Is NASDAQ 500 safe?

Pros

Cons

Is Nasdaq 500 A Scam?

Introduction

Nasdaq 500 is a relatively new player in the forex market, positioning itself as a broker that offers a wide range of trading instruments, including forex, cryptocurrencies, and CFDs. As with any online trading platform, it is crucial for traders to exercise caution when evaluating the reliability and safety of such brokers. The forex market is notorious for its potential risks, including scams and unregulated brokers that can jeopardize traders' funds. Therefore, this article aims to provide a comprehensive analysis of Nasdaq 500, assessing its legitimacy, regulatory status, trading conditions, and overall safety for traders. The investigation will draw on various sources, including user reviews, regulatory databases, and financial reports, to form a well-rounded evaluation.

Regulation and Legitimacy

A broker's regulatory status is a critical factor in determining its legitimacy and safety for traders. Nasdaq 500 operates under the ownership of EM Pika Enterprise Ltd, which is registered in the Marshall Islands. Unfortunately, it is important to note that the broker is unregulated, meaning it does not fall under the oversight of any recognized financial regulatory authority. This lack of regulation raises significant concerns regarding the safety of traders' funds and the broker's adherence to industry standards.

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| None | N/A | Marshall Islands | Unverified |

The absence of regulatory oversight means that Nasdaq 500 is not subject to the same stringent rules and protections that regulated brokers must follow. This situation can expose traders to potential fraud, manipulation, and conflicts of interest. Regulatory bodies like the UK's FCA or Cyprus's CySEC provide a layer of protection for traders, including segregated accounts and compensation schemes in the event of broker insolvency. The lack of such protections with Nasdaq 500 makes it imperative for traders to proceed with caution and conduct thorough due diligence before investing.

Company Background Investigation

Nasdaq 500 was established relatively recently, aiming to attract both novice and experienced traders by offering a user-friendly platform and a variety of educational resources. However, the companys ownership structure and management team are not well-publicized, leading to questions about transparency and reliability. The fact that the broker operates in the Marshall Islands, a jurisdiction known for its lax regulatory environment, further complicates the trustworthiness of the broker.

The management team's background and expertise in the financial industry are crucial for establishing credibility. A broker led by experienced professionals with a solid track record is more likely to provide a safe trading environment. Unfortunately, Nasdaq 500 does not provide detailed information about its management team, which raises concerns about the broker's operational transparency. Without clear information about the individuals running the company, traders may find it challenging to gauge the broker's reliability and commitment to ethical practices.

Trading Conditions Analysis

When evaluating a broker, understanding its trading conditions is vital. Nasdaq 500 offers a variety of trading instruments, including forex pairs, commodities, and cryptocurrencies. However, the overall fee structure and trading costs associated with the broker are essential factors to consider.

| Fee Type | Nasdaq 500 | Industry Average |

|---|---|---|

| Major Currency Pair Spread | 3 pips | 1.5 pips |

| Commission Model | N/A | Varies |

| Overnight Interest Range | Varies | Varies |

The spread on major currency pairs at Nasdaq 500 is notably higher than the industry average, which could significantly impact trading profitability. Additionally, the broker does not provide a clear commission structure, leaving traders in the dark about potential costs. The lack of transparency regarding fees can lead to unexpected expenses, further complicating the trading experience. Traders should be wary of brokers with unclear or unusual fee structures, as these can be indicative of a less-than-reputable operation.

Client Fund Safety

The safety of client funds is paramount when choosing a broker. Nasdaq 500 claims to implement various security measures to protect traders' funds, but the lack of regulation raises serious concerns. The broker does not provide clear information regarding fund segregation, which is a standard practice among regulated brokers to ensure that client funds are kept separate from the broker's operational funds.

Moreover, there is no mention of negative balance protection, which is essential for safeguarding traders from incurring debts beyond their deposits. Historical disputes or issues related to fund security can also be red flags. As of now, there are no widely reported incidents regarding fund mismanagement at Nasdaq 500, but the absence of regulatory oversight means that traders have limited recourse in the event of any financial misconduct.

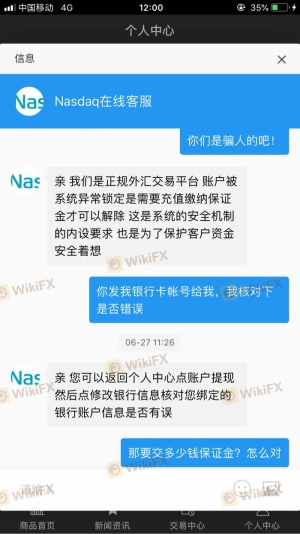

Customer Experience and Complaints

Customer feedback is an invaluable resource for evaluating a broker's reliability and service quality. Reviews of Nasdaq 500 reveal a mixed bag of experiences. While some users report positive interactions and a user-friendly platform, others have expressed concerns regarding withdrawal delays and unresponsive customer service.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Delays | High | Slow Response |

| Poor Customer Support | Medium | Inconsistent |

Common complaints include difficulties in withdrawing funds and slow response times from customer support. For instance, some traders have reported waiting weeks for their withdrawal requests to be processed, which can be frustrating and raises questions about the broker's operational efficiency. The inconsistency in company responses further exacerbates these issues, leaving traders feeling unsupported.

Platform and Trade Execution

The performance and reliability of the trading platform are critical factors for any broker. Nasdaq 500 offers a web-based trading platform that is described as user-friendly, but there are concerns regarding its stability and execution quality. Traders have reported instances of slippage and order rejections, which can significantly affect trading outcomes.

A reliable platform should provide fast and accurate trade execution, but the reports of execution issues at Nasdaq 500 indicate potential problems that could hinder a trader's ability to capitalize on market opportunities. Additionally, the lack of advanced trading features or tools can limit traders' ability to implement complex strategies effectively.

Risk Assessment

Using Nasdaq 500 comes with a range of risks that traders should be aware of. The absence of regulation, coupled with a lack of transparency regarding fees and fund security, places Nasdaq 500 in a high-risk category.

| Risk Category | Risk Level | Brief Explanation |

|---|---|---|

| Regulatory Risk | High | Unregulated broker, no oversight. |

| Financial Risk | Medium | High spreads and unclear fees. |

| Operational Risk | Medium | Reports of execution issues and withdrawal delays. |

To mitigate these risks, traders should consider starting with a small investment to test the platform and its services. Conducting thorough research on market conditions and maintaining a disciplined trading strategy can also help minimize potential losses.

Conclusion and Recommendations

In conclusion, while Nasdaq 500 presents itself as a viable option for forex trading, significant concerns regarding its regulatory status, trading conditions, and customer feedback cannot be overlooked. The broker's unregulated nature raises red flags, and the lack of transparency regarding fees and fund security further complicates its credibility.

Traders should approach Nasdaq 500 with caution and consider alternative, well-regulated brokers that offer similar services with greater security and reliability. For those who prioritize safety and regulatory oversight, brokers such as eToro, Plus500, or IG may provide more secure trading environments. Ultimately, it is essential for traders to stay informed and make decisions that align with their risk tolerance and investment goals.

Is NASDAQ 500 a scam, or is it legit?

The latest exposure and evaluation content of NASDAQ 500 brokers.

NASDAQ 500 Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

NASDAQ 500 latest industry rating score is 1.57, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.57 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.