Regarding the legitimacy of Million forex brokers, it provides HKGX and WikiBit, (also has a graphic survey regarding security).

Is Million safe?

Business

License

Is Million markets regulated?

The regulatory license is the strongest proof.

HKGX Precious Metals Trading (AGN)

Hong Kong Gold Exchange

Hong Kong Gold Exchange

Current Status:

UnverifiedLicense Type:

Precious Metals Trading (AGN)

Licensed Entity:

聯福金號有限公司

Effective Date: Change Record

--Email Address of Licensed Institution:

--Sharing Status:

No SharingWebsite of Licensed Institution:

--Expiration Time:

--Address of Licensed Institution:

香港上環孖沙街12-18號金銀商業大廈602室Phone Number of Licensed Institution:

31666120Licensed Institution Certified Documents:

Is Million Safe or Scam?

Introduction

In the dynamic world of forex trading, Million has emerged as a broker that attracts attention due to its claims of providing a robust trading platform and competitive conditions. However, with the increasing prevalence of scams in the forex market, traders must exercise caution when choosing their brokers. The importance of thorough due diligence cannot be overstated, as the wrong choice can lead to significant financial losses. This article aims to investigate the credibility of Million by examining its regulatory status, company background, trading conditions, customer fund safety, user experiences, platform performance, and overall risk profile. By utilizing a structured approach, we will provide a comprehensive assessment to determine whether Million is safe or a scam.

Regulation and Legitimacy

The regulatory status of a forex broker is a critical factor that influences its legitimacy. A broker that operates under strict regulatory oversight is generally considered safer for traders. In the case of Million, it is reported to hold a suspicious clone license from the Chinese Gold & Silver Exchange Society (CGSE). The regulatory details are as follows:

| Regulatory Authority | License Number | Regulatory Region | Verification Status |

|---|---|---|---|

| CGSE | 136 | China | Suspicious Clone |

The presence of a suspicious clone license raises significant concerns about the legitimacy of Million. Regulatory bodies are essential for ensuring that brokers adhere to industry standards and protect traders' interests. The CGSE's status as a low-tier regulator further complicates the situation, as it is less stringent than top-tier regulators like the FCA or ASIC. Furthermore, the lack of a functional website for Million makes it challenging to verify its compliance with regulatory requirements. This situation underscores the need for traders to be vigilant when considering whether Million is safe or a scam.

Company Background Investigation

Understanding the company behind a broker is vital for assessing its credibility. Million is reportedly registered in Hong Kong, and while it claims to provide a reliable trading environment, the details surrounding its ownership and management remain vague. There is limited information available regarding the company's history, development, and ownership structure.

The management team's background is equally important in evaluating the broker's trustworthiness. However, there is a lack of transparency about the qualifications and experiences of the individuals running Million. This absence of information can be a red flag, as reputable brokers typically provide detailed profiles of their management teams to instill confidence among traders.

Moreover, the company's transparency and information disclosure levels are critical indicators of its reliability. In this case, the scarcity of accessible information regarding Million's operations and management raises further doubts about whether Million is safe or a scam.

Trading Conditions Analysis

The trading conditions offered by a broker can significantly impact a trader's experience. Million claims to provide competitive spreads and various trading instruments, but the absence of clear information about its fee structure raises concerns. A detailed analysis of the trading costs is essential to determine whether the broker's offerings align with industry standards.

| Fee Type | Million | Industry Average |

|---|---|---|

| Major Currency Pair Spread | TBD | 1-2 pips |

| Commission Model | TBD | Varies |

| Overnight Interest Range | TBD | Varies |

The lack of transparency regarding these fees can be problematic for traders. If a broker imposes hidden fees or unreasonably high charges, it can significantly affect a trader's profitability. Additionally, any unusual or problematic fee policies should be scrutinized closely. It is essential for traders to gather detailed information about the trading conditions to assess whether Million is safe or a scam.

