PDFX 2025 Review: Everything You Need to Know

Executive Summary

This pdfx review shows concerning findings about a broker that operates without proper regulatory oversight and has received extremely negative user feedback. PDFX presents itself as a reliable trading platform but fails to provide essential company information, including office addresses, regulatory details, or fundamental legal documents such as terms and conditions, risk disclosure statements, and privacy policies. According to available market information, PDFX is not supervised by any recognized regulatory authority. This raises significant red flags for potential investors.

The broker has received an overall rating of 1.00 from users, indicating widespread skepticism about its legitimacy and operational practices. User feedback consistently expresses doubts about the platform's credibility, with many flagging potential suspicious activities. Given these findings, this review strongly advises potential investors to exercise extreme caution when considering PDFX as a trading platform.

The lack of regulatory protection, combined with overwhelmingly negative user experiences, suggests that traders would be better served by seeking established, regulated brokers that offer transparent operations and proper investor protections.

Important Notice

This evaluation is based on available user feedback and market information gathered from various sources. Due to the limited transparency provided by PDFX itself, much of this assessment relies on external reports and user experiences rather than official company documentation. It's crucial to note that PDFX operates without supervision from any recognized regulatory authority and lacks the fundamental legal documentation that legitimate brokers typically provide.

This absence of regulatory oversight means that traders have limited recourse in case of disputes or issues with the platform.

Rating Framework

Based on available information, here are the ratings for PDFX across six key dimensions:

Broker Overview

PDFX operates in the foreign exchange market as an online trading platform. Specific details about its founding year, company background, and primary business model remain undisclosed in available documentation. The broker's lack of transparency regarding basic company information raises immediate concerns about its legitimacy and operational standards.

The platform claims to offer multiple account types to accommodate different trading preferences, though specific details about these offerings are not clearly outlined in accessible materials. Without proper regulatory documentation or transparent company information, it becomes challenging to verify the actual services and protections offered to clients. This pdfx review finds that the broker operates without the standard regulatory framework that legitimate forex brokers typically maintain.

The absence of clear information about trading platforms, asset classes, and regulatory compliance creates an environment of uncertainty for potential users. Most established brokers in the industry provide comprehensive details about their operations, regulatory status, and service offerings, which PDFX notably fails to deliver.

Regulatory Status

PDFX is not overseen by any recognized regulatory authority, operating outside the standard regulatory framework that protects forex traders. This lack of oversight means clients have no regulatory protection or recourse.

Deposit and Withdrawal Methods

Specific information about available deposit and withdrawal methods is not detailed in available materials. This creates uncertainty about fund management procedures.

Minimum Deposit Requirements

The platform has not disclosed minimum deposit requirements in accessible documentation. This makes it difficult for potential traders to understand entry barriers.

