Is TRADESKA safe?

Business

License

Is Tradeska A Scam?

Introduction

Tradeska is a forex broker that positions itself as an STP (Straight Through Processing) trading platform, offering access to a variety of financial instruments, including forex, commodities, shares, indices, and cryptocurrencies. Established in 2021 and registered in the United Kingdom, Tradeska aims to attract traders with its high leverage options and a wide range of trading tools. However, the forex trading landscape is fraught with risks, and traders need to be cautious when selecting a broker. The importance of due diligence cannot be overstated, as the wrong choice can lead to significant financial losses.

In this article, we will conduct a comprehensive analysis of Tradeska, evaluating its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and overall risk. Our investigation will be based on data gathered from various credible sources, including reviews, regulatory filings, and user feedback.

Regulation and Legitimacy

One of the primary factors to consider when assessing the safety of a forex broker is its regulatory status. Regulation serves as a safeguard for traders, ensuring that brokers adhere to specific standards and practices that protect client funds and promote fair trading. Unfortunately, Tradeska is currently unregulated, which raises significant concerns about its legitimacy.

| Regulatory Body | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| NFA | 0549794 | United States | Unauthorized |

The National Futures Association (NFA) license held by Tradeska is unauthorized, indicating that it does not meet the necessary criteria for regulation. This lack of oversight is a major red flag for potential investors. A regulated broker typically provides a level of security and transparency that unregulated brokers lack, making it essential for traders to thoroughly evaluate the regulatory environment of any broker they consider.

Company Background Investigation

Tradeska Limited was incorporated in September 2021, and its registered office is located in London. The company claims to provide a range of financial services, but its brief operational history raises questions about its stability and reliability. The management teams experience and background are critical in assessing the broker's credibility. Unfortunately, detailed information about the management team is sparse, leaving potential clients in the dark about the expertise behind the broker.

Transparency is a crucial aspect of trustworthiness in the financial sector. Tradeska's lack of clear information regarding its ownership structure and management team further compounds concerns about its reliability. Without a solid foundation of credible leadership, traders may find it challenging to trust the broker with their capital.

Trading Conditions Analysis

When evaluating a broker, understanding the trading conditions is vital. Tradeska offers a minimum deposit of $500 and claims to provide high leverage of up to 1:500. While high leverage can amplify profits, it also increases the risk of significant losses, especially for inexperienced traders.

| Cost Type | Tradeska | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 0.00067 pips | 1.0 pips |

| Commission Model | None | Varies |

| Overnight Interest Range | Not Specified | Varies |

The spread offered by Tradeska appears to be competitive; however, the lack of transparency regarding commissions and overnight interest raises concerns. Traders should be aware of any hidden fees or costs that may not be immediately apparent. The absence of clear information can lead to unexpected charges, which is particularly concerning for those new to forex trading.

Customer Fund Safety

The safety of client funds is paramount when choosing a broker. Tradeska claims to implement various measures to protect client funds, including segregated accounts and risk management protocols. However, the absence of regulation casts doubt on the effectiveness of these measures.

Traders should look for brokers that offer investor protection schemes, which can provide additional security in the event of broker insolvency. Tradeska's lack of such assurances is a significant drawback. Historical incidents involving unregulated brokers often reveal that clients can face challenges in recovering their funds, especially in cases of fraud or mismanagement.

Customer Experience and Complaints

User feedback is a valuable resource for assessing a broker's reliability. Many traders have reported negative experiences with Tradeska, citing issues such as difficulties in withdrawing funds and poor customer service. Common complaint patterns include:

| Complaint Type | Severity | Company Response |

|---|---|---|

| Withdrawal Issues | High | Slow response |

| Customer Support | Medium | Limited availability |

| Transparency Issues | High | No clear information |

For instance, one user reported a significant delay in fund withdrawals, which is a common concern among traders dealing with unregulated brokers. Such experiences highlight the potential risks associated with trading through Tradeska, reinforcing the need for caution.

Platform and Execution

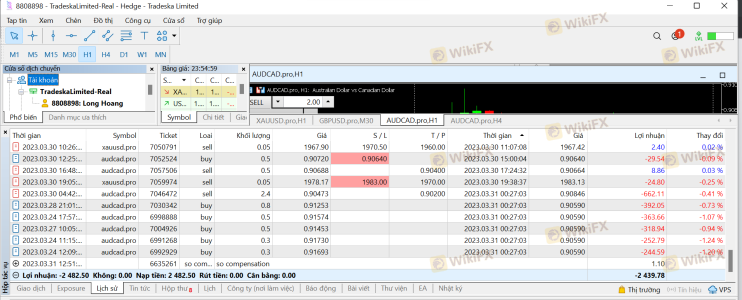

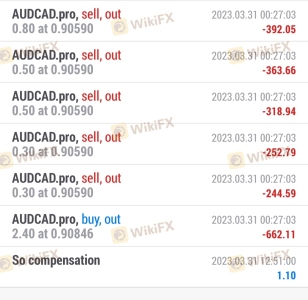

The trading platform is another critical aspect of the trading experience. Tradeska utilizes the widely used MetaTrader 5 platform, known for its robust features and user-friendly interface. However, the quality of order execution, including slippage and rejection rates, is equally important.

Traders have reported instances of excessive slippage and order rejections, which can significantly impact trading performance. Such issues may indicate potential manipulation or lack of liquidity, raising further doubts about the broker's integrity.

Risk Assessment

Using Tradeska presents several risks that traders should be aware of.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Risk | High | Unregulated status increases the risk of fraud. |

| Fund Safety Risk | High | Lack of investor protection schemes. |

| Execution Risk | Medium | Reports of slippage and order rejections. |

| Transparency Risk | High | Inadequate information about fees and conditions. |

To mitigate these risks, traders should consider starting with a demo account to familiarize themselves with the platform and trading conditions before committing real funds. Additionally, thorough research and due diligence are essential to ensure a safe trading experience.

Conclusion and Recommendations

In conclusion, the evidence suggests that Tradeska is not a safe option for traders. The combination of unregulated status, lack of transparency, and numerous negative user experiences raises significant red flags. While the broker offers competitive spreads and a popular trading platform, the associated risks outweigh the potential benefits.

For traders seeking a reliable broker, it is advisable to explore alternatives that offer robust regulatory oversight and a proven track record. Brokers such as HotForex and ThinkMarkets provide more secure trading environments and are better suited for both novice and experienced traders. In light of these findings, it is crucial for traders to exercise caution and conduct thorough research before engaging with Tradeska or any similar broker.

Is TRADESKA a scam, or is it legit?

The latest exposure and evaluation content of TRADESKA brokers.

TRADESKA Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

TRADESKA latest industry rating score is 1.45, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.45 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.