Is PDFX safe?

Business

License

Is pdfx Safe or Scam?

Introduction

In the rapidly evolving landscape of the forex market, traders are constantly seeking reliable brokers to facilitate their trades. One such broker that has garnered attention is pdfx, which positions itself as a platform catering to forex trading enthusiasts. However, the critical question that arises is whether pdfx is a trustworthy entity or a potential scam. Evaluating the legitimacy of a forex broker is essential for traders, as the stakes involved can be significant, with real money on the line. This article aims to provide a comprehensive analysis of pdfx, exploring its regulatory status, company background, trading conditions, customer experiences, and overall risk assessment. The investigation is based on a thorough review of available information and user feedback, allowing for an objective evaluation of pdfx's safety and reliability.

Regulation and Legitimacy

When assessing the safety of a forex broker, regulatory oversight is a crucial factor. A regulated broker is typically subject to stringent compliance standards, ensuring that they operate fairly and transparently. Unfortunately, pdfx operates as an unregulated entity, which raises red flags regarding its legitimacy. Below is a summary of pdfxs regulatory status:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | N/A | Unverified |

Operating without regulatory oversight significantly increases the risk for traders, as there are no governing bodies to protect their interests. While regulation alone does not guarantee safety, it is a vital indicator of a broker's reliability. The absence of oversight means that pdfx is not held accountable for its practices, leaving traders vulnerable to potential fraud or mismanagement of funds. Historical compliance issues associated with unregulated brokers further underscore the need for caution. Given these factors, it is prudent for potential investors to approach pdfx with skepticism.

Company Background Investigation

Understanding the background of a forex broker is essential for evaluating its trustworthiness. pdfx claims to have been in operation for a few years, but specific details regarding its history and ownership structure remain vague. The lack of transparency about the company's origins and its management team is concerning. A reputable broker should provide clear information about its founders and executives, along with their professional backgrounds. Unfortunately, pdfx fails to disclose such critical information, which may indicate a lack of accountability.

Moreover, the company's website does not provide comprehensive details about its operations, which is a common trait among less reputable brokers. This opacity raises questions about the legitimacy of pdfx and its commitment to ethical trading practices. A transparent organization typically embraces open communication and readily shares information about its operations, management, and financial standing. In contrast, pdfx's reluctance to provide such details may suggest potential underlying issues.

Trading Conditions Analysis

An essential aspect of evaluating any forex broker is understanding the trading conditions they offer. pdfx presents a range of trading options, but the specifics of its fee structure and trading costs warrant scrutiny. It is crucial for traders to be aware of any hidden fees or unusual policies that could impact their profitability. Below is a comparative overview of the core trading costs associated with pdfx:

| Fee Type | pdfx | Industry Average |

|---|---|---|

| Major Currency Pair Spreads | N/A | Varies |

| Commission Structure | N/A | Varies |

| Overnight Interest Range | N/A | Varies |

Without clear information on spreads, commissions, and overnight interest rates, traders may find themselves facing unexpected costs that could erode their profits. Additionally, the absence of transparent pricing policies can lead to confusion and frustration among users. It is advisable for traders to conduct thorough research into pdfx's trading conditions before committing any funds, as unfavorable terms could significantly impact their trading experience.

Customer Funds Security

The security of customer funds is paramount when choosing a forex broker. pdfx's approach to fund security is a critical area for evaluation. Traders should be aware of the measures in place to protect their investments, such as segregated accounts and investor protection policies. Unfortunately, pdfx does not provide sufficient information regarding its security protocols, leaving traders uncertain about the safety of their funds.

It is essential for a reputable broker to maintain segregated accounts, ensuring that client funds are kept separate from the company's operational funds. This practice protects traders in the event of financial difficulties faced by the broker. Additionally, investor protection mechanisms, such as negative balance protection, are vital for safeguarding traders from incurring debts beyond their initial investments. The lack of clarity surrounding pdfx's fund security measures raises concerns about the safety of traders' money and the potential for financial loss.

Customer Experience and Complaints

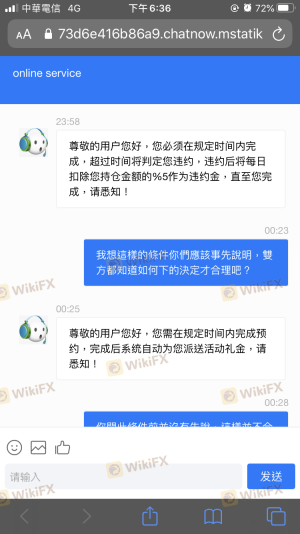

Customer feedback plays a significant role in assessing the reliability of a forex broker. Analyzing user experiences with pdfx reveals a mix of reviews, with some traders expressing dissatisfaction with the platform. Common complaints include difficulties in withdrawing funds, lack of responsive customer support, and issues with trade execution. Below is a summary of the primary complaint types associated with pdfx:

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Difficulties | High | Unresponsive |

| Poor Customer Support | Medium | Slow Response |

| Trade Execution Issues | High | Unresolved |

One notable case involves a trader who successfully withdrew funds initially but faced obstacles during subsequent withdrawal attempts. This experience highlights a concerning pattern that could indicate potential issues with pdfx's operational practices. The lack of timely and effective responses from customer support further exacerbates these concerns, leading to frustration among users. A reliable broker should prioritize customer satisfaction by addressing complaints promptly and effectively.

Platform and Trade Execution

The trading platform's performance is critical for a smooth trading experience. Traders expect a stable and efficient platform that allows for quick order execution and minimal slippage. However, feedback regarding pdfx's platform performance suggests potential issues with stability and execution quality. Traders have reported instances of slippage and rejected orders, which can significantly affect trading outcomes.

Additionally, any signs of platform manipulation or unfair practices should be closely examined. A trustworthy broker should provide a transparent trading environment, ensuring that traders can execute their strategies without interference. The absence of clear information about pdfx's platform performance raises concerns about its reliability and the overall trading experience offered to users.

Risk Assessment

Using pdfx carries inherent risks that traders should carefully consider. The lack of regulation, transparency, and customer support raises several red flags that could jeopardize traders' investments. Below is a summary of the key risk areas associated with pdfx:

| Risk Category | Risk Level (Low/Medium/High) | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker poses significant risks. |

| Fund Security Risk | High | Lack of information on fund protection measures. |

| Customer Support Risk | Medium | Slow response times and unresolved complaints. |

| Platform Reliability Risk | High | Reports of slippage and rejected orders. |

To mitigate these risks, traders should consider conducting thorough research before engaging with pdfx. Seeking alternative brokers with robust regulatory oversight, transparent practices, and positive customer feedback can enhance trading safety and overall experience.

Conclusion and Recommendations

In conclusion, the investigation into pdfx raises several concerns regarding its legitimacy and safety. The absence of regulatory oversight, coupled with a lack of transparency and customer complaints, suggests that pdfx may not be a reliable choice for traders. While it is not definitively labeled as a scam, the indicators warrant caution.

Traders are advised to exercise due diligence when considering pdfx and to remain vigilant about potential risks. For those seeking alternative options, it is recommended to explore brokers that are regulated by reputable authorities, have a proven track record of customer satisfaction, and demonstrate a commitment to transparency. Ultimately, ensuring the safety of investments should be the top priority for any trader in the forex market.

Is PDFX a scam, or is it legit?

The latest exposure and evaluation content of PDFX brokers.

PDFX Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

PDFX latest industry rating score is 1.44, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.44 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.