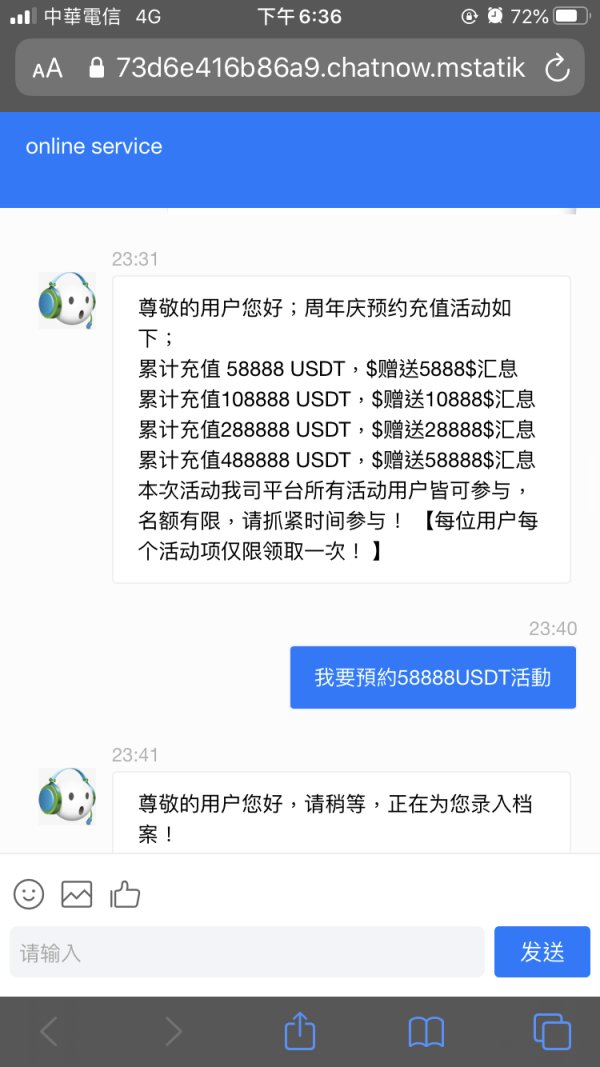

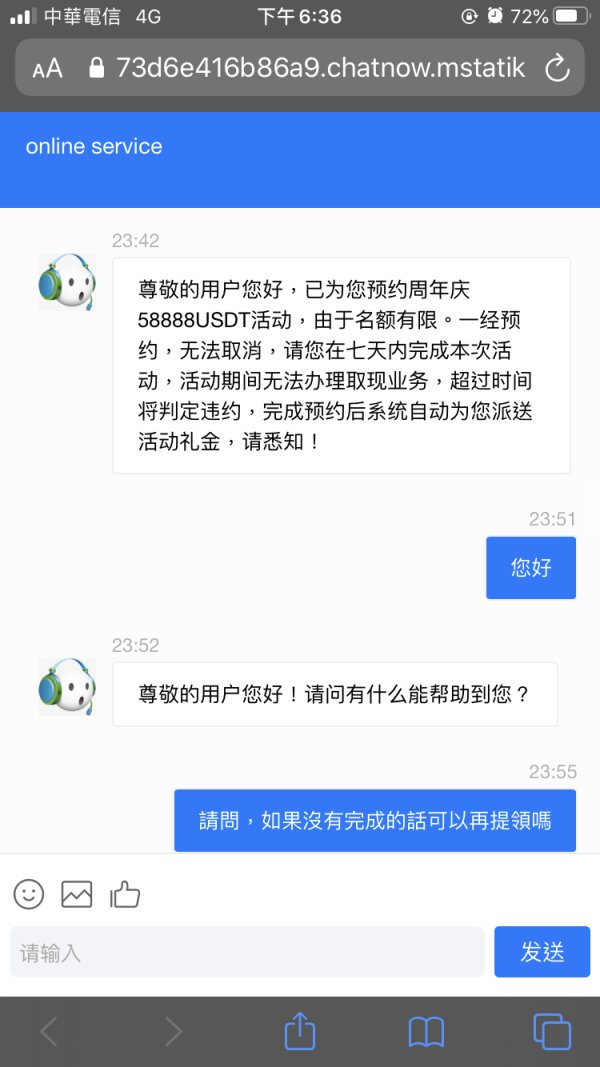

No information about promotional offers or bonus structures is available in current materials.

Tradeable Assets

Details about available trading instruments and asset classes are not specified in available documentation.

Cost Structure

The broker has not provided transparent information about spreads, commissions, or other trading costs. This is essential information for informed trading decisions.

Leverage Ratios

Specific leverage offerings are not detailed in available materials.

Information about trading platforms and technological infrastructure is not clearly specified.

Regional Restrictions

Geographic limitations and availability are not outlined in accessible documentation.

Customer Support Languages

Available customer service languages are not specified in current materials. This pdfx review highlights the concerning lack of transparency across all fundamental aspects of broker operations.

Detailed Rating Analysis

Account Conditions Analysis (1/10)

The account conditions offered by PDFX receive the lowest possible rating due to the complete lack of transparent information about account types, features, and requirements. While the platform mentions offering multiple account types, no specific details are provided about what distinguishes these accounts or what benefits they might offer to different types of traders. The absence of clear minimum deposit requirements makes it impossible for potential clients to understand the financial commitment required to begin trading.

Legitimate brokers typically provide comprehensive information about their account structures, including detailed breakdowns of features, costs, and requirements for each account tier. The account opening process remains unclear, with no detailed information available about verification procedures, documentation requirements, or timeline expectations. This lack of transparency creates uncertainty for potential users who need to understand what to expect when establishing an account.

Without access to proper terms and conditions or account agreements, traders cannot understand their rights, obligations, or the specific conditions under which their accounts would operate. This pdfx review finds that the opaque account structure represents a significant concern for potential users.

PDFX receives a very low rating for tools and resources due to the limited information available about trading tools, analytical resources, and educational materials. The platform has not provided clear details about the trading tools available to users, making it difficult to assess whether the technological infrastructure meets modern trading standards. Research and analytical resources, which are crucial for informed trading decisions, are not detailed in available materials.

