NASDAQ 500 Review 1

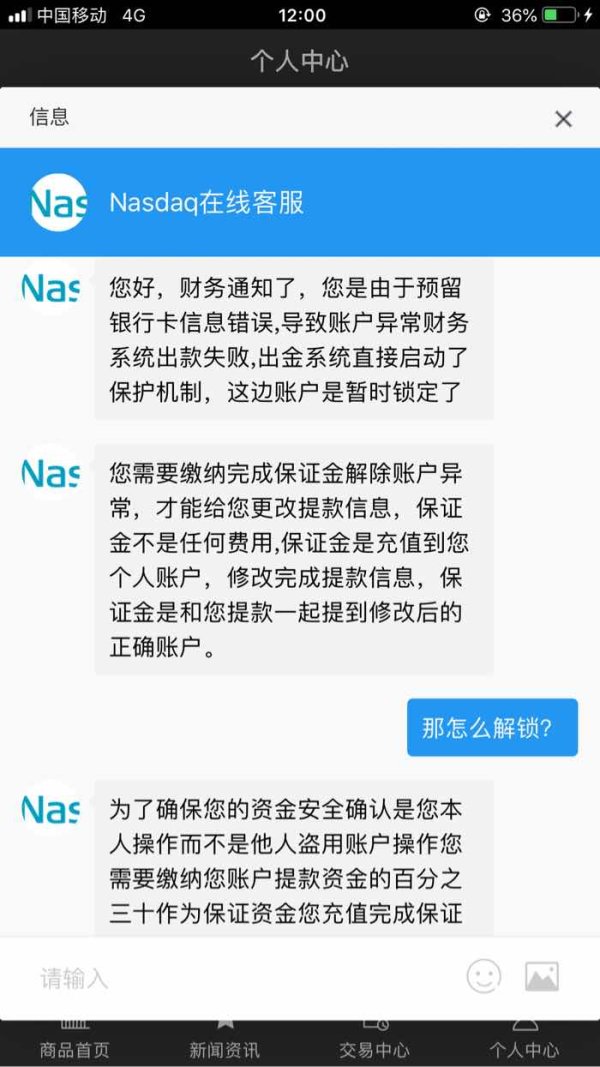

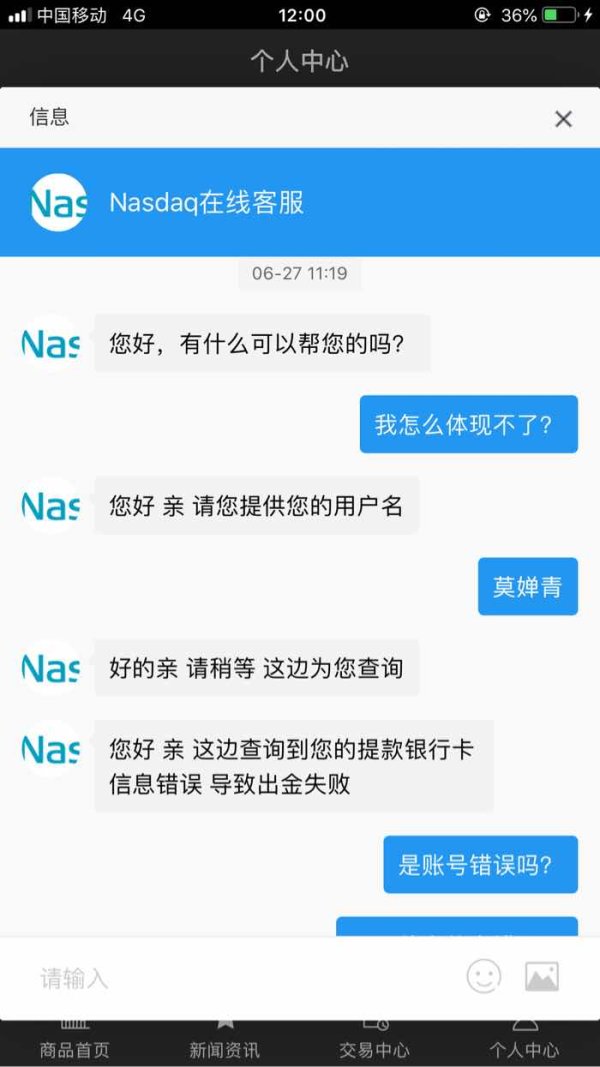

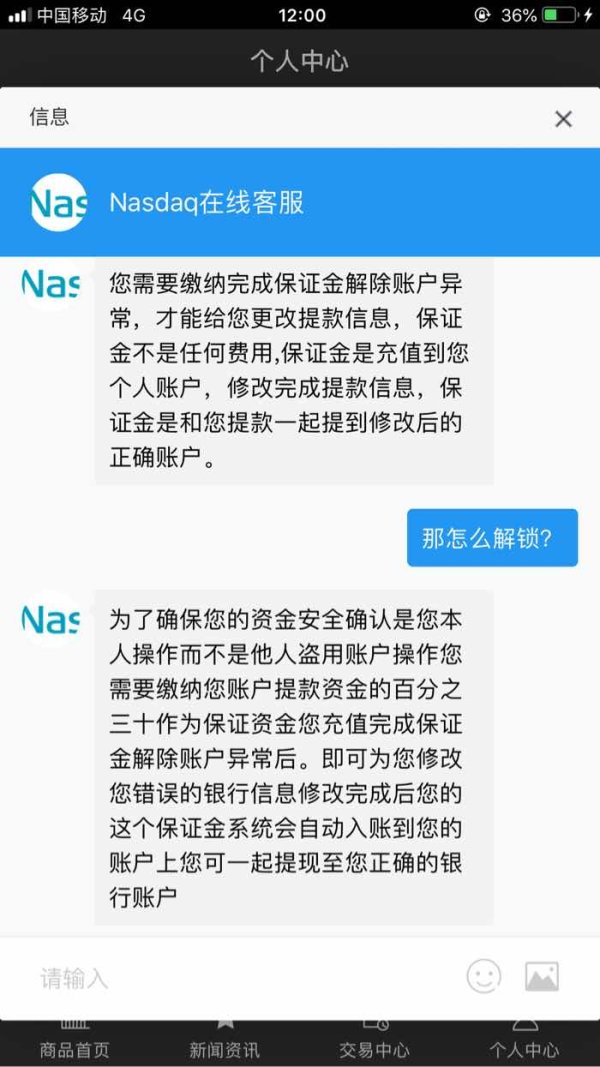

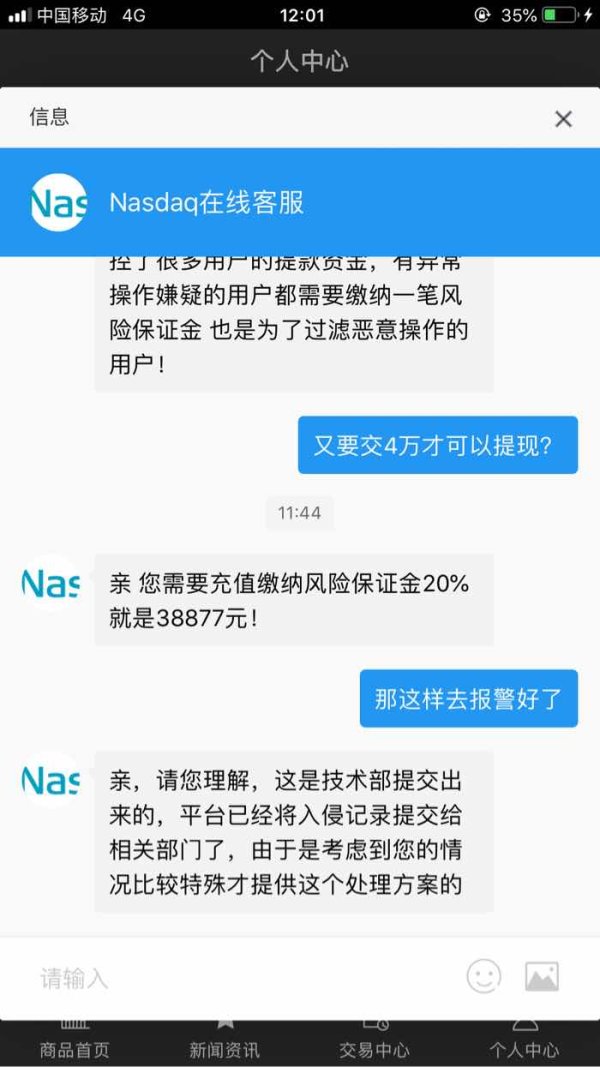

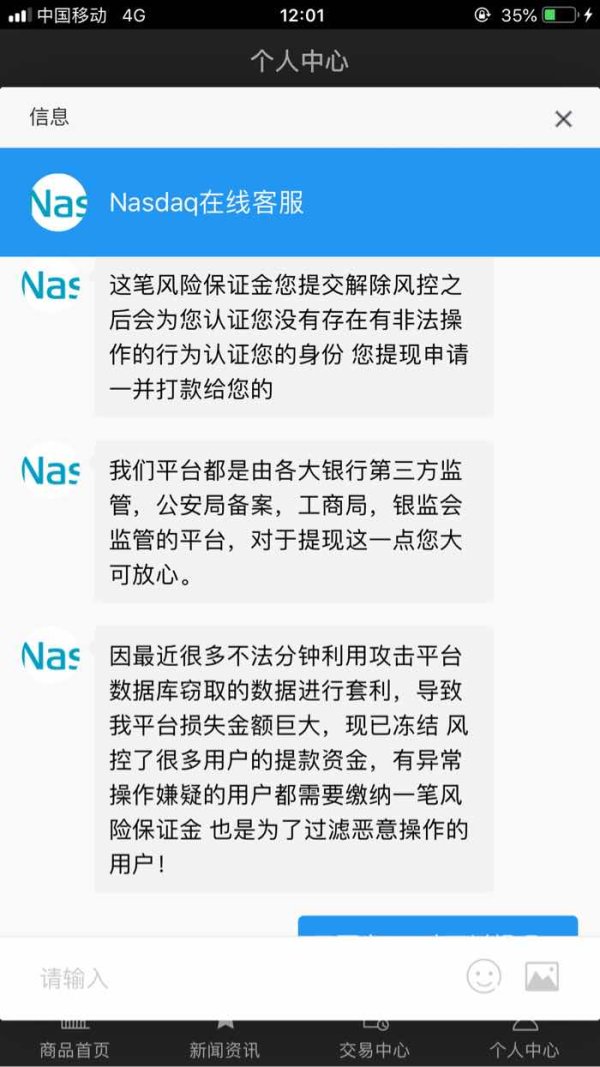

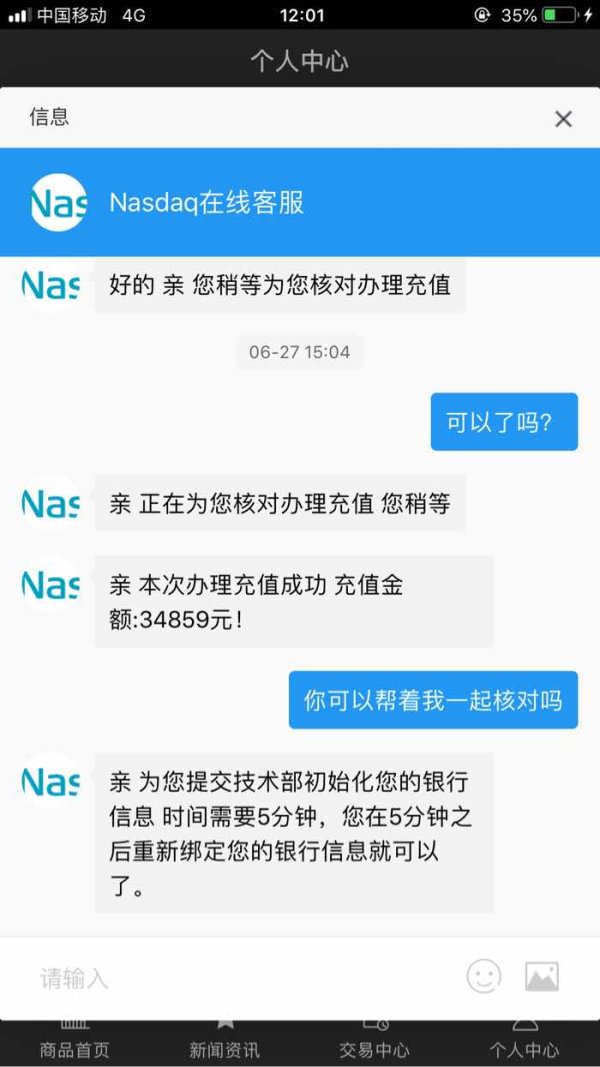

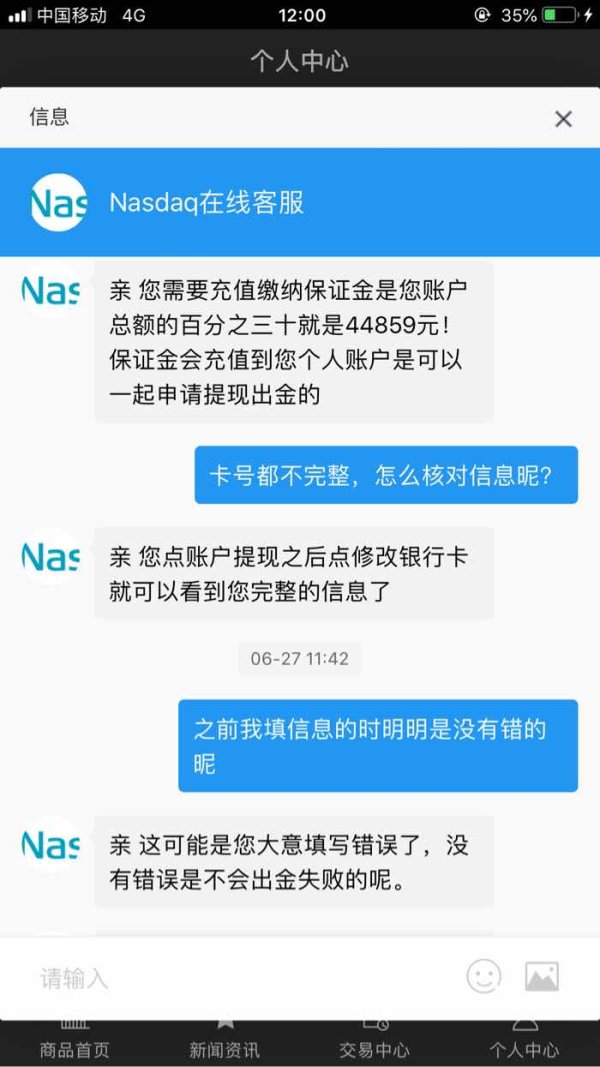

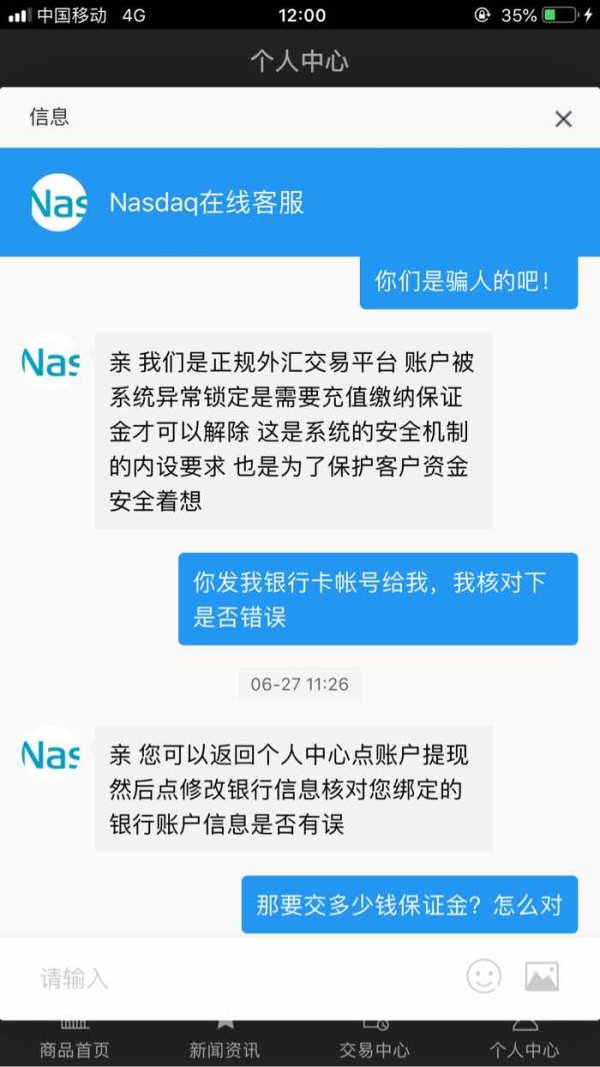

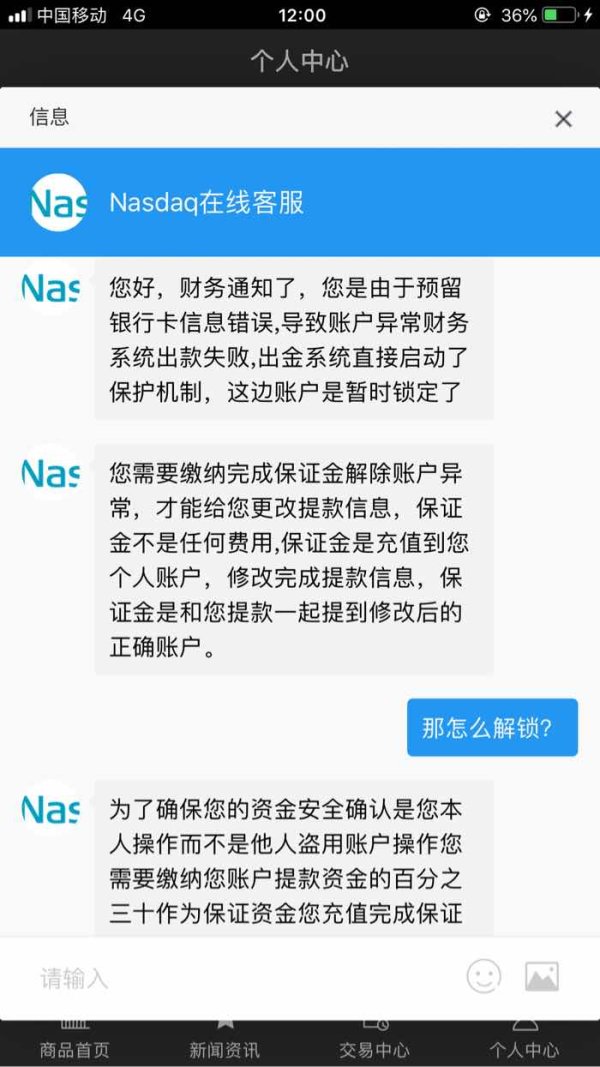

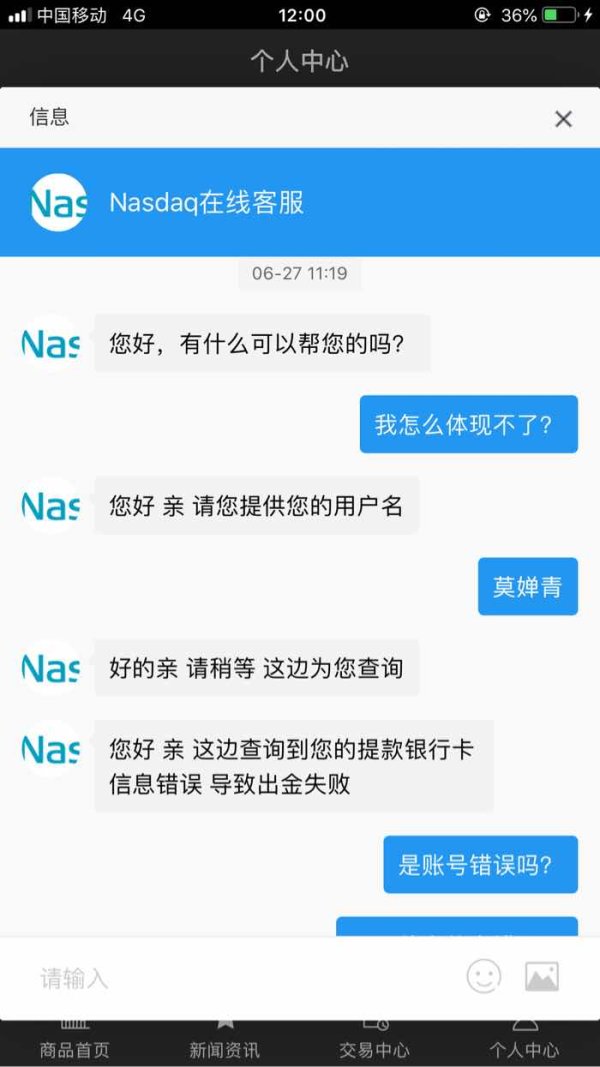

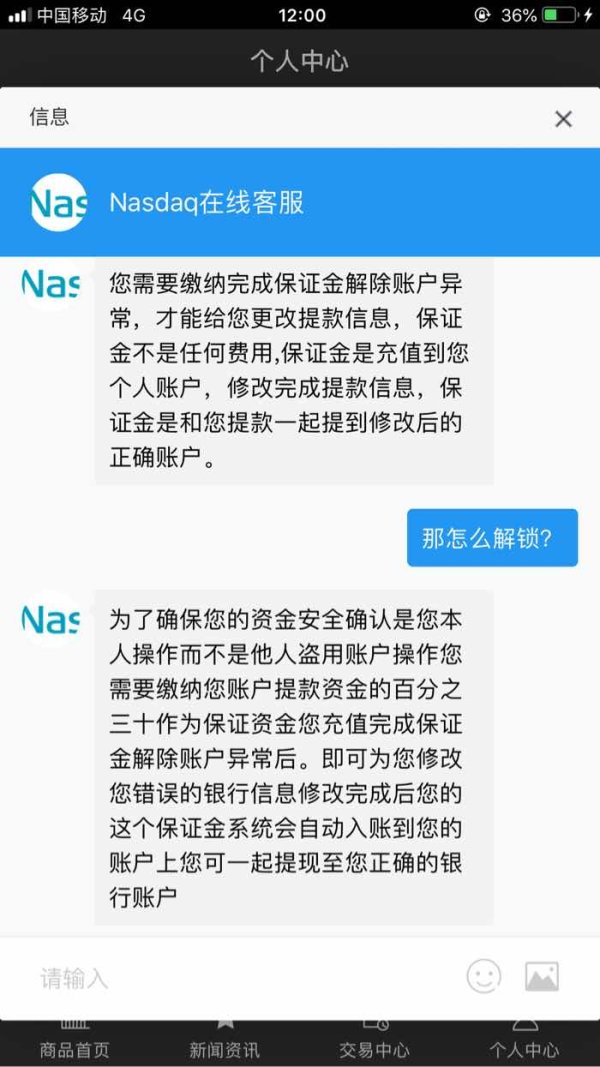

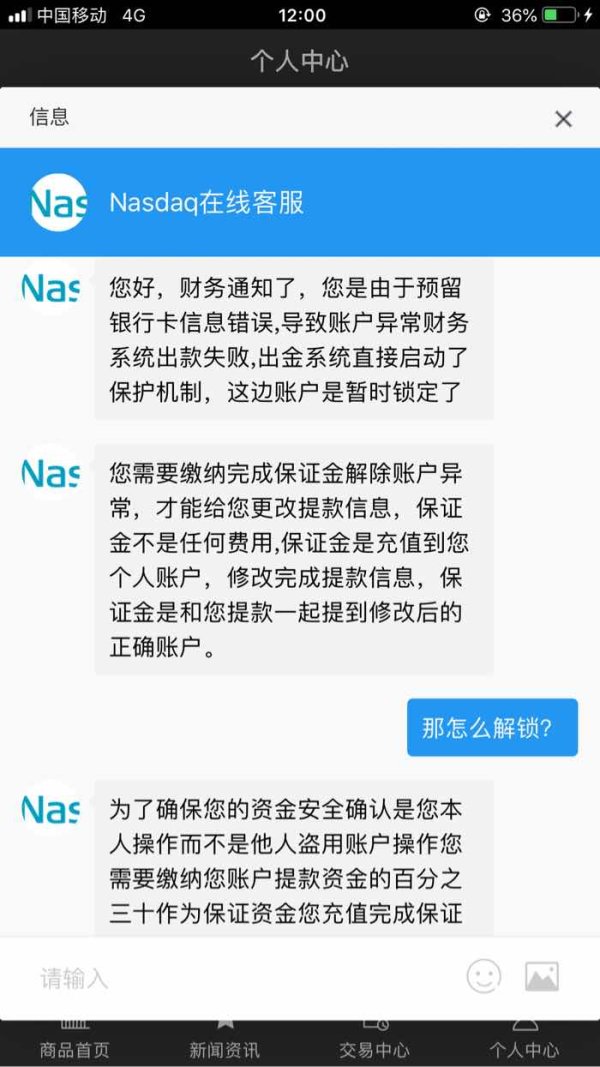

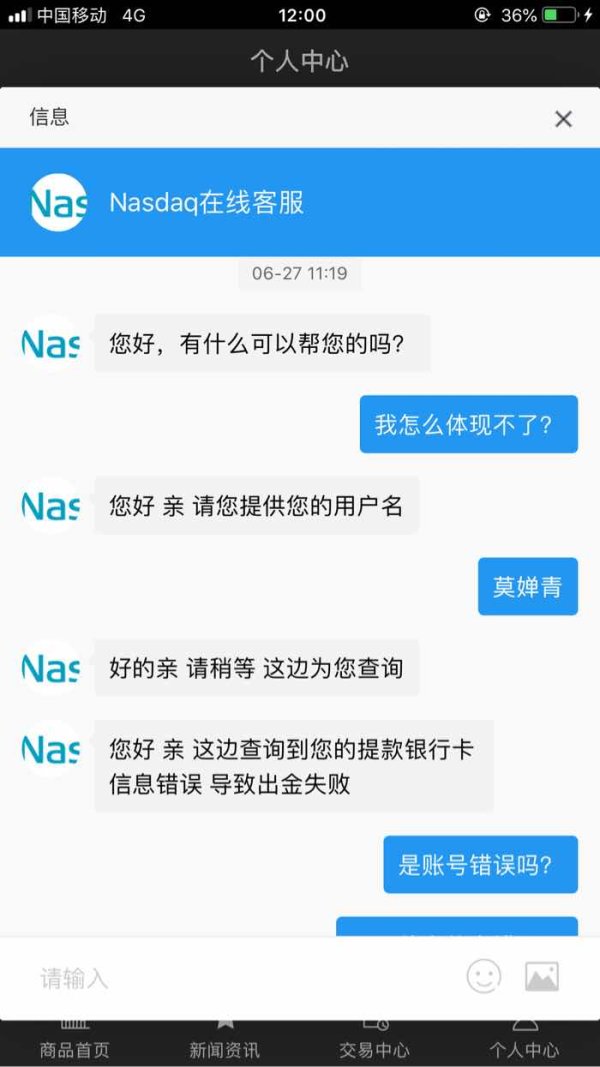

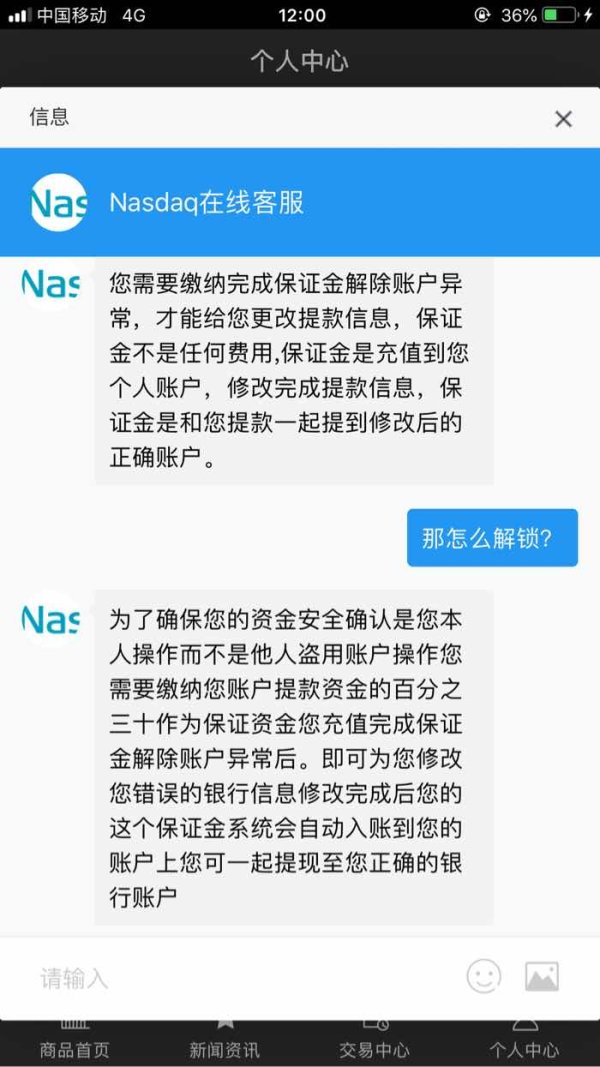

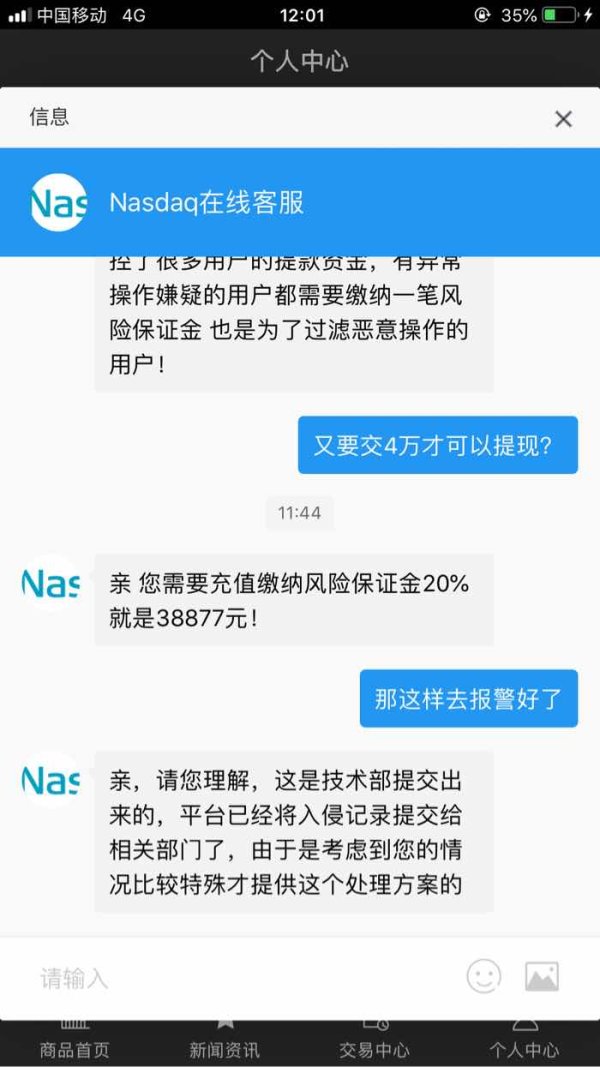