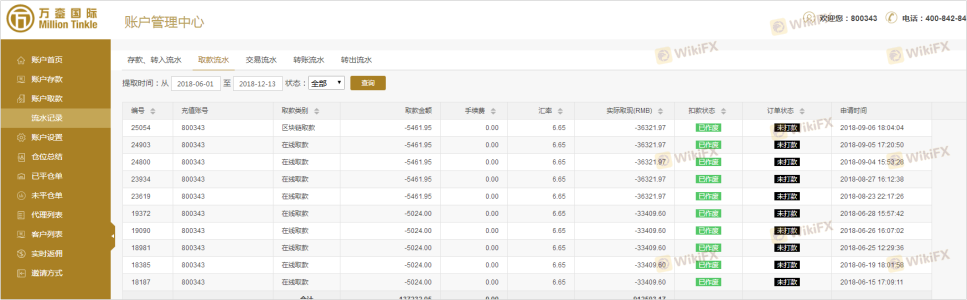

Customer Fund Safety

The safety of customer funds is a paramount concern for any forex trader. A reputable broker should have robust safety measures in place to protect clients' investments. In the case of Million, there is limited information available regarding its fund safety protocols.

Key aspects to consider include the segregation of client funds, investor protection mechanisms, and negative balance protection policies. The absence of publicly available information on these measures is alarming and raises questions about the broker's commitment to safeguarding clients' assets. Any historical issues related to fund safety or controversies should also be examined to understand the risks associated with trading with Million.

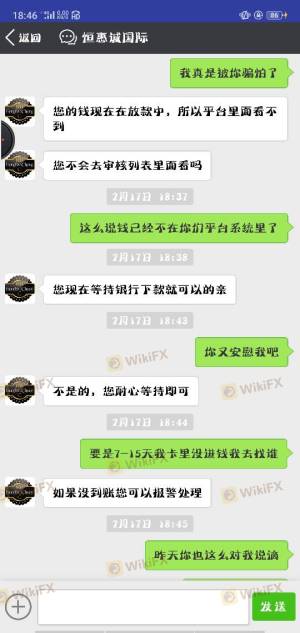

Customer Experience and Complaints

Analyzing customer feedback is crucial for assessing a broker's reliability. In the case of Million, numerous complaints have surfaced regarding withdrawal issues and poor customer service. Common patterns of complaints include difficulties in accessing funds and unresponsive customer support, which are significant red flags for potential traders.

| Complaint Type | Severity Level | Company Response |

|---|---|---|

| Withdrawal Issues | High | Poor |

| Customer Service Complaints | Medium | Poor |

Two notable case studies highlight these concerns. In one instance, a trader reported being unable to withdraw funds after making a deposit, leading to frustration and financial loss. Another user indicated that customer support was unresponsive when they sought assistance. These patterns suggest that potential traders should approach Million with caution, questioning whether Million is safe or a scam.

Platform and Execution

A broker's trading platform is a critical component of the trading experience. Million claims to offer a user-friendly platform, but the performance and stability of this platform remain to be seen. Key factors to evaluate include order execution speed, slippage rates, and any indications of platform manipulation.

If a broker's platform consistently experiences downtime or issues with order execution, it can severely impact a trader's ability to make informed decisions. Therefore, it is essential to gather user feedback regarding the platform's reliability and performance to assess whether Million is safe or a scam.

Risk Assessment

Engaging with any forex broker comes with inherent risks. In the case of Million, several factors contribute to a higher risk profile.

| Risk Category | Risk Level | Brief Description |

|---|---|---|

| Regulatory Compliance | High | Suspicious clone license raises concerns |

| Customer Fund Safety | High | Lack of transparency in fund protection measures |

| Customer Support Issues | Medium | Frequent complaints indicate potential problems |

To mitigate these risks, traders should consider using a demo account to test the platform before committing real funds. Additionally, conducting thorough research and reading reviews from other users can provide valuable insights into the broker's performance.

Conclusion and Recommendations

In conclusion, the investigation into Million reveals several concerning issues that suggest potential risks for traders. The suspicious regulatory status, lack of transparency regarding company operations, and a history of customer complaints raise significant doubts about the broker's credibility. Therefore, it is imperative for traders to exercise caution when considering whether Million is safe or a scam.

For those seeking reliable alternatives, it is advisable to choose brokers that are regulated by top-tier authorities, have transparent operations, and demonstrate a commitment to customer service. By prioritizing safety and transparency, traders can protect their investments and enhance their trading experience.

Is Million a scam, or is it legit?

The latest exposure and evaluation content of Million brokers.

Million Similar Brokers Safe

Whether it is a legitimate broker to see if the market is regulated; start investing in Forex App whether it is safe or a scam, check whether there is a license.

Million latest industry rating score is 1.56, the higher the score the safer it is out of 10, the more regulatory licenses the more legitimate it is. 1.56 If the score is too low, there is a risk of being scammed, please pay attention to the choice to avoid.