Professional traders rely on comprehensive market analysis, economic calendars, and research reports to guide their trading strategies, but PDFX's offerings in this area remain unclear. Educational resources, which are particularly important for novice traders, are not prominently featured or described in accessible documentation. Established brokers typically offer extensive educational programs, webinars, tutorials, and market insights to help traders develop their skills and knowledge.

The platform's support for automated trading systems and algorithmic trading tools is not specified, limiting options for traders who rely on these advanced trading methods. Without clear information about available tools and resources, potential users cannot adequately assess whether the platform meets their trading needs.

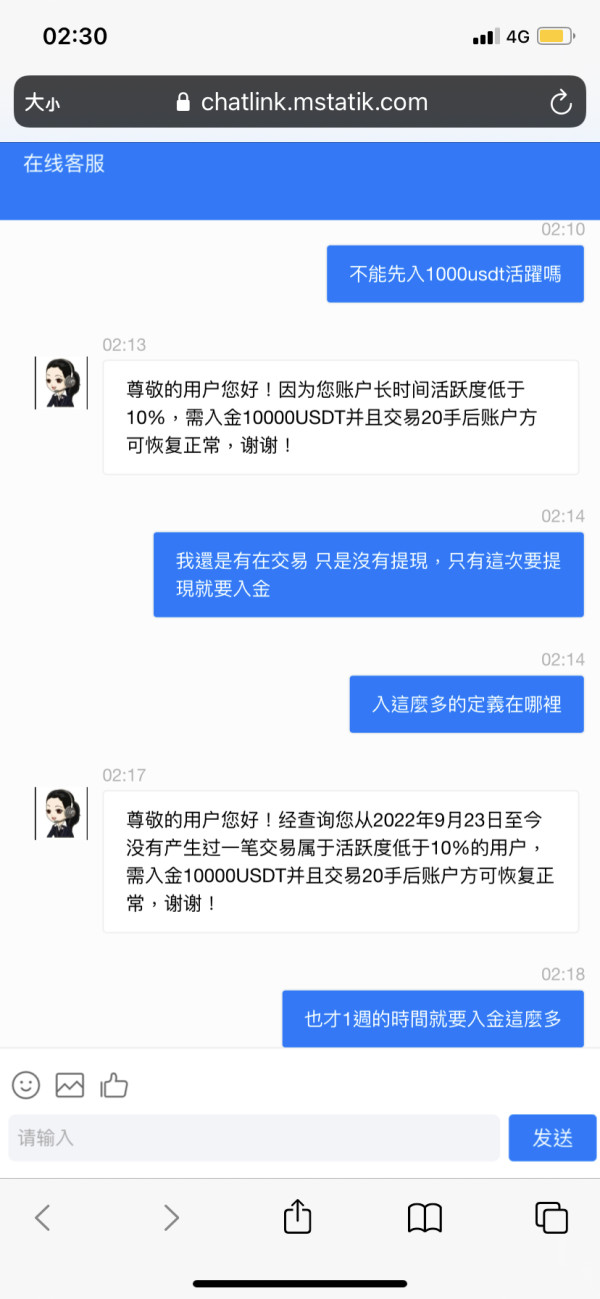

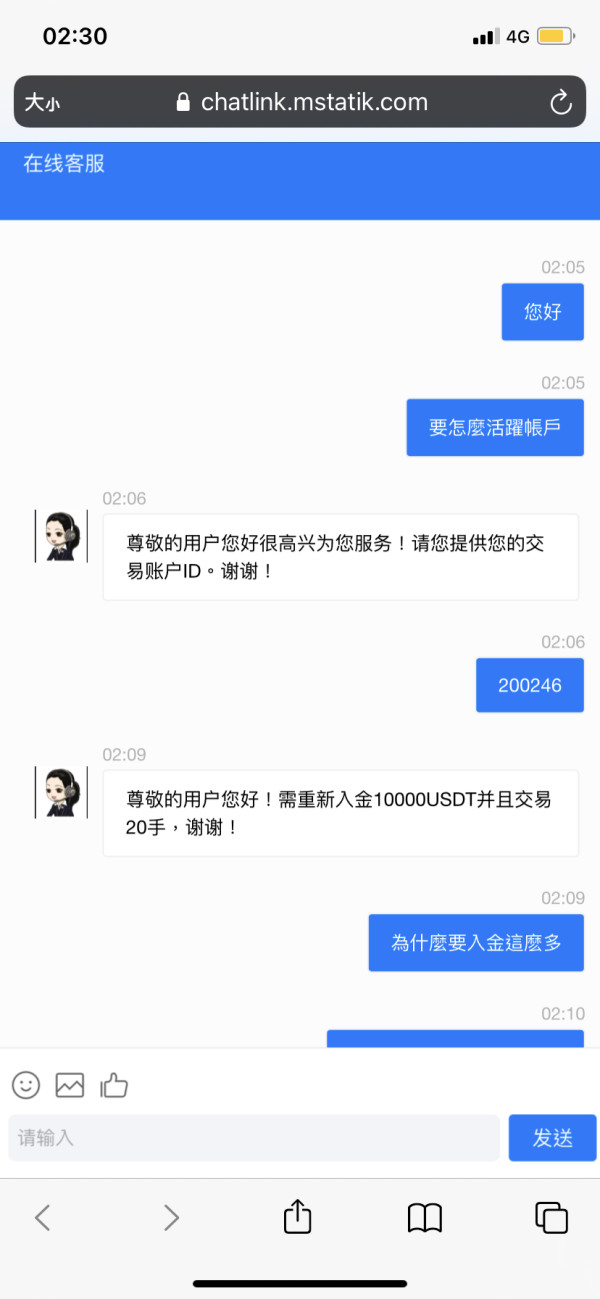

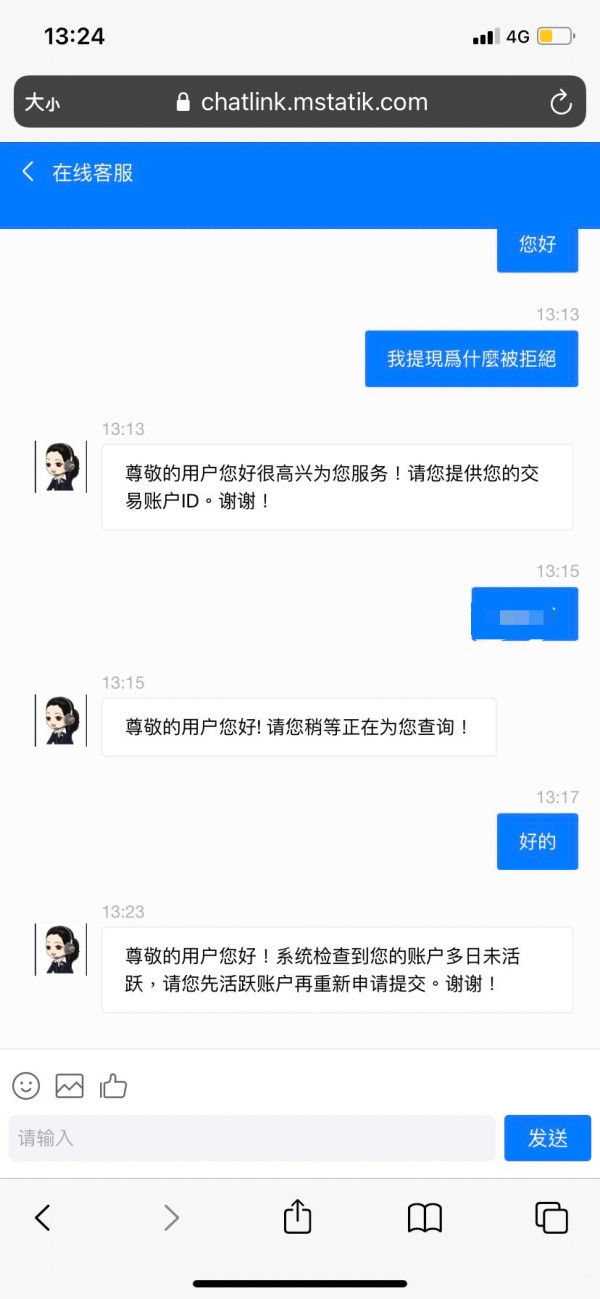