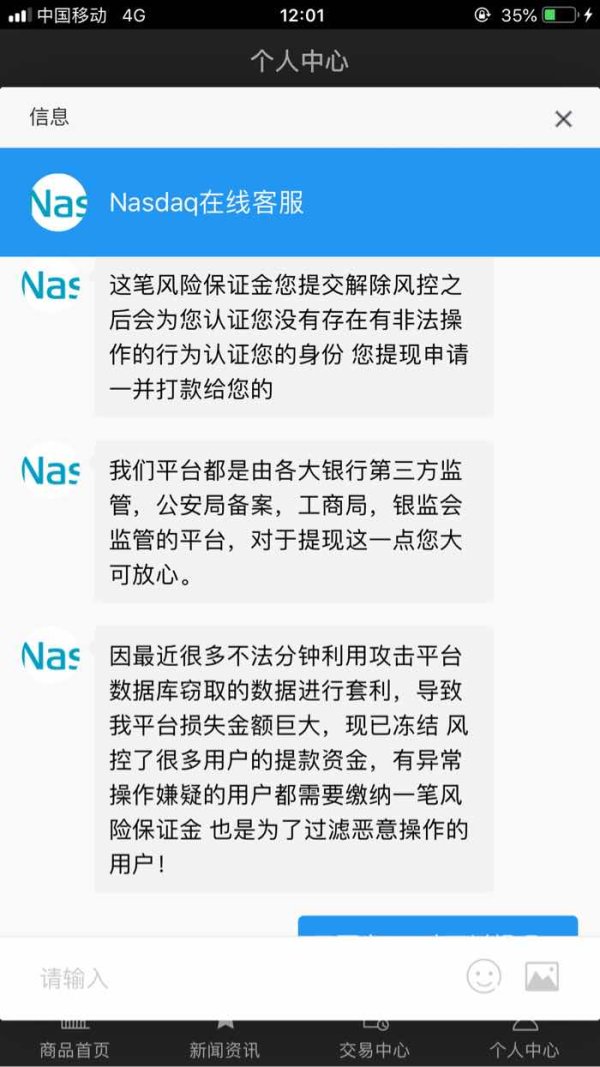

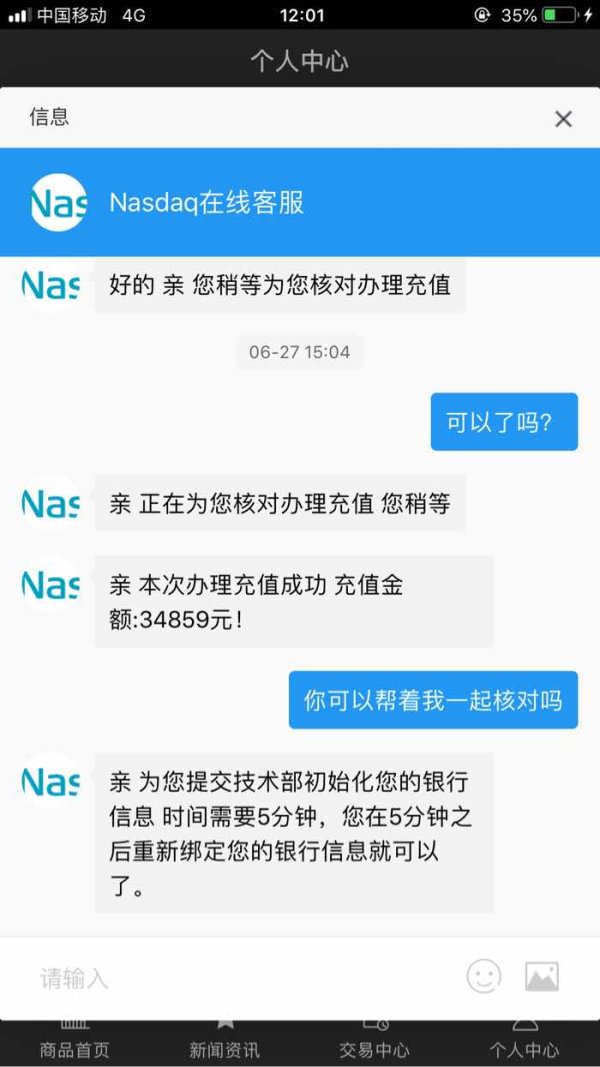

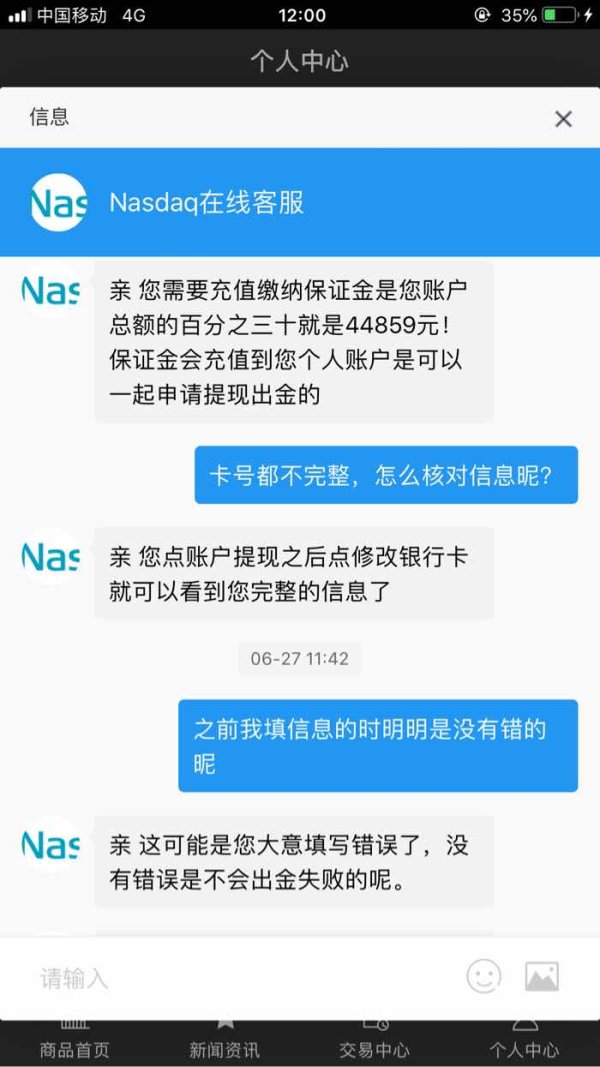

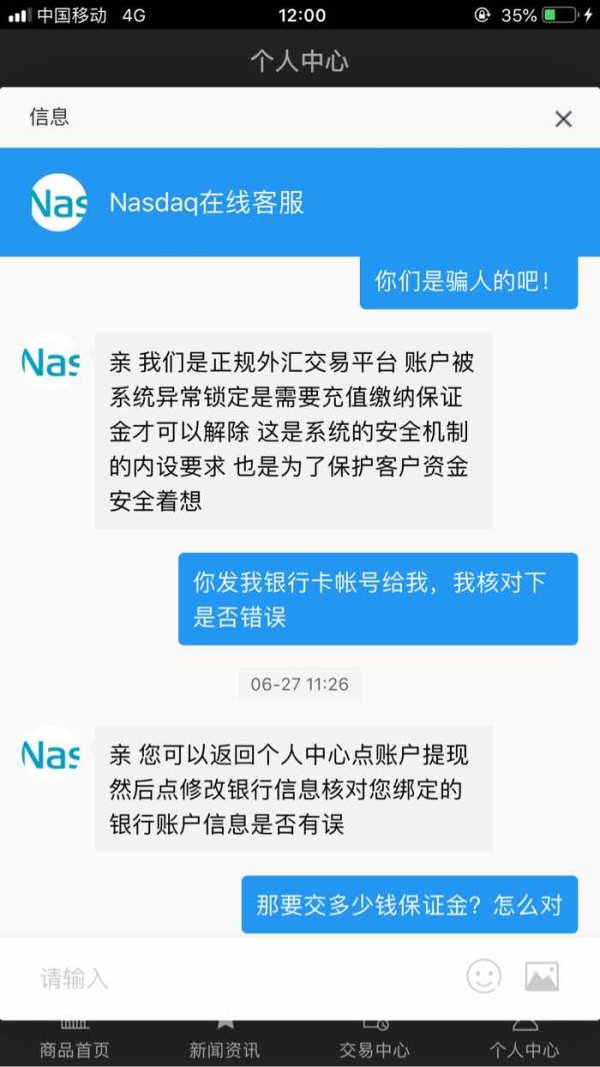

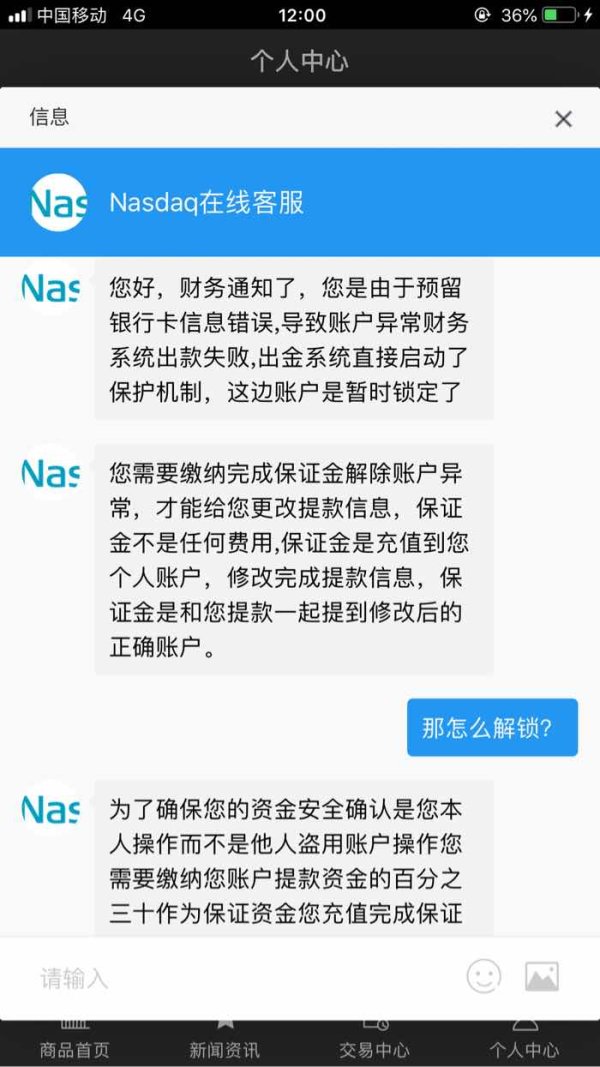

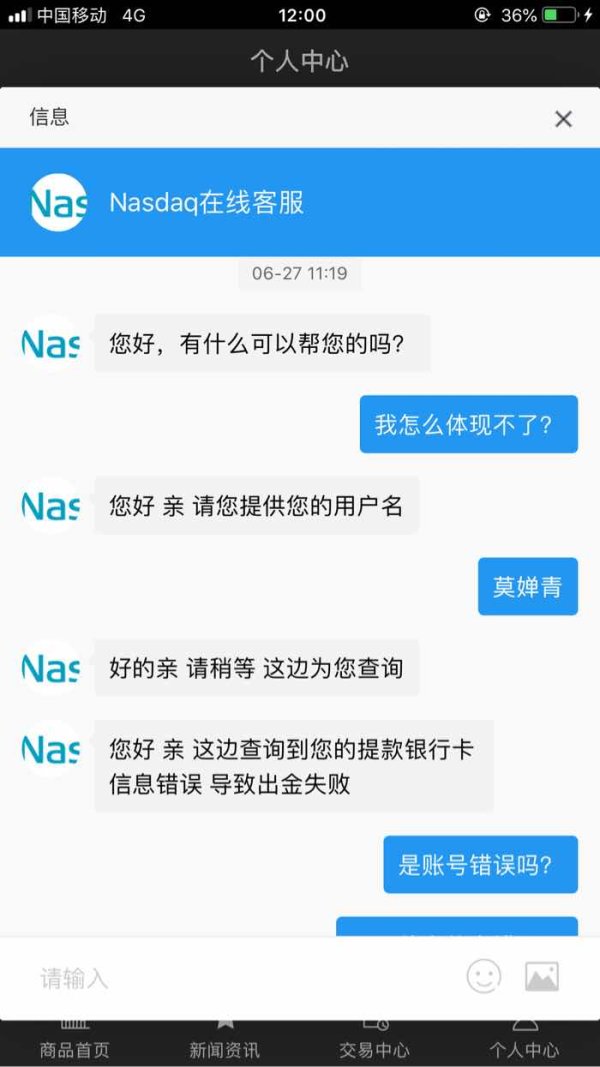

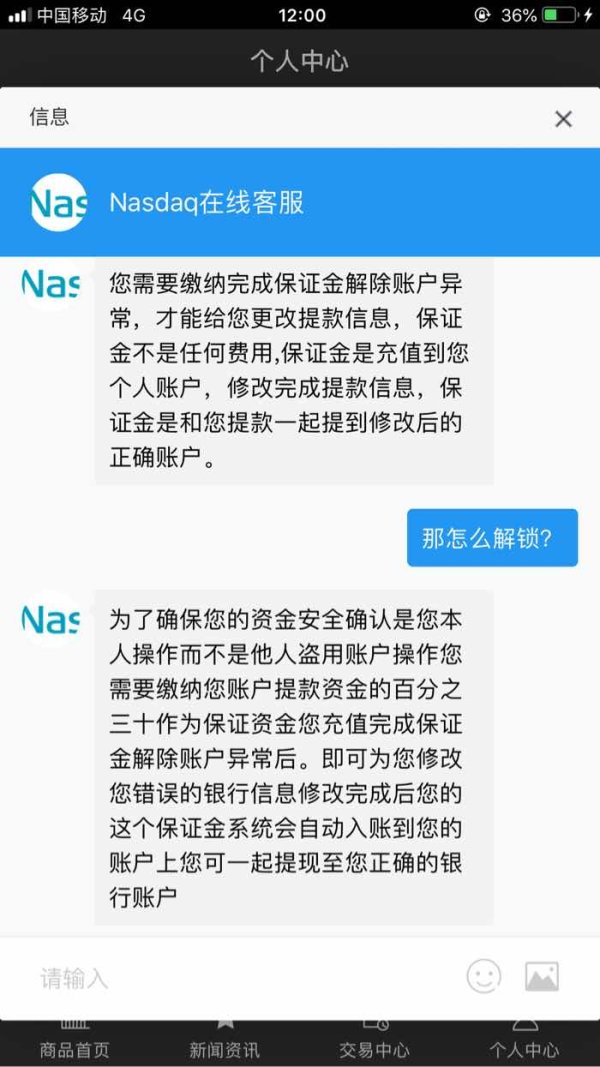

After paying 44859 yuan, in wake of wrong bank card account, I still couldn’t withdraw fund. NASDAQ 500 continued to ask for 33887 as a margin, which is simply a scam!

NASDAQ 500 Forex Broker provides real users with * positive reviews, * neutral reviews and 1 exposure review!

After paying 44859 yuan, in wake of wrong bank card account, I still couldn’t withdraw fund. NASDAQ 500 continued to ask for 33887 as a margin, which is simply a scam!

