various sources, including user reviews, regulatory databases, and trading conditions, to offer a comprehensive understanding of whether Profit Fx is safe or if it poses significant risks to potential investors.

Regulation and Legitimacy

The regulatory status of a brokerage is a critical factor in determining its legitimacy and safety. Profit Fx currently operates without any valid regulatory oversight from major financial authorities, which raises significant concerns regarding its safety and trustworthiness. Regulation is designed to protect traders by ensuring that brokers adhere to strict operational standards and provide a level of security for client funds.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unregulated |

The absence of regulation means that Profit Fx is not subject to the same level of scrutiny and accountability as regulated brokers. This lack of oversight can lead to potential issues such as inadequate client fund protection, unfair trading practices, and limited avenues for dispute resolution. Traders must be aware that engaging with an unregulated broker significantly increases their risk of falling victim to fraud or mismanagement of funds. In summary, the lack of regulatory oversight is a strong indicator that Profit Fx may not be safe for trading.

Company Background Investigation

Profit Fx was founded in 2018 and claims to operate from the United Kingdom. However, the company lacks transparency regarding its ownership structure and management team. There is limited information available about the individuals behind the brokerage, which raises questions about accountability and trustworthiness. A reputable brokerage typically provides clear information about its founders, management team, and operational history, which helps build confidence among potential clients.

The company's address, listed as 71-75 Shelton Street, Covent Garden, London, is often associated with many unregulated entities and does not provide assurance of legitimacy. Moreover, Profit Fx has not established a track record of compliance or operational history that traders can rely on. The combination of these factors suggests that Profit Fx may not be a safe choice for traders seeking a reliable trading partner.

Trading Conditions Analysis

Profit Fx offers various trading conditions, including multiple account types, leverage options, and spreads. However, the overall fee structure and trading costs raise concerns. The broker's minimum deposit requirement starts at $100, which is relatively low compared to industry standards, but the spreads can be higher than average.

| Fee Type | Profit Fx | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 2.5 pips | 1.0 - 1.5 pips |

| Commission Model | No commission | Varies (0-10 USD per lot) |

| Overnight Interest Range | Not specified | Generally between 0.5% and 2% |

The spreads offered by Profit Fx, starting at 2.5 pips for major currency pairs, are significantly higher than the industry average, which may indicate that the broker is profiting at the expense of its clients. Additionally, the lack of transparency regarding overnight interest rates and other potential fees is concerning. Traders should be cautious of brokers that do not clearly disclose their fee structures, as this can lead to unexpected costs that erode profits. In light of these factors, it is essential for traders to consider whether Profit Fx is safe for their trading needs.

Client Fund Safety

The safety of client funds is paramount when evaluating any brokerage. Profit Fx does not provide sufficient information about its fund protection measures, such as segregated accounts or investor compensation schemes. Regulated brokers typically offer these protections to ensure that client funds are kept separate from the broker's operational funds, reducing the risk of loss in case of insolvency.

Moreover, there are no indications that Profit Fx has implemented negative balance protection, which is a critical feature for safeguarding traders from incurring debts beyond their initial investment. The absence of these safety measures raises significant concerns about the security of funds deposited with Profit Fx. Traders should approach this broker with caution, as the lack of robust fund protection mechanisms suggests that Profit Fx may not be safe for trading.

Customer Experience and Complaints

An analysis of customer feedback reveals a pattern of complaints regarding Profit Fx. Many users have reported difficulties with withdrawals, claiming that the broker delays or outright denies their requests. This is a common red flag in the forex industry, often indicating that a broker may be engaging in fraudulent practices.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal delays | High | Poor |

| Account management issues | Medium | Inconsistent |

| Unresponsive customer service | High | Poor |

A notable case involved a trader who reported waiting three weeks for a withdrawal to be processed, only to receive no funds. This type of complaint is alarming and raises serious questions about the operational integrity of Profit Fx. The overall sentiment among users suggests that Profit Fx is not safe, as many traders have experienced significant challenges in accessing their funds.

Platform and Trade Execution

Profit Fx utilizes the MetaTrader 5 (MT5) trading platform, which is widely regarded for its advanced features and user-friendly interface. However, the performance of the platform has been called into question by some users, who reported issues such as slippage and order rejections during high volatility periods.

The quality of order execution is a critical factor for traders, as delays or failures can lead to missed opportunities and financial losses. If a broker exhibits signs of manipulating prices or executing orders in a manner that disadvantages clients, it poses a significant risk to traders. Given the mixed reviews regarding Profit Fx's platform stability and execution quality, traders should be cautious and consider whether Profit Fx is safe for their trading activities.

Risk Assessment

Engaging with Profit Fx presents several risks that potential traders should be aware of. The absence of regulation, combined with a lack of transparency regarding fees and fund safety, creates a precarious trading environment.

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | No regulatory oversight increases the risk of fraud. |

| Fund Safety Risk | High | Lack of fund protection measures puts client money at risk. |

| Withdrawal Risk | High | Reports of delayed or denied withdrawals indicate potential fraud. |

| Execution Risk | Medium | Issues with order execution may lead to financial losses. |

To mitigate these risks, traders are advised to conduct thorough research, consider using regulated brokers, and remain vigilant regarding their account activities.

Conclusion and Recommendations

In conclusion, the evidence suggests that Profit Fx is not safe for traders. The lack of regulatory oversight, combined with numerous complaints regarding fund withdrawals and overall transparency, raises significant red flags. Traders should exercise extreme caution when considering this broker and explore regulated alternatives that provide greater security and accountability.

For those seeking reliable trading options, brokers such as IC Markets, IG, and Admiral Markets are recommended alternatives that offer robust regulatory protection and a more trustworthy trading environment. These brokers have established reputations and provide the necessary safeguards to protect client funds, making them safer choices in the forex market.

Is Profit FX a scam, or is it legit?

The latest exposure and evaluation content of Profit FX brokers.

Profit FX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Profit FX latest industry rating score is 1.49, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.49 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.