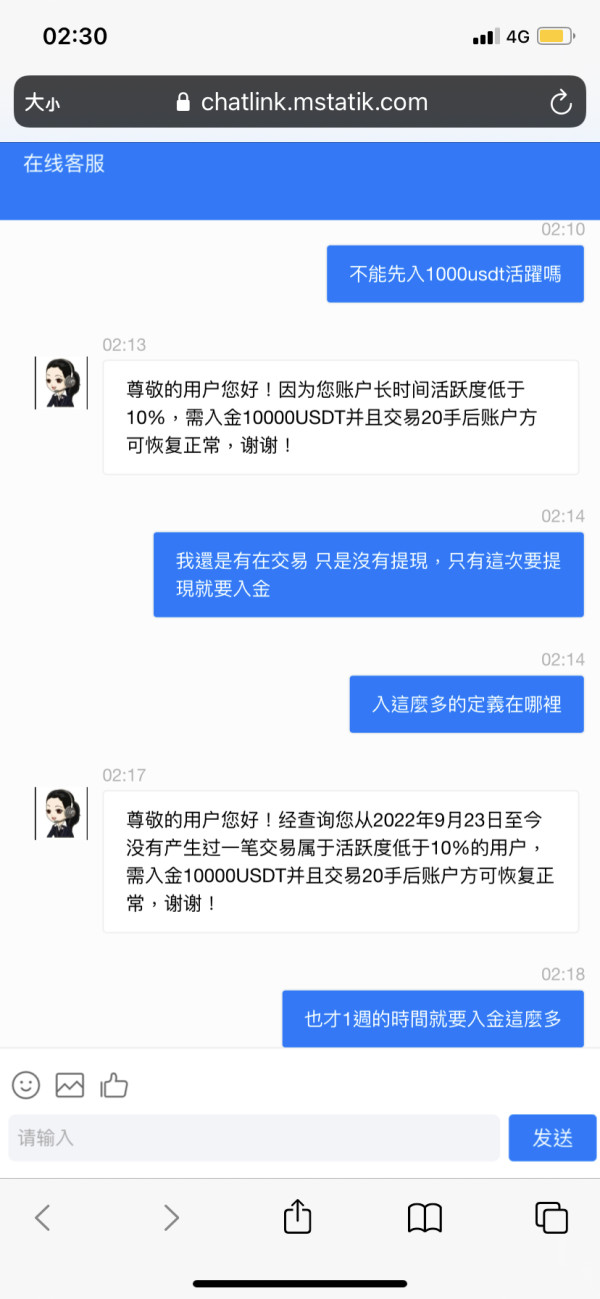

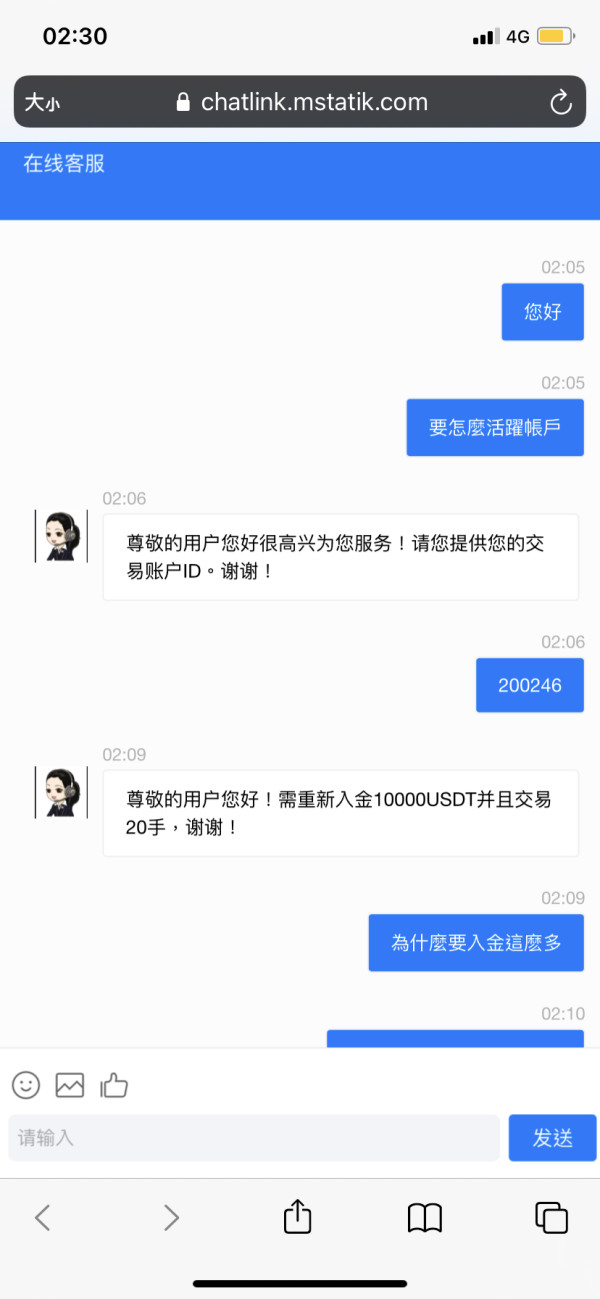

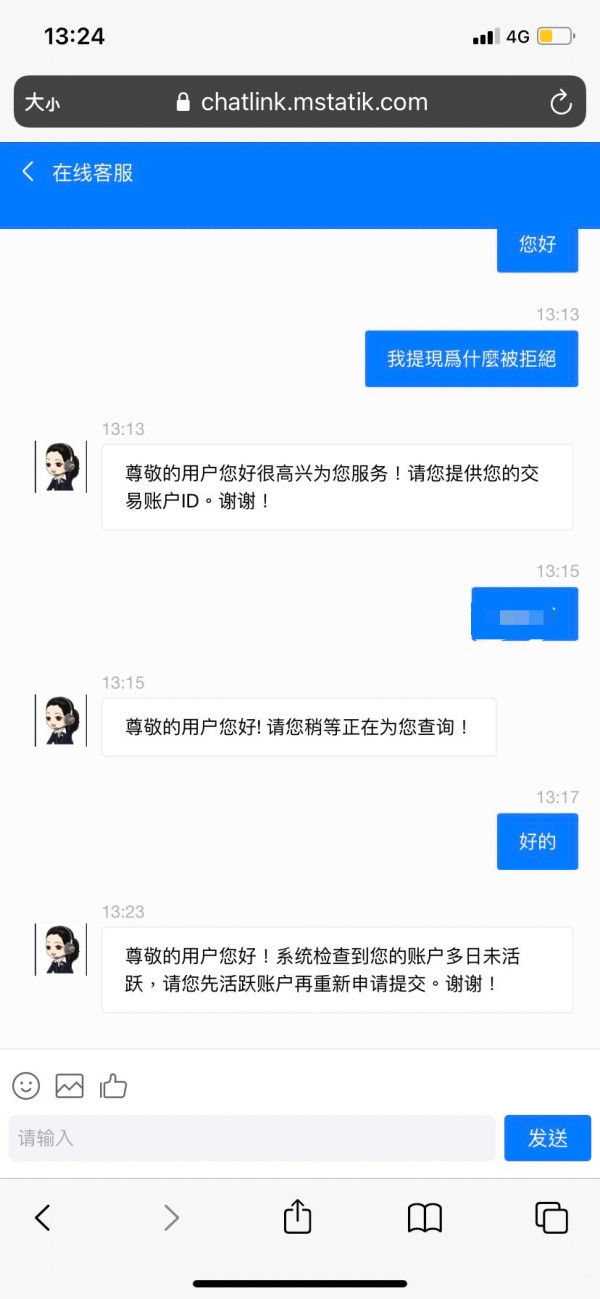

Customer Service and Support Analysis (1/10)

Customer service and support receive the lowest rating due to widespread user concerns about the platform's credibility and the absence of clear information about support channels and availability. The lack of transparency about customer service options creates uncertainty about how users can seek assistance when needed. Response times and service quality cannot be adequately assessed due to the limited availability of reliable user feedback and the absence of official service level commitments.

Professional trading platforms typically provide clear information about support availability, response time expectations, and multiple contact methods. Multi-language support capabilities are not specified in available materials, which could limit accessibility for international users. The absence of clear customer service hours and availability information makes it difficult for potential users to understand when they can expect assistance.

The overall user sentiment regarding customer service appears negative based on available feedback, with users expressing general skepticism about the platform's reliability and responsiveness. This raises concerns about the quality of support that users can expect to receive.

Trading Experience Analysis (1/10)

The trading experience offered by PDFX receives the lowest possible rating, primarily due to the overall user rating of 1.00 and widespread concerns about platform reliability. User feedback consistently indicates poor experiences and significant skepticism about the platform's operations. Platform stability and execution speed cannot be adequately assessed due to limited reliable user feedback and the absence of technical performance data.

Professional trading requires reliable platform performance, especially during volatile market conditions, but PDFX's capabilities in this area remain unclear. The completeness and functionality of trading features are not well-documented, making it difficult to assess whether the platform provides the tools and capabilities that modern traders expect. Essential features such as order types, risk management tools, and market analysis capabilities are not clearly outlined.

Mobile trading experience and cross-platform compatibility are not detailed in available materials, which is concerning given the importance of mobile access in modern trading. The overall trading environment appears to lack the transparency and reliability that professional traders require. This pdfx review finds that the poor user ratings and lack of transparent information about trading capabilities create significant concerns about the overall trading experience.