This nasdaq 500 review looks at a trading platform that gives real-time data and market analysis for the NASDAQ 500 index and related financial tools. The platform uses AvaTrade's infrastructure, which is an award-winning broker that offers many different assets like forex, cryptocurrencies, stocks, and commodities.

The platform targets traders who want NASDAQ 500 exposure and related assets. It provides market data, charts, and news updates. Our nasdaq 500 review shows big information gaps about regulatory details, trading conditions, and service offerings.

The overall assessment stays neutral because key operational areas lack transparency. However, the connection with AvaTrade's established platform gives some credibility to the service.

Key Features: Real-time NASDAQ 500 data provision, AvaTrade platform integration, multi-asset class coverage

Target Audience: Traders focused on NASDAQ 500 and related financial instruments

The information in this review comes from publicly available data and may not show the complete picture of services offered across different areas. Regional differences in regulatory compliance, trading conditions, and service availability may exist, but specific details were not available in the source materials.

This nasdaq 500 review uses accessible information and user feedback where available. However, complete data across all service areas was limited. Potential traders should verify current terms, conditions, and regulatory status before making trading decisions.

| Evaluation Criteria | Score | Rationale |

|---|---|---|

| Account Conditions | N/A | Specific account types, minimum deposits, and terms not detailed in available information |

| Tools and Resources | 8/10 | AvaTrade platform provides comprehensive analytical tools and real-time market data |

| Customer Service | N/A | Support channels, response times, and service quality information not available |

| Trading Experience | N/A | Platform stability, execution quality, and user experience details not specified |

| Trust and Security | N/A | Specific regulatory information and security measures not detailed |

| User Experience | N/A | Interface design, usability, and overall satisfaction metrics not available |

The nasdaq 500 platform works as a specialized service that focuses on NASDAQ 500 index trading and analysis. However, company background information including when it started and corporate history stays unclear in available documentation.

The business model centers on providing market data and trading access rather than traditional brokerage services. Specific operational details need clarification though.

The platform's main strength lies in its integration with AvaTrade's established infrastructure. This connection uses the capabilities of this award-winning multi-regulated broker. The partnership enables access to diverse asset classes beyond the NASDAQ 500 focus, including foreign exchange markets, cryptocurrency trading, stock investments, and commodity markets.

The AvaTrade foundation suggests professional-grade trading capabilities. However, specific regulatory oversight details for the nasdaq 500 service remain unclear in the available information sources.