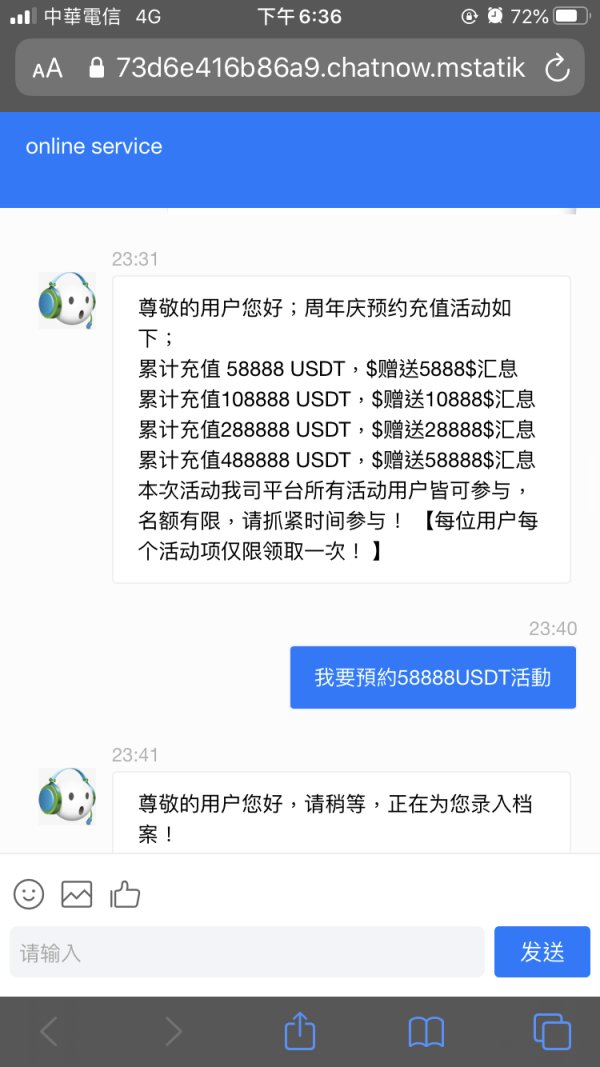

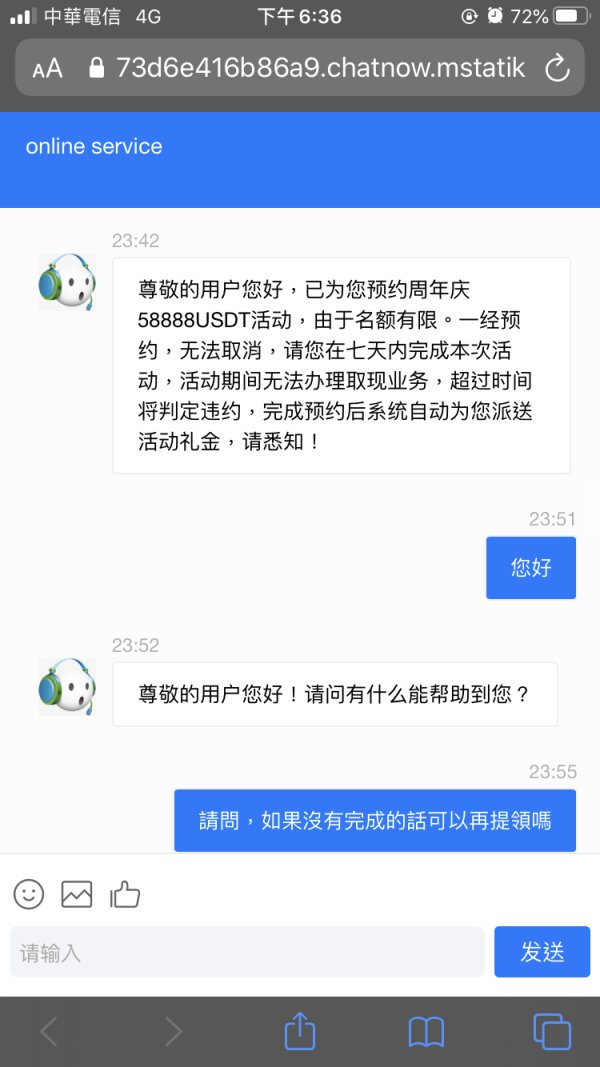

Trust and Safety Analysis (1/10)

Trust and safety receive the lowest rating due to PDFX's lack of regulatory oversight and the platform being flagged as potentially fraudulent by users. The absence of supervision by recognized regulatory authorities means that clients have no regulatory protection or recourse in case of disputes or issues. The platform has not provided information about fund safety measures, segregated accounts, or other client protection protocols that legitimate brokers typically implement.