Regulatory Jurisdiction: Specific regulatory oversight details not provided in available documentation, though AvaTrade association suggests multi-jurisdictional compliance.

Deposit and Withdrawal Methods: Available funding options and withdrawal procedures not detailed in source materials.

Minimum Deposit Requirements: Entry-level investment thresholds not specified in accessible information.

Promotional Offerings: Current bonus structures, incentive programs, or promotional campaigns not detailed.

Tradeable Assets: Confirmed access to forex pairs, cryptocurrency markets, stock indices including NASDAQ 500, and commodity instruments through AvaTrade platform integration.

Cost Structure: Specific spread configurations, commission rates, overnight financing charges, and additional fees not detailed in available information.

Leverage Options: Maximum leverage ratios and margin requirements not specified.

Platform Technology: AvaTrade's proprietary trading platform with focus on NASDAQ 500 data and analysis tools.

Geographic Restrictions: Service availability limitations by region not specified in source materials.

Customer Support Languages: Multilingual support capabilities not detailed in available information.

The account structure and conditions for this nasdaq 500 review present big information gaps that limit complete evaluation. Available documentation does not specify the range of account types offered, whether standard retail, professional, or institutional categories exist, or what features might make various account levels different.

Minimum deposit requirements, which typically serve as a key accessibility factor for retail traders, remain unclear in the source materials. This absence of transparent entry-level investment thresholds makes it difficult for potential clients to assess affordability and suitability for their trading capital levels.

The account opening process, including required documentation, verification procedures, and timeline expectations, lacks detailed explanation in available information. Additionally, specialized account features such as Islamic-compliant trading options, which are increasingly important for diverse global clientele, receive no mention in the accessible documentation.

Without specific user feedback about account conditions or comparison with industry standards, this nasdaq 500 review cannot provide clear guidance on how competitive or appropriate the account structures are.

The tools and resources dimension represents one of the stronger aspects identified in this evaluation. This strength comes primarily from the AvaTrade platform integration. The service provides complete real-time data for the NASDAQ 500 index, including detailed charts, market analysis, and relevant news updates that support informed trading decisions.

AvaTrade's established platform infrastructure brings professional-grade analytical capabilities to users. However, specific tool varieties and advanced features available through the nasdaq 500 service require further clarification. The platform's multi-asset approach suggests access to cross-market analysis tools that could benefit traders seeking broader market context for their NASDAQ 500 positions.

Research and analysis resources appear focused on delivering current market information and data visualization. The depth of fundamental analysis, technical indicator availability, and research report access remains unclear in available documentation. Educational resource provision, which increasingly distinguishes quality brokers, lacks detailed coverage in the source materials.

Automated trading support capabilities, including expert advisor compatibility, algorithmic trading tools, and API access for advanced users, receive no specific mention in the available information. This represents a notable gap for technically sophisticated traders.

Customer service evaluation proves challenging because of the absence of specific information about support infrastructure and service delivery standards. Available documentation does not detail the communication channels offered, whether including traditional phone support, live chat functionality, email ticketing systems, or emerging social media support options.

Response time commitments, which serve as crucial service level indicators in the competitive forex industry, lack specification in the source materials. Without established benchmarks for initial response, problem resolution, or escalation procedures, potential clients cannot assess service reliability expectations.

Service quality metrics, including customer satisfaction scores, resolution rates, or independent service evaluations, receive no coverage in available information. The absence of multilingual support details particularly limits assessment for international clients who may require native language assistance.

Operating hours for customer support, including weekend availability, holiday coverage, and time zone considerations for global clientele, remain unclear. This information gap significantly impacts the practical usability assessment for traders in different geographic regions requiring assistance during their active trading hours.

Platform stability and execution quality represent fundamental concerns for any trading service. Yet specific performance metrics and reliability data remain absent from available documentation. Without concrete information about server uptime, connection stability, or system redundancy measures, this nasdaq 500 review cannot adequately assess the technical foundation supporting trading activities.

Order execution quality, including fill rates, slippage statistics, and execution speed benchmarks, lacks detailed coverage in source materials. These factors critically impact trading profitability, particularly for active traders and those using short-term strategies around NASDAQ 500 movements.

The AvaTrade platform integration suggests complete functionality. However, specific features, customization options, and advanced order types available through the nasdaq 500 service require clarification. Mobile trading capabilities, increasingly essential for modern traders, receive no specific mention about app availability, feature parity, or mobile-specific optimizations.

Trading environment details, including market depth visibility, price feed quality, and real-time data accuracy, remain unclear despite their importance for effective trading decisions. User experience feedback about platform navigation, learning curve, and overall satisfaction would significantly enhance this nasdaq 500 review but proves unavailable in current source materials.

Trust and security evaluation faces substantial limitations because of insufficient regulatory and operational transparency in available documentation. While the AvaTrade association provides some credibility foundation as a multi-regulated and award-winning broker, specific regulatory oversight details for the nasdaq 500 service remain unclear.

Client fund security measures, including segregated account policies, deposit insurance coverage, and banking partner selections, lack detailed explanation in source materials. These protections serve as fundamental safeguards for trader capital and represent essential considerations for any complete broker evaluation.

Company transparency about ownership structure, financial reporting, regulatory compliance history, and operational policies receives limited coverage in available information. This transparency gap complicates trust assessment, particularly for traders prioritizing security and regulatory compliance in their broker selection process.

Industry reputation benefits from the AvaTrade connection. However, independent verification of regulatory status, compliance record, and any historical regulatory actions would strengthen confidence. Third-party security audits, certification achievements, and industry recognition details could enhance credibility but remain unclear in current documentation.

Overall user satisfaction assessment proves challenging given the absence of complete user feedback and experience data in available source materials. Without customer testimonials, satisfaction surveys, or independent user reviews, this evaluation cannot provide concrete insights into real-world user experiences with the nasdaq 500 service.

Interface design and usability considerations, including platform navigation, visual clarity, and feature accessibility, lack specific coverage despite their significant impact on trading efficiency and user satisfaction. The learning curve for new users, onboarding support, and platform familiarization resources remain unclear.

Registration and account verification processes, which form users' first impressions and can significantly impact initial experience quality, receive no detailed explanation in available documentation. Timeline expectations, document requirements, and potential verification complications lack coverage.

The target user profile appears focused on traders specifically interested in NASDAQ 500 exposure and related asset classes. However, broader user demographic analysis and satisfaction patterns across different trader types remain unavailable. This limitation restricts the ability to provide targeted recommendations for specific user categories or trading styles.

This nasdaq 500 review reveals a service with potential strengths in data provision and AvaTrade platform integration. However, significant information gaps limit complete evaluation. The neutral overall assessment reflects the balance between promising foundational elements and insufficient transparency in crucial operational areas.

The service appears most suitable for traders specifically seeking NASDAQ 500 exposure with access to real-time data and multi-asset trading capabilities. However, the lack of detailed information about regulatory compliance, trading conditions, and customer support standards requires careful due diligence before engagement.

Primary Advantages: Real-time NASDAQ 500 data, AvaTrade platform benefits, multi-asset access

Key Limitations: Limited regulatory transparency, unspecified trading conditions, insufficient service detail coverage

FX Broker Capital Trading Markets Review