This lack of transparency about asset protection creates significant risks for potential users. Company transparency is severely lacking, with no clear information about company ownership, management, or operational structure. The absence of fundamental legal documents such as terms and conditions, risk disclosures, and privacy policies further undermines trust in the platform.

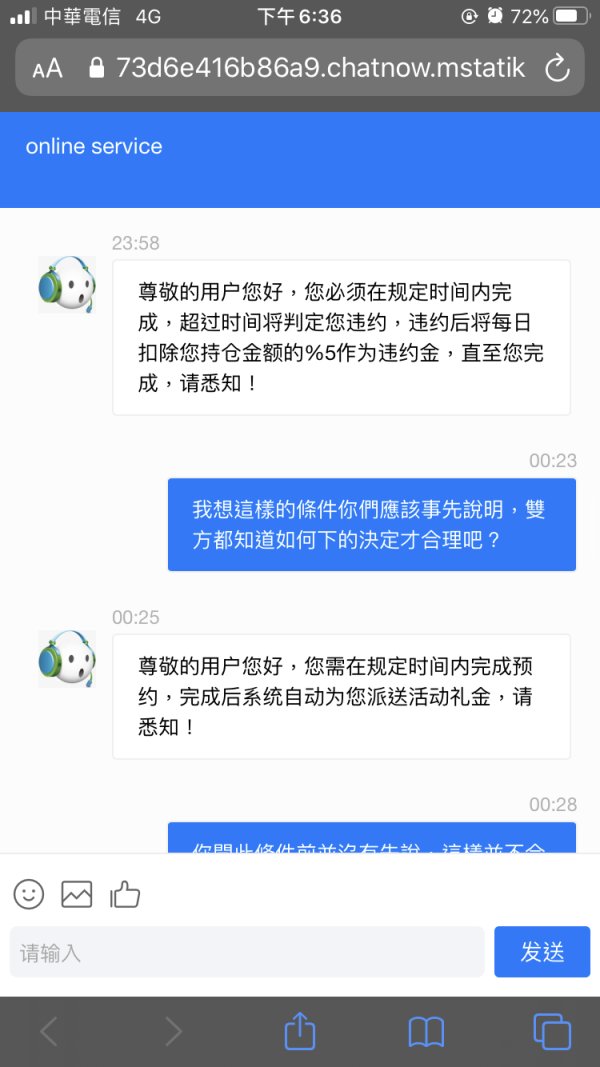

Industry reputation appears to be poor, with users expressing widespread skepticism about the platform's legitimacy. The platform has been marked as a potential scam, indicating serious concerns about its operations and intentions. The handling of negative events and user complaints cannot be assessed due to the lack of transparent dispute resolution procedures and the absence of regulatory oversight that would typically ensure fair treatment of client concerns.

User Experience Analysis (1/10)

User experience receives the lowest possible rating based on the overall user rating of 1.00 and widespread negative feedback about the platform. The extremely low user satisfaction scores indicate fundamental problems with the platform's operations and user treatment. Interface design and usability cannot be adequately assessed due to limited reliable user feedback, but the poor overall ratings suggest significant issues with the user experience.

Modern trading platforms require intuitive interfaces and smooth functionality, but PDFX appears to fall short of these expectations. Registration and verification processes are not clearly outlined, creating uncertainty about account setup procedures and requirements. The lack of transparent onboarding information makes it difficult for potential users to understand what to expect when attempting to establish an account.

Fund management experiences, including deposit and withdrawal processes, are not well-documented, which is concerning given the importance of reliable fund access for traders. Users have expressed general skepticism about the platform's credibility, which extends to concerns about fund safety and accessibility. Common user complaints center around credibility concerns and suspicions about the platform's legitimacy.

The overwhelmingly negative user sentiment suggests that the platform fails to meet basic user expectations for reliability, transparency, and service quality.

Conclusion

This comprehensive pdfx review reveals a trading platform that presents significant risks and concerns for potential users. PDFX operates without regulatory oversight, lacks transparency in its operations, and has received overwhelmingly negative user feedback with an overall rating of 1.00. The absence of fundamental regulatory protection, combined with the lack of basic legal documentation and company transparency, makes PDFX unsuitable for any type of trader.

The platform's poor user ratings and reputation concerns suggest that users should avoid this broker entirely. Instead of considering PDFX, potential traders are strongly advised to seek regulated brokers that offer transparent operations, proper investor protections, and positive user experiences. The forex market offers numerous legitimate, well-regulated alternatives that provide the safety and reliability that traders deserve.